Trade Anatomy - 100% win rate in 10 signals.

Post Mortem - Signal du Jour 2025/10/23

Two weeks ago, we brought you an opportunity in EFA, the ETF tracking international equities excluding American and Canadian markets. That came right after a bout of volatility in the S&P 500 options complex, which saw the VIX spike to 28 pre-market on October 16.

The market had calmed since, but the trade still felt uneasy to many: was the pay worth the risk, and would it not be better to wait a few extra days for confirmation that things had truly improved before putting the position on?

That doubt never fully disappears when you trade volatility from the short side. You will always second-guess yourself and wondering if the spike is really over or if we are headed for a repeat of August 2024. Yet in this case, the data was on our side. It was a time to lean on the numbers, trust the process, and tune out the noise.

This brings our track record to nine out of nine Signal du Jour trades generating profits for our readers. And we can already tease that last week’s SMH setup was also quickly in the green. Stay tuned as next week we will be celebrating a 100% win rate across ten published trades since Aug 28.

Want to emulate our results? Check out our platform, where you can access the same probability models we use to identify and structure trades or plug our signals directly into your own data pipeline through the API.

The trade

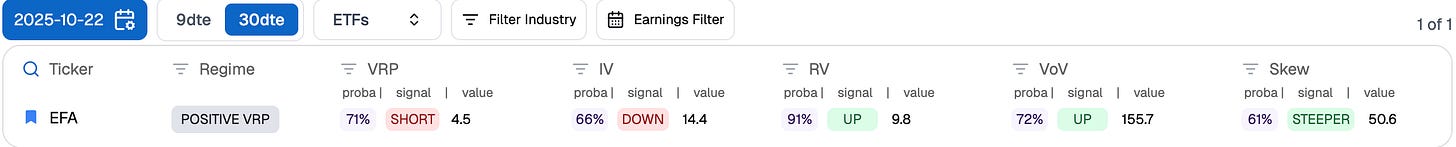

In our Signal du Jour from two weeks ago, we highlighted an opportunity to short implied volatility in EFA. At the time, volatility from U.S. equities had spilled over into international markets, and investors were staying cautious ahead of the critical Xi–Trump meeting and the upcoming FOMC. Data-wise, our system was pointing to the following:

The probability that implied volatility (as of the 10/22 close) would exceed the subsequent realized volatility over the next 30 days was far from negligible as it stood at 71%, giving us solid odds to sell overpriced one-month options.

