Forward Note - 2025/07/20

VIX is low and options are expensive.

Quiet summer we were promised, and quiet summer we’ve had—so far. SPY added 0.77% this week, while the Nasdaq closed up 1.34%. Hardly eye-watering performance, but it compounds—Nasdaq is up 10% year-to-date, and here we are, comfortably trading at all-time highs.

How long can this last? We do not know. Especially when, every now and then, the White House throws a curveball—almost like they’re testing the market’s resilience, probing just how far they can push their agenda without rattling investors too much.

So far, so good.

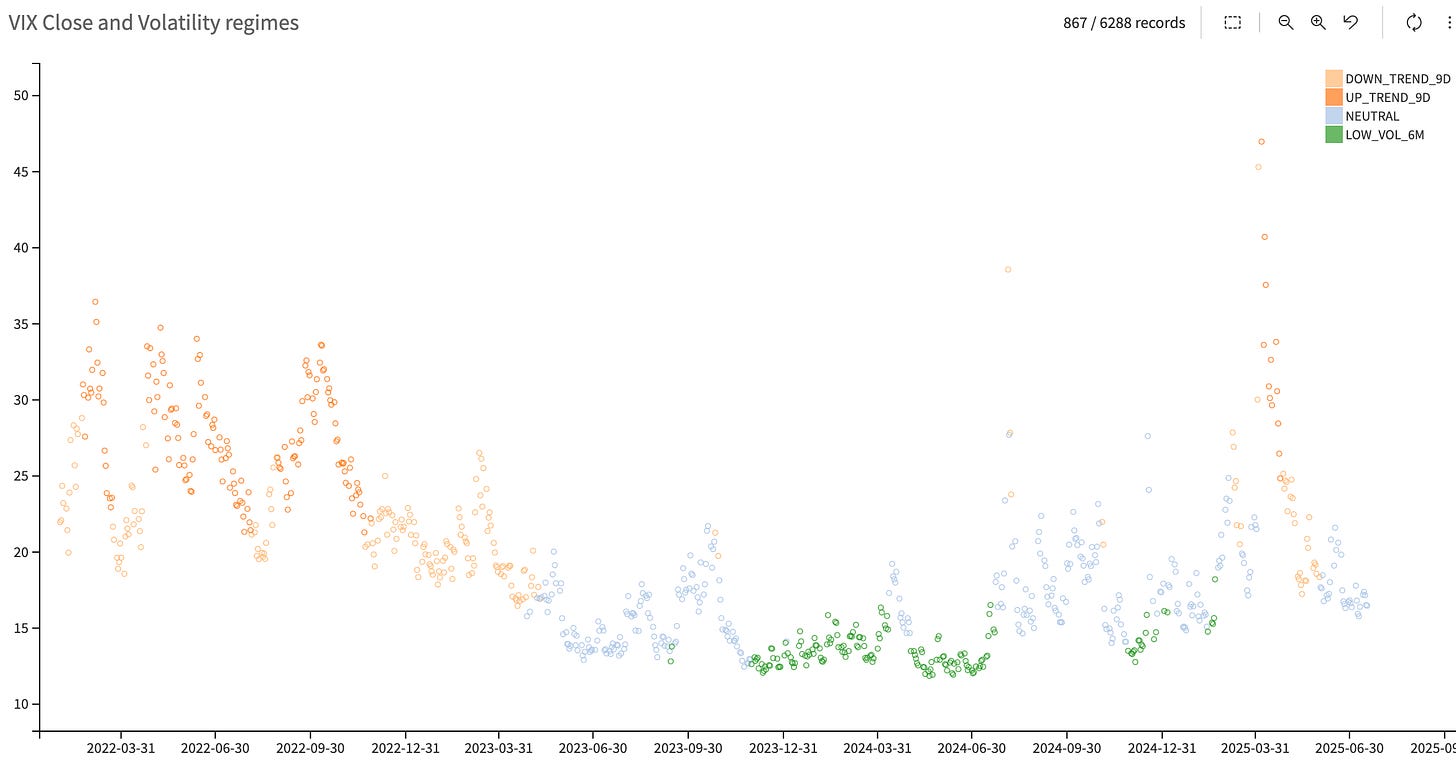

VIX closed the week at 16.40, almost unchanged since the end of Q2. What stands out to us is how it’s been unable to stick above 18. Yes, it popped intraday—like on Thursday—but nothing sustained, nothing that brought us meaningfully closer to the 20 handle.

