Forward Note - 2025/08/17

Back to school yet?

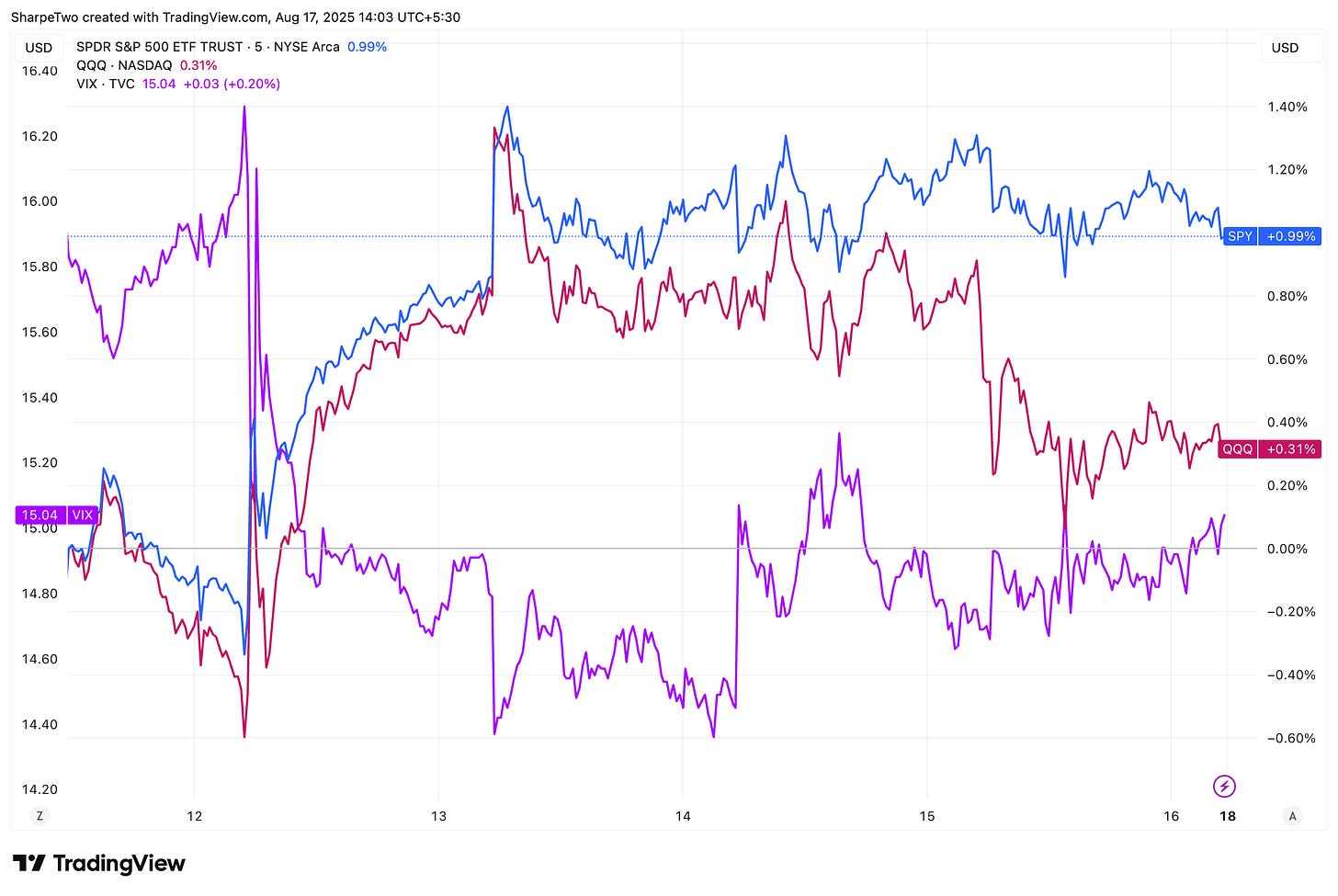

The pain shifted back to the call side. Despite some contradictory inflation signals, equities ended the week pushing higher, closing in on all-time highs. The SP500 gained about 1%, the QQQ a little less than 0.5%, while the VIX stayed pinned to the 15 handle, apparently indifferent to the latest developments.

