Forward Note - 2025/11/16

Sell the noise.

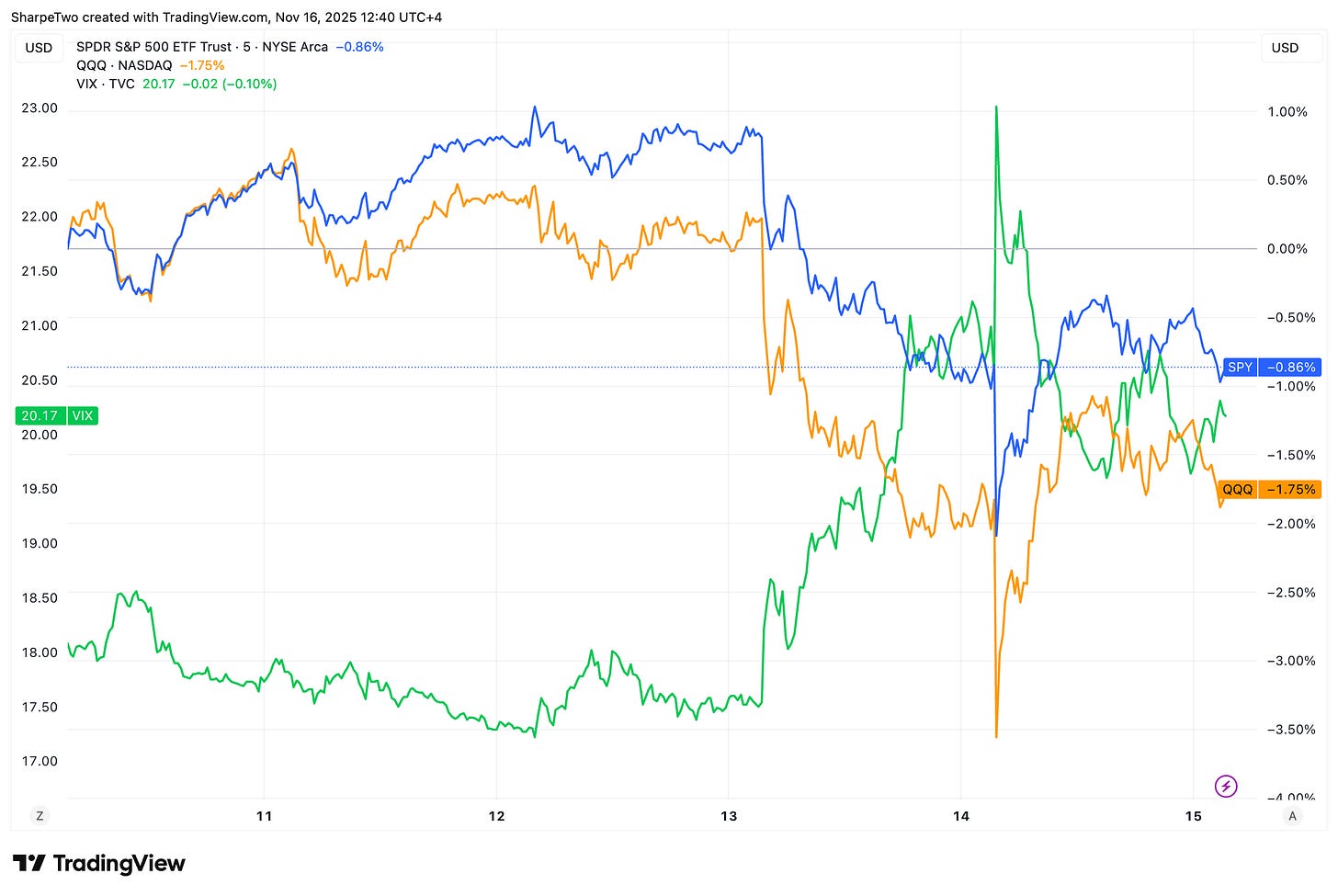

Second consecutive week of decline for US equities, with the SP500 losing just under 1% and the Nasdaq 100 a little over that. The VIX added nearly 2 points to close right at the 20 handle, at 19.83.

