Forward Note - 2025/10/05

Cut the noise and be present in the moment.

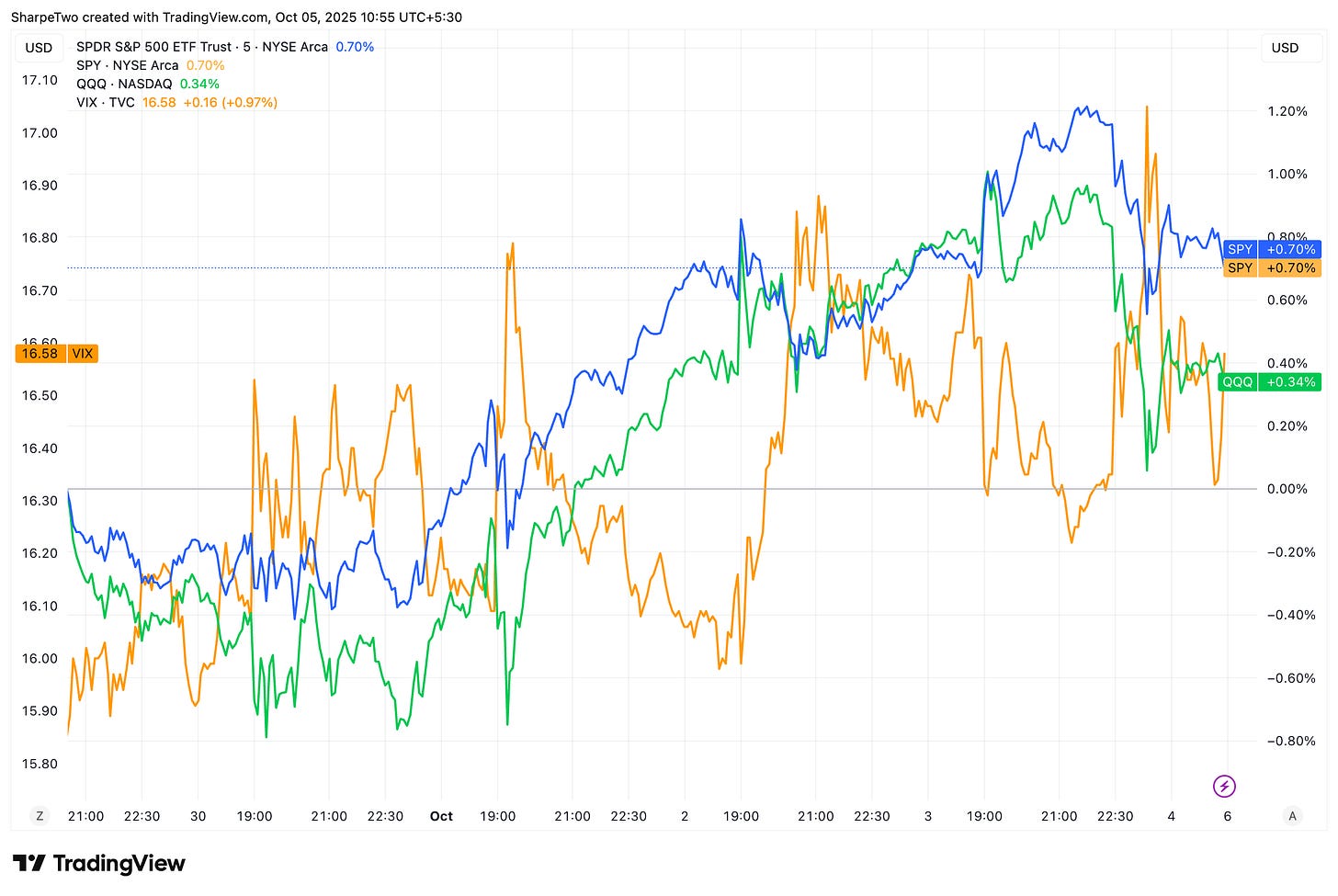

The government is officially shut down, but that did not put a dent in year-end optimism. Stocks climbed to new all-time highs again this week, with both SPY and QQQ adding just over 1%.

