Forward Note - 2025/11/23

Sell the flatness and go away.

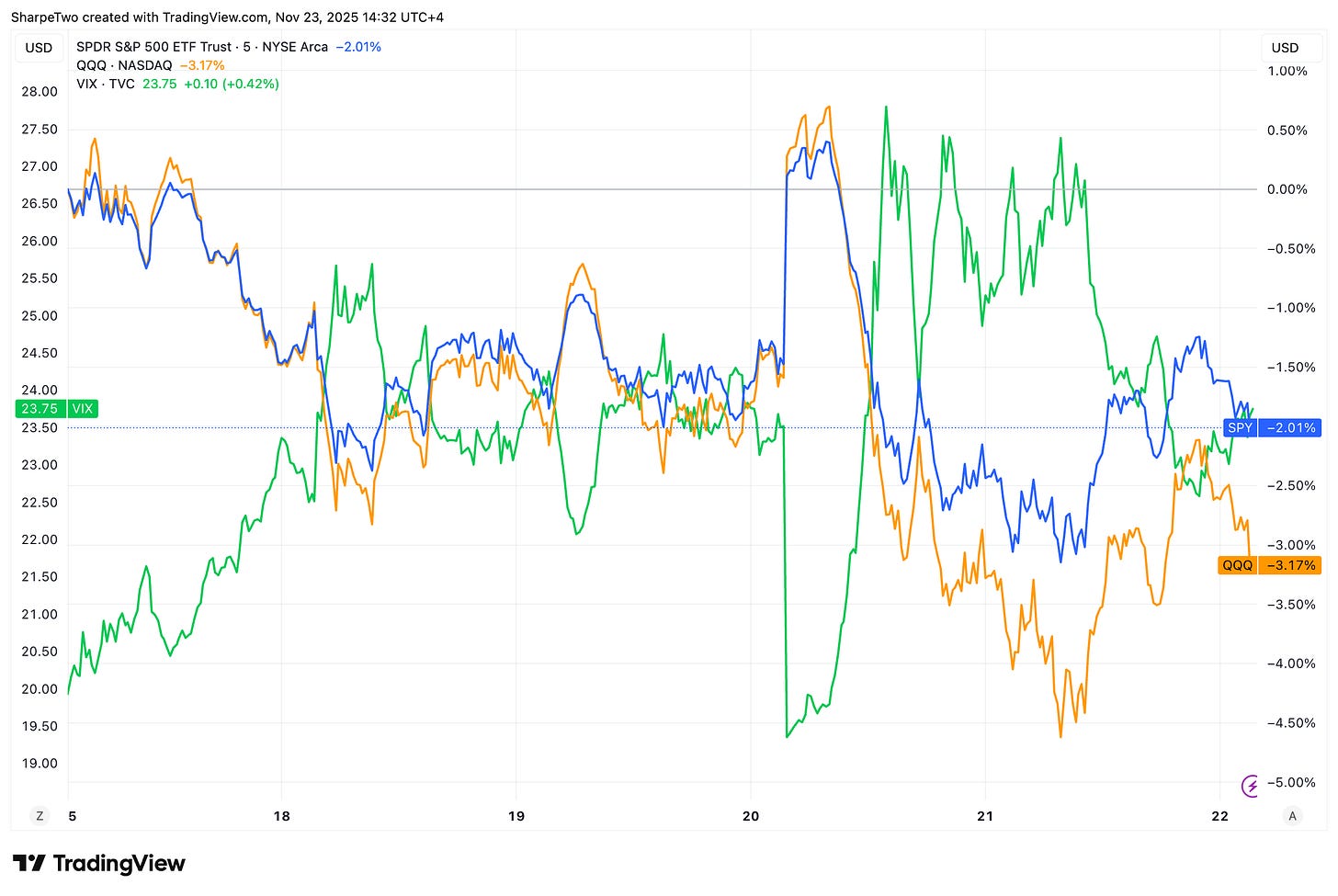

This week on paper looked like it could have been one of the busiest of the year, and it did not disappoint. The paradox is that the SP500 lost only 2 percent and the Nasdaq 3 percent, yet several times it felt as if things should have been far worse. Not because we learnt anything terrible (more on this later), but because implied volatility has so far refused to diffuse.