If you consider that the down moves have softened, the week was almost a copycat of the one before: indices could have finished much lower if not for another Friday rally to save appearances. And just like last week, options buyers resurfaced midweek, propelling the VIX to 22 at Friday’s open — though that spike did not last long.

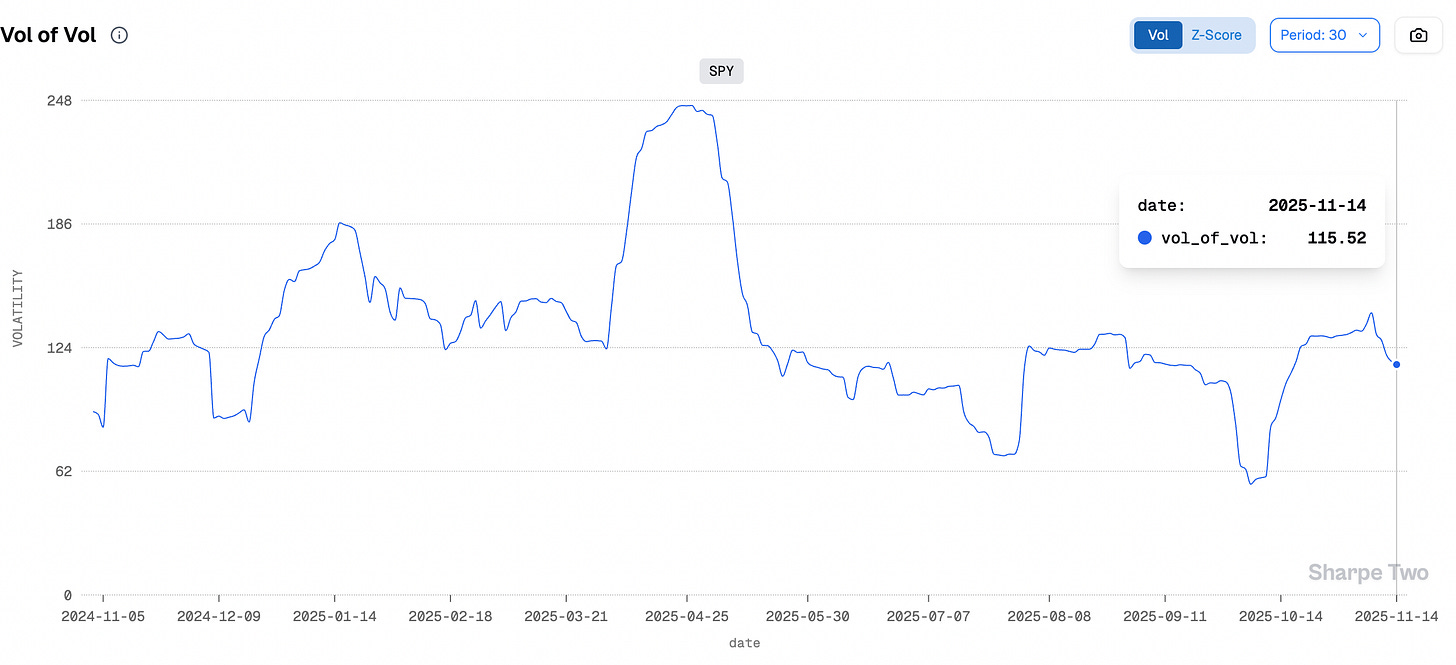

As we highlighted last week, this outcome was expected. The volatility of implied volatility remains elevated compared to most of the summer, and one should not be surprised by 2- or 3-point swings in the VIX. What is notable, however, is that this metric is now slowly reverting from the highs reached last week.

Currently sitting at 115.5, this number no longer says anything special; it sits right in the middle of last week’s range. In other words, get used to these 2-to-5-point vol swings in a single session. It is not summer anymore, and until the typical year-end slowdown kicks in, one should expect this regime to hold.

