Forward Note - 2025/11/30

On intellectual honesty.

The Thanksgiving week did not disappoint. Volatility vanished as traders abandoned their desks for the comfort of home, and to make things spicier, we got a black swan instead of the traditional turkey on Friday: a CME outage at one of their data centers. A somber story of failed cooling. The market was plunged into darkness for more than ten hours, far longer than the last significant disruption in 2019, and only came back online an hour before the Friday half-day session.

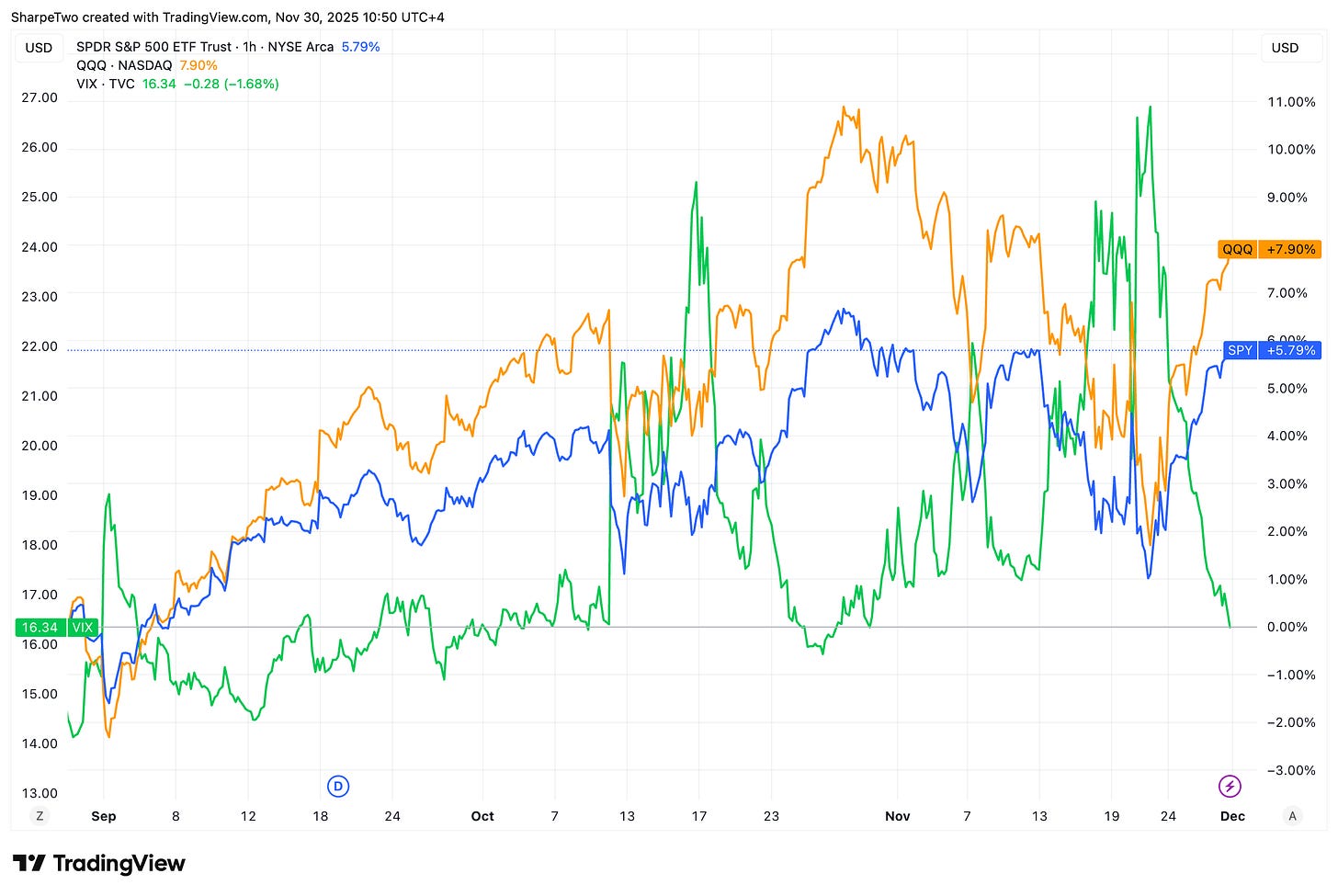

In the end, the SP500 added 4.4%, the Nasdaq 5.5%, and the VIX closed right on the 16 handle.

