Signal Du Jour - Short Vol in EFA

Exploiting the slight change in investor's psychology.

The big news this week is the return of meme stocks — and the frenzy in BYND, a name we were literally wondering what had happened to just a few weeks ago.

Putting the fun aside, gold is having a rough week while equities have found some footing. Despite yesterday’s pullback, we remain only a few percentage points from all-time highs, with the VIX now firmly below the psychological threshold of 20. We are entering earnings season for big tech: TSLA is down 3% despite better-than-expected sales, as it posted its slowest revenue growth on record.

In a week from now, AAPL, META, AMZN, and GOOG will have reported their earnings, and the FOMC will be behind us. What does that leave for implied volatility in the US market, as we slowly but surely drift toward Thanksgiving and the end of the year? As usual, we are not saying nothing can happen — but more than ever, the burden of proof is on the bears.

That said, we will stay clear of US equities today and turn our attention abroad. We are considering a trade in EFA, the ETF that gives investors exposure to international equities excluding — you guessed it — the US. Pretty handy if you want to watch developments over the next week without being too involved, and hopefully keep our winning streak intact.

Let’s have a look.

The context

By every measure, EFA has had a terrific year: it is up almost 25% year-to-date, and considering it was not spared by the sharp plunge in April that briefly pushed it into negative territory, that is a performance investors will applaud. That is roughly twice the return of the S&P 500 and still a solid 33% premium over the tech-heavy Nasdaq.

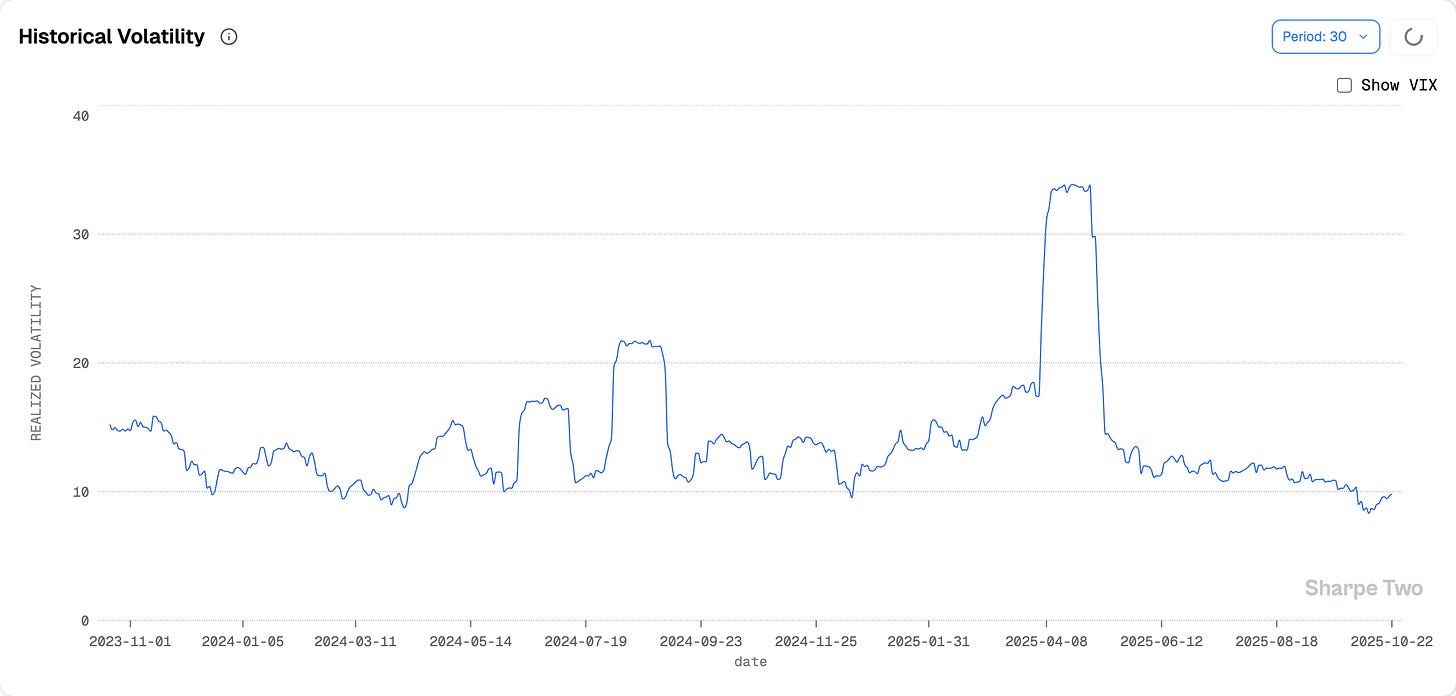

EFA was not immune to bouts of volatility throughout the year, especially as geopolitical tensions kept investors on edge. Yet things remained fairly orderly once the tariff shock was absorbed and the Israel-Iran conflict came to an end in June.