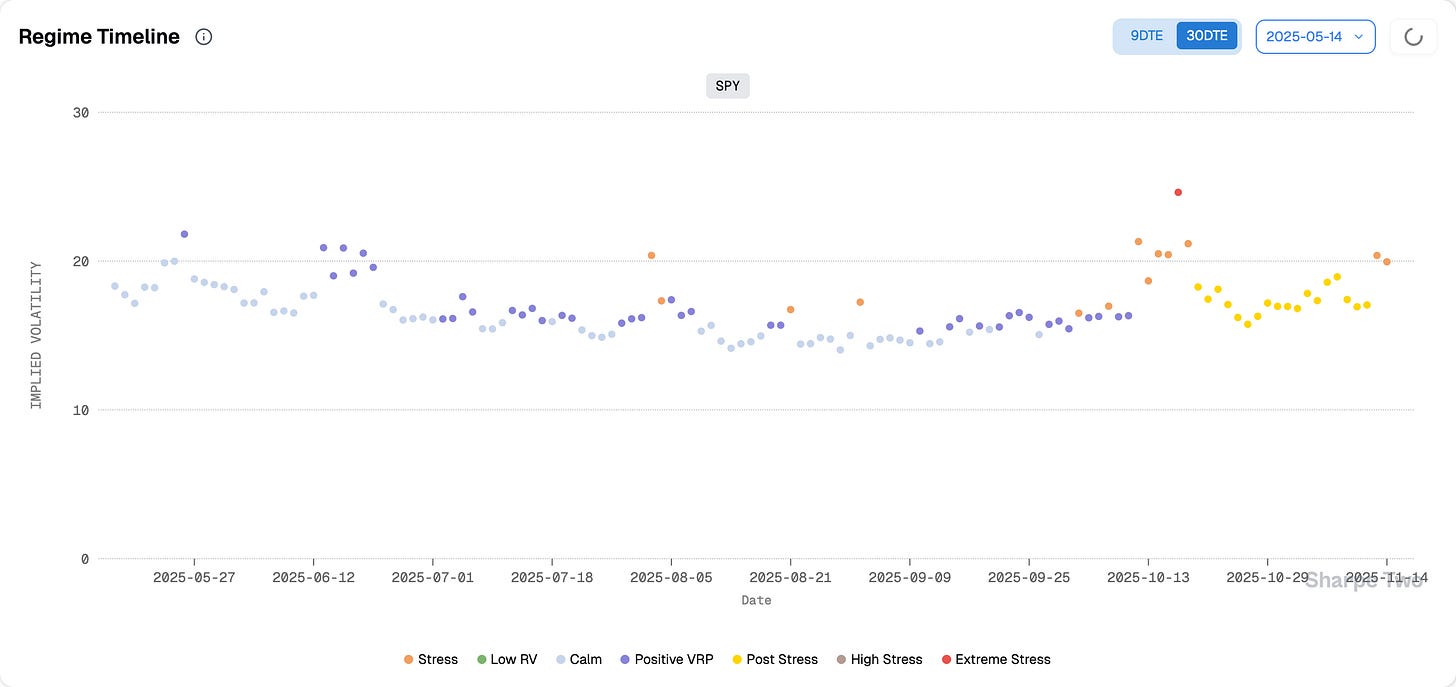

As was the case a month ago, there is still a faint trace of stress in the market. It should not deter us from acting but only make us more deliberate in how we trade. These waves in the VIX, up and down, are more a feature of the current regime than a bug and a feature that can be quite profitable.

In fact, with the VIX touching 22 at Friday’s open, you had to be quick to grab the cards the market was dealing.

