Forward Note - 2025/10/26

Red light.

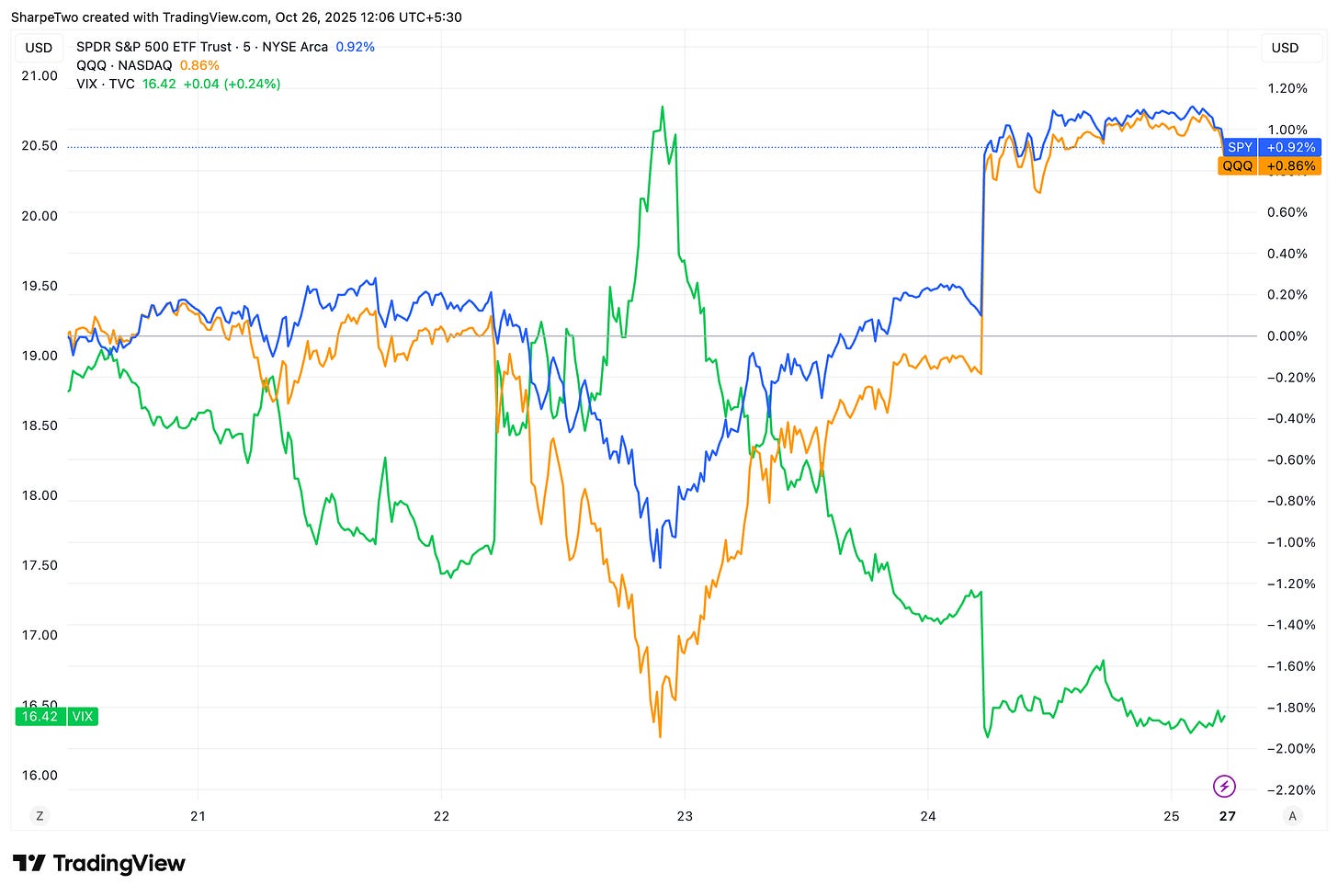

The markets are back at all-time highs after the shockwaves that sent them spinning two weeks ago—at the time, promising some rougher days ahead. None of that materialized. Both the S&P 500 and the Nasdaq 100 tacked on another 1.5%, while the VIX slid back to the 16 handle.

