Forward Note - 2025/12/21

Have you been rational enough to deserve a Santa Rallye?

Last article of the year. We will take a break over the next two weeks as the market winds down and catches its breath before 2026. Subscribe now and enjoy 40% off the Substack yearly plan.

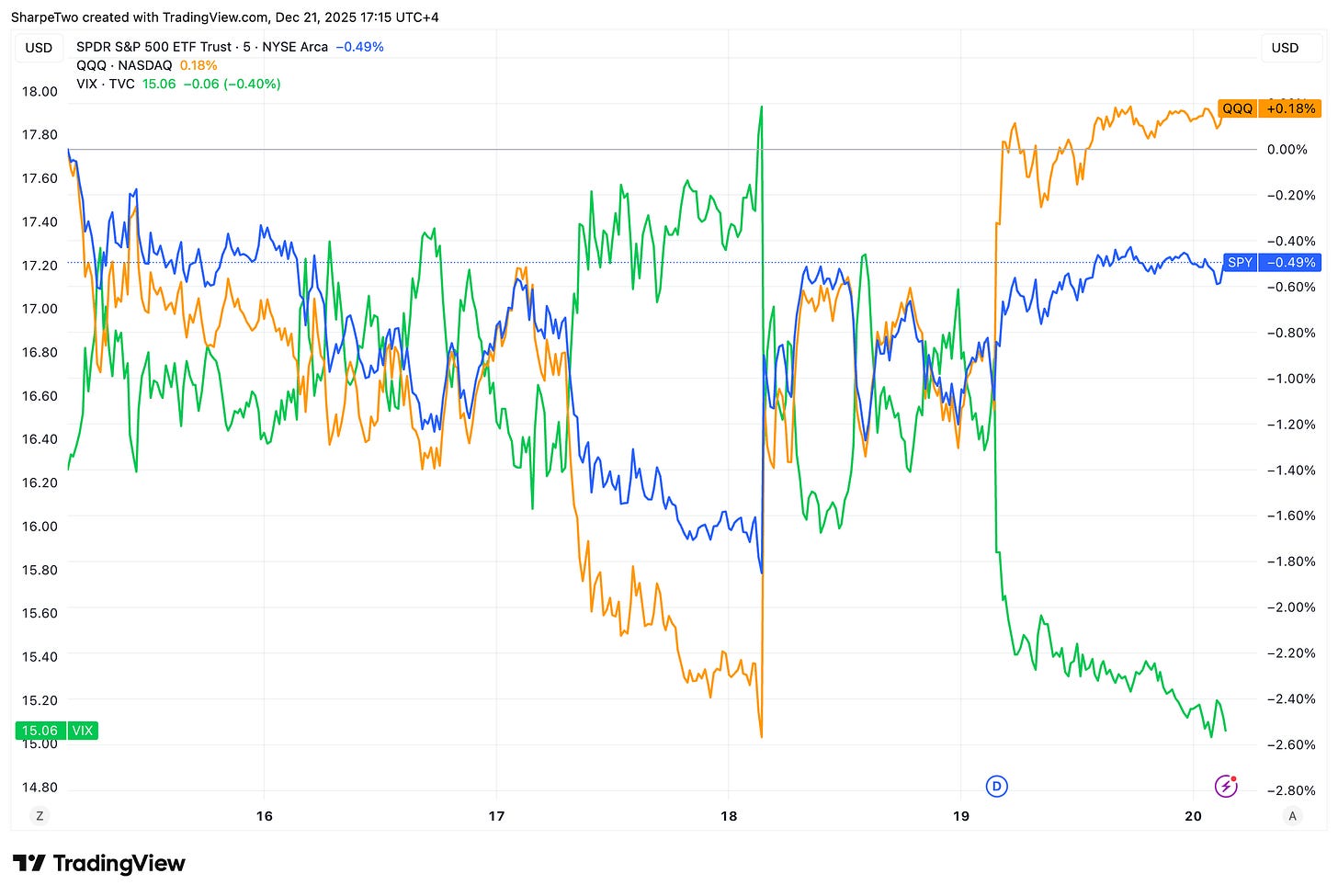

The main indices ended the week mostly flat, with the S&P 500 down about half a percent while the Nasdaq 100 added a little less than half a percent. The VIX closed right on the 15 handle and, despite a few hiccups up to 18 in the middle of the day on Wednesday around vixpiration, nothing of real consequence happened this week.

