Forward Note - 2025/09/21

Don't be a panician... but don't be irresponsible either.

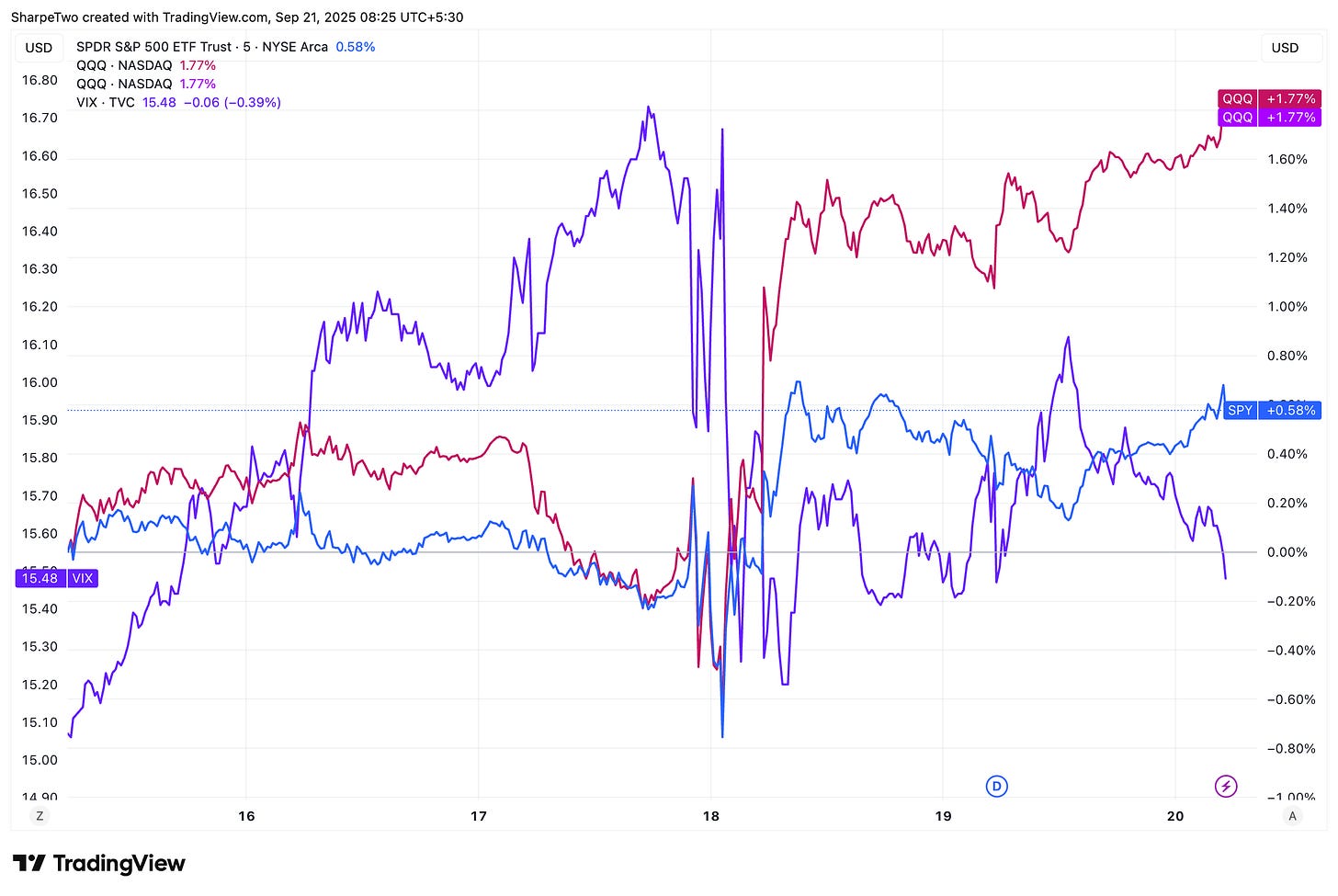

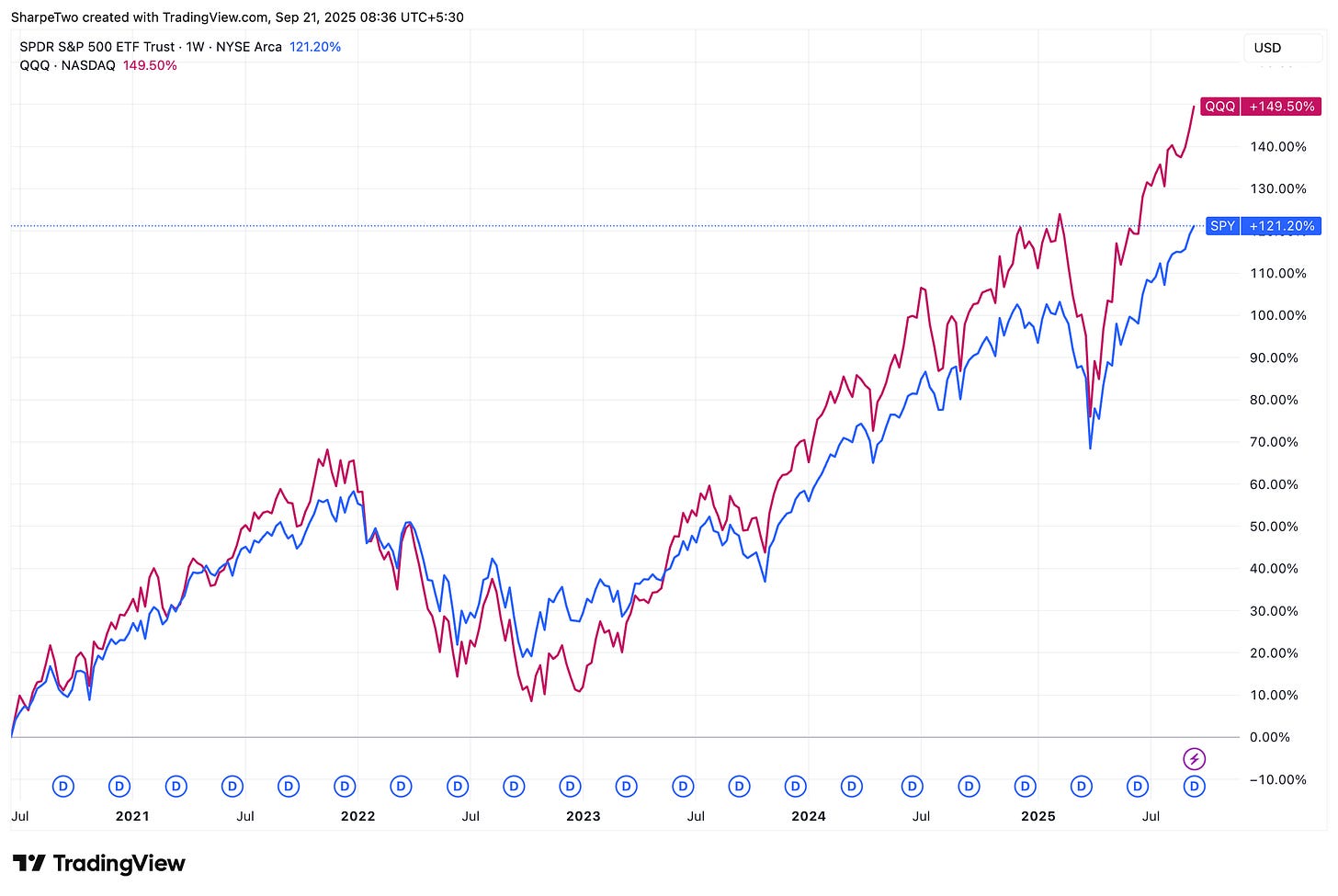

Another week where the world did not end. By stock market standards, it even looks like everything is at its best right now. The S&P 500 added a little over half a percent and traders had their fun with a close at 666—one full month before the Halloween of the Market, October 19. Brrr. At least this time it happened at an all-time high, and unlike 1987, volatility remains sound asleep.