No real sense of relief across social media either. If anything, the disappointment felt genuine: all of that… for this? No thrilling sell-off, no giant red candle, not even a proper catapult to the upside. “So boring,” as Jim Carroll from Vixology aptly put it.

So, back to the good old days as if it were summer 2025? Not so fast. Yes, you read that right—hold your horses. That may sound unusual coming from a publication that has spent months encouraging vol-selling, even going outright long at times.

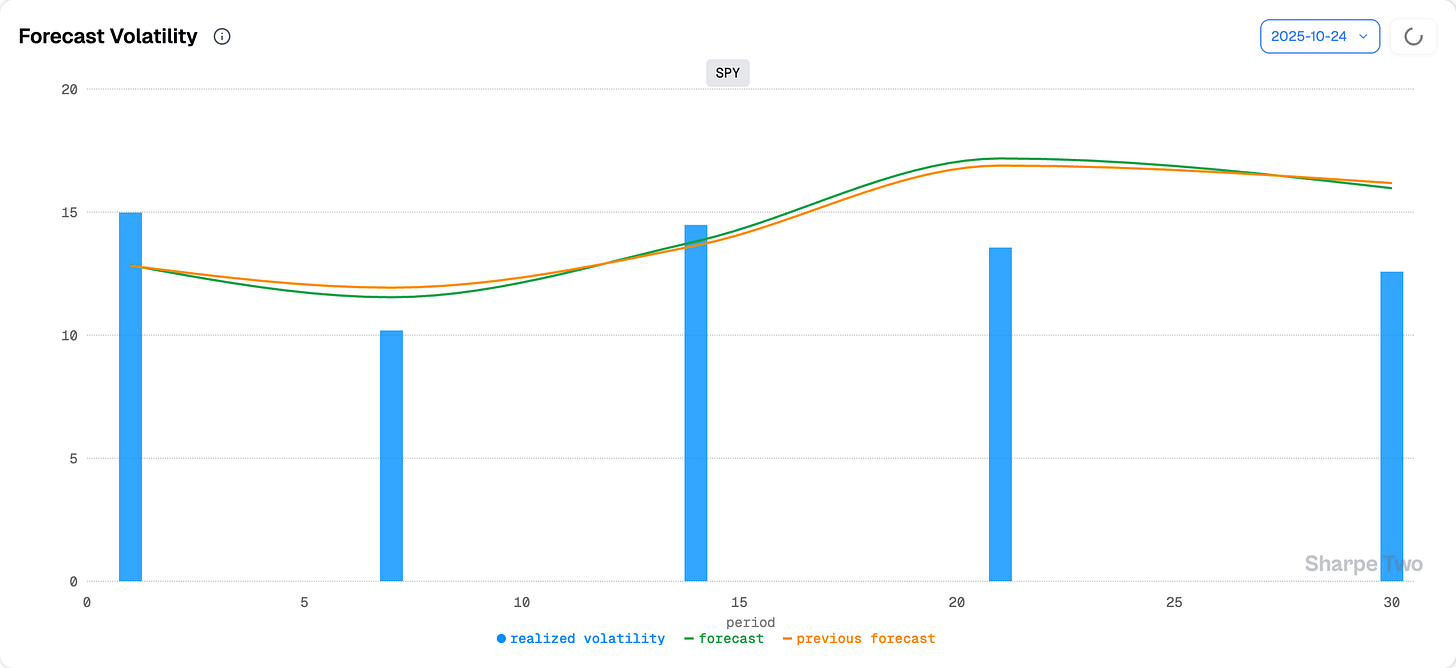

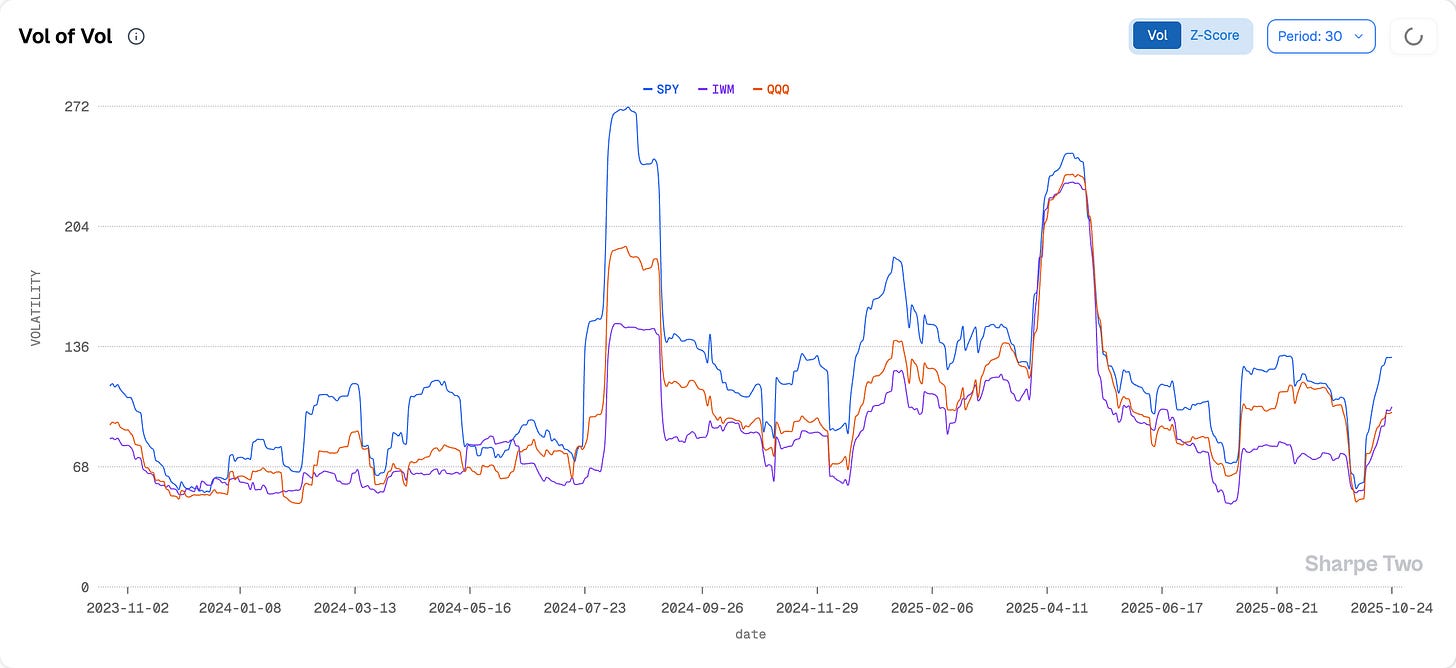

Let’s start with the obvious: no, we still do not see a crash coming. But from a pure volatility standpoint, things have shifted. Ignoring that would be a mistake. With realized volatility climbing through October, a VIX at 16 suddenly looks far less appealing for anyone considering selling options.