In other words, vol of vol has drifted back to levels where the market does not seem particularly bothered—even by headlines out of the White House. Powell being replaced before year-end? That sparked a few jitters on Wednesday, but the story was quickly shrugged off. Frankly, it is hard to tell whether markets would have truly reacted over any meaningful time frame.

Let’s be rational: Powell’s term ends in May 2026. That gives him fewer than seven FOMC meetings left—one of which is scheduled in just 10 days. Each passing session chips away at his influence. The market knows it. Put differently: Powell is short theta. And you can be sure the market is pricing that in. Some chatter about an early replacement might move things in July—but as gets closer Q4, we doubt it shifts much.

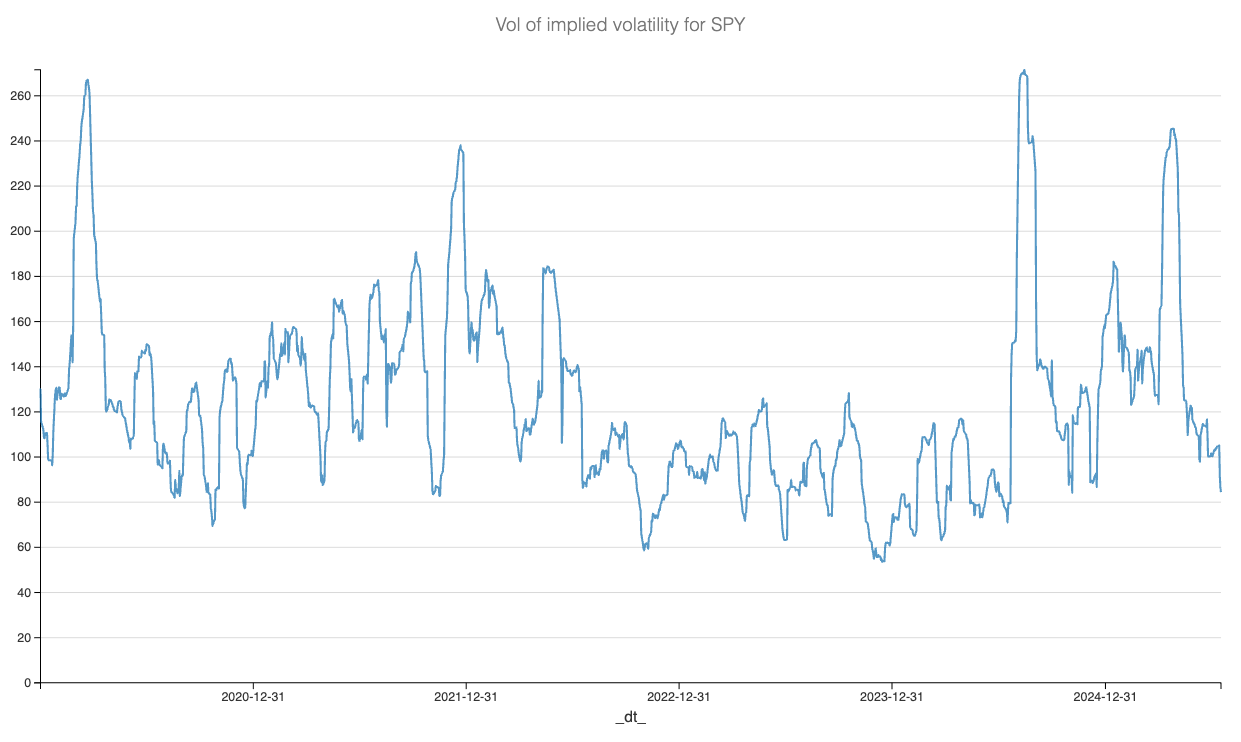

Now, back to the data—let’s put this apparently low vol-of-vol into perspective.