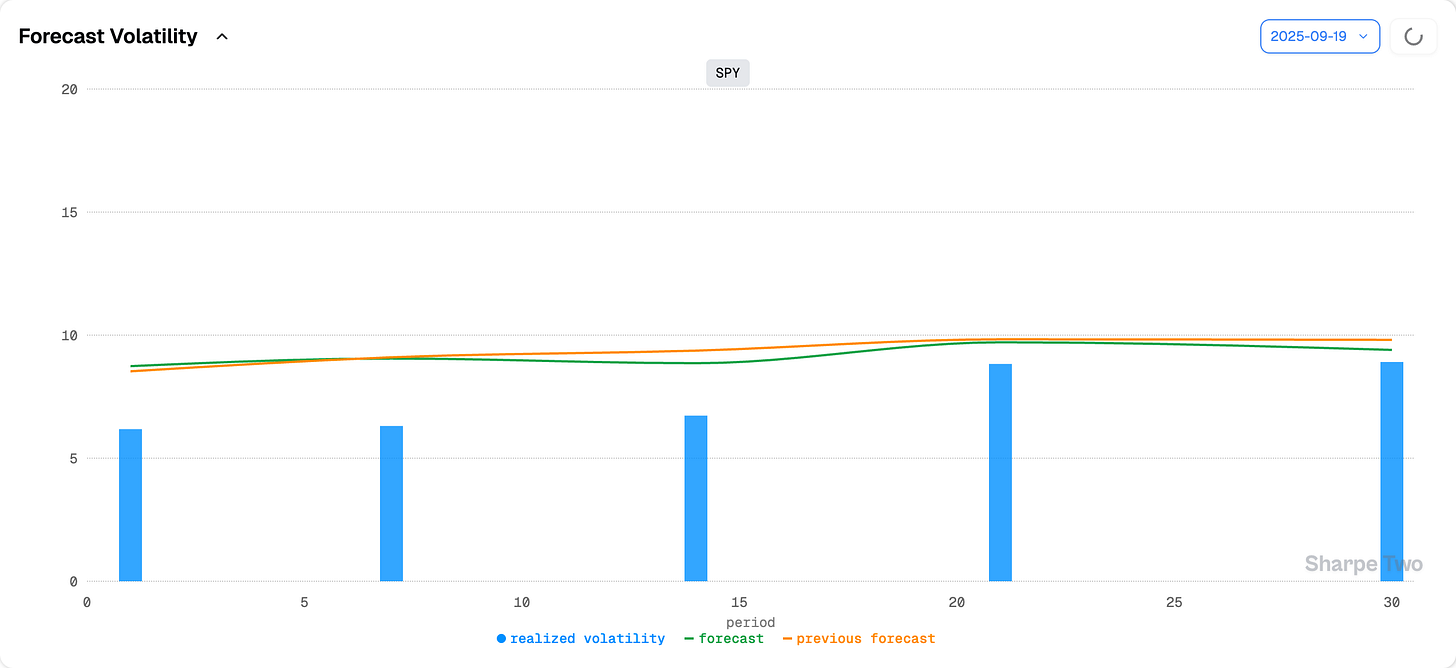

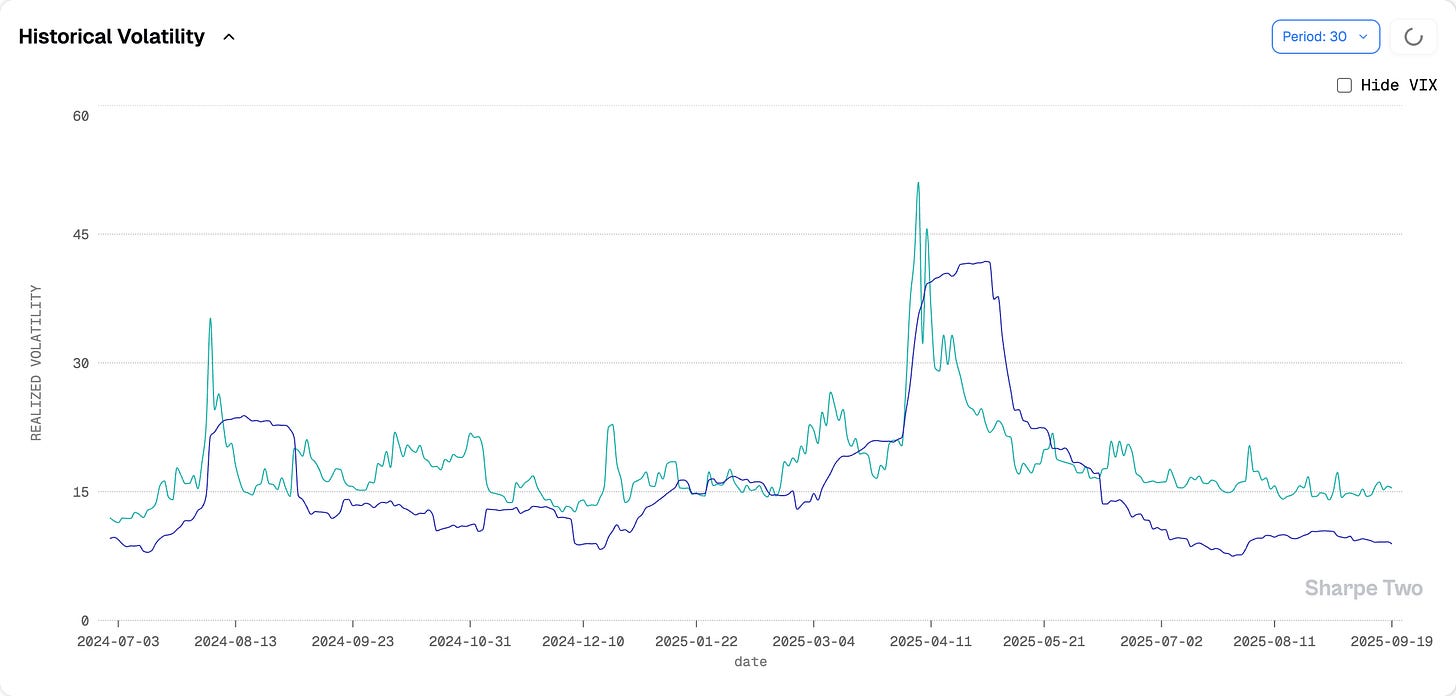

The VIX closed at 15.45, still below 16, and that tells you most of what you need to know. What happened this week? The FOMC, and triple witching. But if we had not told you, you would have to squint hard to find any trace of it in the data. Realized volatility over the week came in at one of the lowest levels of the year—which, even for us, was a surprise.

Six percent annualized on triple witching. The first time we have ever seen that. Six percent on a week that combined triple witching with the FOMC. And six percent over the last two weeks of September—traditionally among the busiest on the trading calendar. Realized volatility over a month is pinned at 8%, and it is hard to imagine it breaking meaningfully above 11% as we head toward Thanksgiving.

Yes, the odds of a government shutdown before year-end are rising on Polymarket, but the market already knows this—and still does not budge. So what exactly is happening out there? Are people bored? Still on holiday? Hiding in fear that something might happen?

