Forward Note - 2025/11/02

Deals, cuts and patience.

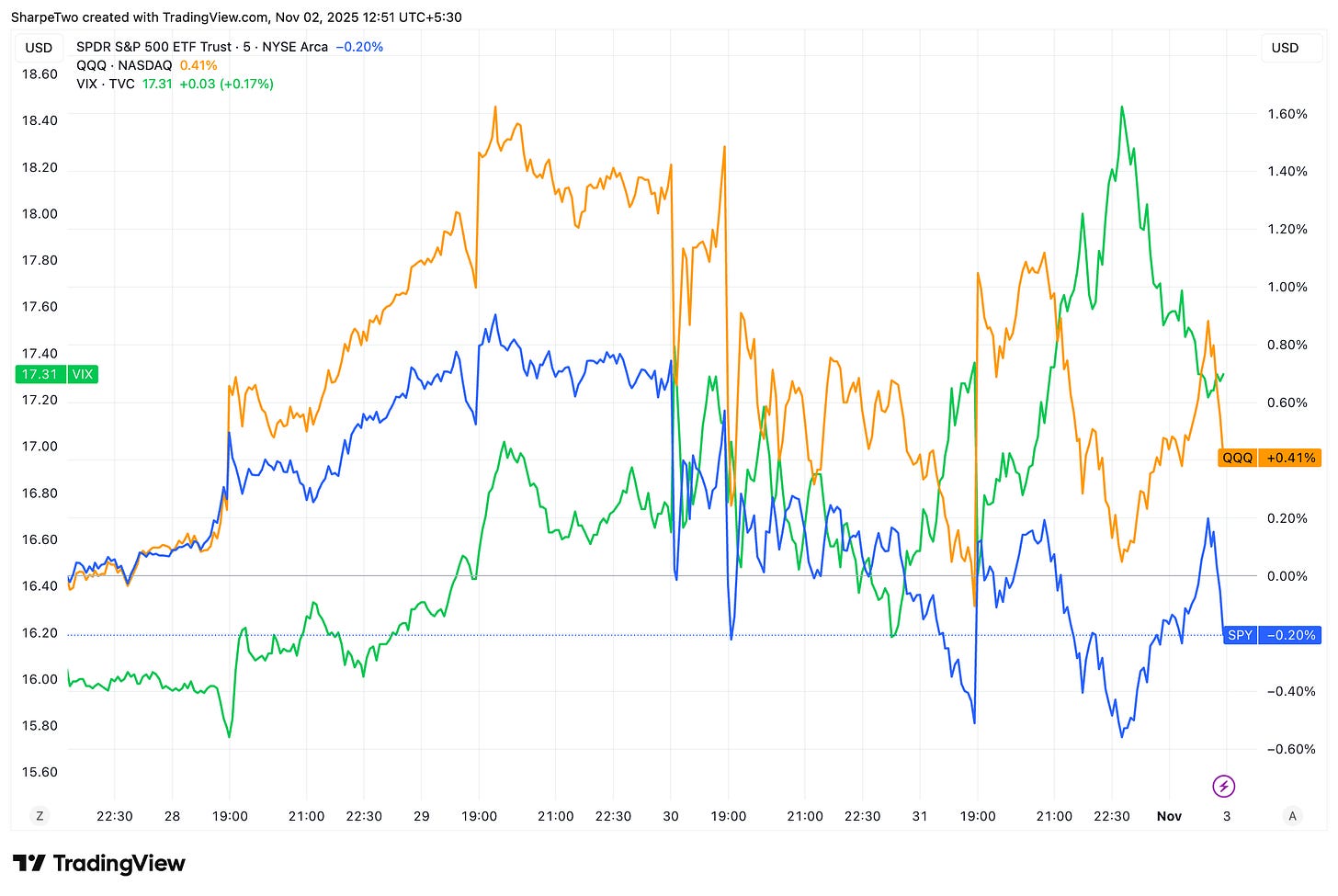

It was a quiet last week of the month, despite the fireworks we witnessed only a few weeks ago. US indices ended mostly flat, with the S&P 500 marginally in the red, while the tech-heavy Nasdaq 100 added just under half a percent. The VIX climbed nearly two points to close at 17.44.

So why the atone mood? The Fed cut rates, and Trump and Xi agreed on a trade deal, did they not? They did. But as usual, the market had already priced it in. When Trump briefly threatened to turn up the pressure in negotiations, the market go caught wrong footed but the situation quickly de-escalated.