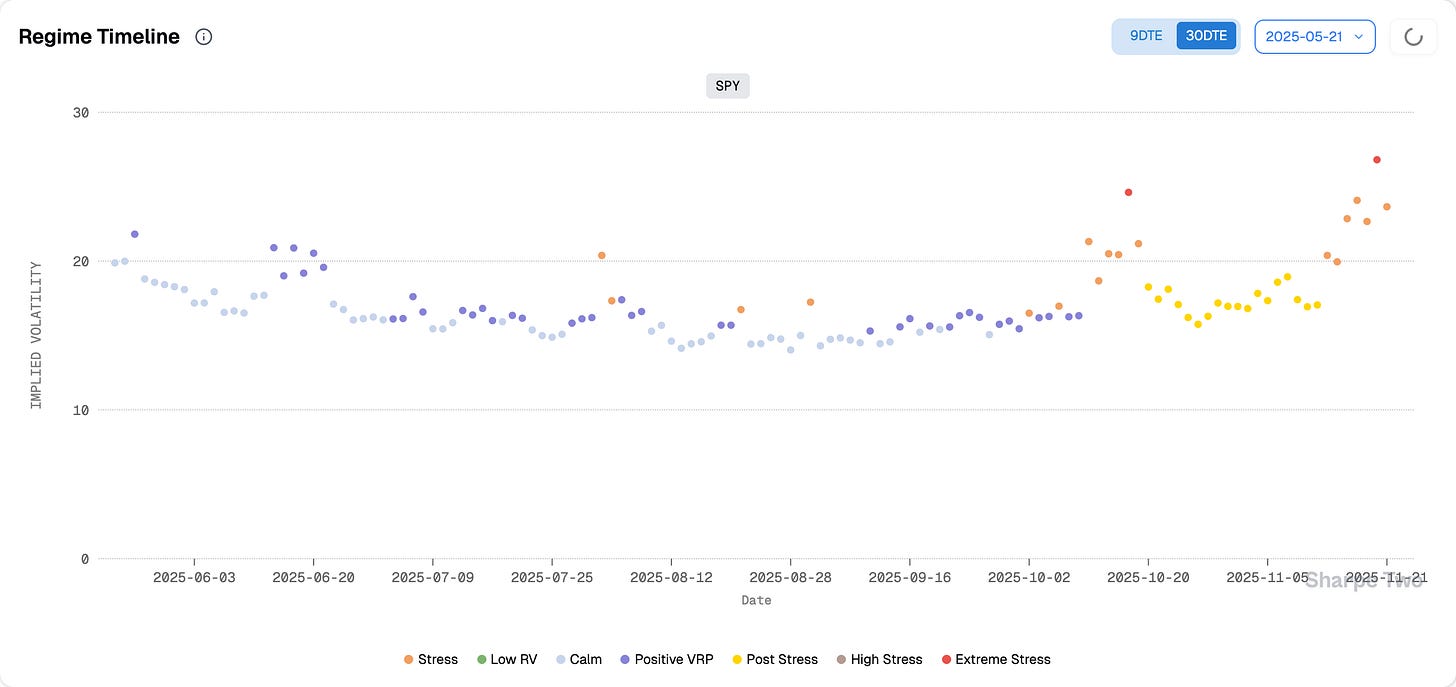

We left the VIX below 20 last Friday, but it added almost 4 points to finish at 23.75 after printing a few times above the 27 handle. It made for a couple of uncomfortable days to say the least, and the regimes pointed towards extreme stress on Thursday, even though things slowed down a little as we headed into the weekend.

So what exactly happened? It is unclear. We learnt on Wednesday that the Fed was fairly divided on the appropriate course for monetary policy, and the impression Jay Powell left during his last press conference was confirmed by the minutes: there is roughly a 50/50 chance of a rate cut in December, and so far very little visibility on the rate trajectory for 2026. Most likely it will not be as accommodative as many had anticipated after September. Higher interest rates bring sharper focus to already concerning tech valuations, as they mechanically dwindle the value of future cash flows through the magic of discounted cash flow… which already look meagre relative to capex.

We see this as the main driver of the chain reaction we observed. The frothiness of AI valuations? Burry’s new big short and Thiel stepping out of NVDA? The Google CEO warning that if we are in a bubble, everyone will be impacted? All of this adds to the nervosity, but if rates do not go down, tech valuations will mechanically suffer.