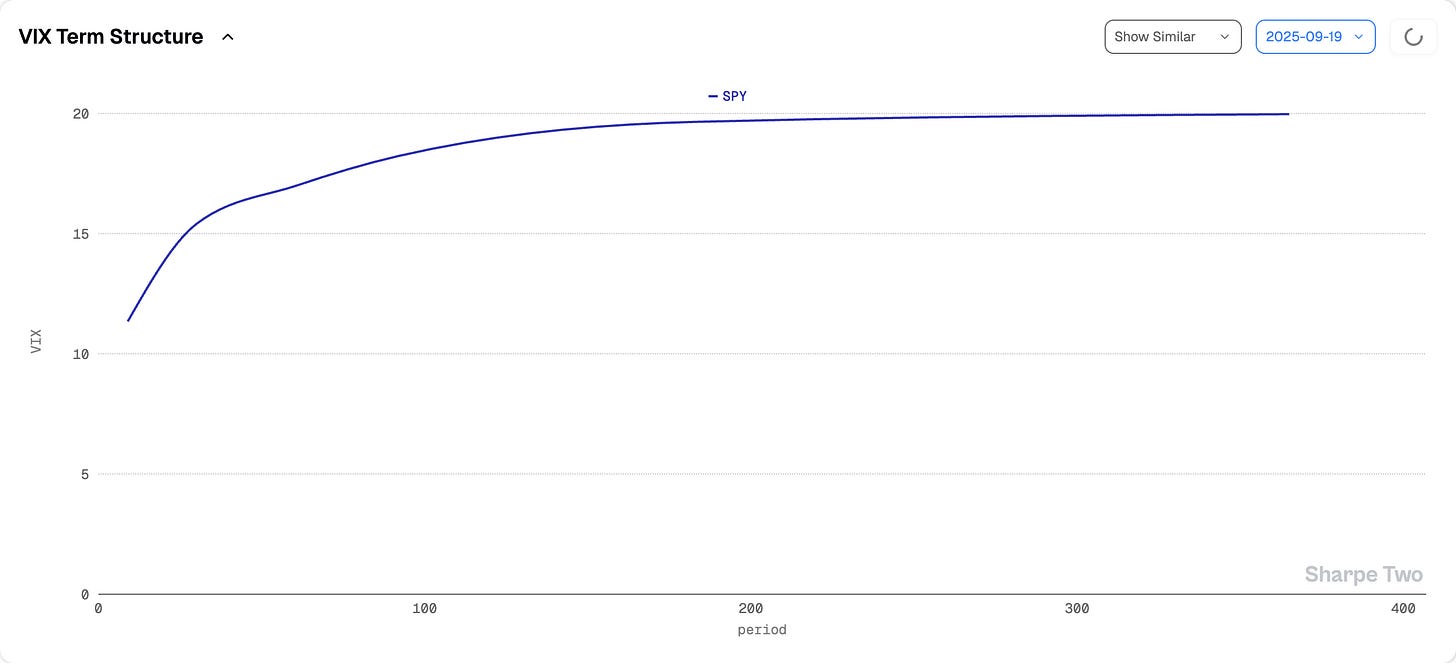

If it were the last one, we would not be sitting at all-time highs with a SPY term structure so perfectly in contango.

What is happening is fairly simple: while one side keeps looking for reasons to sit on cash, the other side is blindly following the script handed to them.

Oh no, that line is not from us—it is straight from the White House X account. We spend our time buried in data, hunting for the little wrinkles that can be exploited. That is why we do this: looking for an edge over the competition, building a better model, a better forecast, a sharper read of what is happening—so we can make more money than the next guy.

Look at the three charts we put above. Go look at them again. They scream “no problem at all,” and the White House is telling you the same thing: do not be a panician. The market is up 40% since the lows of April. What else do you need to realize that you should probably be long, instead of overthinking what is right in front of you?

Because if you ask us, that is exactly what a big part of the marketplace is doing—and the reason why it feels so quiet. They are preparing for a period where money gets cheaper and business smoother. Articles talking about the IPO market are blooming like spring flowers. And we are more likely heading towards more of the AI wave, more of the crypto-finance revolution, and more all-time highs.