The obvious conclusion? While we’re near the lower end of the past year’s volatility range, it can still grind lower. A reminder—loud and clear—that buying implied volatility just because things feel “too quiet” is rarely a winning strategy.

Yes, catching the big April spike would have felt great. But as the chart suggests, you usually get some warning—some catalyst with actual disruptive potential. And yes, every now and then you get an August 2024 moment: volatility jolting overnight on what seemed like a benign print—a “poor” NFP headline that triggered the Sahm rule and hinted the U.S. economy might be in recession, just as the BoJ decided to stir the pot. These things can happen. But they’re rare.

Again, this is not to downplay what is happening with the Fed or tariffs—but in terms of market sentiment, these are now old headlines. Unless something truly spectacular breaks, they are unlikely to trigger a major volatility event.

If you keep looking at the vol of vol chart, one regime in particular should stand out: from late 2022 to early 2024, vol of vol swung around but remained relatively muted. During that stretch, implied volatility kept drifting lower, week after week—eventually settling into a six-month stretch of ultra-low VIX, with prints between 11 and 13 not uncommon.

This is not a call suggesting we’re headed back there. Our current cluster is firmly anchored in neutral territory, and market participants do not seem eager to ditch all hedges just yet. That pent-up demand is likely what is keeping the VIX from drifting materially lower—for now.

Still, it is another cautionary tale: buying implied volatility at these levels can be an expensive habit. We get it—there’s always a reason to hedge. But as we said a few lines up, if you're buying options simply as a speculative bet that “things might blow up,” be careful. The market can stay like this longer than you’d like—until real catalysts show up.

In fact, as we pointed out in Thursday’s Signal du Jour, this is a prime window to sell implied volatility in U.S. equities.