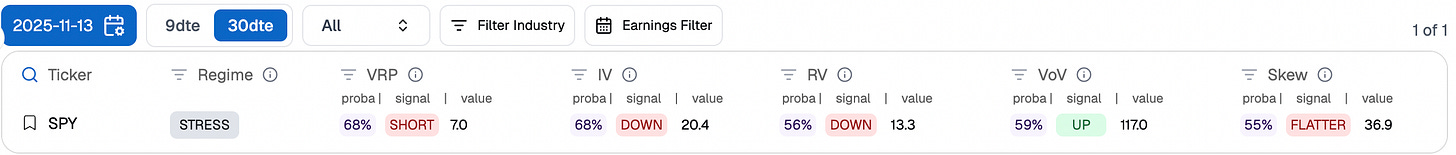

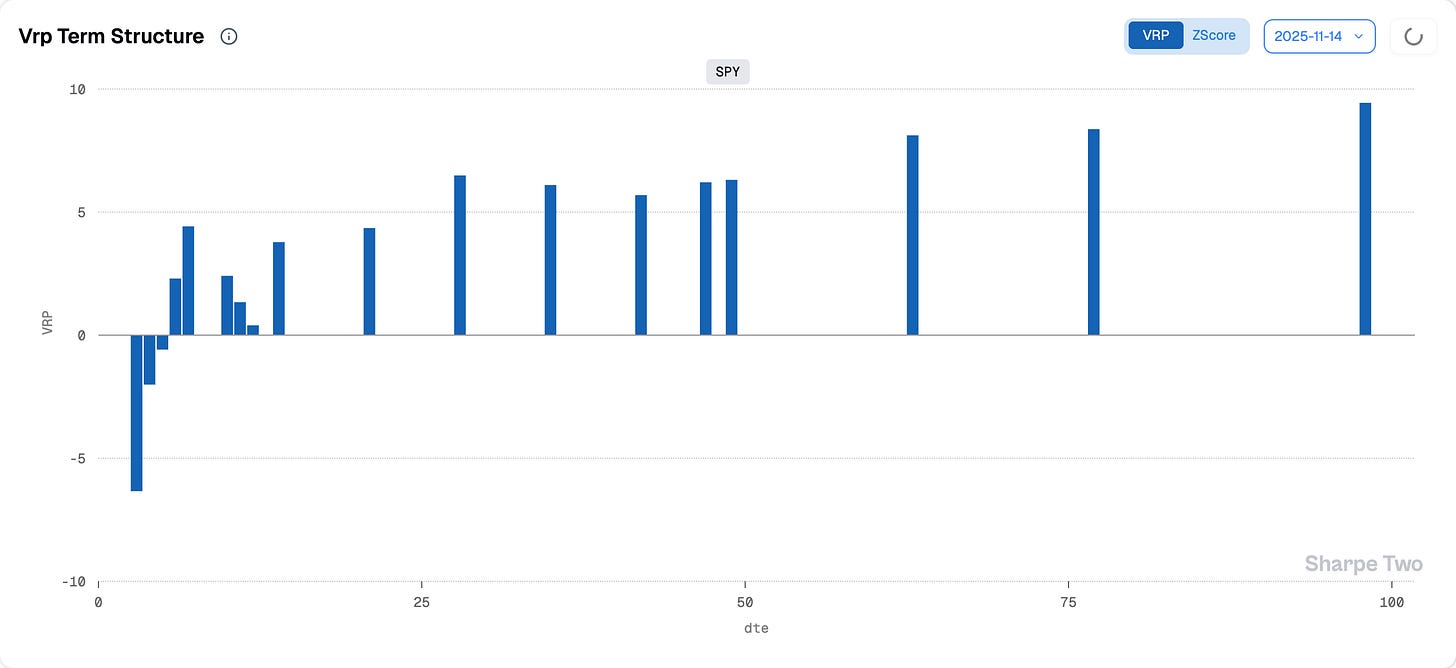

This was almost a 9-point VRP, an improvement from the 7 points observed at Thursday’s close, when our models were pointing to a decent probability that implied volatility would exceed subsequent realized volatility. It always feels a little unsettling and that is the curse of insurance sellers. Yet this is precisely where the money lies, and taking advantage of these back-and-forth swings is how one monetizes the VRP.