Many (ourselves included) expected Tuesday’s CPI print to carry weight. It came broadly in line, even showing a slight decline in the year-on-year figure at 2.7%. Still above the Fed’s 2% target, but the market took it as another confirmation of a September rate cut. That was enough to push indices back to highs, and for a while it looked like the slow grind upward would simply continue.

But on Thursday, PPI disrupted the mood: a much stronger-than-expected 0.9% versus the 0.2% forecast. A reminder that tariffs may slowly be filtering into the economy. Was it enough to derail everything? Not really. Volatility ticked higher that day, but the week as a whole remained contained. The grind higher continues, though with cracks worth watching.

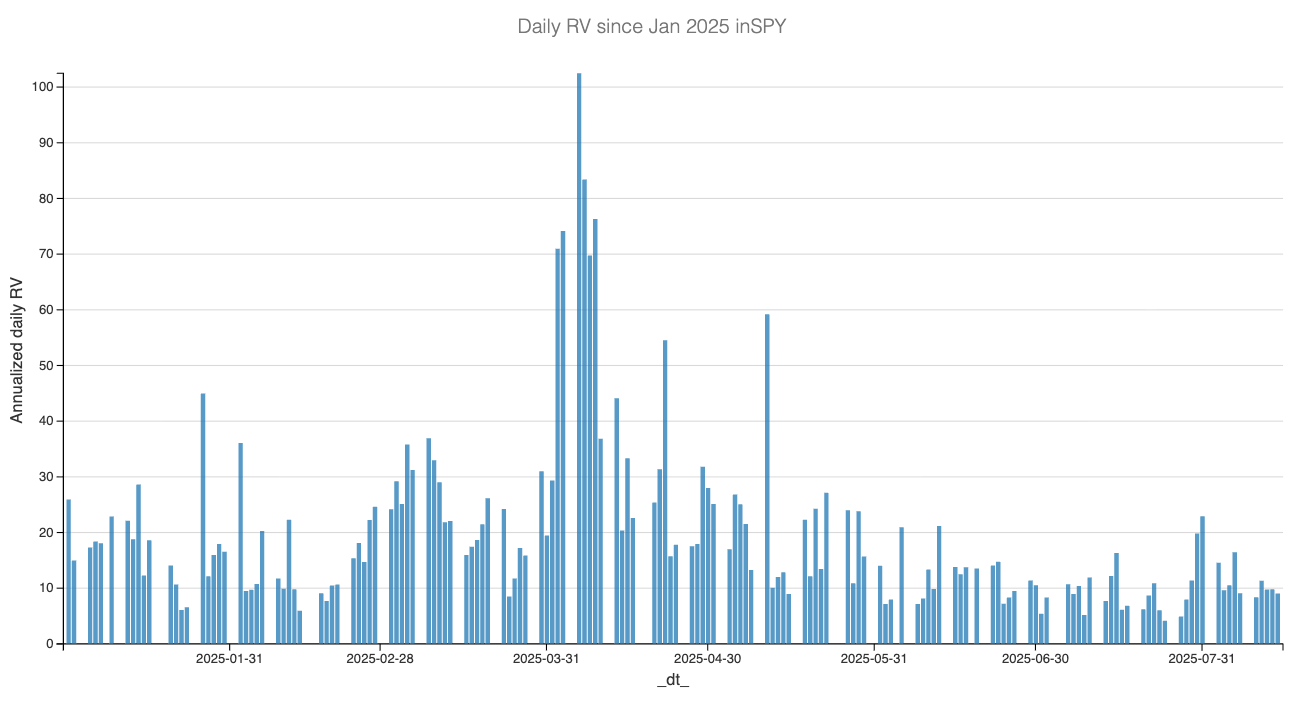

Another angle here is the semi-variance. Break realized volatility into its components—upside versus downside returns over a 9-day window—and it becomes clear: the early August blip has faded, and the bulk of realized volatility in the past 10 days has come from the upside.