Apart from that? NVDA posted another blockbuster of a quarter, once again proving that the transformation underway is not slowing down. Like many in the marketplace, we initially thought this would be enough to diffuse the volatility of the last six weeks. Especially after learning on Thursday before the open that the US economy added 119k jobs in September. But que nenni. On Thursday we witnessed the kind of reversal that gets the entire marketplace riled up and financial institutions excited (absolutely not incentivized at selling you expensive options contracts, by the way…). From up 2 percent to down 1 percent, it did not take much to bring back memories of April last year.

So let us slow down for one second, compare apples to apples, and figure out where the trade may be.

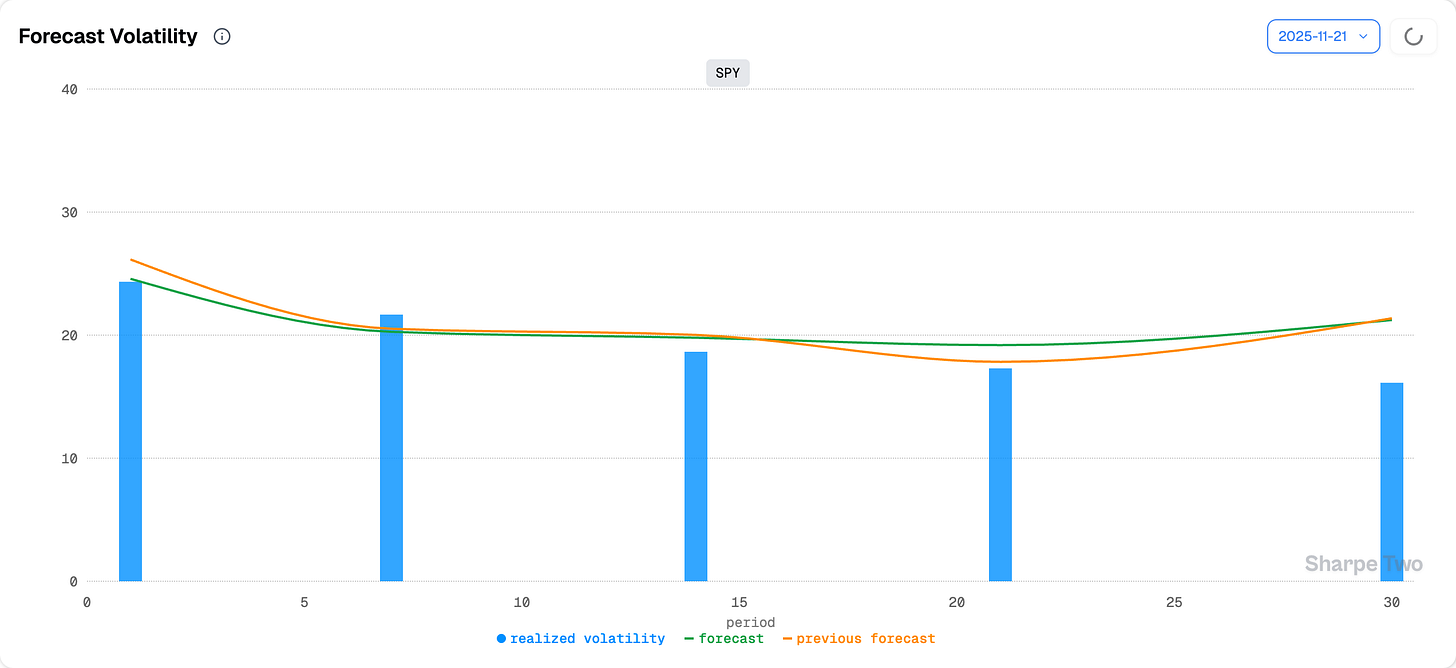

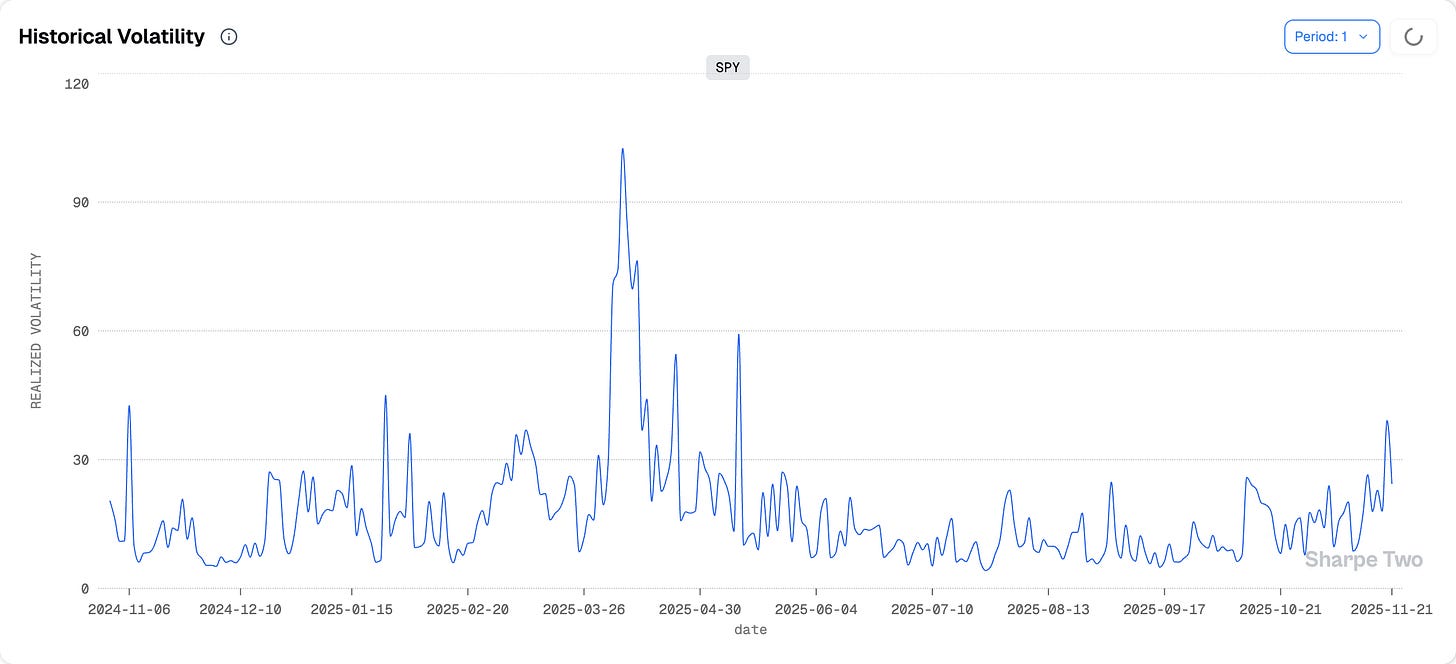

Let us start with in-session realized volatility.

We peaked at 39 percent on Thursday before cooling off to 24 percent on Friday. Respectable, and on par with the “vol events” from January 27, when the world learnt about DeepSeek, and from early March while the market was nervously waiting for the Trump tariff details. Things can cluster from here; we are not denying it, and this is exactly what we will analyse over the next few weeks. Our current scenario is that volatility may stay elevated but slow down (next week is a short week) until we get more clarity on the Fed policy.

Realized volatility over the last 30 days now sits at 16, and if things remain as busy as they are, you should expect to see it closer to 20 over the next few weeks.

When you look at it from that angle, you understand why the VIX is not going back down. Our model is not a secret (we use a classic HAR with high-frequency data), and if you need to justify buying options at VIX 20, you can simply point to this forecast. If you wonder who is buying at these levels, here you have part of the answer.