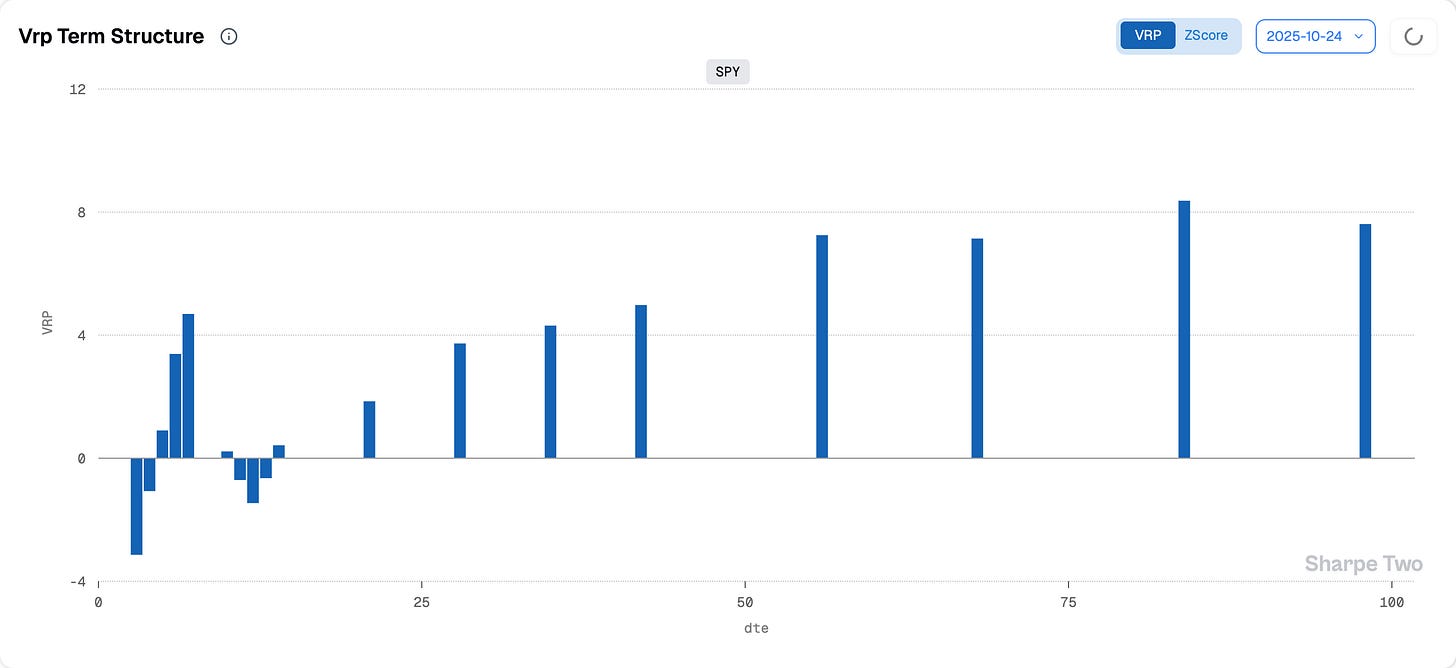

Let’s start again with the obvious: you still have a decent bit of premium at 30 days, and a 4-point VRP can get you a long way despite the long list of potential catalysts lining up over the next two weeks. But it is definitely not the 8, or even 12 points, we saw just a few weeks back. You have to adjust your mindset and accept that the margin of error has narrowed quite a bit.

Failing to adjust would be an outright bet that realized volatility is heading back to 8 and cannot climb to 16. That may be a little presumptuous.

The second point from this chart is that we would not be surprised to see realized volatility climb toward 16% over the next 30 days. We always take that kind of forecast with a grain of salt, but it remains a useful cue to review the book, the margin sold, and the cost of error.

Back in early October, when the VIX was at 16 and realized vol sat near 8, that cost of error was cheap. Even when the market threw its little tantrum in October—spiking from 16 to 28—those 20-delta options barely flinched.

It will not feel like that again with only a 4-point cushion. Especially now that the vol of implied volatility is much higher than it was a few weeks ago. It is mean-reverting, yes, and will likely calm down over the coming weeks—but you should not be surprised to see a 2- to 3-point move in the VIX.

Put differently: if you are not trimming some risk or ready to hedge as things unfold, you are unprepared. From our standpoint, the better strategy is to wait for better implied-vol pricing or for confirmation that realized volatility is drifting back toward 8. Otherwise, you are simply taking the risk of handing some of your P&L back.