As expected, the VIX barely flinched — closing at 16.58, up from 15.82 — just enough to keep the wildest doomsday theories alive. Because Trump is mad. Because the government is shut. Because inflation is not going away. Because central banks are buying gold. Because gamma is concentrated and dealers will soon pull the rug. Because the job market is weaker than economists think. Because AI is a bubble. Because Western governments are broke.

We could write a thousand-word paper on all the reasons why the market should not be trading here.

In fact, that is what happens every single day. Journalists, social-media trade-fluencers, and even investment bankers make their living off the what-ifs. When JP Morgan warned clients three weeks ago that a rate cut could trigger a sell-off because it might signal worsening economic conditions, do you really think they cared about being right — or about selling puts to a nervous client base? If you think it is the former, there are still a few things you may not fully grasp about the adversarial nature of finance.

Take another example: have you noticed any difference in how Bloomberg presents the news when tariffs hit versus when gold reaches another all-time high? Of course not. Only the content changes — the tone never does. That is intentional. The flash, the pace, the constant alerts are designed to make your brain associate noise with importance. You stay glued to the screen… and consume the ads it is built to sell.

At Sharpe Two, we stay data-driven for a reason: it keeps us rational and immune to the daily hysteria. And right now, the regime we are in does not justify the noise.

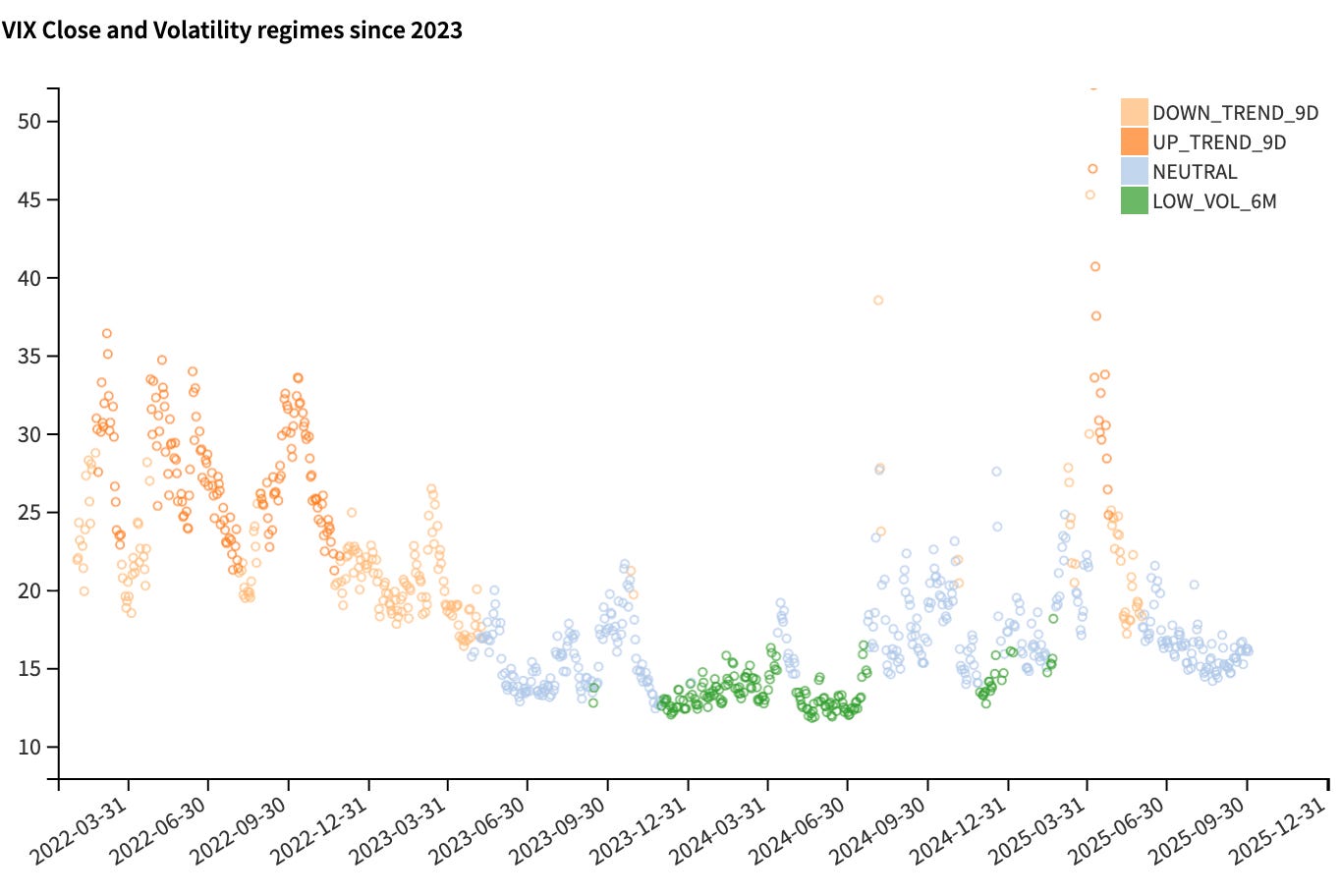

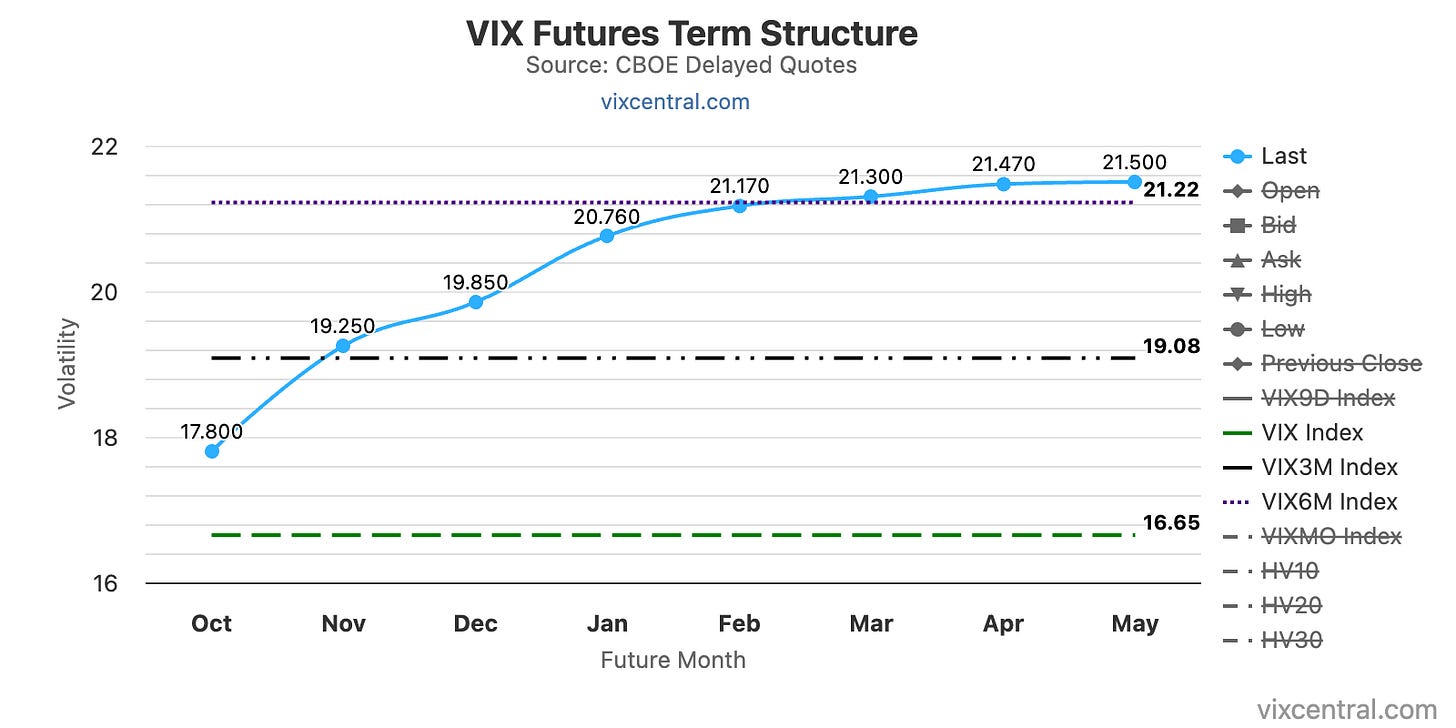

We are deep in a neutral volatility regime. Does this look even remotely close to what was happening in March and April? Or during 2022? If you think so, it might be time for a full reset — social media, financial media, the whole thing. Could it eventually look like 2022 again? Absolutely. But you will have clear signals along the way telling you that something has changed.