What is the old adage again? Stocks climb the stairs and take the elevator down? This time it took four weeks to lose 4% in the SP500, and barely three and a half days to take them back.

Remember when we told you to quietly sell the noise, hedged if you had to, and to close your social media feed if that helped? That advice proved useful once again. Many things make sense in hindsight, a running joke often made at the expense of economists, but perhaps it is time to update the target and point that joke at social media commentators.

The beauty of the 2020s is that anyone can voice an opinion, become an expert for a day, and for a split second rub shoulders with Mike Burry (more on him in a moment). Take the gamma and flow prophets. They burst onto the scene five years ago, multiplying services that reinvented the old concept of support and resistance, dressed up for modern times: slick visuals, clean apps, a hint of conspiracy, and a bigger unseen order supposedly engineering your losses through algorithms and high-frequency trading.

One ought to wonder: how many of these gamma commentators have ever dealt with a dealer in their professional life? Let alone had a simple pub conversation with one? Would it not be odd if we (who actually dealt over the phone early in our careers, as a reminder) started selling services about F1 engineering just because we have access to telemetry data through the official F1 app but have never spoken to a single engineer in the paddock?

When trying to separate signal from noise, it has become essential to distinguish information from entertainment. Nothing is wrong with entertainment, and many of us look at markets partly for that reason. Betting a few dollars on an economic outcome for pure distraction is as old as time. The financial industry does not even shy away from it anymore: you can now wager on the prudishly named “prediction markets,” even through IBKR.

When discussing the conflation of rigorous thesis and entertainment, it is hard not to look at Burry. Is he doing it for the Kultur, or because he is genuinely still trying to invest? A mystery. Closing his fund was already an answer of sorts, and the half-million dollars he collected through one of the most successful Substack launches makes it even clearer.

He was already big on Twitter, and deciding to fully monetize an audience already sold on his short thesis has been an amazing trade: infotainment for dollars. Why not? We trade and sell services too. These things should be normalized and not frowned upon, especially in an age where one can stay small, nimble, and use every tool available to make a living. But Burry is not exactly trying to make a living (at least we hope so). He is a veteran of the field and knows all too well the responsibility that comes with such a vast audience. His words are either carefully weighed or completely YOLO’d, and many will lose a fortune on his misfortune… while he still finds a way to get paid. Not everyone can monetize an audience, or buy CDS on hyperscalers, a far superior trade to simply being long puts on NVDA.

As far as we are concerned, we will not bad-mouth Burry too much; everything has already been written about the man who predicted ten out of the last recessions, was short Tesla in 2018, and so on. Why? Because it is easy to comment on his demise, but how many of us would have actually called GS and told them we were about to bet 100 million USD against the housing market? That is the difference between commentators and doers, between entertainment and a thesis, between astrology and intellectual rigor.

