Forward Note - 2025/11/09

Over leveraged investors are your customers.

This week, US equities closed on the back foot, with the S&P 500 down a little over 2% and the Nasdaq off more than 4%. If not for a mid-session rally on Friday, the damage could have been far worse. At one point that morning, the VIX spiked to 22 sending a chill down the spine of overleveraged investors.

By the end of the week, the volatility index had added two points, settling just below the psychological 20 level. What to make of this?

When the Nasdaq drops this much, the message is usually clear: tech took the hit. Investors are starting to get jittery about stretched AI valuations. Case in point; AMD beat expectations and guided higher for Q4, yet margins failed to impress. The stock sank 7% on earnings day and another 3% on Friday before clawing back some losses.

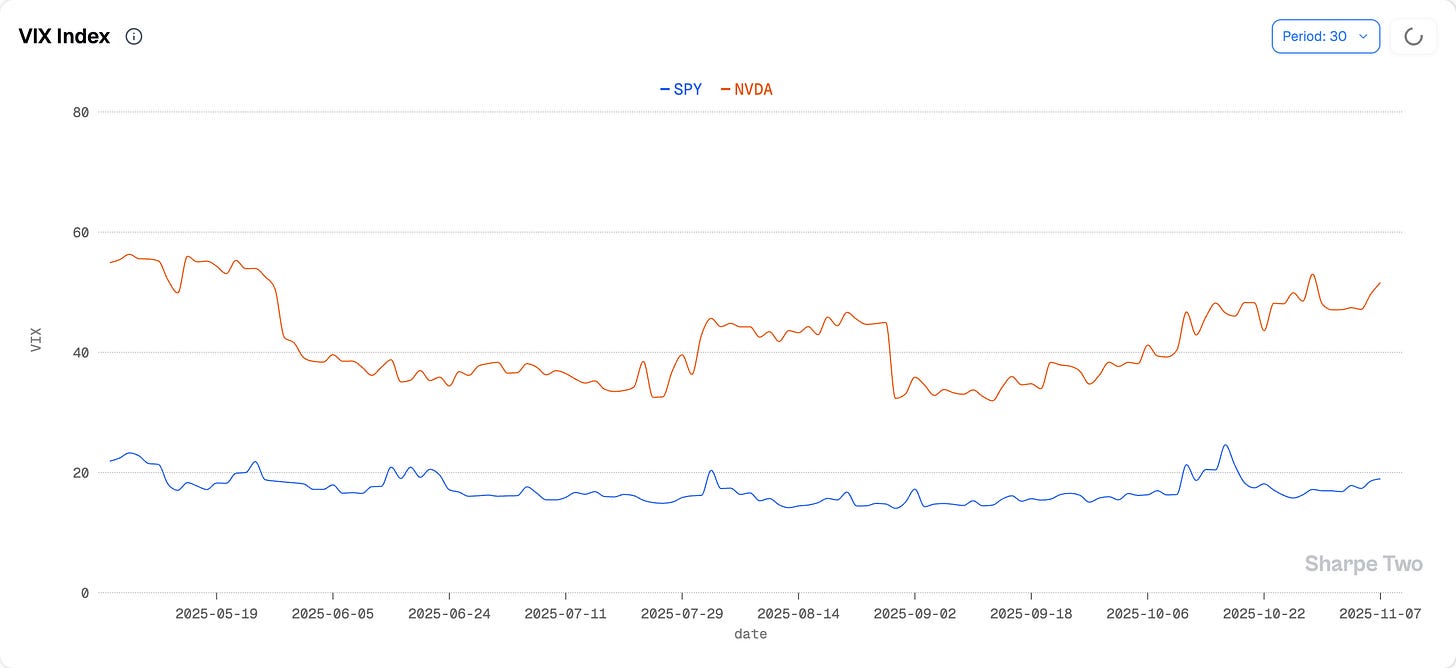

Needless to say, if AMD took that kind of beating, Nvidia was not going to be spared. Both stocks lost around 8% this week, and given their weight in the index, it was almost mechanical that the broader market would end up sharply lower.

Is this the start of something more serious? Hard to say but one thing is clear: despite different triggers, this move feels like a continuation of what we saw almost exactly a month ago, then blamed on US–China trade tensions. In realized volatility terms, we are now back to levels last seen in mid-June.

In just a month, 30-day realized volatility has nearly doubled from 7.77 to 14.48 at Friday’s close. That is a solid move forward. But with it, investors should recognize that intraday swings will naturally grow wider.

There is still a strong sense of “late adaptation” in the market: participants keep reacting to the present moment by comparing it to the calm of the previous regime. Yes, things are moving more than they did over the summer, when realized vol was unusually low. But in the grand scheme of things, 14.48 is hardly dramatic.