The (awkward?) photo-op of the two leaders shaking hands was largely anticipated and changed nothing: see you in a year or sooner, for round two of a contest in which China made clear to the world, and to its rival, that it now sits on equal footing when it comes to writing the rules of the global economy.

Many will analyze this more eloquently than us, but it is worth reading the fine print of the “agreement.” It amounts to little more than a full rebuttal of everything the US administration has tried to impose on China since April.

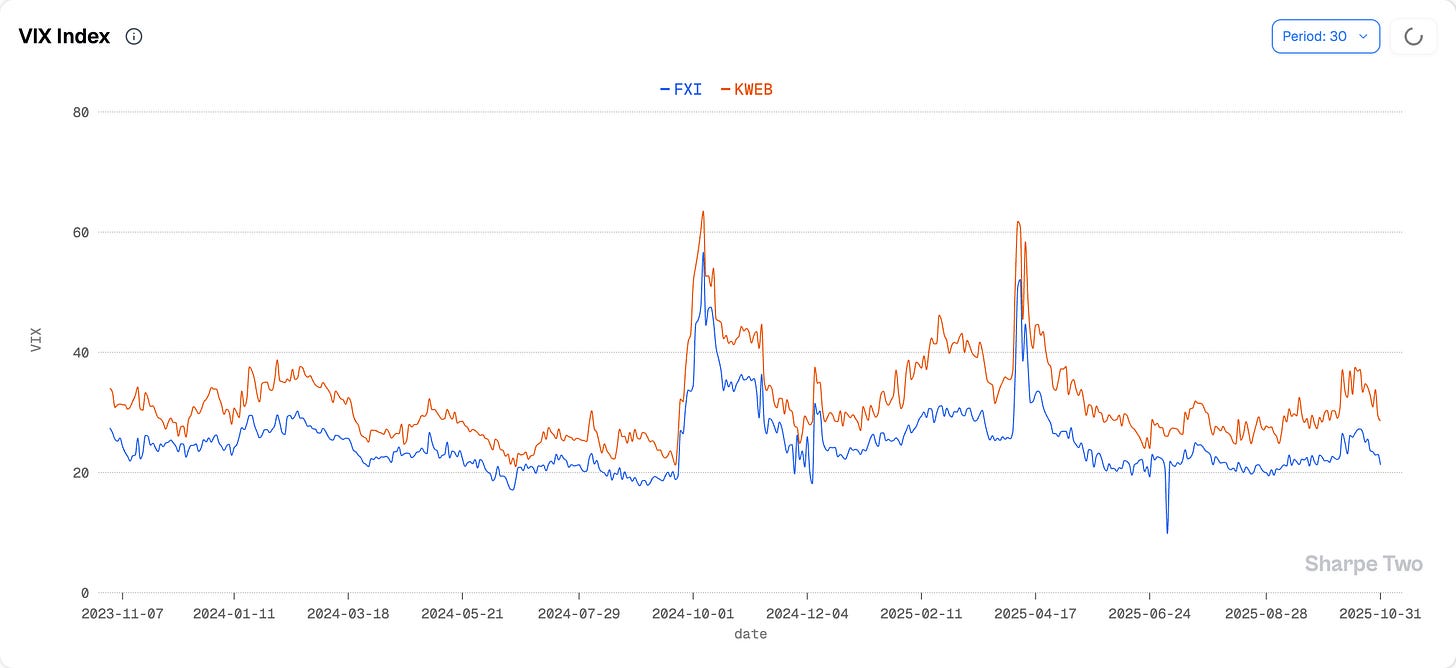

That said, it certainly removed a layer of uncertainty over Chinese equities.

And how about the Fed? We are starting to witness the inevitable loss of Powell’s grip on the Committee. The last FOMC showed two dissents and interestingly enough, pulling in opposite directions. One member argued for a 50 bps cut, another for none at all.

This divergence forced the Fed to alter its statement quite substantially from the previous one, including a clear and explicit acknowledgment from Powell that a December cut was no longer a given. And while he also confirmed that quantitative tightening would end in December (for reference, the Fed’s balance sheet still stands at a whopping 6.6 trillion USD), it was not enough to lift investor sentiment much further.