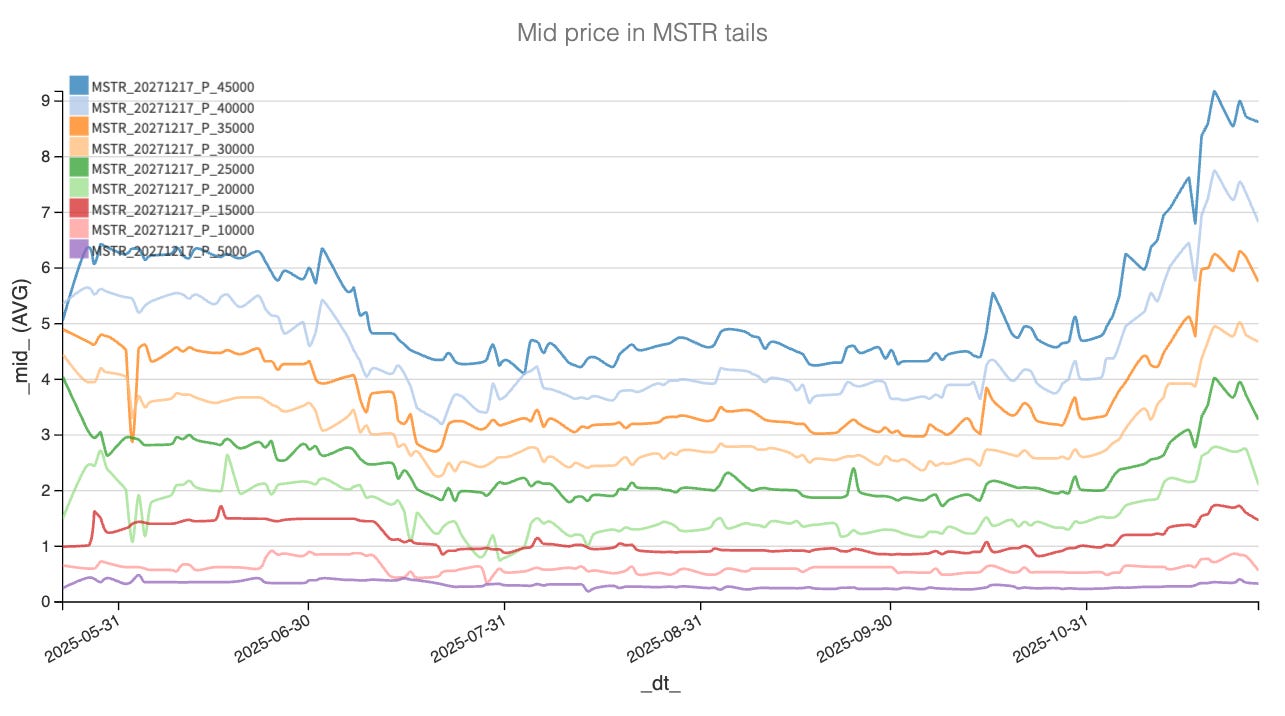

Yet one thing bothers us: the biggest and arguably simplest short of the year is sitting in plain sight, and we know it already paid nicely through November. Why on earth are Burry and the market doomsayers so obsessed with shorting NVDA and tech when something like MSTR is right there? Why deploy treasures of creativity in analysis when the flaws are obvious? An already-convicted bookkeeping felon scrambling to save his “company” as BTC is losing altitude toward levels that make even hardcore believers uneasy. And to quote the FT, MSTR may already be FUKCD (Note: they then change the original title, as a true well established and british financial media)

