Signal du Jour - short vol in US equities

And a bonus long/short trade.

NVDA did not break the market. VIX sits quietly at 14.5 pre-market, the S&P 500 broadly unchanged, while the world’s most valuable company licks its wounds from what was—let’s be honest—a very light beating. Only $56 billion in revenue when analysts were banking on $60 billion? How dare you, NVDA. Such a letdown.

You can always dig up reasons why markets “should” go down. But with realized volatility anchored this low, and with no one bothering to buy downside protection, it is going to take something truly unexpected to knock this move off course in any lasting way.

Now, roll in the calendar: a long weekend ahead, preliminary GDP at 3.3%, and odds are stacked toward a quiet Thursday, a quiet Friday… before the curtain lifts again with the next NFP.

So for once, we tilt short vol in US equities. Yes, yes—we can already hear the protests: who in their right mind sells VIX 14? Which is why, as a bonus, we are adding a long/short twist to the mix.

Let’s unpack it.

The context

We are now much closer to the start of Q4 than the end of Q2. Q3 has slipped by under the banner of a lazy summer—stocks drifting higher, the occasional dip, but nothing that could pass as a proper bout of volatility.

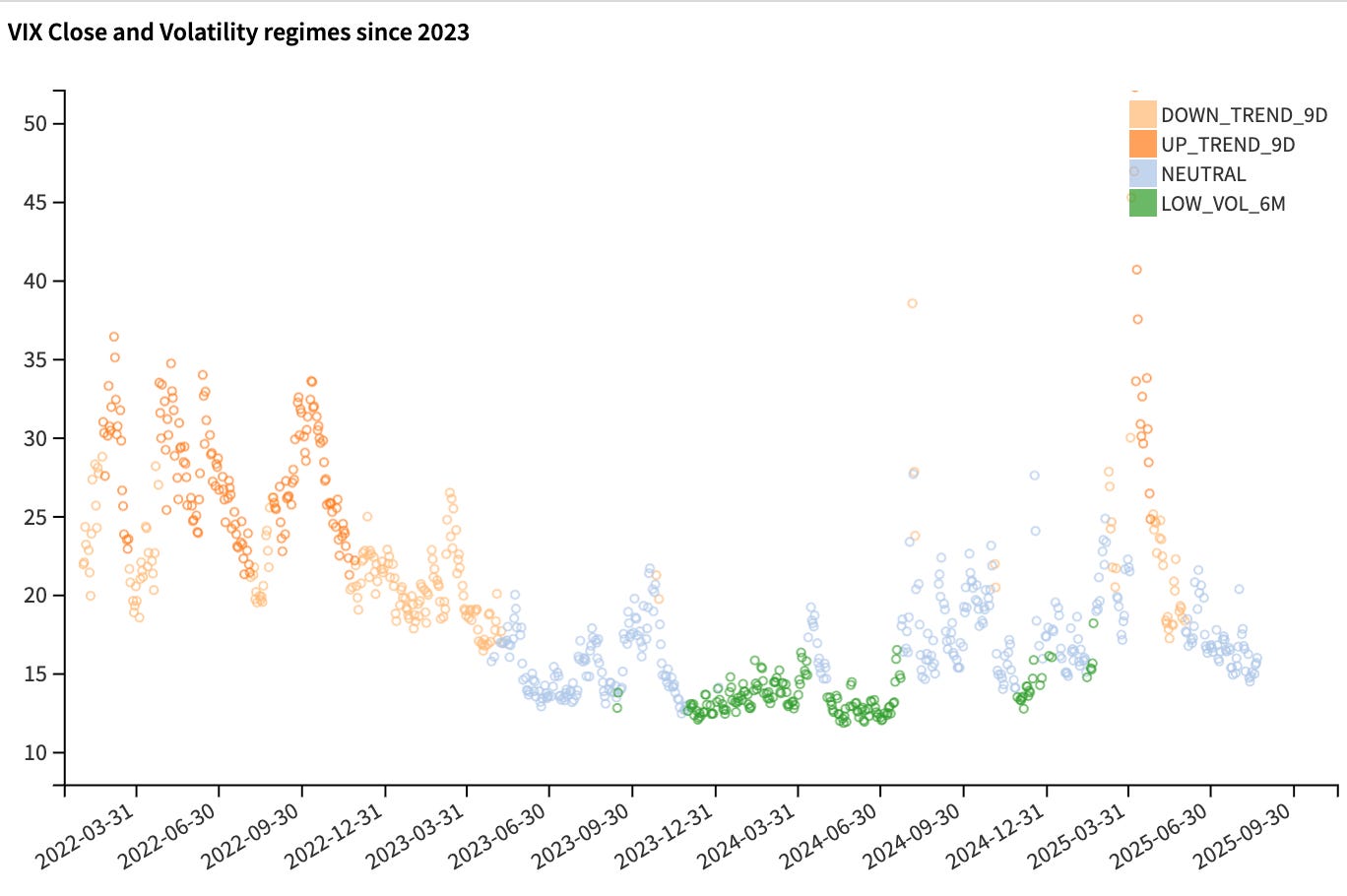

From a low of 7.7% realized volatility across July—one of the lowest prints we have seen in years—things edged a little higher in August, but still remain anchored near the lows of the past two years. For context, we are broadly in line with the last extended low-volatility stretch, which ran from Q4 2023 through Q2 2024. That comparison is not accidental: low-volatility regimes can linger, and history suggests they often do.

