Forward Note - 2025/09/14

Dr Powell? The patient is still not convinced.

D-minus 3 before the most anticipated rate cut of the past 12 months. We wanted to say five years, but let’s be honest — it is hard to argue this one is more choreographed than 2024. And back in 2023, the whole story was about securing absolute certainty that rate cuts were done, so the market could move on with its life.

This week cleared the last few unknowns: inflation came broadly in line with economist expectations, cementing the certainty that rates will be lower a week from now. The market responded by climbing to new all-time highs, with the S&P 500 adding just under 1.5% and the VIX still glued to the 14-handle.

Yet a few unknowns remain. The first is size. A 25bps cut is a given, but some voices have called for 50. With inflation in check but job-market concerns mounting, the argument is that unchoking the economy faster could prevent a deeper, lasting derailment. Because that is where the focus has shifted over the past days and weeks: yes, a cut is mechanically bullish through discounted cash flows, but it is also an admission that something is wrong. Or at least not as great as it looks. The 900k downward revision in 2024 jobs is yet another signal.

So where do we go from here?

Scroll through social media and you will see bubble talk everywhere — endless clever takes about buying puts or, worse, VXX, and sitting tight for the crash. We are writing this now, so if something major happens in the next few days, the joke is on us.

But judged on this week data again, this is not a market remotely concerned about anything. SPY’s term structure remains in clean, orderly contango.