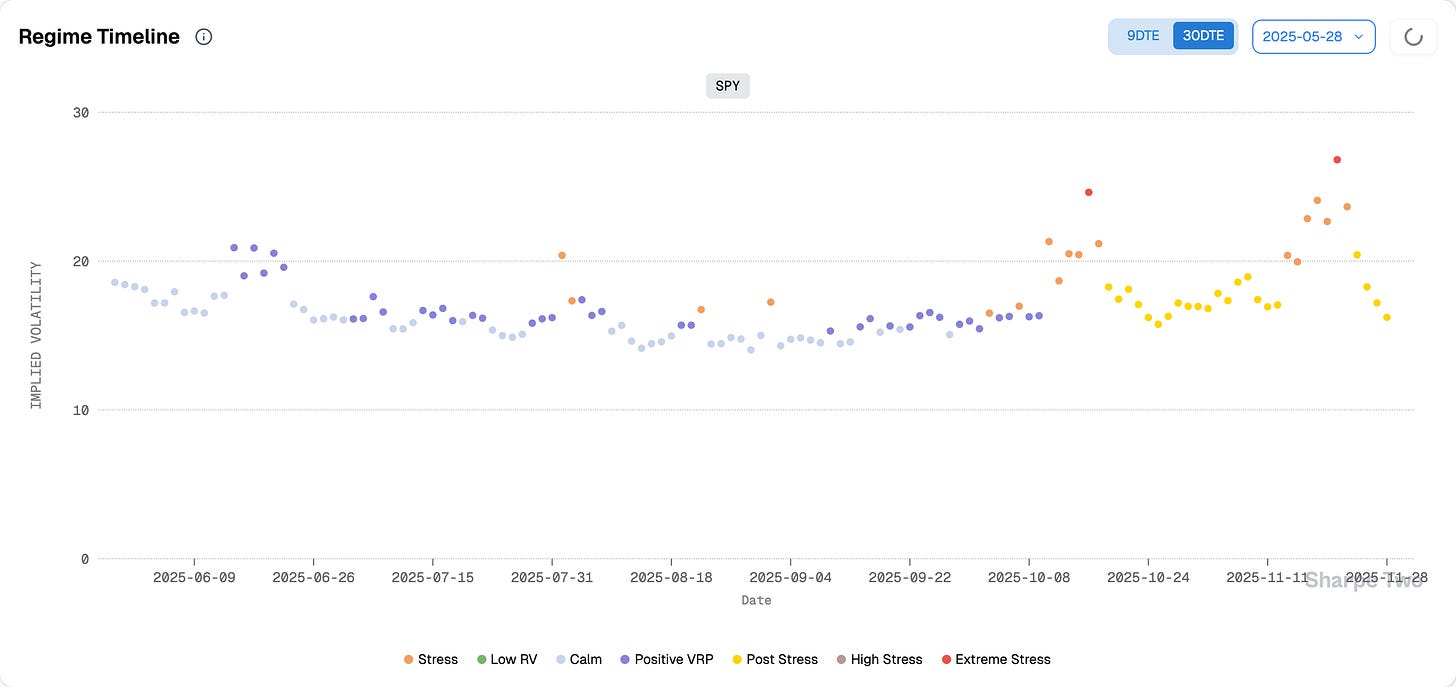

We know the trade paid because we discussed buying puts with people in our Discord, and some cashed out nicely last week. Shame on us for not putting it on. We were too busy harvesting the strongest variance risk premium in the SP500 we have observed in years, and did not want the distraction. Yes that’s right, when many were busy explaining tariffs, inflation, job data the Fed and what not would disrupt the market we were …. doing, placing trades, and harvesting that premium.

But if we did (and we still might), we would go full Burry and wait for it to go to zero. A 50% drawdown for a stock that was once knocking on the SP500’s door, and a 100% return on some of these puts since the June highs, does say something, does it not? Especially when your entire brand is built on being the contrarian. So why not focus on this, instead of the single overvalued, yes, but genuinely transformative industry that already touches more than one billion people after barely three years?

A mystery to us. And now that he is just a Substack message away, we may as well ask him directly.

Phew, that was a long pavé, quite different from our usual format. But it is Thanksgiving weekend, and it marks the two-year anniversary of this newsletter. We are genuinely grateful for our readership; you have made us (rumors has it that Alex and Ksander may be the same person) fundamentally better data engineers, quant and traders. They say putting yourself out there is the surest way to sharpen your skills, but I did not expect it to be this true. I have also formed unbelievable friendships along the way, and had the chance to interact with some very respected authors in the trading space.

My way of giving back? Sharing my insights, my signals (against a fee, yes; this is finance, not a charity so take the Black Friday discount while you can), but above all something I will never discount: my intellectual honesty.

In other news

We did things in reverse today, mostly because it was a short week with little to talk about. So for once, we will use this section to focus on what the data are telling us. As it stands, the VRP is the most compressed it has been in months. With realized volatility at 16 and the VIX at 16, you do not want to be selling vol right now. We insist on this. It was a great trade all summer when realized volatility sat at 8, but at this stage, selling premium and hoping to collect theta is the surest way to get steamrolled.

Is this the end of the glorious five months of VRP trading we have enjoyed in US equities? A little early to tell. With the FOMC ten days away, we would not be surprised to see some nervosity creep back into the market as we approach the date. So… long vol until then? Why not. The entire surface looks a little too compressed, and as usual, do not forget the call side.

But our favorite position right now is still to wait or look at other corner of the market where things may be more obvious. After that, it is already year-end, and volatility should calm down, until everyone gets ready to repeat this entire circus, sorry, cycle in 2026.

Thank you for staying with us until the end. As usual, here are two great reads from last week:

Seasonal effects are a real thing in equity markets. We are quick to point out that most trading is now algorithmic, but forget that behind the code sit humans with extremely predictable patterns. A great strategy from the Lay Quant, showing how you could use Mondays to seriously diminish the variance of your returns.

Larry Summers got himself into trouble after his email exchange revealed he was asking the late Epstein for advice about an extramarital affair. Far from us to defend the behavior, yet we could not help but admire the loyalty of a (true) friend willing to muddy himself to save what could be saved. Summers is, first and foremost, a great economist. Well done Brad.

That is it for us. We wish you a wonderful (NFP + inflation) week ahead. And as usual, happy trading.

Ksander