This is typical when most of the uncertainty clouds have been pushed off the horizon. The market has a decent read on policy rates. The economy, while no longer roaring like two years ago, is still more than holding up. Inflation, though elevated, remains contained. Geopolitics, for the moment, appear dormant. What is there not to like?

Yes, we know—it is always easier to list the reasons why things could unravel than to accept the dull “good enough.” But when you have a mandate to put hundreds of millions of dollars to work, you do not sit around waiting for a peace treaty between Ukraine and Russia, or for GDP growth to spit fire at 5%. Finance is built on calculated risk-taking. That is the context.

With that in mind, what is our forecast for realized volatility over the coming weeks?

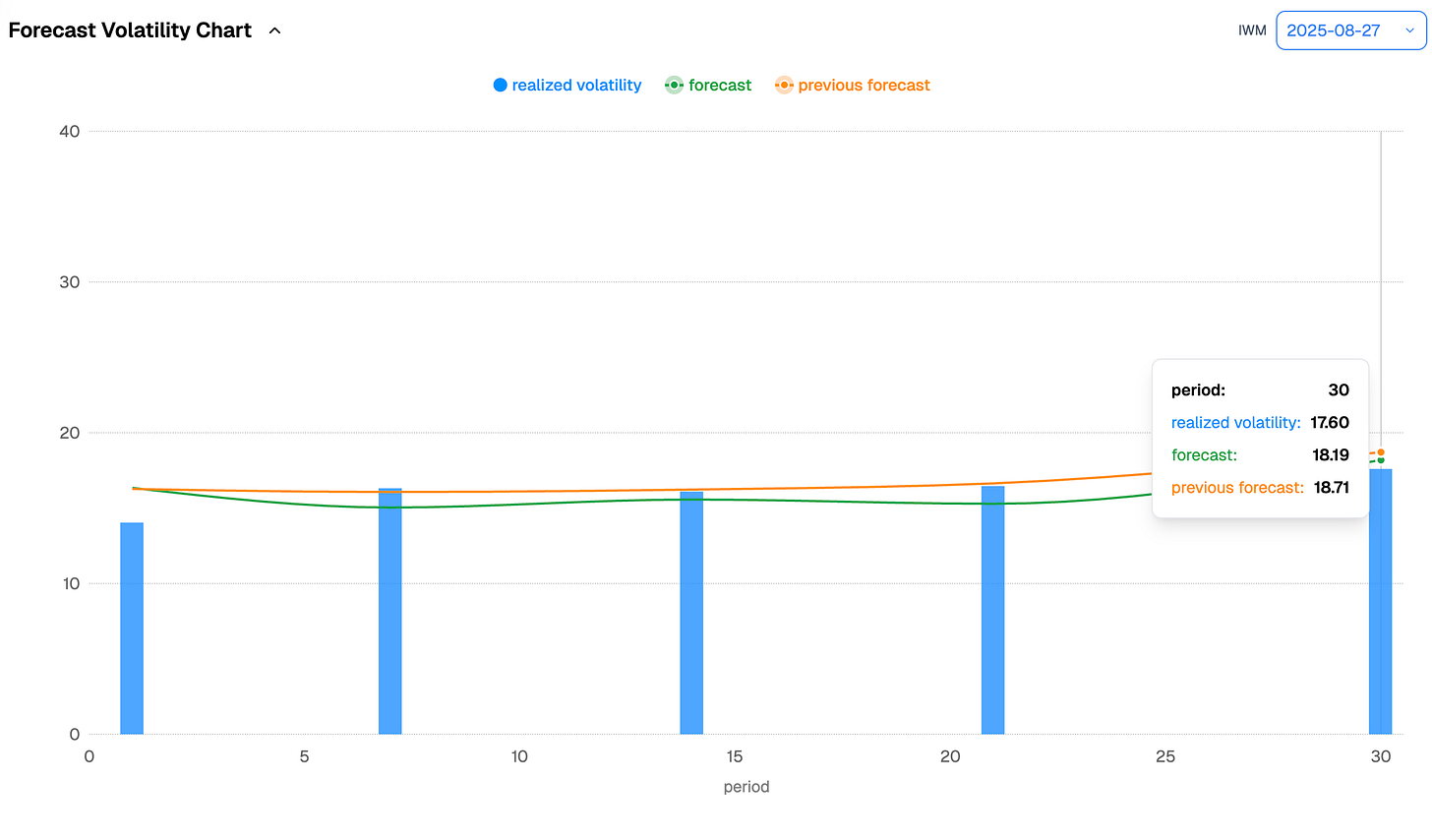

We expect IWM to behave much as it has over the past month, delivering realized volatility around 18% over the next 30 days. Of course, any fresh catalyst could dent that view. But absent a shock, the assumption holds: steady behavior for the weeks ahead.

Now let us turn to how the options market is pricing things.