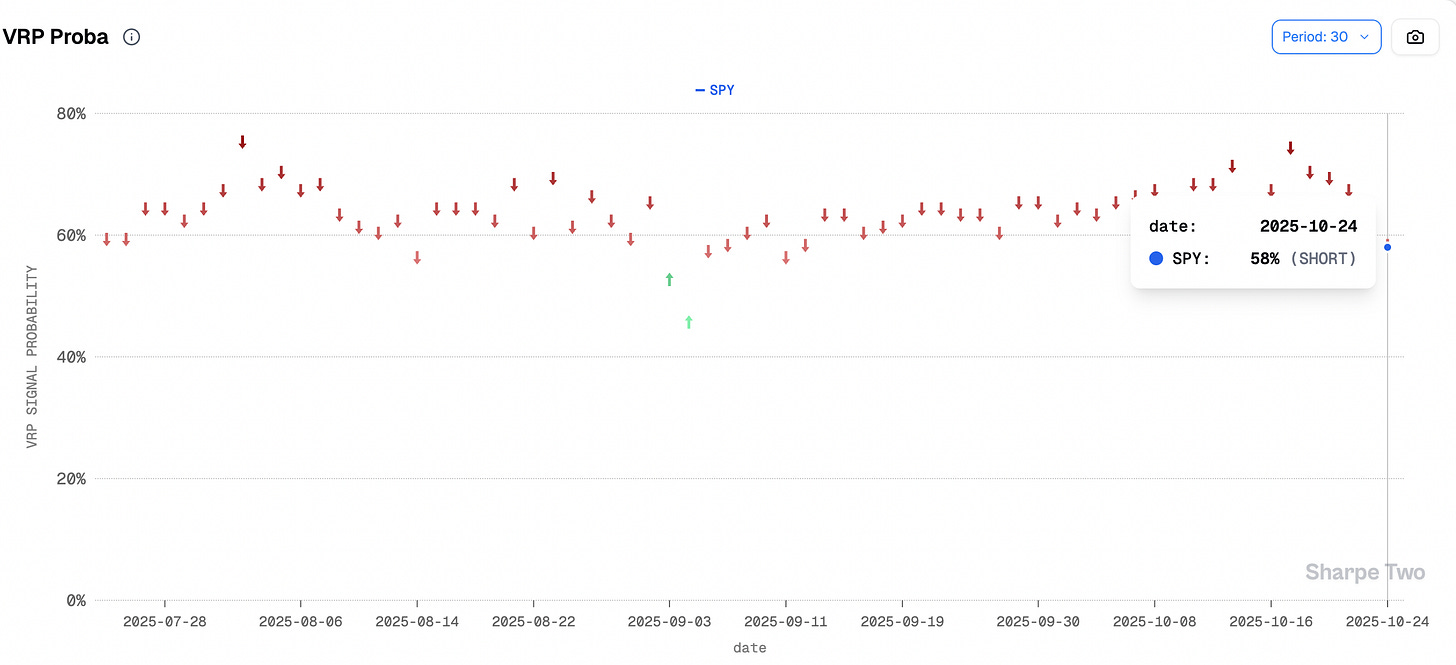

Our VRP forecast answers a simple question: what is the likelihood that the implied volatility sold today will outperform the subsequent realized volatility? Right now, we are back in coin-flip territory.

At 58%, it is hardly worth gambling last month’s gains just to squeeze a bit of carry from something that could turn on you fast.

How likely is that to happen? Once again, our money is not necessarily on a repeat of October, but the catalysts are lined up, and one would be wise to respect and monitor them. Big Tech earnings hit next week, alongside an FOMC meeting—and, surprise surprise, the long-rumored sideline meeting between Xi and Trump is finally happening. More tariff talk ahead.