Trade the regime you are in, not the one you wish or fear we will be in. That mantra — passed down to us by an old boss almost fifteen years ago — remains the single most important principle for consistent trading.

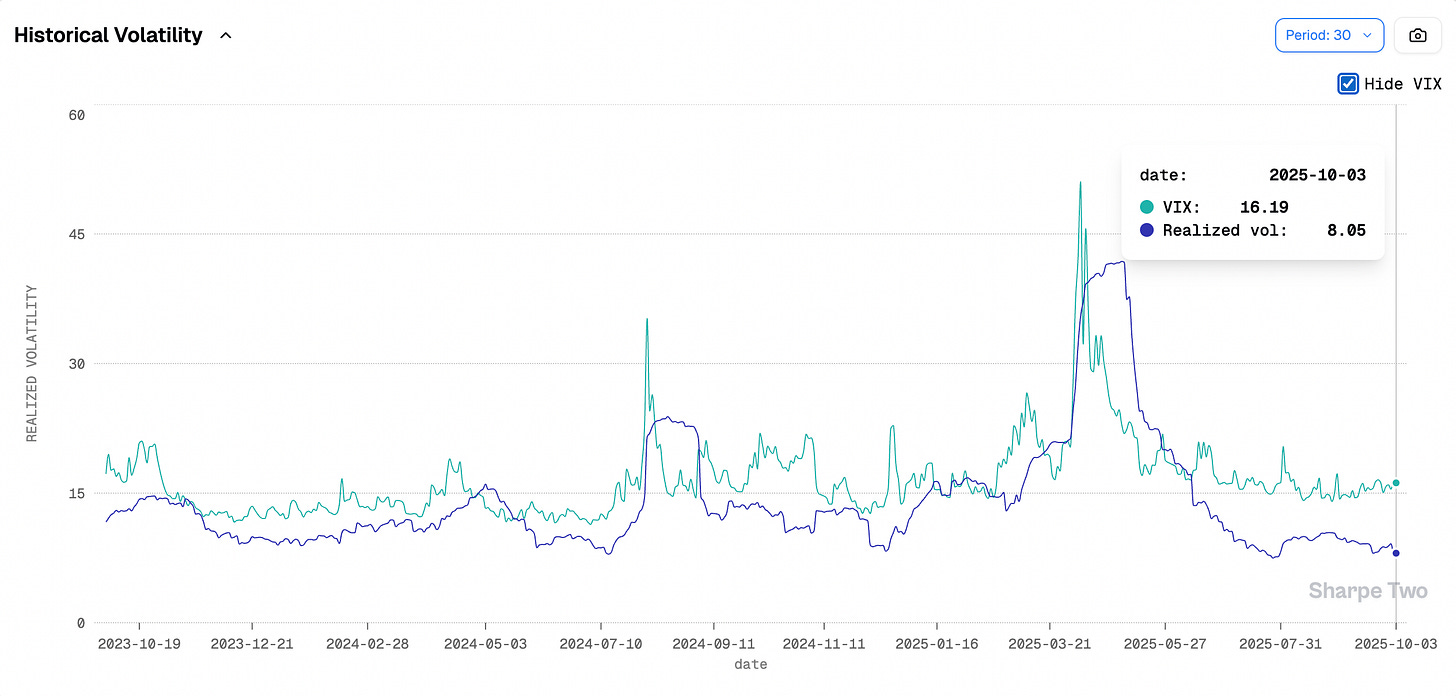

And right now, the message from the data is simple: reset, refocus, and look at what is actually in front of us. Since June, realized volatility has been glued to the floor, the VIX has stopped venturing above 20, equities are up 20%, and rates are trending lower.

This is all the information you need. Everything else is just speculation about what might break the current regime. In the meantime, trade what is right in front of you — especially when it looks this good.