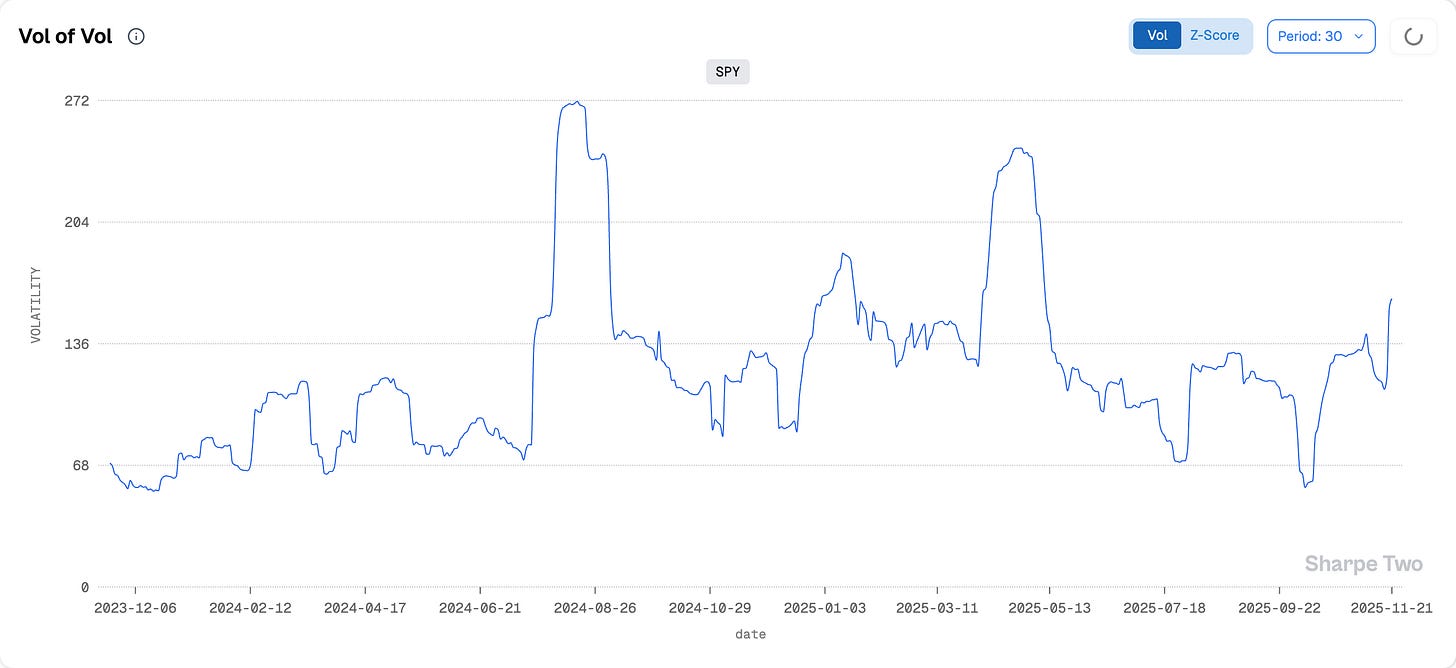

Back to the data. Vol of volatility is still climbing and is now at levels similar to what we saw throughout Q1 in the run-up to the tariff policy. Yet we are still below early January, when the market was digesting the rather odd December 2024 FOMC meeting that sparked an unexpected jump in volatility.

At these levels, the back and forth we observed this week will make everyone feel a little nauseous, but 4 or 5 VIX points intraday is entirely expected. We have written quite a bit about this metric as it kept rising over the last six weeks, arguing that you needed to wait for the peak in implied volatility instead of jumping on any price. That turned out to be useful advice, but what do we make of it now that we are reaching levels that are becoming… quite uncomfortable?