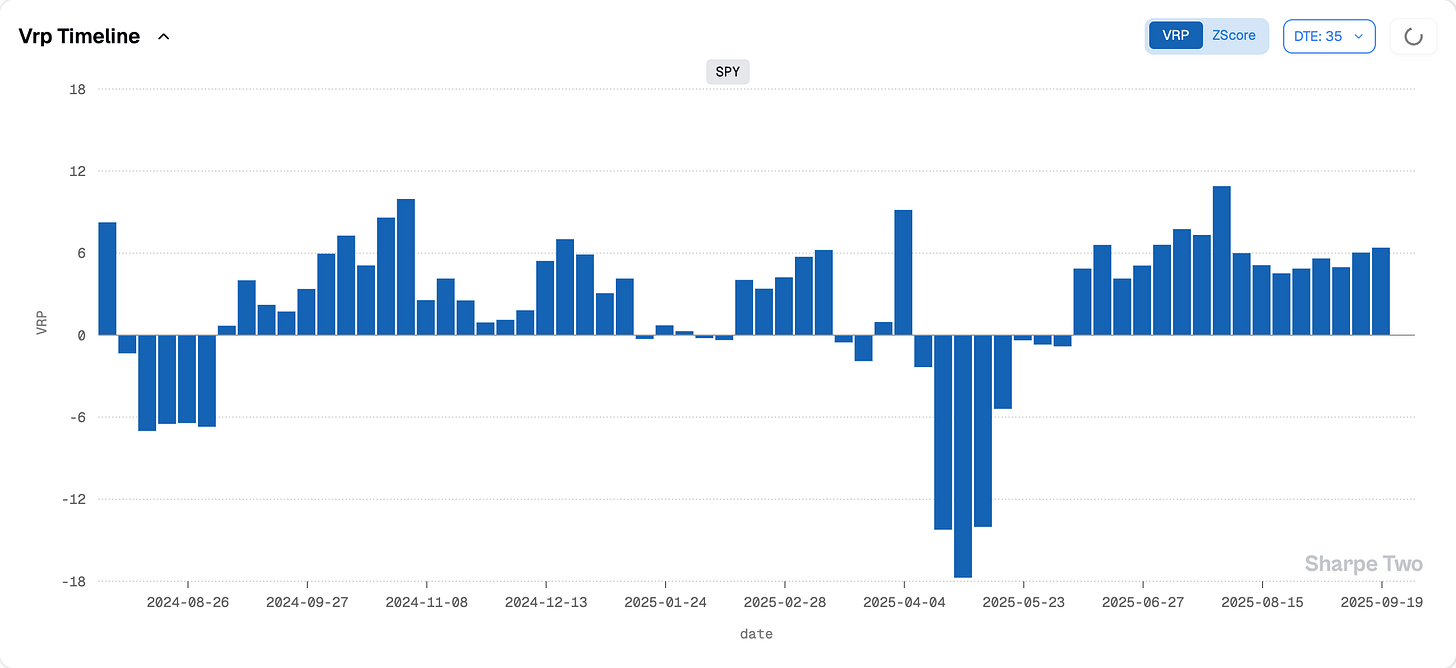

We may be wrong. In fact, part of the market strongly disagrees: they keep buying protection on moves that never realize. The VRP remains particularly stretched.