So the question becomes: Santa rally or not Santa rally? And the only honest answer is the usual one. Have you been naughty or nice in 2025?

That answer will obviously feel very personal. Still, with the S&P 500 up roughly 18% on the year, it is fair to say that, collectively, market participants have been rather nice, despite a fair share of turbulence and some shenanigans involving shady acquaintances and their questionable practices.

For us at Sharpe Two, 2025 will mostly be remembered for two things.

The first is the very visible dent in the “rational investor” theory. You have probably heard it at least once: investors, all having access to the same information, make rational decisions. That idea did not exactly survive multiple real-world stress tests this year. Otherwise, how do you explain the sudden changes in fortune within the Mag 7 club, and more specifically TSLA?

Not convinced? We can also talk about MSTR. Or BYND.

And if we stick to a market we know very well, the image that will stay with us for a while is the sheer amount of VIX calls bought in the first part of the year, paired with a stubborn refusal to buy S&P 500 puts. That asymmetry alone tells you most of what you need to know about how “rational” positioning really was.

The second thing we will remember is to never ignore the little clues, especially when they look completely irrational.

Sticking with the last example, a market aggressively buying VXX calls while realized volatility in the main indices is already going up, yet refusing to buy puts, is strange enough to deserve attention. But sometimes the signal is even more insidious.

Remember the day when bid-ask spreads suddenly widened across the market, right before the announcement that Trump was cancelling his meeting with the Chinese scheduled for later that month? It felt odd at the time and, in hindsight, it was clearly one of those clues you were supposed to notice. And potentially act on.

If market makers are demanding more money to trade, it means they are hedging themselves against something. Something you do not know. Yet, you now have a new piece of information: are you going to act on it, and hedge yourself, just a little, just in case?

Once you start reframing these two pillars of modern market theory, things begin to make sense and, more importantly, they justify why we do what we do. Markets are efficient enough. And inside that “enough” lies the treasure, where the trader who knows what to look at can carve out a real edge.

This is both great and terrible news. Let us start with the terrible part.

Many people point at what they call inefficiencies but, in practice, they are often just adding noise to the marketplace. Are you really challenging the narrative when you claim that NVDA is overpriced, even if you come armed with clever arguments about depreciation or circular financing? Or are you simply contributing to the noise with yet another repurposed meme?

The great news is that inefficiencies tend to be correlated with the level of noise. And if we are anywhere near an all-time high in noise, this perspective should make you rather ecstatic about 2026; there will be even more participants in the marketplace willing to pay absurd prices for insurance at the peak of tension or, even better, speculating that the worst is still ahead when it may already be behind us. At least until the next stress episode.

Remember June to November. You did not need to predict the next big thing. You simply had to harvest while the market was busy waiting for it.

What truly excites us, however, is the response we have seen over the past few months to the signals we published, as well as the reception of the product itself. Many of you are clearly willing to look past the smoke and mirrors and stick with data to make better trading decisions.

In that regard, the end-of-year performance article triggered a lot of reactions. We received many thoughtful messages and kind notes, for which we are genuinely grateful. We will use the next few paragraphs to address the most common and recurring question that came out of those exchanges. But before we start, remember there is a 20% off for all our yearly plans on the product; a great way to invest in your 2026 success!

What is the advantage of a probability-based system over simply looking at the variance risk premium?

The VRP is a very good starting point. It tells you whether options are expensive. But it does not tell you the full story.

To get closer to that, you need to pay attention to many other variables: skew, curvature in the term structure of realized volatility, signals coming from vol of vol, and all of that framed within the broader context, including how close we are to the next FOMC meeting. A skilled analyst at a hedge fund could absolutely pull this off and come up with a reasonable assessment of whether options are overpriced or not.