And we cannot really blame them. Once again, we will refrain from deep macro commentary and simply highlight that… we have not learned anything new likely to meaningfully improve the outlook over the next six months. Despite the mockery on social media, everyone sees the same thing: tech stocks are absurdly expensive, but what is the alternative when you have to justify your performance against an index… whose top seven names drive 20% of its weight? It will take more to flip the switch on that seemingly circular loop. Seemingly, because we also learn that Amazon is reducing his corporate workforce to embrace the AI transformation: it may be slow to happen, but it will happen, once again, despite the mockery on social media.

Let’s get back to our favorite topic: what is the trade in such circumstances?

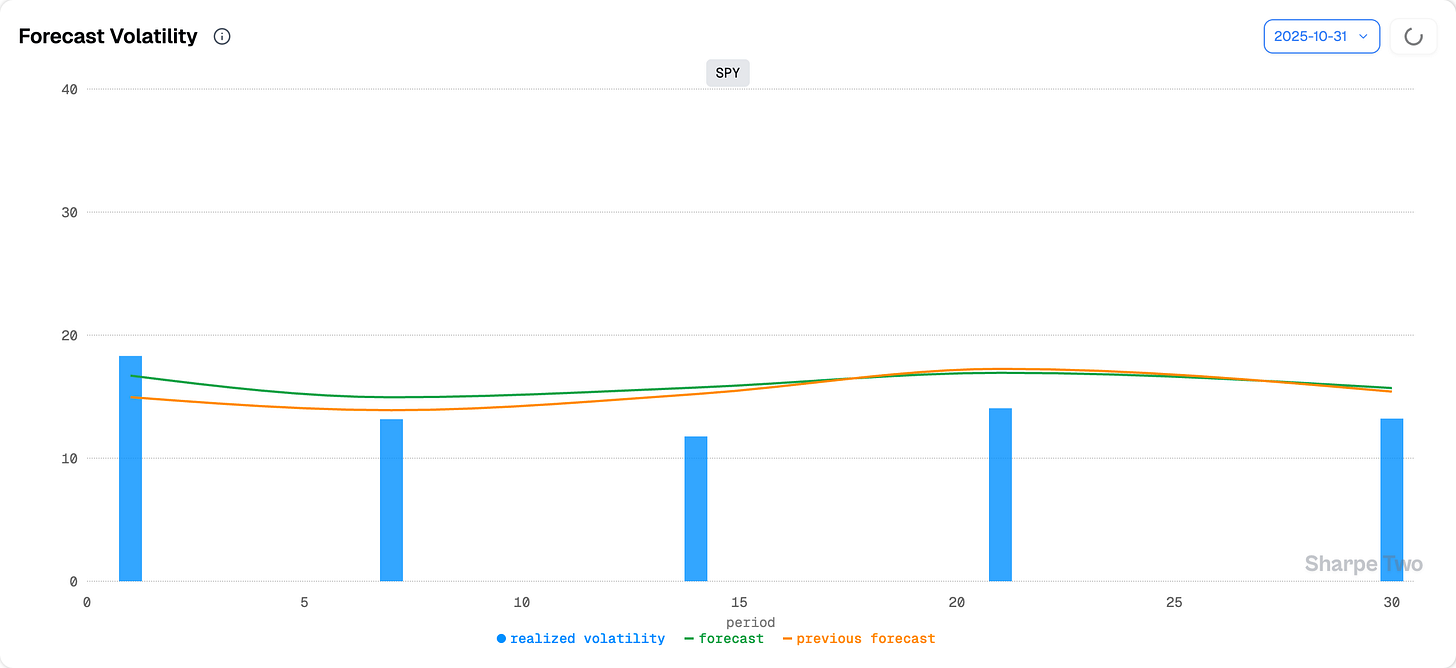

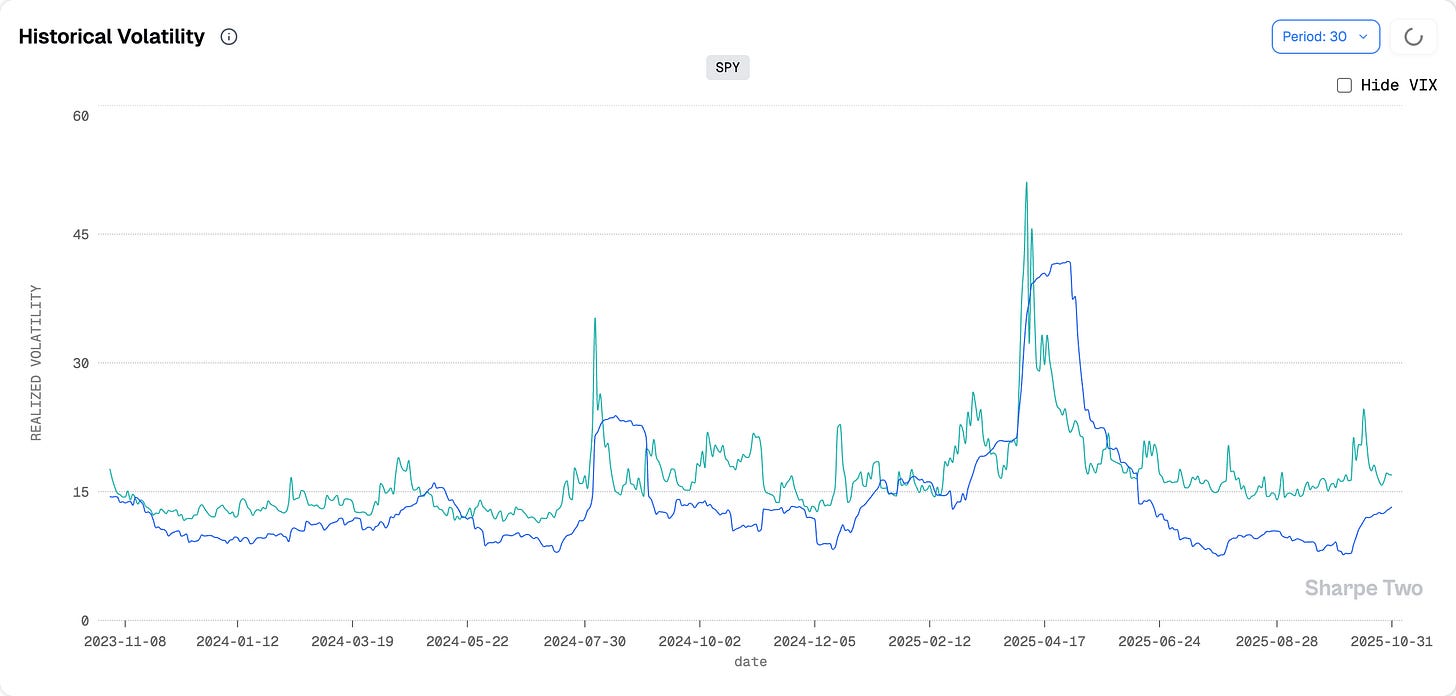

We highlighted last week that conditions differ from six weeks ago and that one should be cautious before diving back into the same setups. While the VRP is still there, at a VIX of 16 it is far less pronounced given the recent rise in realized volatility. VIX 18, as we saw on Friday, offers a better entry but even then, caution is warranted.

Realized volatility over the last 30 days now sits at 13.22%, and the margin for error when selling implied volatility grows thinner by the day. This is especially true if we expect more movement in the coming weeks before Thanksgiving. The government remains shut, NVDA earnings are still ahead, and given how sharply VIX spiked as we approached big tech earnings last time, it would not be far-fetched to see realized volatility grind another point or two higher from here.

Our forecasts currently point to realized volatility around 15.5%, and one can see why selling 16 is risky or at the very least, much riskier than when we could sell 16 while realized sat at 10 and was expected to rise toward 12.