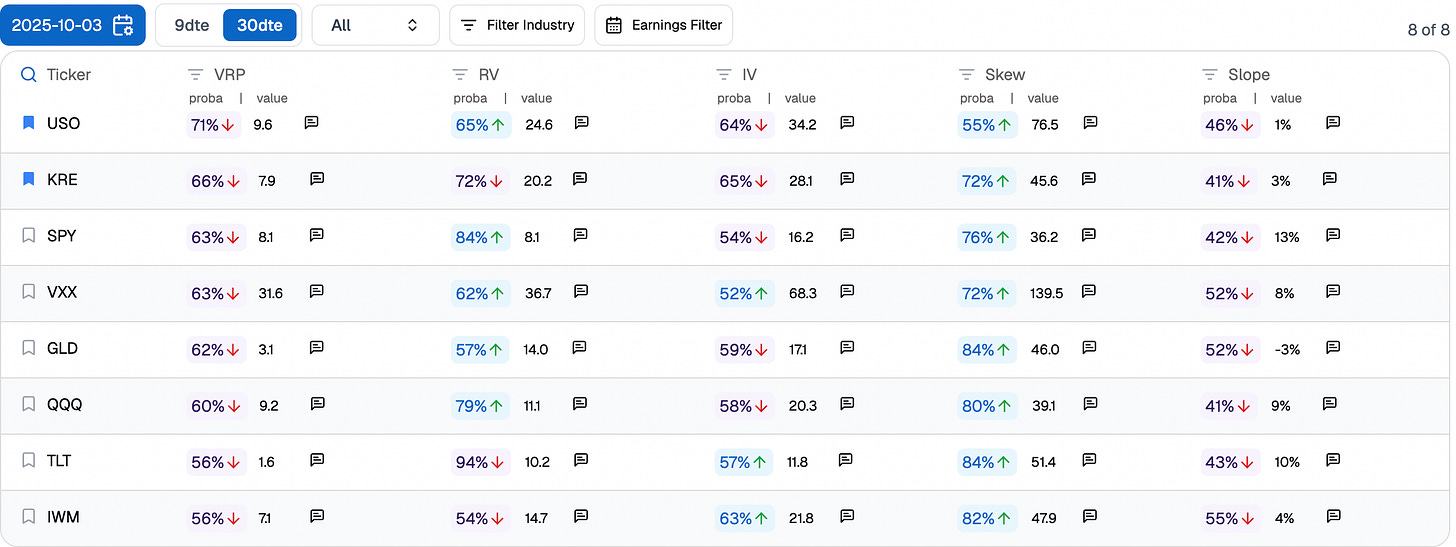

A 100% VRP in SPY is a first for us. We live and breathe forecasts and probabilities, and while a 63% forecast probability is not quite as high as we would like, we have never seen anything like this: the market is paying twice the realized movement — 16.2% implied versus 8.1% realized.