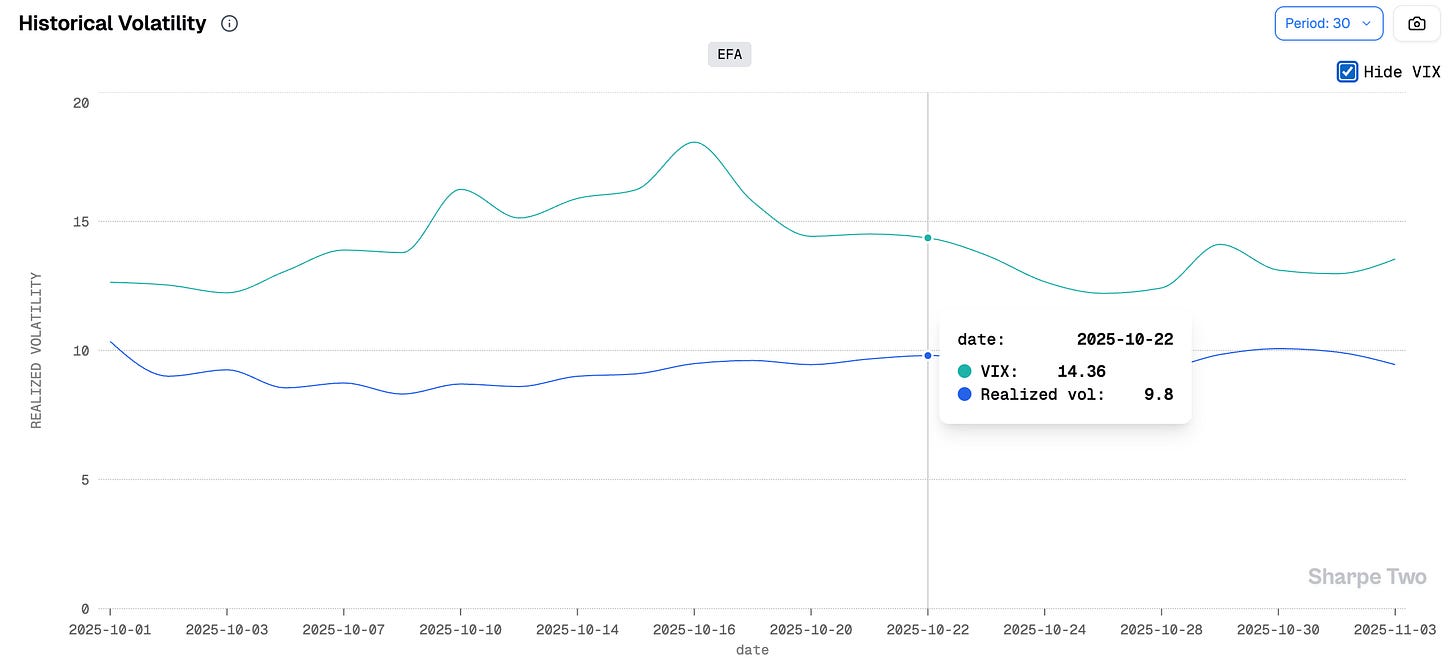

We also had a strong chance to see implied volatility compress. At 66%, that alone was a good reason to expect a positive outcome as investors dropped hedges and uncertainty around international markets faded. The only nuance was managing the fact that realized volatility was still likely to rise from there.

Yet, starting from a realized volatility of 9.8, we had more than enough margin to absorb shocks in the underlying. It would have taken something truly catastrophic to push realized volatility past 14.4.

In the end, realized volatility kept grinding higher throughout the life of the trade, but nothing dramatic. Implied volatility, meanwhile, dropped early on, then ticked back up last week before stabilizing about one point below our entry level. That should have supported the P&L and potentially triggered an early exit from the position.