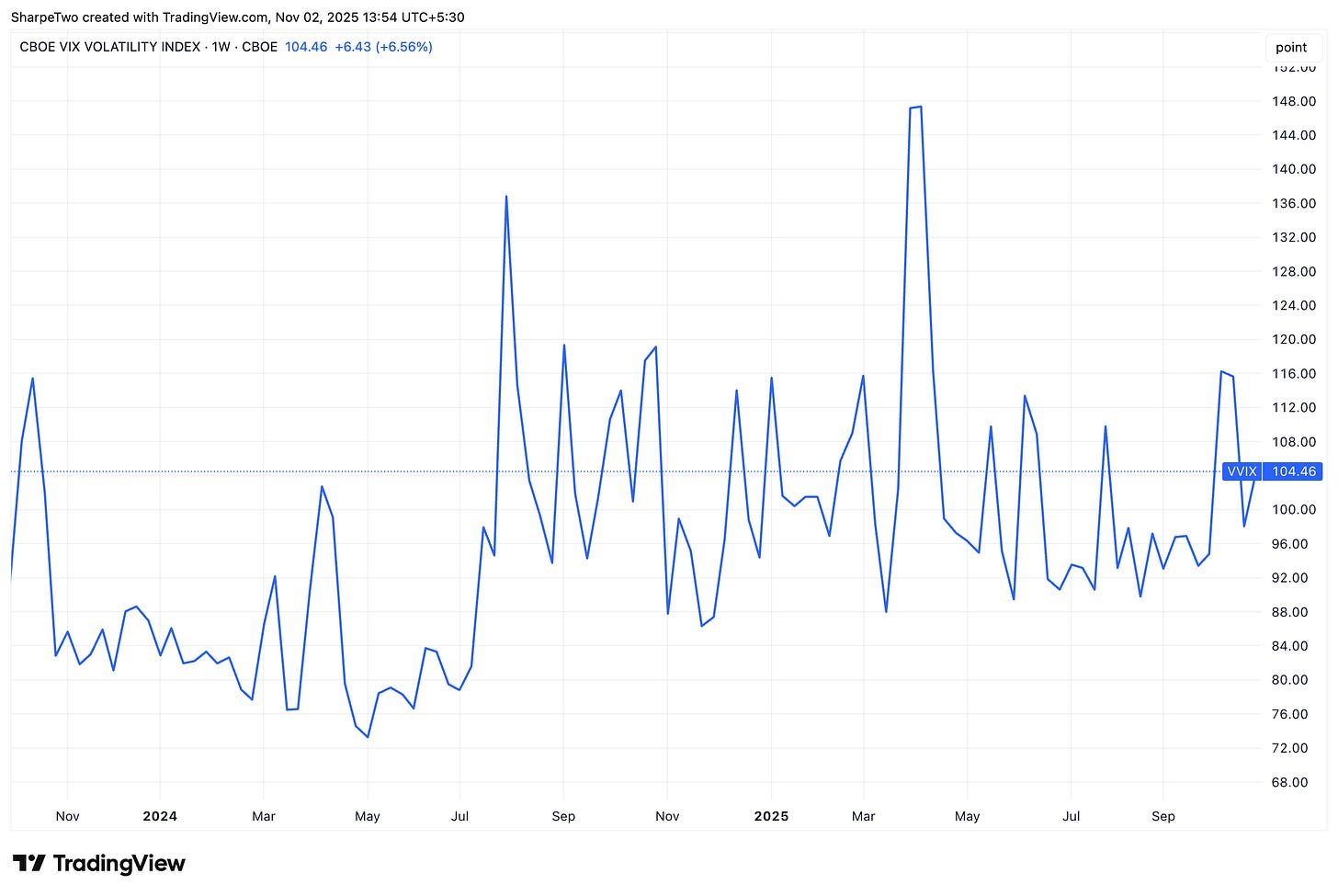

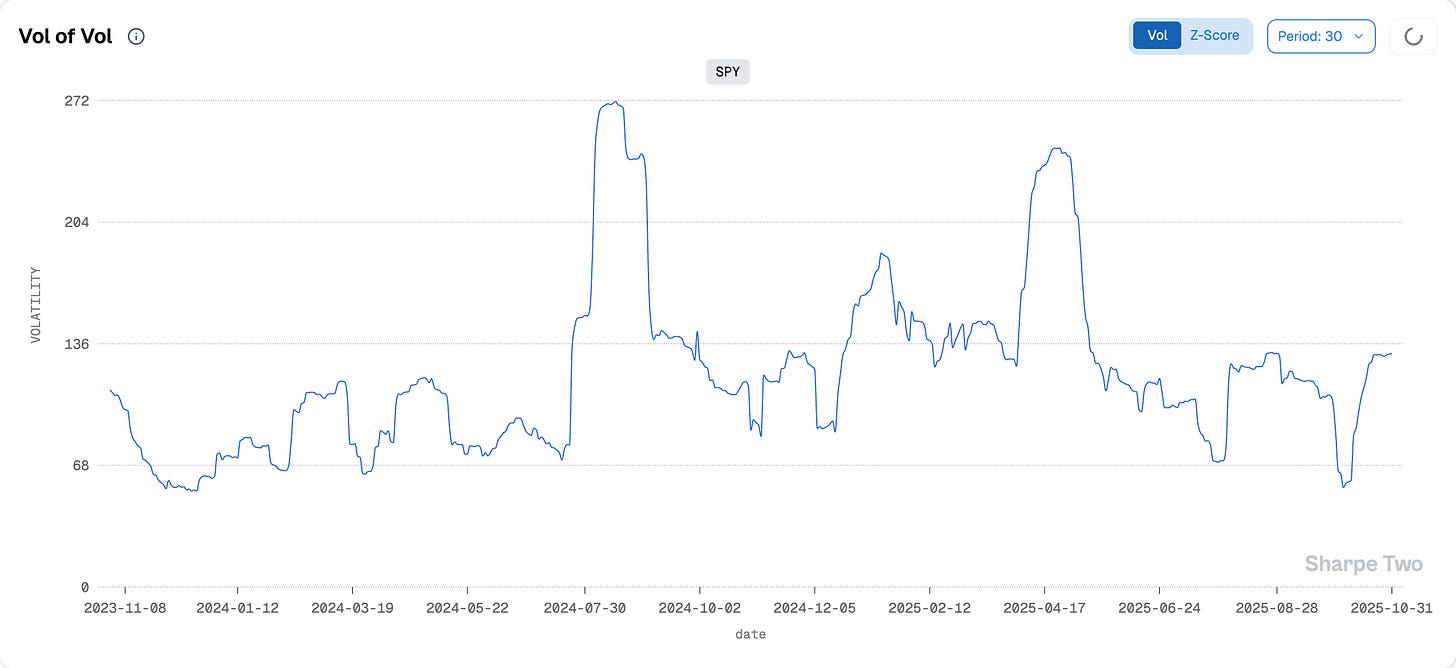

That said, we are certainly not buying into the casual doom and gloom that often circulates, nor into those searching for meaning in microscopic shifts in term structure or the latest percentage change in VVIX. Since Trump’s election, VVIX has remained above its long-term average of 90. If you ask us, that is one of the cleanest expressions of the so-called “Trump risk premium” and it remains a valuable gauge for spotting when the market becomes more optimistic about the future.

But volatility-of-volatility has not accelerated beyond what one would normally see in a regime gearing up for a period of heightened stress. In fact, we would not be surprised to see it slowly retreat as the year winds down and we head toward Thanksgiving and the Christmas break.

So what is the trade? Well, the year has not been terrible, has it? Even if you hit a rough patch in April, the variance risk premium was so pronounced between June and October that you are likely on track for a neat performance by year-end.

When conditions are like this, opportunities in short-dated options often carry better odds and we had a perfect illustration with our Signal du Jour on Thursday: enter at the open, exit by Friday, as volatility in SMH eased and time decay did the rest.

It is worth revisiting how Sharpe Two’s signals from September when we started our Trade Anatomy series (and so far a perfect record) to see what prime setups for option selling look like. And right now, it is not prime time.

So why force a trade now and risk throwing it all away? The hardest part for most retail traders is to stay patient and to wait for conditions where compensation truly justifies the risk. Otherwise, sitting on the sidelines is a perfectly valid position.

In other news