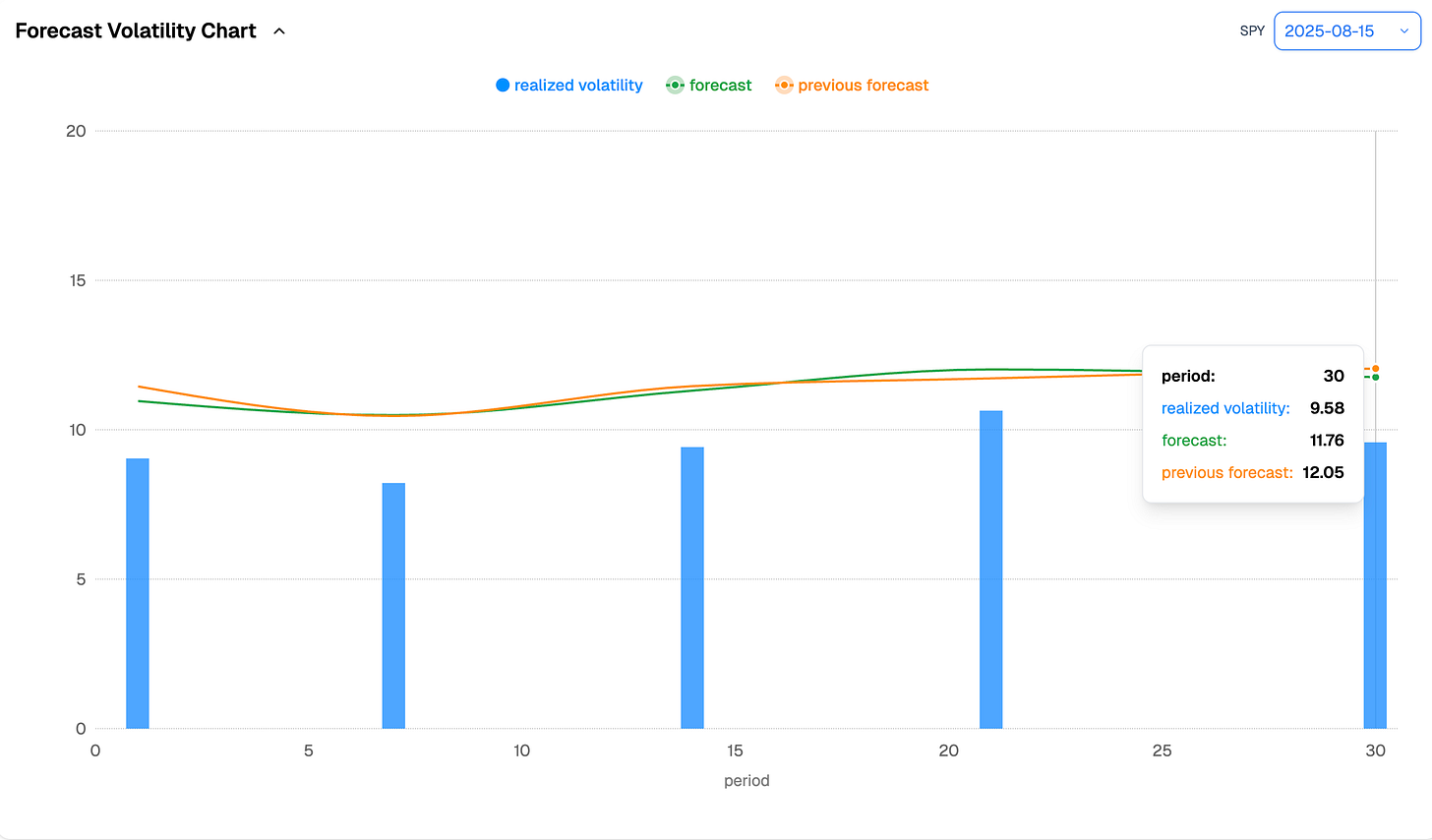

The obvious limitation of realized volatility is that it looks backward to anticipate the forward path. Driving with the rear-view mirror is hazardous, though not impossible. The key property we can exploit is that realized volatility tends to revert toward its medium- to long-term averages.