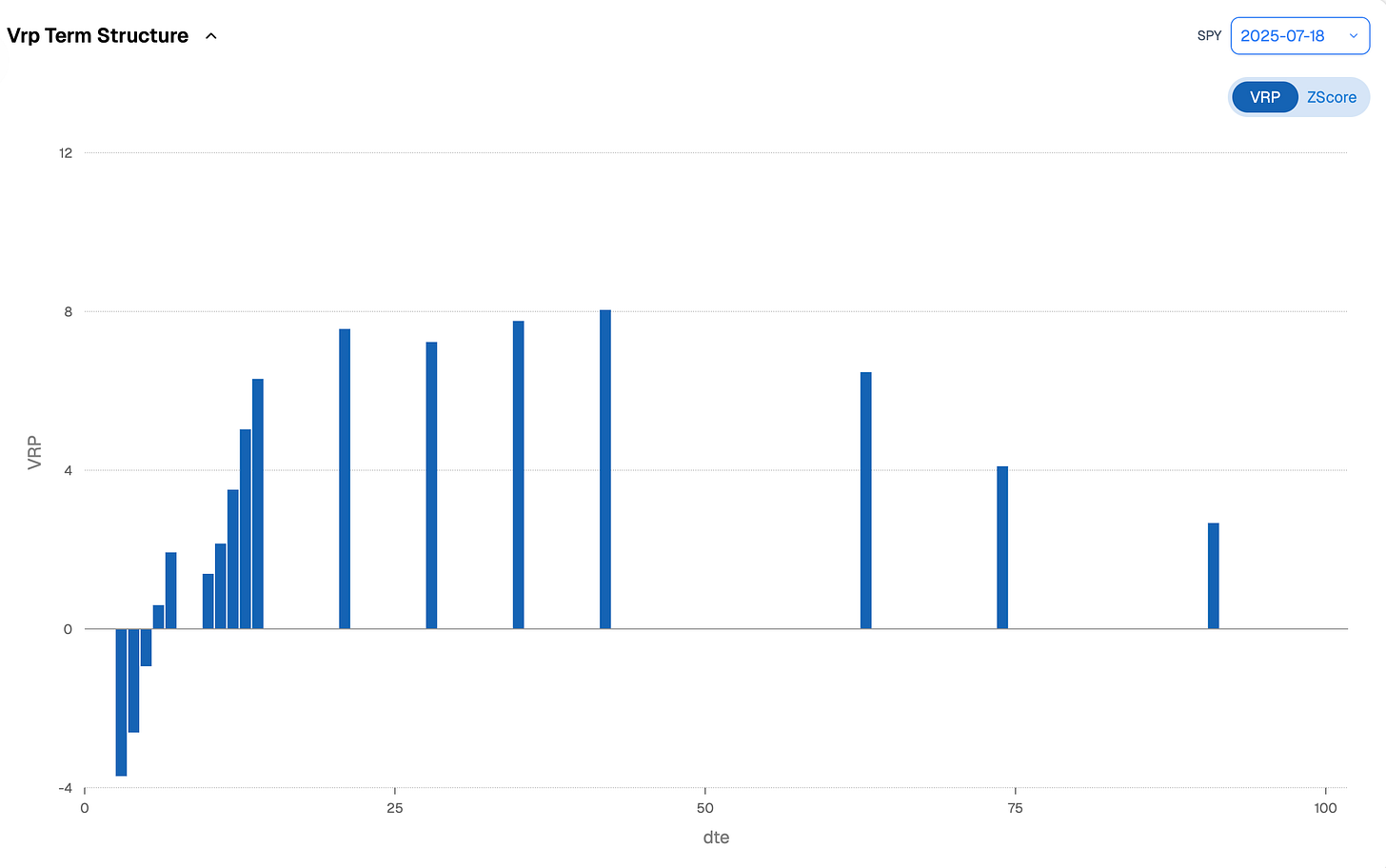

The VRP is particularly pronounced in the 14- to 45-day window. And almost counterintuitively—at least to what you might read on Reddit or Twitter—the smartest position right now would be to buy tails in super short tenors (one or two DTE), and sell vol further out, past 14 days. If a headline hits, your short-dated protection can pay off. But with enough time on your side, your short volatility exposure has room to absorb the tremors.

We cannot stress this enough: an 8-point VRP in U.S. equities is massive. Even during last year’s slow drift into the election cycle, conditions were not this good for selling vol. And it makes sense—Trump now dominates every conversation, economic or geopolitical. After what happened in April, many feel compelled to hedge. Because, well, you never know.

We are not saying nothing will happen again. We are just saying these options are too expensive—at least for now, and hopefully through the rest of this lazy summer.

In other news

The ECB cut rates on Thursday by 25bps, triggering another wave of buying in European equities. The Euro Stoxx 600 is now up 7% on the year—but has been materially flat over the past three months.

In any case, the decision adds pressure on the Fed to “do something before it’s too late.” Fed Governor Waller had already floated support for a July cut a month ago citing a cooling economy and job market fatigue.

That was before the latest inflation print—still a respectable 2.7%, but clearly above target—and a stronger-than-expected June jobs report. Yet he went back at it this week, with the same arguments and pushing in the direction, of the White House.

So, a July cut? We do not think so. Markets agree: current pricing implies less than a 10% probability. September is far more plausible.

Here is a counterintuitive take—ours alone: if a cut did happen in July, it may not be well received. Why? It would signal a potential erosion of Powell’s control over the committee, and possibly an admission that the economic picture is weaker than previously assumed. Think about it: equities have weathered the past 24 months with rates above 4.5%. Cutting now might read less like pre-emption and more like problems on the horizons.

Yes, the White House wants lower rates—we get it. But be careful what you wish for. The pain might come wrapped in the very policy meant to avoid it.

Thank you for staying with us until the end, and as usual here are a few interesting reads from last week:

How to manage $1.7 trillion the Norwegian way. This piece walks through the world’s largest sovereign wealth fund—its origins, its philosophy, and what it’s quietly doing while retail argues over the Magnificent 7. If you care about positioning capital across regimes, this is a read worth bookmarking.

Out-of-the-money options and lottery tickets have more in common than people like to admit. This wild, true story of a Waffle House waitress who wins $10M will remind you why buying tails is easy—and managing them is the real game. A brilliant read on luck, leverage, and unintended consequences.

That is it for us this week - we wish you another lazy (VRP selling) week ahead, and as usual, happy trading.

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.