One hundred minutes, a strong handshake, a few smiles for the cameras but the most important ingredient was missing: warmth. And it is not as if we have never seen Xi laugh or show emotion when meeting Western leaders; his past interactions with President Macron or Chancellor Scholz in 2024 come to mind.

The show put on by Trump to display strength and control over China left many observers with a far more nuanced impression than the official statements would suggest. Yes, the rare earth export restrictions have been lifted, but so have most of the “reciprocal tariffs” imposed on China back in April. More strikingly, the extended blacklist of companies barred from purchasing US technology has been suspended for a year.

Put simply, this marks a steep de-escalation, at least for now, and a clear message from China to the rest of the world: the US cannot keep acting as the bully in global trade, and China is willing to fight that battle head-on.

What happens after a year remains unclear, but we would be surprised if this topic does not resurface before March. How is there not yet a Kalshi market on when the first accusation of non-compliance with the October agreement will appear?

Thank you for staying with us until the end, and as usual, here are a few interesting reads from last week:

What if one of the most persistent, overlooked risk premia sat hidden in plain sight inside crypto funding rates? This paper isolates that signal with a delta-neutral cash-and-carry framework that strips out market direction and captures pure implied yield from BTC and ETH term structures. The results are striking and for investors chasing diversification that is actually uncorrelated, this research points to a new, liquid, and harvestable source of edge.

We’ve had the chance to start our career on a trading floor in London almost 15 years ago (!!!) now. Reading this piece felt a bit nostalgic but also extremely informative: there is no two trading floors alike, especially when you compare fundamentally different financial institutions.

That is it for us; we wish you a wonderful week ahead, and as usual, happy trading.

Ksander