Needless to say, realized volatility has stayed anchored around its 12-point average, and despite the brief alert earlier this month, no material move has developed… yet.

Next week brings the Jackson Hole conference, where Chair Powell often chooses the stage to strike a tougher tone. And while the VIX sits comfortably at 15 (and even 14 on the laziest day), it would not be surprising to see him inject a dose of doubt into the market’s near-certainty about a September rate cut.

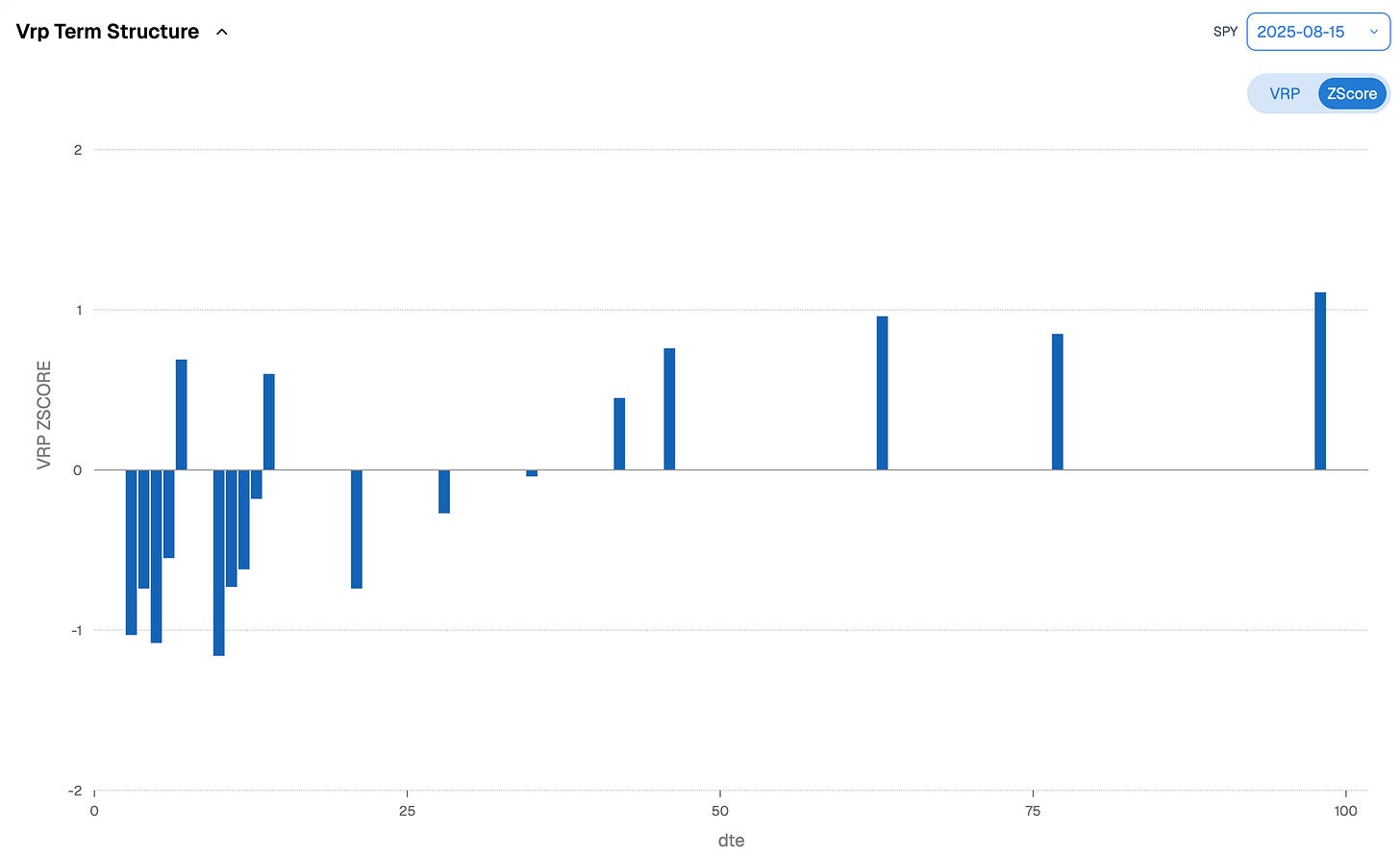

So how do we prepare for that as studious little traders? One, we can trade where it’s much more obvious and we talked about it on Thursday while diving in MSTR. Two, The playbook is not so different from the one we have used since early August: VRP cannot be traded as carelessly as in the easy days of summer.