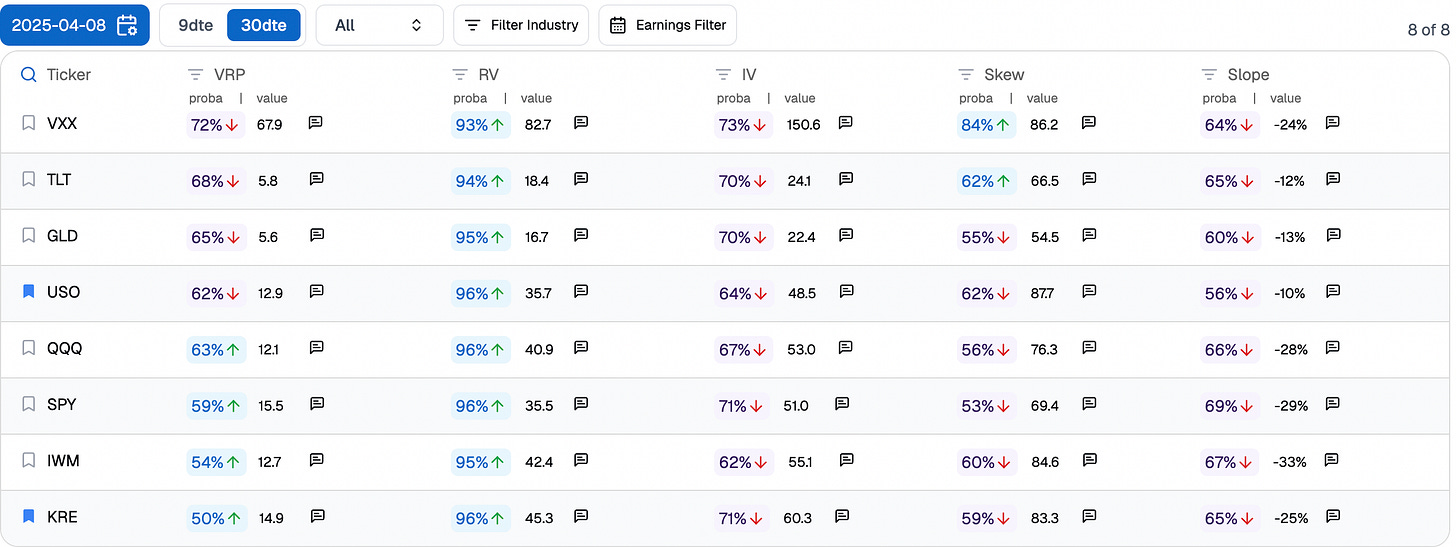

If you do not take advantage of that now, when will you? When the VIX is at 30, realized is at 35, and every tick in the underlying sends your PnL flying? For context, here is what our forecasts looked like back on April 8, when things were a bit messier than they are today.

Avoid the main indices for now — TLT and VXX remain far safer bets. “OMG OMG, short vol in VXX would have been insanely risky!” Sure. No one forced you to take it. But we did — and those 110/50 strangles turned out very profitable, and far less stressful than managing the whipsaw in equities.

Options trading, when done right and backed by data-driven forecasts, quickly becomes boring and repetitive. That is exactly the point. It protects you from the costly mistakes born out of subjective analysis. The trouble with subjectivity is that we try to rent someone else’s expertise to fill our own blind spots. Nothing wrong with that — except that even experts have blind spots of their own, and they often pay to rent someone else’s view in turn.

So where is the real source of truth? For us — your third-party “expert,” and we thank you for subscribing — it lies in the spread between what the market pays and what the underlying realizes. Nothing else.