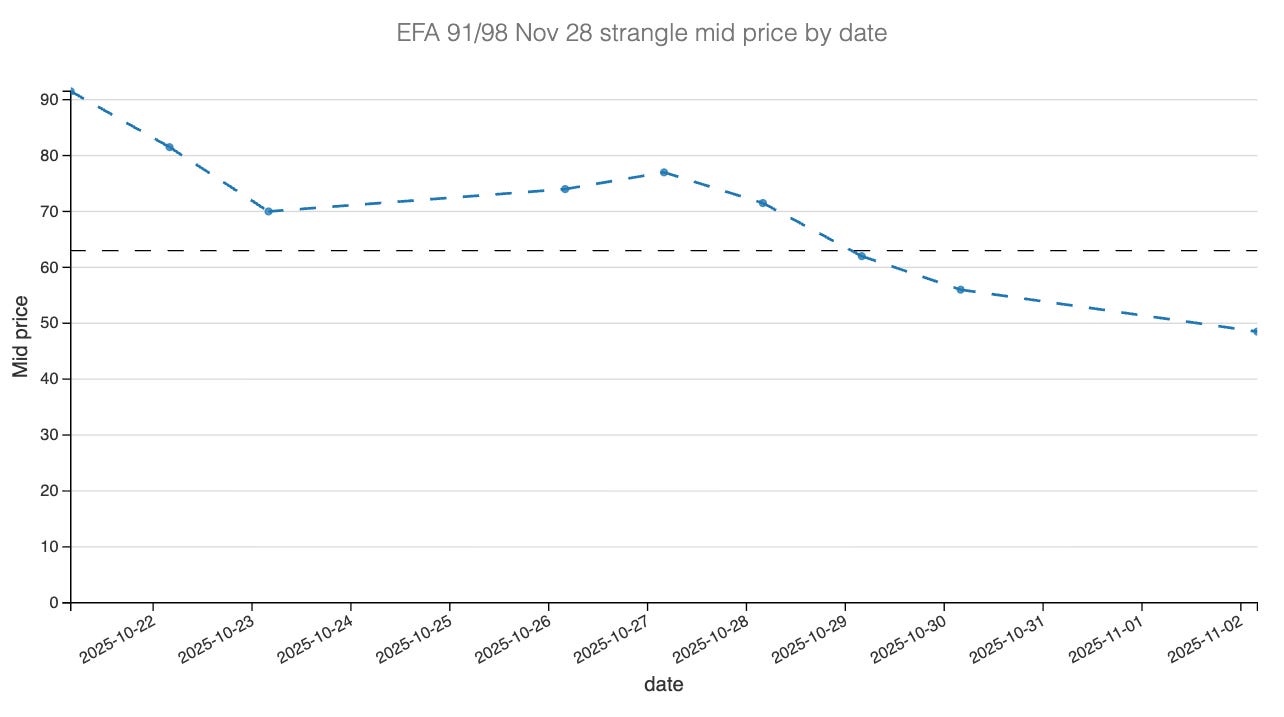

We emphasize this because it is a conversation we have had several times lately: taking profit at 25% is good trading hygiene. Holding for 50% targets something different; it assumes not only that volatility remains overpriced versus realized, but also that the underlying will not move enough to challenge your strangle or straddle. That is a strong assumption. In this case, the drift was limited, but we recently had a position in XLU where realized volatility sat well below implied, yet the trade still lost money because we did not hedge directional risk. Taking profits at 25% ensures you do not overstay your welcome and keeps you out of the trap of path dependency.

In the end, the underlying drifted quite a bit in the first part of the trade, from the 22nd to the 29th, as markets rallied in a sigh of relief after two complicated weeks. We would expect the delta component to have hurt the P&L early on, before easing as the market reverted. The interesting question is whether that initial drift was strong enough to offset the benefits of implied volatility compression and time decay.

To build some intuition, let us look at the P&L of the position over time:

We entered the trade with our Discord group on Thursday at the open, around 83 cents, and managed to close it early about a week after putting it on. As the chart shows, the underlying had not even fully reversed its move at that point.

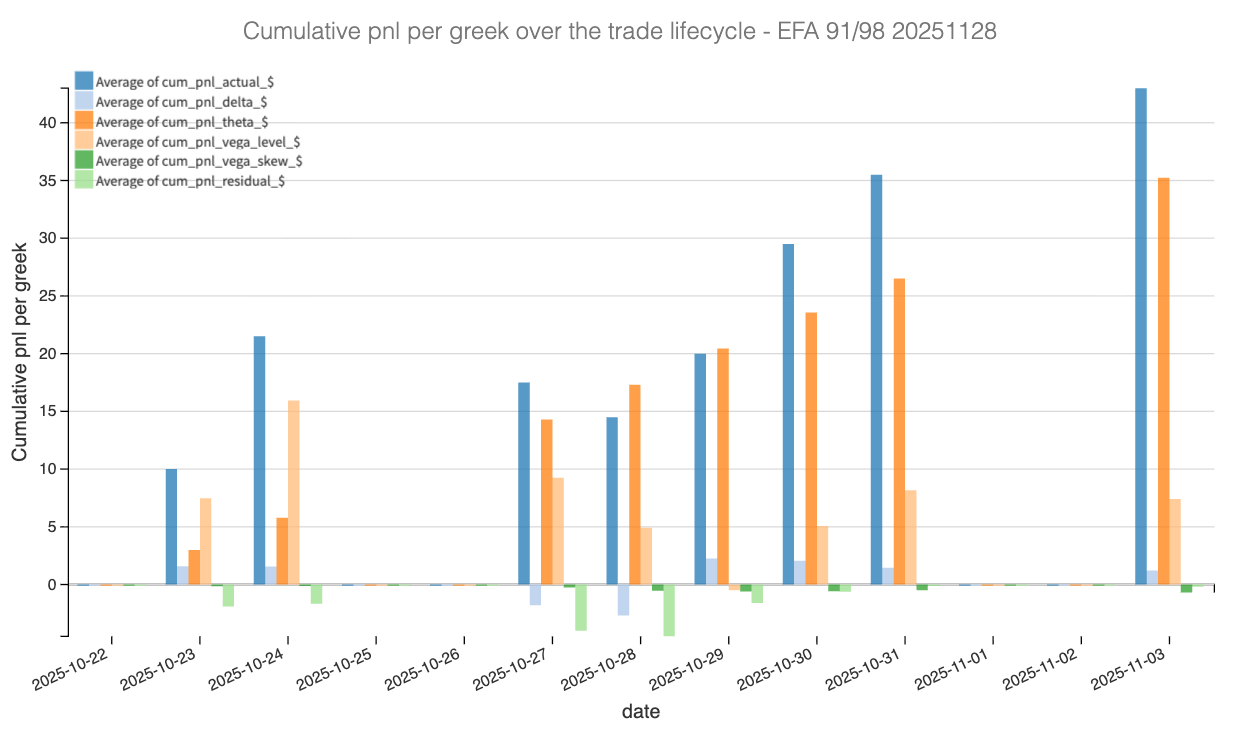

Let’s now have a look at the complete greek pnl attribution.