The same logic applies to the VIX. Had we closed near the session highs, the message might have been different. But with volatility of volatility elevated, two- or three-point intraday swings are entirely normal at these levels.

What one will want to keep an eye on is if the move keeps going higher. But right now, we are not at a floor like we’ve seen for months over the summer and if one doesn’t see the VIX movements over the past week as normal and expected, one may not be comparing things to what it should be compared.

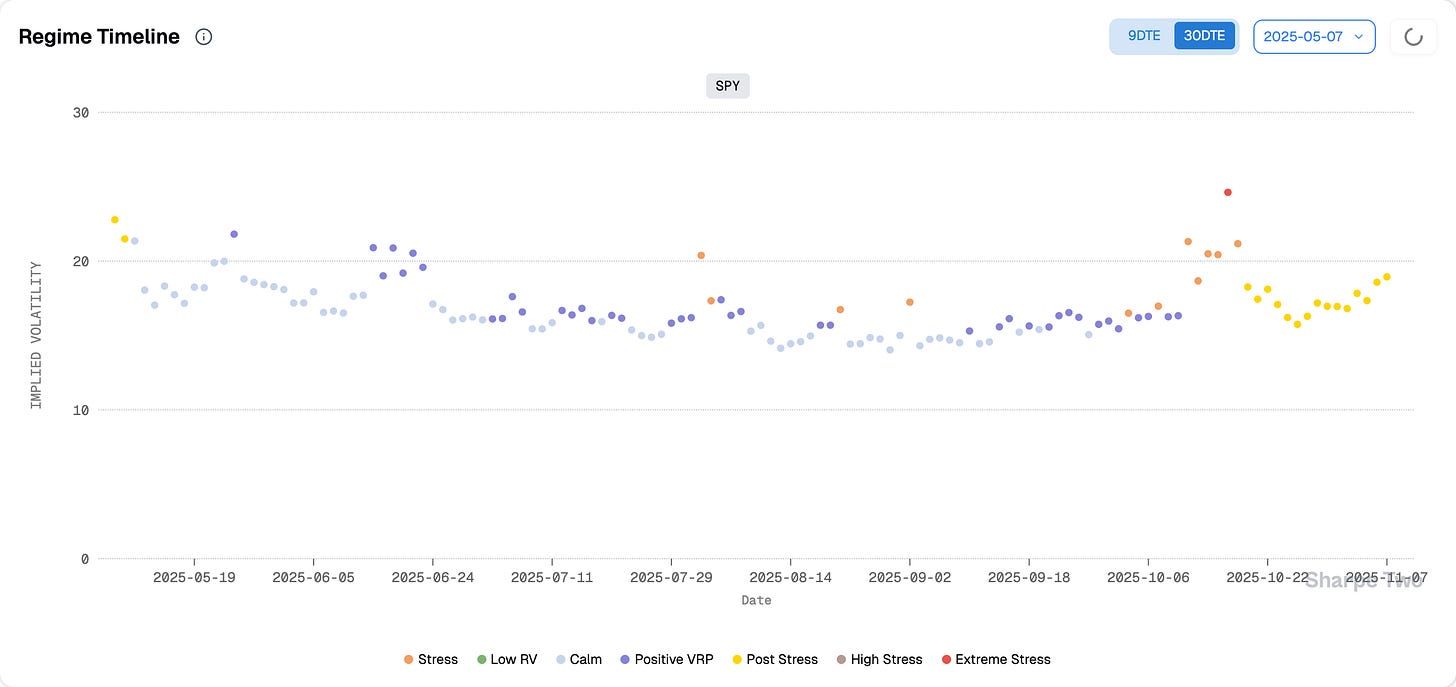

Since mid-October, SPY has shifted into a post-stress regime marked by higher realized volatility, elevated volatility-of-volatility, and a compressed variance risk premium. That stands in sharp contrast to the summer, when vol-of-vol was muted and the VRP remained stretched for long stretches of time.

All of this is descriptive, not predictive. If you asked us to make a Mike Burry-style bet, Sharpe Two is, unfortunately, not in that business: we do not take directional views on equities. But one thing is clear; when the VIX shows intraday tension like it did on Friday, those moments tend to offer solid opportunities for anyone looking to sell the variance risk premium.