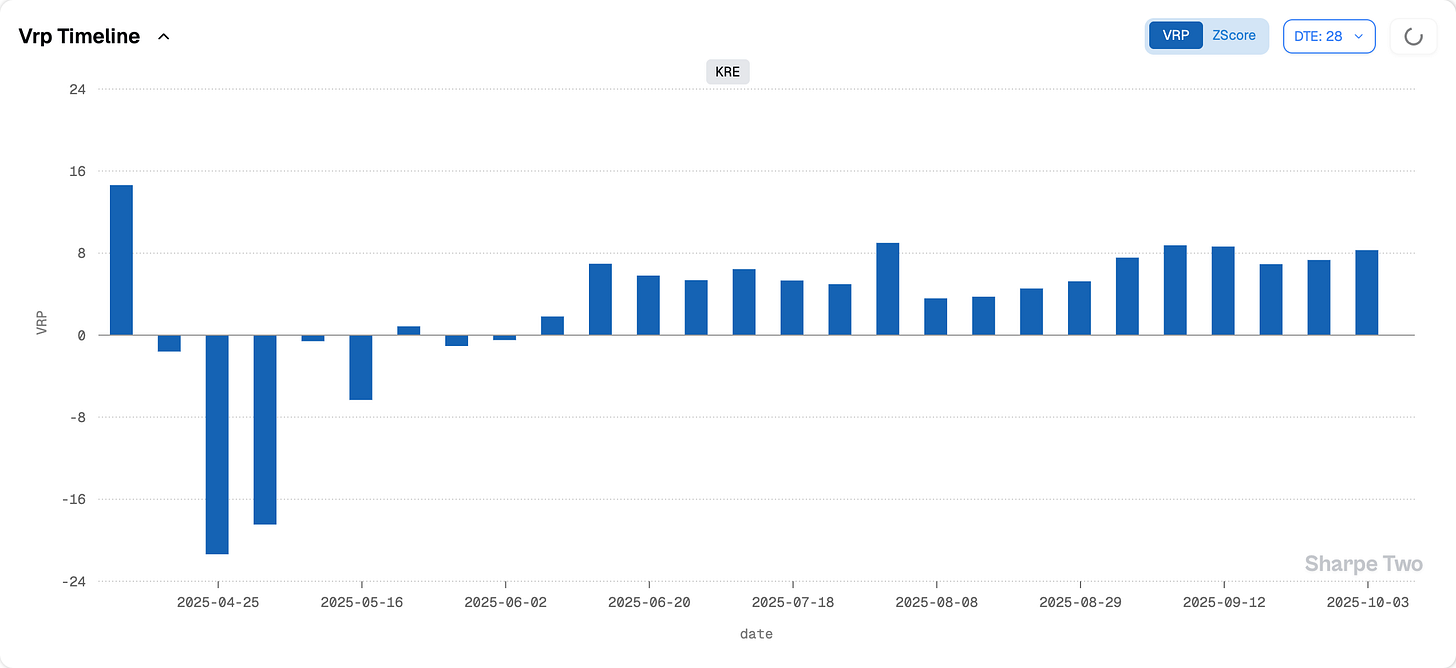

Right now, you can chase popular names, venture into tickers promising explosive returns, or focus on USO, KRE, and SPY — where the market continues to overpay. When conditions change, for whatever reason, you will simply shift to what offers the best odds of success then.

Better decisions often start with less noise: stepping back, ignoring the endless speculation, and focusing on the data sitting right in front of you.

Early this summer, we were mocked for using VIX6M to make a quick, back-of-the-envelope estimate of how many sessions could see a 1%+ drop in equities. With VIX6M hovering around 21, we concluded there would be maybe one or two difficult sessions per month. In hindsight, the mockery was deserved — just not for the reasons people thought. There were certainly not six rough sessions in the last three months; we can recall three at most.

VIX6M has barely moved since, and as we drift toward Thanksgiving, Christmas, and the usual end-of-year calm, one spoiler stands: the government will reopen — eventually.

Could realized volatility return in full force next week? Absolutely. Could something trigger a genuine recalibration of realized volatility and expectations? Absolutely.

But right now, you can either speculate endlessly about what that catalyst might be — or play the best cards already on the table.

In other news

The argentinian liberal dream took a hit in this second year. Lifting currency controls in April 2025 led the peso’s value to appreciate, worsening export competitiveness just as reserves ran low and foreign investment dried up. Argentina’s stock market became the worst performer globally, and a new crisis loomed as investors feared the sustainability of Milei’s approach. International support—especially from President Trump and the IMF—helped stave off immediate disaster, but financial institutions and markets remain unconvinced, and default risks have resurfaced.

As such the country is battling a renewed run on the peso ahead of midterms as Argentina’s inventive traders exploit exchange-rate loopholes. Individual investors drained nearly $10 billion from the central bank between April and August through arbitrage strategies such as el rulo, worsening Milei’s struggle to rebuild reserves. His government has reimposed curbs on dollar sales, but each new rule seems to spawn another workaround. With liquid reserves reportedly down to just a few billion USD and elections weeks away, markets expect officials to defend the peso at all costs before facing an inevitable post-vote adjustment. In the option market? The VIX we compute from ARGT climbed from 17 to 34 in 2 months. That, is real struggle.

Thank you for staying with us until the end, and as usual, here are two great reads from last week:

The experience of retail traders greatly varies based on the size of their bank account: one will not trade a high six figures account, the same way he would a 5k account, although … you can borrow some principles. Here is a great article from The Rogue Quant showing you just that: no technical analysis, some form of volatility control and momentum exploitation, what’s not to like about it.

Everyone’s been talking about the AI boom. But what’s actually being built to make it happen? Citrini takes you straight to the Texas plains, where the largest industrial investment cycle since World War II is literally rising from the dirt. Forget charts — we’re talking gigawatts of power, 600 football fields of hardware, and data centers the size of Manhattan. This is what the AI trade looks like when you step away from the screen.

That is it for us this week, we wish you a great week ahead and as usual, happy trading.

Thanks for the mention.