The regime still looks healthy enough—+5 points at 30 days is nothing to dismiss—but with implied volatility steadily converging toward realized, caution is warranted. Margins in the back months remain attractive, but in the front weeks they are thinning fast.

It means that a single sharp move to the downside could easily turn three points of implied volatility into the equivalent of one—unless you are carefully delta hedged. This is why the very short term should be avoided now: too much gamma sensitivity, especially as we approach what is, historically, one of the more volatile stretches of the calendar. And even looking further out, there is no obligation to sell VIX 15.

Viewed through a z-score, the picture is even clearer: the front weeks should be avoided, but the one-month VRP is not as stretched as it was earlier this summer. Of course, it is unlikely we will see realized collapse back to 7 with such a heavy economic and geopolitical agenda ahead. But are we headed for 15 either? Nothing is impossible—but recall our forecast for realized volatility.

Which naturally leads to the question: when does the move higher in vol actually arrive?

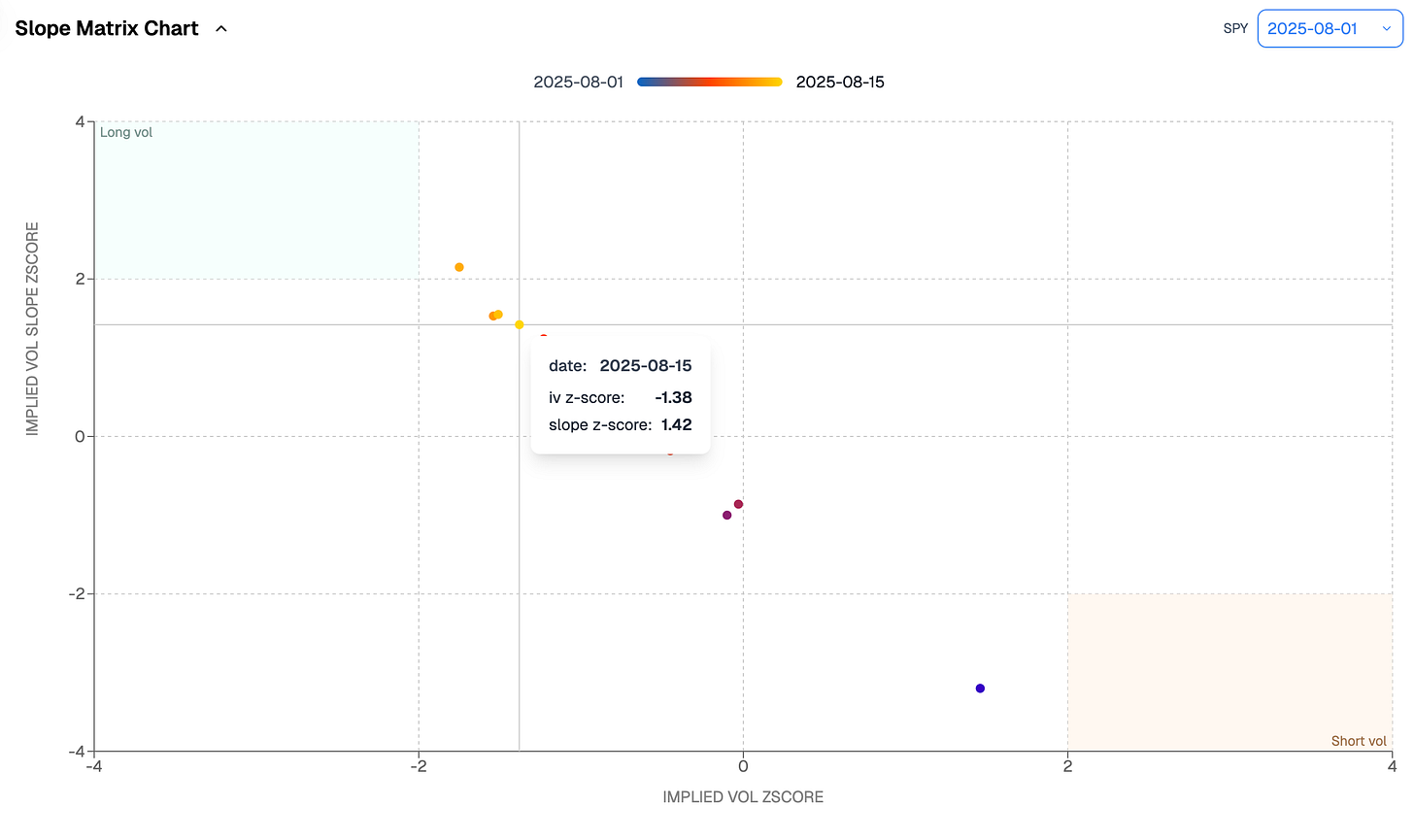

That question is difficult to answer. But if we place today’s implied volatility against the backdrop of how steep the contango currently is, we are edging into a quadrant where, historically, implied volatility has been prone to mean reversion. Nuance matters here: mean reversion does not necessarily imply a return to 20 and staying there. It looks more like what we saw a few weeks ago—a broad market pullback of 1–2%, maybe 3% if fortunate—before dip buyers and vol sellers inevitably re-emerge.

And while we are at it, recall the long-term relationship between SPX and VIX: roughly a 1% drop in SPX translates into a 7–8% rise in VIX. That would imply the VIX climbing just under 25% from current levels, still leaving us shy of 19.

We have not said this in a while, but it bears repeating: trade the regime you are in, not the one you wish we were in.