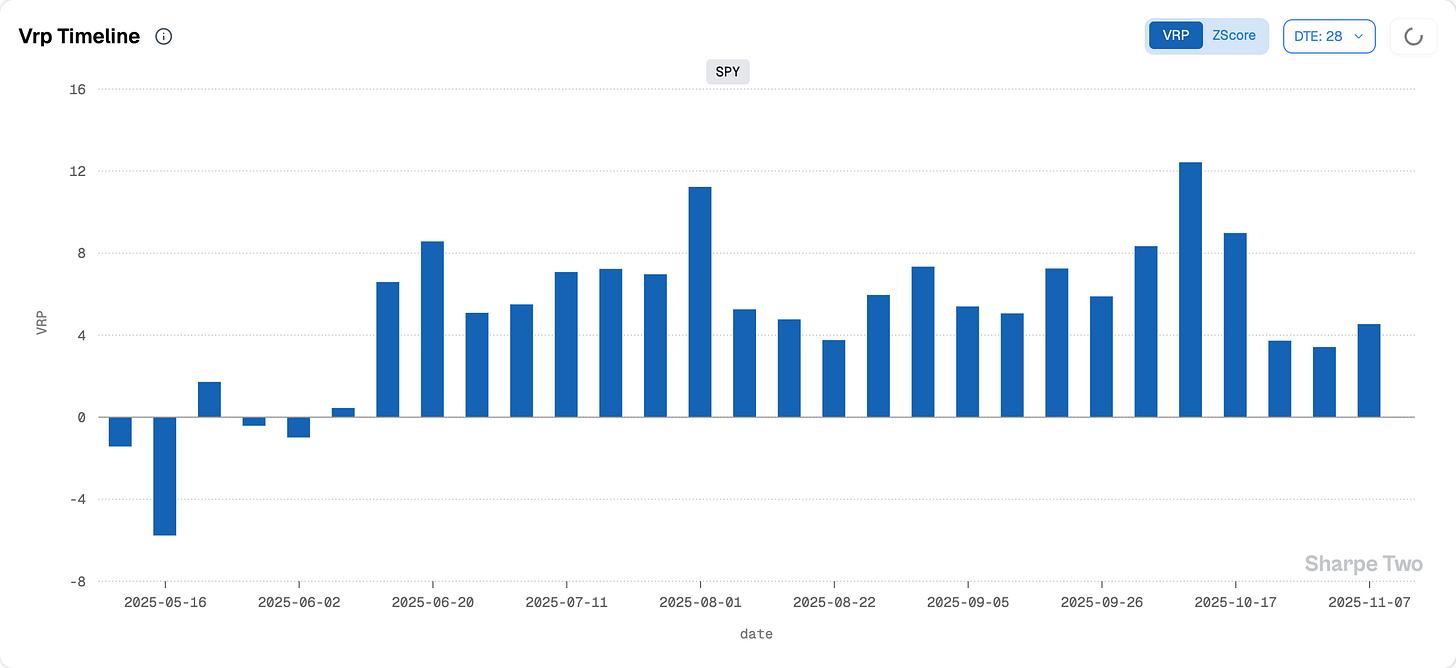

As of Friday’s close, it stood around 4.5 points.

Yes, that sits on the lower end of what we have seen over the past five months, but it is still a solidly positive VRP. And needless to say, those extra two or three VIX points that appear out of nowhere during a session, whatever the reason du jour, tend to offer great opportunities for short-volatility sellers, provided they can tune out the noise and wait for the right entry.