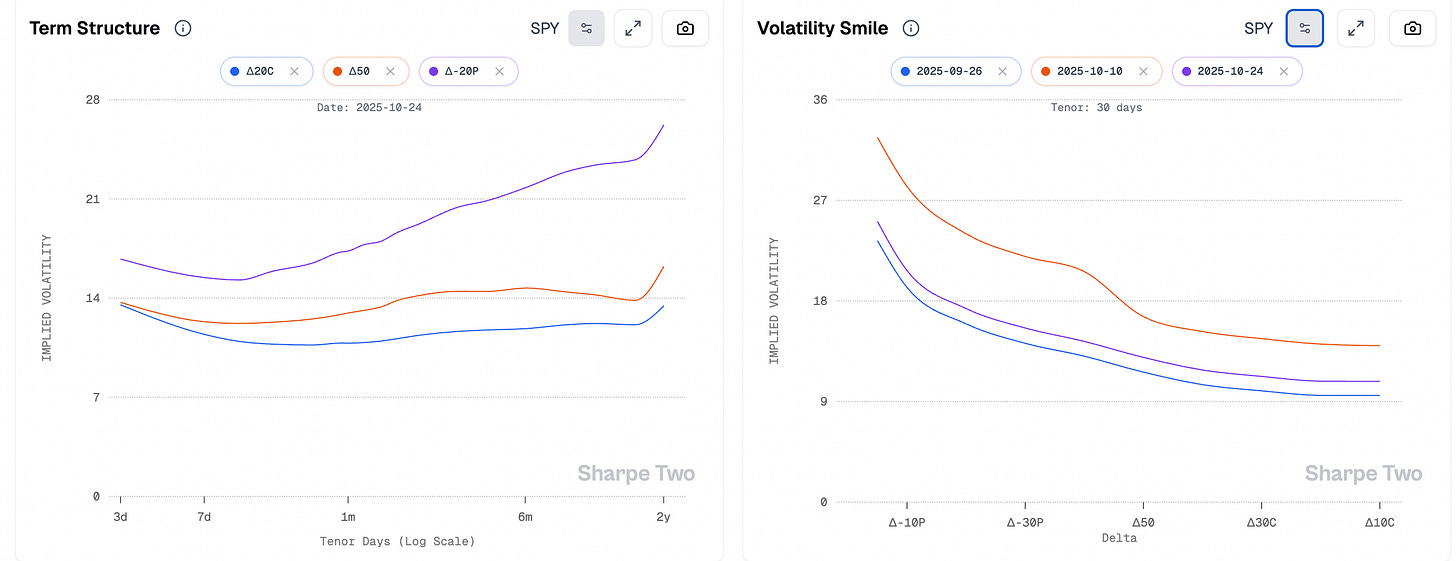

Now that we have said all this, why bet against Bessent? The S&P 500 is no Argentine peso, and Bessent (not so subtly) reminded everyone of that in the FT this weekend. And if you want a data-driven confirmation, just look at the shape of the volatility surface.

Contango is alive and well, as perfectly illustrated by the 20-delta puts. The volatility smile now looks almost identical to what we saw at the end of September—and far removed from where it stood two weeks ago.

That does not mean things cannot readjust, and fast, if new information hits the tape. But that is precisely the point of this weekend’s note: there will be better moments. And this weekend is one of those where you fold without looking back.

In other news

Just when we were tempted to think the commodities complex was behaving like a meme stock, the meme-stock complex reminded us what true meme status looks like. BYND jumped from $0.68 to over $8 in a few weeks, after an investment “thesis” surfaced on Reddit—followed by just the right “marketing” campaign to spark a perfect retail frenzy.

In two short weeks, Reddit offered a live demonstration of what the stock market has become: a giant forum where anyone can vote by putting their capital on the line and maybe get rewarded for it. The casino analogy no longer does it justice. Yes, most of these people are gambling. But it is a free world, and you cannot deny anyone the right to use their money as they please. What they are truly after—with BYND today, as with AMD or GME back in the day—is entertainment. In a few clicks on Robinhood, you can join an army of equally irrationally motivated investors, have some fun, and try to stick it to the (Wall Street) man while you are at it.

Except this time, the man—Wall Street or not—stuck it to the crowd, and hard. We learned some pretty horrifying details: the number of shorted shares was reportedly four to six times greater than the actual float. That is, of course, strictly forbidden by any market rule and raises a simple question: how did that happen?

We are not surprised it did happen—mostly because it had never happened before, and it is the kind of situation you cannot truly test in real time… until it does. One has to wonder who knew that such a dangerous backdoor was not just open but simply non-existent. We will be waiting with great curiosity for the regulator’s “very detailed” report on the matter.

Thank you for staying with us until the end, and as usual here are some interesting reads from last week and this week, both of them pulled from X

This one is a gem for anyone who has ever tried to beat the market instead of just surviving it. It breaks trading down to its essence — a game of guessing, adapting, and staying sane while the rules evolve. A brilliant reflection on what makes a trader — and a human — stay in the game.

We are not involved (enough) in crypto market, yet we have heard many times that Binance is evil but no one actually tested the hypothesis. This piece does. It’s a masterclass in bias-free research: clearly stated assumptions, randomized corrections, and honest benchmarking versus Coinbase and Bybit. A must-read for anyone who still believes data, not drama, should decide who the villain is.

That is it for us this week, as usual we wish you a wonderful (FOMC + big tech earnings) week ahead and happy trading!

Ksander