The contrast with summer could not be clearer. Back then, we were in positive VRP and calm regimes; all you had to do was sell the 15/16 handle and wait, collecting carry as realized volatility stayed below 10. But now that it has climbed above 13, and could keep rising, one must be far more selective about where to sell and accept being paid to act as the insurer of last resort. When tensions are high, some investors will always pay up for protection, just in case.

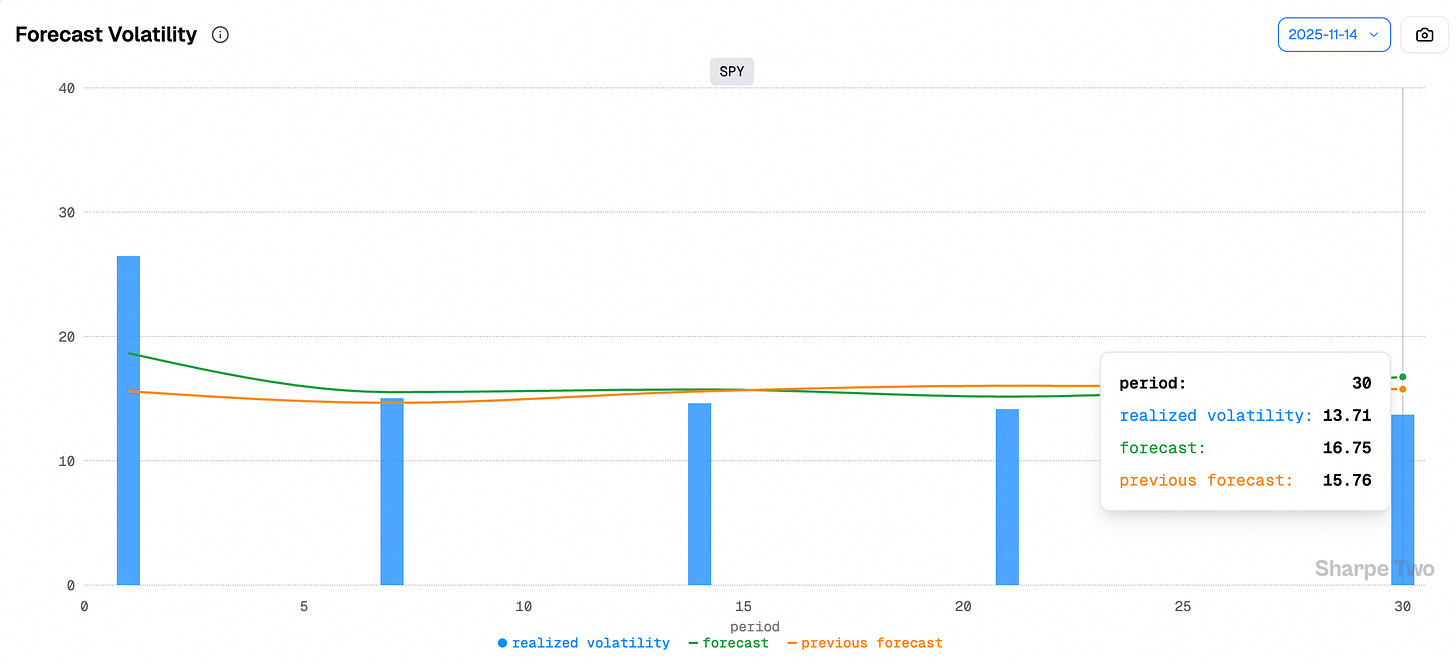

As of Friday, we still expect realized volatility to climb, potentially up to 17. In case it is not obvious, selling anything below that level can still be profitable (as long as realized volatility remains contained), but it does not offer a great risk profile.

Patience becomes critical here as it is what allows you to build a healthy margin of error in case new catalysts hit the market and catch everyone off balance. By Friday’s close, there was still a decent bit of VRP in SPY.