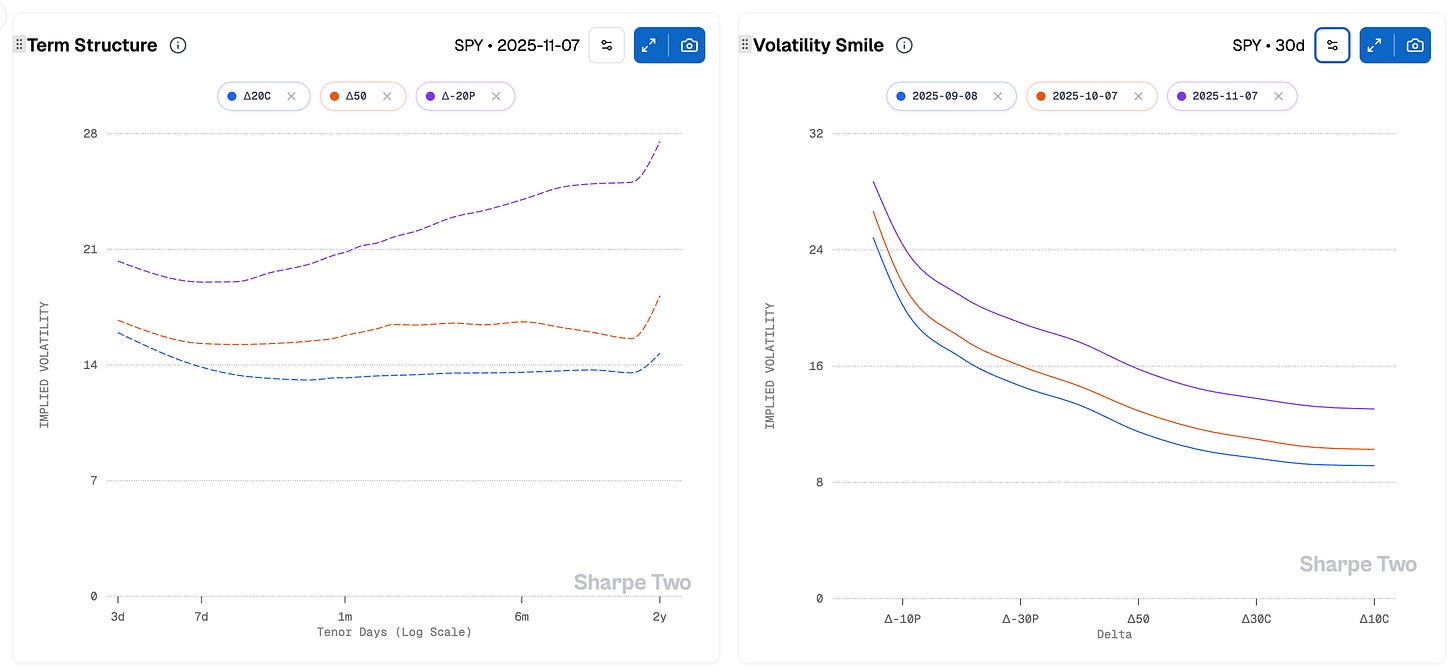

The game is a bit different from the summer, when you could enter almost anytime and simply collect the carry. Back then, implied volatility hovered around 15–16 while realized stayed pinned below 10. Now, you have to be more selective and wait for the late premium buyers, the over leveraged traders, the ones spooked by headlines and the look of their portfolios, willing to pay a hefty premium over current realized risk around 14.5 to hedge their books. At the worst point on Friday, that premium stretched to an 8.5-point VRP: whatever one thinks of the tech selloff, that is a pretty healthy margin to sell, unless, of course, we are heading for a full market meltdown, which is not what the term structure is currently suggesting.

Over the past two weeks, we had been warning that options were too cheap and urging patience before selling anything. That alarm has now passed. This does not mean one should chase the first premium buyer, but rather stay selective and ideally using probabilities to identify the best trade opportunities: we are now ten-for-ten on our Signals du Jour, all available on the platform; what are you waiting for?

But with higher volatility-of-volatility, the best setups often appear in-session, when a quick two- or three-point pop can turn a decent trade into a great one. Until one this will happen? NVDA earnings are not programmed before another 2 weeks, and we would be surprised to see its implied volatility not spilling over the SP500 as we wait for more.

Of course, it will feel unsettling, the noise always is. But when it gets like this, think of little Matilda, the Roald Dahl character who stayed in her room reading quietly while her parents watched bad TV downstairs and thought of tricks to play on their customers. In other words, find your version of that calm. That mindset is as much your responsibility as having an opinion on whether volatility is cheap or rich.

In other news

Mike Burry did it again. Last week, the market learned, with a mix of fascination, mild envy, and guaranteed entertainment, that the legendary investor who not only called the subprime crisis but famously bought CDS from Goldman Sachs is now betting heavily against PLTR and NVDA.

And needless to say, as the market sold off this week, his position was allegedly deep in the green, adding fuel to the fire for the growing crowd of AI skeptics.

Caution is warranted, though. First, 13F filings are always delayed — they reflect holdings at the previous quarter’s end. We have no visibility on what he has done since then, or how he has managed those positions since earnings. More importantly, Burry is a multi-decade value investor, obsessive in his research and perfectly at ease living with contrarian trades that take time to play out. (Remember the Tesla short that backfired?)

We have plenty of respect for him and wish him luck. After all, we learned just a few weeks ago that 2025 has so far been one of the toughest years for short sellers, many of whom now blame retail investors, who are apparently, rooting for him.

Who wrote a thesis about … rational investors in the stock market again?

Thank you for staying with us until the end. As usual, here are two great reads from last week:

First, a fascinating long-form piece from the Financial Times. Three years into global sanctions that were supposed to cripple the Russian economy and, at least officially, restrict its oil exports we meet Eppinger, a 31-year-old German who has made a fortune trading over $2 billion of Russian oil. Operating in the gray zones of international law and logistics, he is a reminder that traders exist to provide a service to the marketplace; often doing the “dirty work” others prefer to avoid.

Since late August, we have been reviewing every Signal du Jour through a full PnL attribution exercise and, with a touch of luck (and a lot of data), we stand at a perfect ten out of ten on our first ten trades. Luck, of course, only favors the prepared. Behind it lies our predictive analytics and machine-learning pipeline, built to identify what is expensive and what is cheap. We strongly encourage you to read that piece to see how one can make money consistently selling options and to give the platform a try. Subscribing grants access to our Discord, where we trade far more than the weekly Substack signals… and we are up 5% over the last two months. Just saying.

That is it from us this week. We wish you a wonderful week ahead — and, as always, happy trading.