The Greek Decomposition

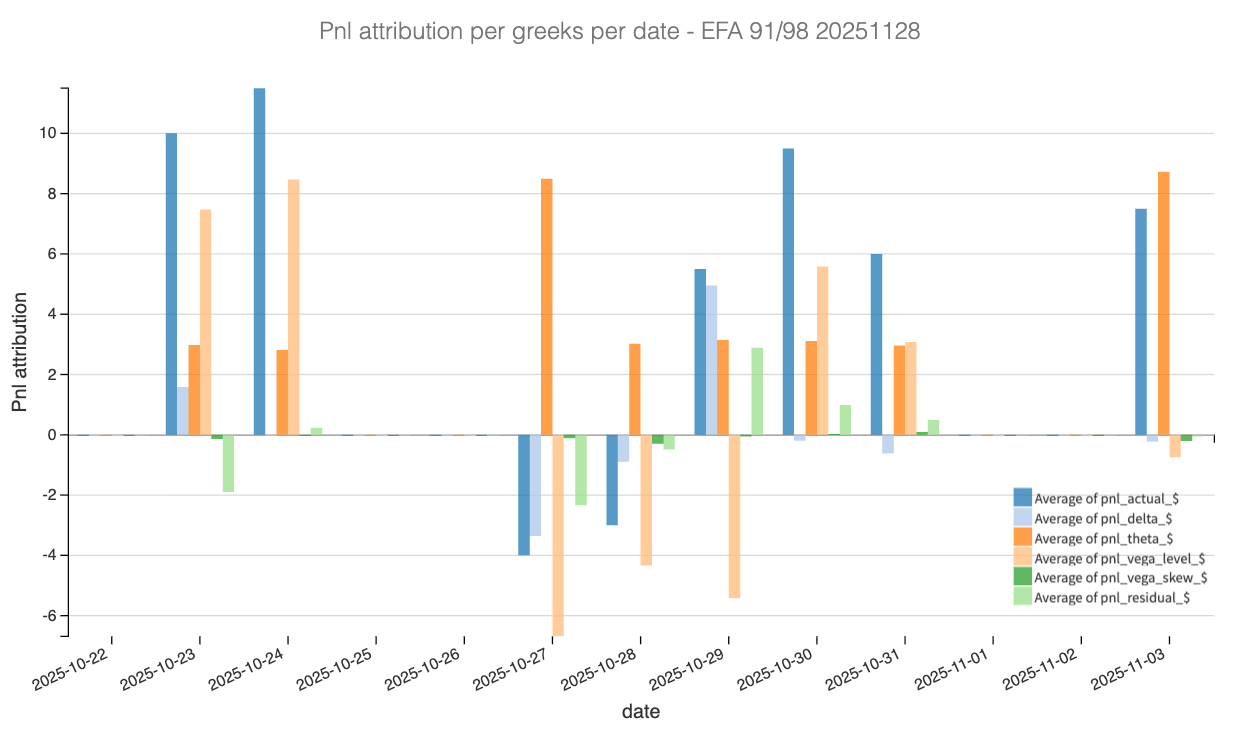

The attribution tells the story we expected.

The early life of the trade was marked by a decisive vega crush and steady time decay; the two forces that carried most of the PnL. Implied volatility fell sharply right after entry, immediately validating the signal and generating an outsized vega-level gain. This initial vol compression did most of the heavy lifting: it neutralized the small directional losses that emerged as the underlying rallied and kept the position comfortably positive even while spot drifted higher.

Once the vol had normalized, delta exposure naturally diminished, a crucial dynamic often overlooked. With a flatter vol surface and tighter option greeks, directional swings lost influence on PnL. That is why the delta component only turned meaningfully negative around October 27, coinciding with a brief rebound in implied volatility that produced a temporary setback in both the vega-level and total PnL. The move was short-lived: vol quickly mean-reverted, theta resumed its contribution, and the trade recovered almost instantly.

From that point, the position behaved like a textbook short-vol carry: theta grind dominated, residual effects stayed small, and skew remained stable. The combination of early vega crush and continuous decay allowed for an early, clean exit, proof that timing volatility dislocations correctly matters more than trying to forecast direction. In this case, trusting the data and acting decisively after the spike was the difference between hesitation and another smooth win.

Now is it worth putting this trade back on ? Let’s have a look.