Five points or more at 30 days is often enough to get away with almost anything, but as always, you never know. Seven points would certainly feel more comfortable.

The calendar between now and year-end will only get denser as the data backlog clears following the government shutdown. Next week, for example, NVDA reports on Wednesday and the October NFP follows the next day. Could a bad surprise come from either? Absolutely and it should not be discounted.

Applying the same logic, dabbling in super short-dated options right now may look tempting (premiums appear juicier) but you are effectively renting your balance sheet to someone hedging potential gamma risk that could erupt on any surprise over the next few weeks.

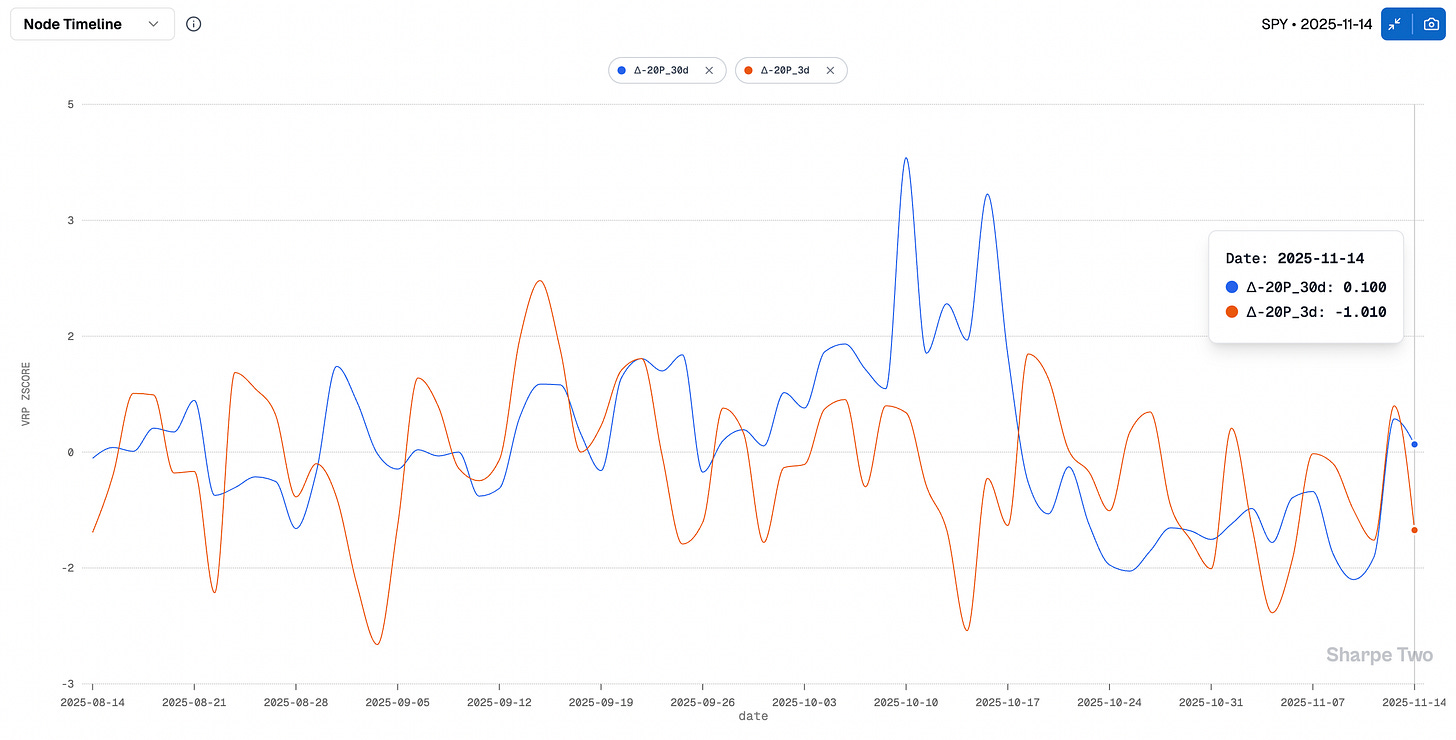

At Friday’s close, the VRP z-score for a 20-delta put at 30 days was slightly positive, while the 20-delta put at 3 days was negative. There is no premium for making money the hard way. And just because all the volume, open interest, and social-media noise are concentrated in those expiries does not mean you have to be part of it.