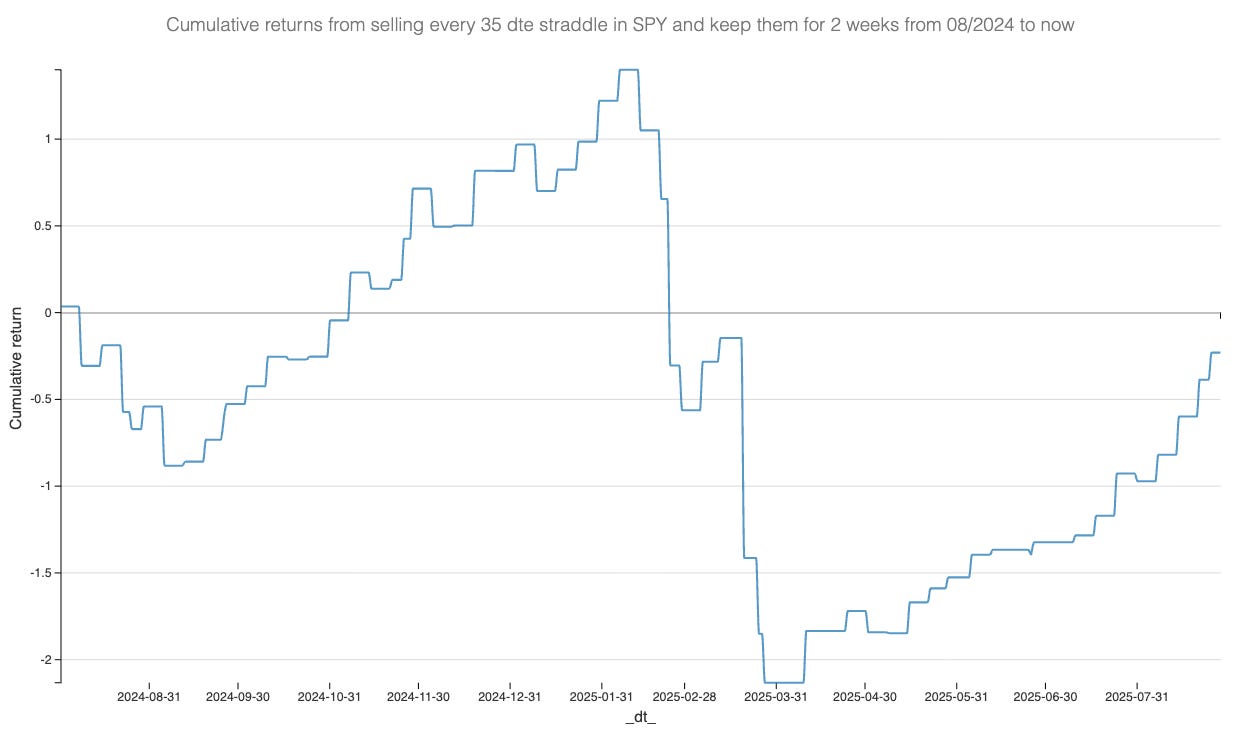

What does that mean in practice? Imagine you sold an ATM straddle on SPY every Friday at 28 days and held it for two weeks. What would your P&L look like?

As you can see, that trade would have staged quite a recovery since the tariff-war days. But the stretch from January to April would have been especially painful.

By contrast, the September-to-December window worked beautifully. So what explains this divergence?

Overlay these two charts and it becomes pretty clear: when the market is overpaying for insurance, it is relatively easy to make money trading options. You just sell the overpriced product, and your margin is, more often than not, embedded in the randomness of the outcome. But you have an edge over that randomness: the variance you sold was to expensive to overcome the boundaries of your delta neutral structures (straddles, strangle, variance swaps).

Sell options when that premium turns negative, however, and you face a painful truth: the market is not a free ATM. What it handed you when conditions lined up, it will mercilessly take back the moment you sell risk too cheaply.

But let’s take a step back from the option world for a minute—because at the end of the day, they are derivatives. We call them insurance contracts because they insure against the intensity of the underlying’s path. Right now, the VIX is “low,” which translates directly into people not buying options. In real-world terms, it is as if fewer people are buying car insurance than usual.

It does not mean you should skip buying car insurance yourself: a black swan, by definition, is something we never see coming. But it also does not mean you should be walking everywhere because “drivers are reckless and you die more often in car crashes than pedestrian accidents.” In other words—be long.

Even the White House is telling you this. Are some valuations horrendous and irresponsible? Very likely. Just as some drivers abuse the speed lane (think over-leveraged accounts, tail-selling…), it does not mean you should not keep part of your account in equities.

And if you want to trade options, recognize this is one of those fast stretches where premium buyers know their insurance is overpriced but have no choice—compliance, regulation, mandates.

Enjoy these fast periods while they last. Because the only certainty is they will not last forever. But enjoy them… responsibly. The primary goal of trading is simple: trade in a way that lets you live to fight another day.

In other news

While the White House was busy telling 350 million Americans not to be panicians, Trump and Xi were meeting in Hong Kong to negotiate a long list of topics. The mood was described as constructive—far from the chest-thumping and threats that usually flood social media in response.

So constructive, in fact, that a deal for TikTok may be within reach. The crown jewel of ByteDance could see its U.S. operations handed over under an American flag. What great news! At last, American data would be 100% supervised by Uncle Sam, leaving citizens with absolutely nothing to worry about.

One of the big winners from this arrangement could be Oracle—and more specifically, Larry Ellison. Oracle already hosts TikTok’s U.S. data services and would take the lion’s share of the deal. Fast times for Ellison, who recently celebrated his wedding to Jolin Zhu, a 33-year-old Chinese national from a prominent (read: wealthy) family.

The American dream wedding. We wish Ellison the best on his sixth? marriage—may it be forever filled with love and happiness.

Thank you for staying with us until the end. As usual, here are two great reads from last week:

Trading is a messy data problem. It is a trap for those who miss the scientific angle—and just as much for those who bury themselves too deeply in the science and forget the critical point: markets are not a solvable equation or a neat engineering problem. Here is a strong piece exploring that paradox.

It is a rosy market, and everything you touch seems to land on the right side of the coin. Human nature being what it is, you size up. You creep closer to the money. And why not take the 0DTE coin while it is on the table? Here is a serious research piece on 0DTE—one we are fairly sure we flagged a few months back. Still, nothing beats a reminder that the current state of play will not last forever. Be careful out there.

That is it from us. We wish you a wonderful (GDP) week ahead, and as always—happy, and responsible, trading.

Ksander

Charts, and analysis are powered by Sharpe Two Insights.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.