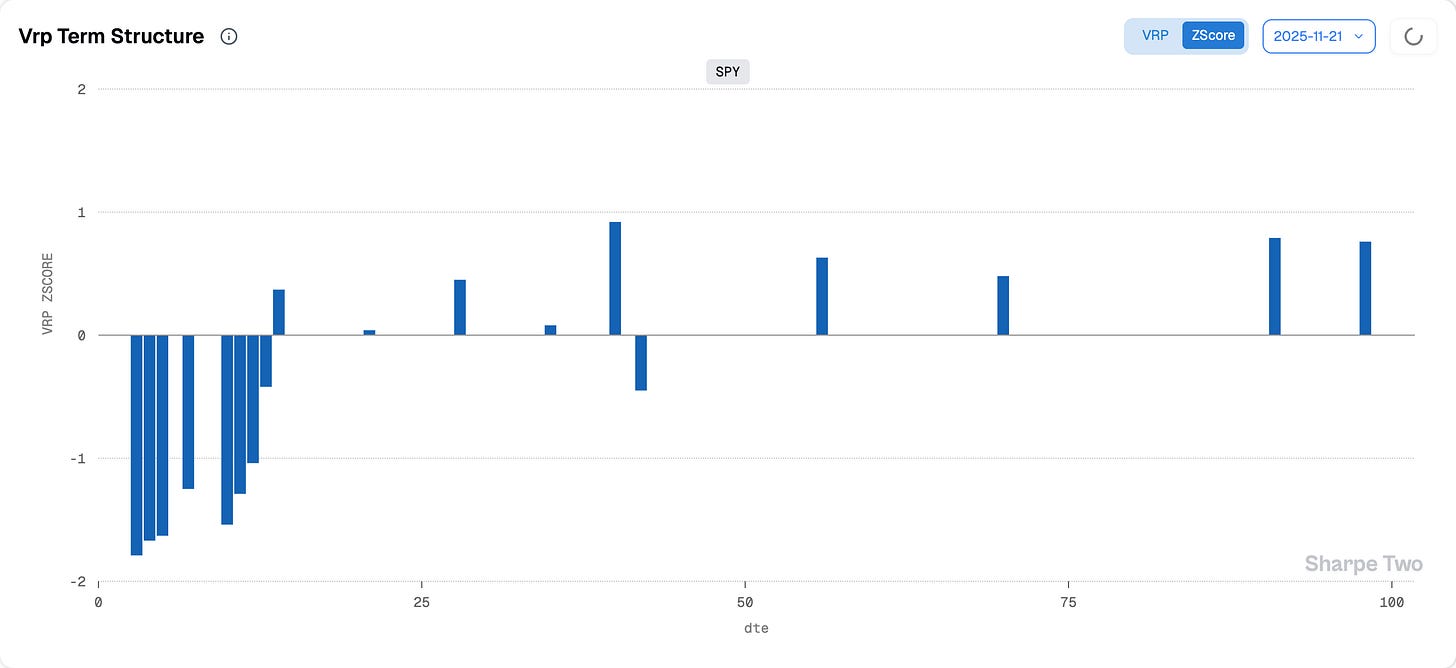

The first look at it is through the VRP.

At the close on Friday, you had 7 points, but 7 points when RV is at 16 is very different from 7 points when RV was at 12 and as is, the zscore is not particularly appealing, especially in the short dated options.

More than ever, one has to be mindful and wait for the moment when the air becomes unbreathable in session before entering positions. That will be VIX 25 and above if we see it again next week. And with the current level of vol of implied volatility, we will most likely see it at some point.

However, the problem with heightened levels of stress is that we start leaving the realm of normalcy. Models like realized volatility and the variance risk premium can quickly be thrown out of the window if the market enters a real tailspin. As a vol seller, your job is never to declare that the market is losing its senses or pretend nothing is happening. We insist on this. We may play it cool because we do not see the same level of uncertainty we observed earlier this year that justified the swings, but you must respect any reading of VIX 25 and above.