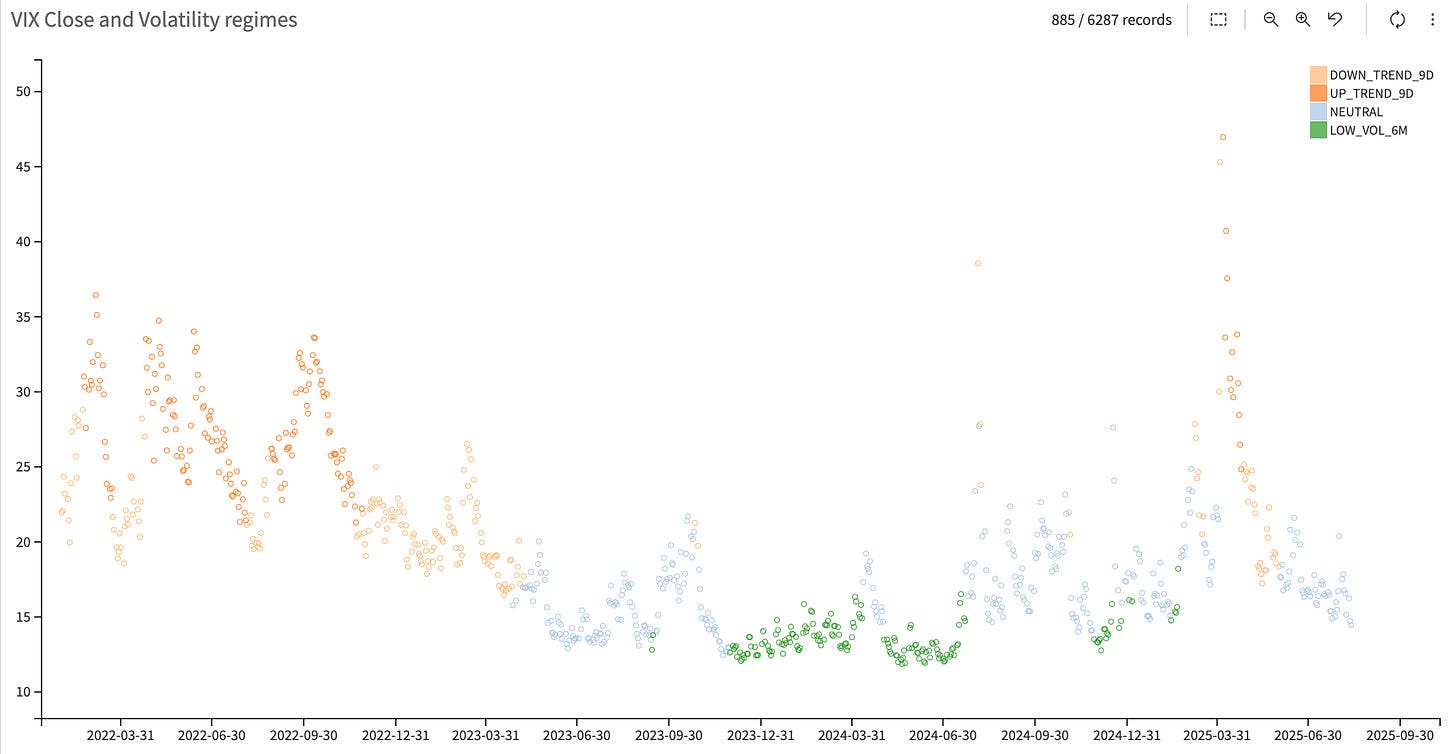

Until proven otherwise, we remain squarely in neutral territory, with momentum pointing toward a low-volatility regime. Landing there would be remarkable, but should it happen, the pain would only deepen for those shorting the call side.

In other news

Some notable geopolitical developments this week—but this time far from Russia and Ukraine. The spotlight turned to Nvidia (NVDA) and China, with tensions over AI chips—specifically the H20 series—escalating under the banner of security risks.

Chinese regulators have instructed domestic giants—ByteDance, Alibaba, Tencent, and Baidu among them—to halt purchases of Nvidia’s H20 chips pending a national security review. This comes right after the Trump administration’s decision to ease restrictions, allowing Nvidia and AMD to sell to China provided they surrender 15% of revenue to the US government. Beijing, however, is not rolling out the welcome mat without suspicion.

At the core are fears of “backdoors” embedded in Nvidia’s hardware—mechanisms that could enable remote tracking or even shutdowns, with obvious data-security implications. Nvidia, for its part, has publicly denied any such vulnerabilities, insisting the chips are safe and provide no means of remote control.

Chinese state media has now gone further, declaring Nvidia’s H20 chips “not safe for China” and criticizing them as neither technologically advanced nor eco-friendly. The Yuyuan Tantian account (affiliated with state broadcaster CCTV) was blunt: “When a chip is neither friendly, advanced, nor safe, we have the option not to buy it.” Meanwhile, the People’s Daily has demanded that Nvidia provide “convincing security proofs” before confidence can be restored.

Will this dent Nvidia’s next few earnings reports? We doubt it. But the message is unmistakable: sooner or later, Beijing will push its national champions to accelerate the development of advanced chips and carve out dominance in the AI race. And with such a forceful rebuttal, one cannot dismiss the possibility that they already have something in the works that the rest of us are not ready for.

Thank you for staying with us until the end. As usual here are two great reads from last week

GPT-5 is a big flop apparently (we beg to differ), but the real story isn’t the model itself: it’s that the old formula (scaling with more data and more parameters) for AI progress has finally broken. If you trade, invest, or just follow tech, you need to understand what comes after scaling—because that’s where the winners (and the biggest risks) will emerge. This piece lays out why the next era of AI will be messier, more innovative, and far more important than the hype cycles we’ve lived through so far.

Tech valuations are breaking records so fast that the numbers barely make sense anymore—trillions added in a day, billions tossed around like pocket change. But behind the headlines lies the same, timeless question: when is it ever enough? This piece isn’t just about wealth; it’s about our obsession with comparison, and why even in an age of AI-fueled abundance, we may never stop doing the math.

That is it for us this week, we wish you a wonderful Jackson Hole week ahead, and as usual, happy trading.

Ksander

Charts, and analysis are powered by Sharpe Two Insights.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.