Since then, EFA has been hovering near its lowest levels of volatility in the past two years, even dipping meaningfully below 10 at the end of September. This may seem surprising given what has happened in the US market since early October, but one has to remember that EFA excludes any US or Canadian names from its listings.

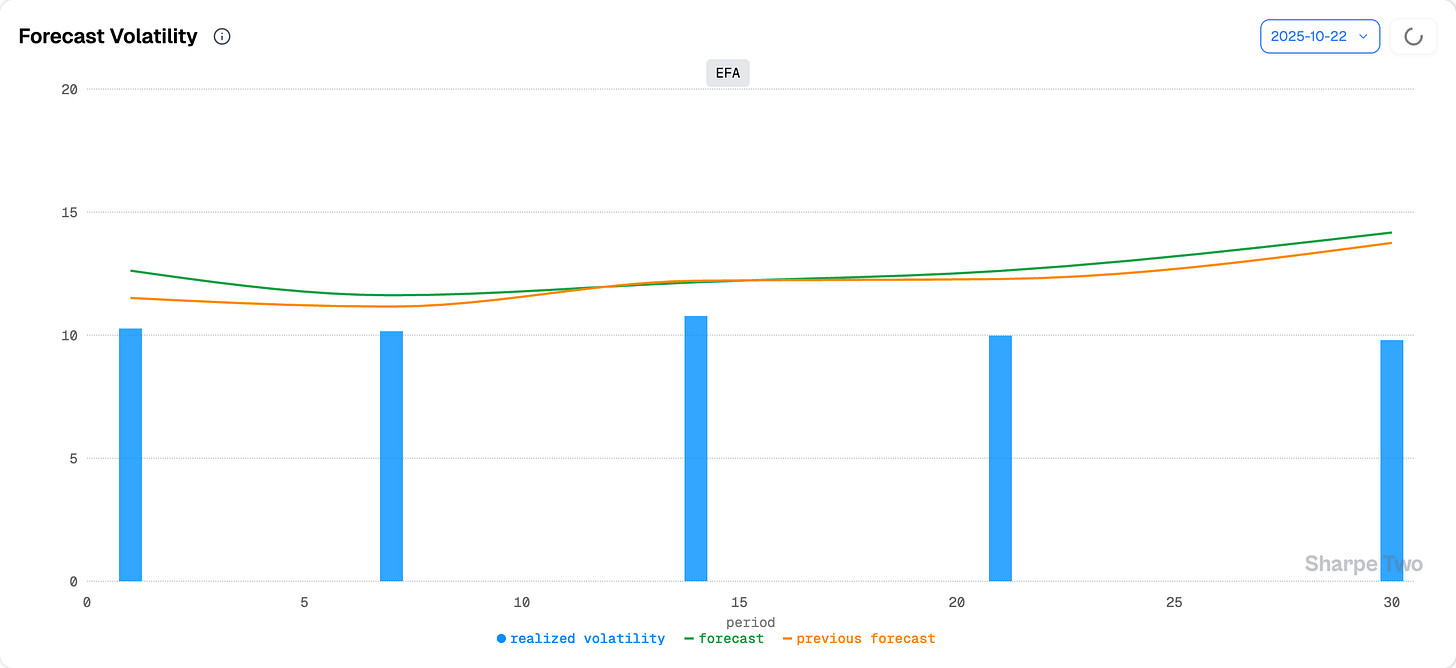

We do not necessarily expect things to stay this calm as we move toward year-end. Our models currently suggest we may be looking at something closer to 14% realized volatility over the next 30 days.

One must also remember that this model gives significant weight to the long-term average observed in the product, effectively calling for a mean reversion in realized volatility. That can happen, but we should not be surprised if the rise only extends to around 12.

With that in mind, let us see what the options market is telling us — especially since investors may already be wary of any dent in what has been an impressive run so far.