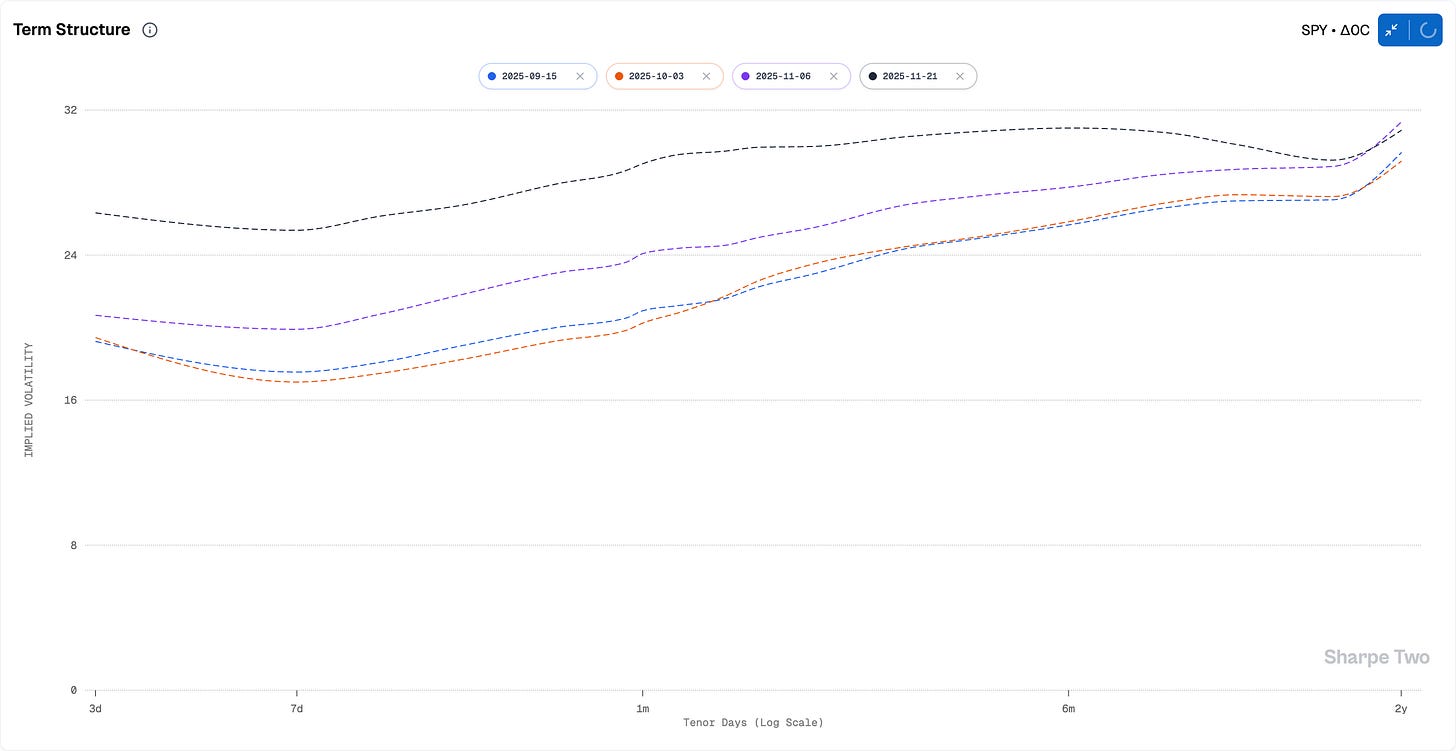

And you must also find ways to trade it. It has been a while since we last looked at the term structure, and in situations like this it offers great opportunities while controlling risk and exposure.

If you think the spread between 3m and 6m VIX is too compressed, for instance, you can enter a vega-neutral calendar where you sell the 3m and buy the 6m and quietly wait for things to drift back to normal.

Because eventually, they will.

In other news

So NVDA has done it again. While everyone worries about an AI bubble, Jensen, the iconic CEO, calmly says that “from his vantage point we see something different”. And it is hard to contradict him. Revenue for the last quarter came in at 59 billion, exceeding the 57 billion expected by analysts.

Let us pause here for two seconds. Do you realize how hard it is to exceed your target by 2 billion dollars? Do you know how many listed companies report an annual revenue below 2 billion dollars? A lot. Do you know how many companies report an annual revenue below 59 billion? Even more.

And if this was not enough, NVDA expects revenue for the fourth quarter to be a whopping 65 billion.

Yes, we have heard and read the wildest theories of cooked books and shady partnerships across the mega-tech complex in the US. None of this explains why the company is standing on something that looks like 200 billion dollars of revenue (or very close to it) in 2025, with expectations of at least 250 billion in 2026.

End customers still associate GPUs and NVDA with gaming and ChatGPT. But deep learning is becoming a mature technology that goes far beyond these shiny use cases. How do you think social media platforms know exactly what to recommend you? It is not done on a CPU anymore. How do you think your car can almost drive itself? It was never done on a CPU in the first place. How do you think AMZN knows how to stock its warehouses ahead of Black Friday? Not entirely on a CPU either.

We remember writing in 2024 about how the hate for NVDA reminded us of what AAPL went through during the relentless smartphone adoption cycle. Back then it felt more tangible because you could see the phones. Be careful betting against something you cannot see, but that is definitely happening.

Thank you for staying with us until the end, and as usual, here are two interesting reads from last week.

We had to trim some positions in the portfolio we maintain with our Discord group and, for once, we took a loss on a vrp trade in IBIT. Yet the VRP remains very pronounced and it should not deter anyone from sticking with it. Here is what academia has to say about the effect in cryptocurrency.

While everyone was going wild about what could have happened on Thursday, we heard a few rumours of funds positioning for year-end in an already thin liquidity market, and a few others clearly under stress. Among them, unusual enough to be cited, RenTec. We first read about it in October when the development was unfolding, but here is another view of the situation.

That is it for us this week. We wish you a wonderful week ahead and, in advance, a happy Thanksgiving.

Ksander