The problem is scale.

That analyst can work twelve hours a day, sixteen if he happens to be a cousin of Stakhanov, but he still cannot properly review the 500-plus tickers that matter across the marketplace. This is where machine learning actually comes in. It becomes an assistant with access to a full catalog of market metrics, able to contextualize them and turn that information into a probability once everything has been put together.

In other words, relying solely on the VRP is like looking at the options market through a single dimension. It may be the most important one, but on its own, it is not enough.

How do we know the model is not a black box?

The model is trained on features that any trader can interpret because they were built by a trader, for traders. We would never rely on signals or features that we would not be willing to write about or explain clearly to our readership.

In that sense, the model is, once again, an assistant. It crunches the data before you even arrive at your desk and points you toward the elements that matter, along with the reasoning behind the decision, so you can focus on what is relevant for the day ahead.

Explainability is critical for us, and it also happens to be one of the favorite features among our users. When the probability sits at 70%, there is almost always a very logical and rational explanation the assistant, sorry, the model, is able to surface and it is shown in the platform; come try it!

Does the risk of selling options disappear with such a model?

Absolutely not.

We have had excellent results in backtests and encouraging ones already in forward tests. But at the end of the day, you are still short variance. Let us put it this way: while we make money on the short side of volatility, we also know very well that there exists a path, somewhere in the distribution, that would wipe out any system, machine-learning-based or not.

Given the nature of markets, there is even a philosophical argument to be made that the positive expectancy lives on the long side of volatility. The problem is timing. It may take a lifetime to realize.

This is why, even if we are very comfortable with these models, it should not prevent any reasonable, and ideally rational, investor from continuing to buy options, either as a hedge or simply as reinsurance for the business. On an institutional trading desk, someone would constantly hound you to make sure this is done properly. As a retail trader, you are on your own, and you need to take that responsibility seriously.

Remember August 2024.

Why put it out there instead of raising money and becoming rich?

That one always makes me smile. Especially because some pro quant traders or fund managers have this stubborn habit of dismissing all content creators as nonsense, people supposedly unable to make money outside of selling tools or running a Substack. And sure, when you look at someone like Burry now sitting on tens of thousands of subscribers, reportedly generating around four million in ARR with what we have heard is a rather average newsletter, they might feel vindicated.

Yet, let’s take the argument in reverse: it would also be nice if such traders would quit their jobs and show us how to make a living purely from trading. After all, if they are that successful where they are, they must have both the capital and the skill to thrive as prop traders, right? You would be surprised.

The number of people we have seen make the jump from employee to prop trader, only to return to being an employee within a year, is far larger than most would admit, an uncomfortable truth very few are willing to talk about openly. Why? Often because you are not paid anymore, and you also do not have access to the tooling, the data, the entire firms asset you are just simply extracting value, as an employee.

When you become a prop trader, you automatically become an entrepreneur. You do not start with an eight-figure account, and every revenue stream suddenly matters. Some will chase anything available: consulting, part-time roles, side projects. Others will not.

Personally, I sell my research because there is a clear demand for it, not only among retail traders, but also among institutional investors.

The goal with Sharpe Two is to remain as independent as possible and to build a real trading business around it. Selling research is simply a way to grow the company’s capital, because Sharpe Two is, first and foremost, a trading firm. I hope this will become clearer in 2026, but you have to start somewhere.

I would like to end this year on a more personal note. I understand that being part of a top trading firm is a dream for many. It is not mine. Put it this way: I had a little girl seven weeks ago, and I get to do whatever I want, whenever I want, without going to an office, reviewing code for an impatient boss, explaining yet again why I still believe in a position, or pretending I am enjoying a discussion about elegant equations from the smart ass at the next desk. Yes I don’t get the nice monthly paycheck and the bonus at the end of the year.

Yet, watching my daughter grow every day, at our own pace, trust me, that is worth far more than any nine-figure envelope you can think of.

With all that said, I wish you a very happy end of year and all the celebrations that come with it. Enjoy the time with your family and loved ones.

See you in 2026 for another successful trading year.

Ksander