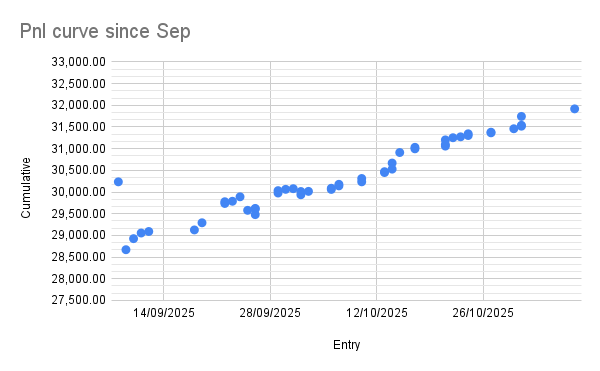

Every option contract is a situation, a tool, an odd handed to you by the market. You want to play the cards where the edge is in your favor, and leave the rest. When you do that, trading becomes more than a game and far more addicting because you start winning consistently. Here is our equity curve since product launch (you are in luck, we’ve just started our BlackFriday discount) and all the trades taken with our Discord group.

This is what you get when you trade with probabilities and there is nothing more satisfying than watching your equity curve move up and to the right, uncorrelated to market direction. And all the theories you read on social media turn back into what they have always been: pleasant distractions, while you wait for the next customer willing to overpay for his insurance contract.

In other news

Last week we learned that Michael Burry was launching another Big Short on tech, and this week we learned he was closing his fund, Scion Capital, turning it into a family office, a move that conveniently frees him from reporting obligations. In other words, keeping his cards close to his chest.

There has been plenty of speculation about whether he is unwinding the trade or taking profits, especially given the recent sell-off in PLTR, which must have paid well if he was indeed positioned there.

Here is our two cents. First, we have no idea at what price he bought those puts or when, and while they might be in the green, the beauty of options mechanics makes nothing certain. Second, knowing his temperament, we are unlikely to hear from him until one day he posts a blunt tweet along the lines of “+789%.”

Will it be on puts again?

Hard to tell, but the timing of Burry’s decision to close his fund is intriguing. This same week, we also learned that CDS spreads on the hyperscalers (think of them as the cost of insurance) have been sharply rising. These are the very instruments that made Burry famous, allowing him to bet on the collapse of the US housing market. In other words, while equity markets keep dancing, the credit market has started to notice the weight of all that recent borrowing and to wonder how exactly the Oracles and Nvidias of the world plan to pay it back. Could Burry be dabbling in CDS again? We would not be surprised.

And because everything this week seems to be about timing, we also learned that Buffett’s last trade was to go long Google, right as everyone frets about a bubble in the AI sector. At first glance, the timing makes him look out of touch, but as he has often said, “If you like a business, you should be ready to hold it for decades.” Needless to say, his bet on Apple ten years ago, and at multiples that seemed laughable at the time, will go down as one of his best.

Thank you for staying with us until the end. As usual, here are two interesting reads from last week:

A touch of politics first and depending on where you stand, you will either love or hate this one. Especially if you are a Millennial or a Gen Z’er. Either way, the perspective is worth the read.

The second piece drifts far from markets, until, of course, Ukraine, rare earths, and the “buy American” defense narrative return to the headlines. In the meantime, we are reminded that being on the side of the good is rarely simple, and even when facing the roughest aggressor of the 21st century, one is not exempt from questionable moral zones.

That is it for us. We wish you a busy, NVDA-heavy week ahead — and as always, happy trading.

Ksander