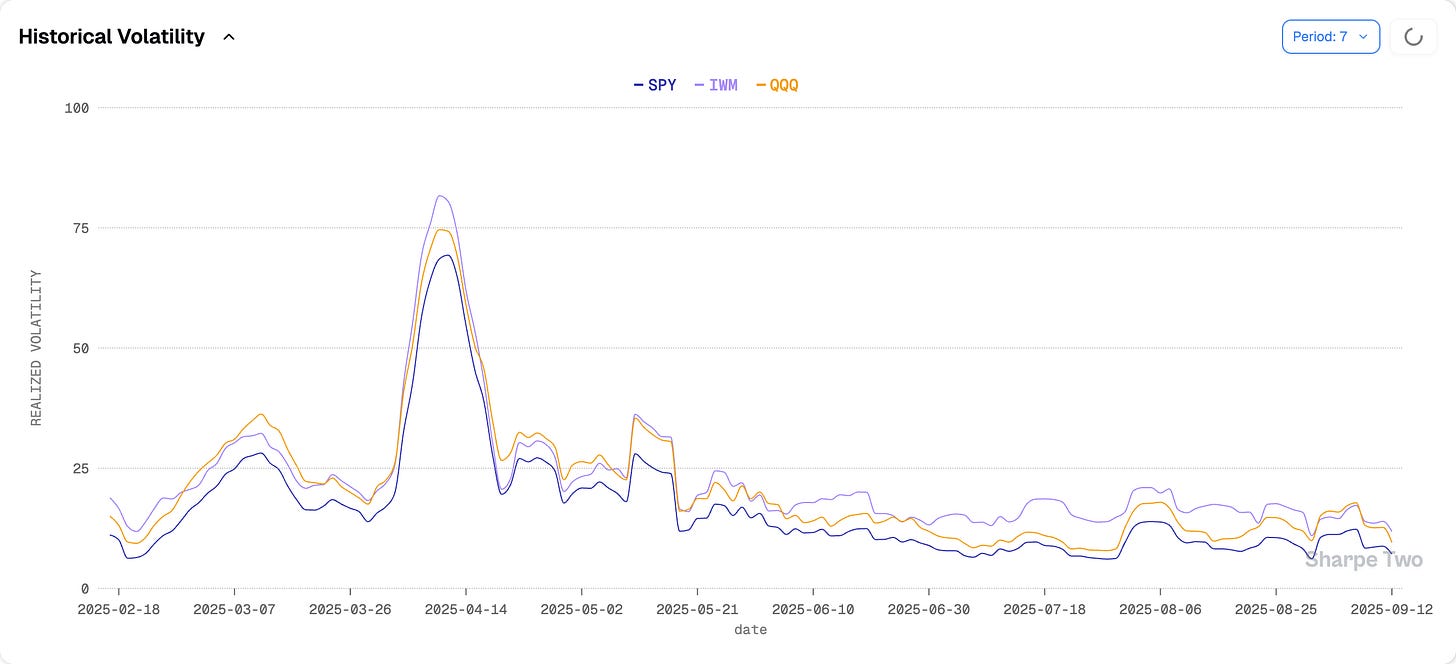

Three weeks ago, we wrote about getting ready for a steady climb in realized volatility through September to get a little closer to 15, which was making VIX 15… unappealing. Well, that call was wrong. Realized still sits under 10% over the past 30 days, with this week clocking a sleepy 5.73, despite all the noise and hand-wringing around inflation.

So too quiet a market, and this time, next week, for sure it will be different? That is the thing. Maybe we see a bit more agitation than the last four months have given us, but enough to spark a true regime change? We highly doubt it.

First of all, volatility clusters and it’s been doing that just fine over the last 3 months. Why not another 2? Secondly, vol-of-vol is always worth watching for little tells of pressure building under the surface. But at 115, with an almost perfect zero z-score, you cannot argue this is anything but normal.

Frustrating, is it not? Like going to the doctor with a dull headache, only to be told after every test imaginable that you are fine.

And maybe you are. But in hunting so hard for problems, you risk missing the obvious opportunities — even TSLA and AAPL, the two laggards of the Mag 7, are almost green on the year. At one point both were down 40% with no recovery in sight.

So where are the opportunities if you still want to dab in vol and not in equities? Last week we pointed out that SPY’s VRP was looking harder and harder to justify, and that IWM offered a better profile with a more stretched premium. This week, that edge is less clear. And we have to add some nuance: VIX at 14 feels “low” and VRP zscore are now compressed, almost in negative territory in some cases. Yet, there are still positive.

Also our view rested on an expectation that RV would rise and as we mention above, it did not.

If it does not over the next few days, the odds favor seeing VIX at 12 before the end of the year rather than 25. Remember, Thanksgiving week is only nine weeks out — historically one of the quietest stretches of the year. As always, it comes down to catalysts, and right now it is hard to spot anything that could send the market into another tailspin. So much so, that the number of articles talking about the return of the IPO season has been ballooning this week.

We will keep an ear on Powell Wednesday, but quickly shift focus to the next NFP report two weeks later, as most of the market will as it seems the only thing able to darken the mood these days.

Paranoia in markets is healthy. It is what keeps traders alive longer than their peers. But in this instance, it should not come at the cost of missing the regime we are in. Because inevitably this will stop, and when it does, the only regret will be not having enjoyed how easy these days really were.

In other news

We still remember that not-so-distant night in May 2023 when we sold an NVDA straddle ahead of earnings, only to wake up to a 25% move overnight. Twenty-five percent. Needless to say, NVDA sat on our personal blacklist for a while — a short roster otherwise reserved for GME and a few others, but that is beside the point.

This week, history rhymed. ORCL delivered a staggering 27% jump on what looked like routine earnings, fueled by explosive demand for data centers and cloud. That was enough to briefly crown Ellison — the ex–bad boy of tech — the world’s richest man, leapfrogging his old friend, the probably even more notorious Elon Musk.

What to make of it? If you still have not received the memo: betting against AI remains expensive. Reports calling it a bubble keep piling up. And sure, maybe it is. But bubbles can last, and markets will keep allocating capital so long as the promise of future returns is there — which, inconveniently, is the point of financial markets in the first place.

But let us stop on Ellison for a second. Twenty-five years ago he was already hearing every story and accusation under the sun about Oracle’s supposed lack of real value, the “bubble” status, and the disconnect between his company and actual technological progress. The moral of that story: shorting a stock is easy. Holding on through the direction of innovation is harder — but far more lucrative in the long run.

So here is the choice. Do you sell your beloved tech names because they are “over valued”, or do you glance at the list of the ten wealthiest Americans and notice what they are all doing? Building. And building requires investment. And over time, those investments tend to pay.

Good luck.

Thank you for staying with us until the end. As usual, two good reads from last week — though this time with a dose of self-promotion:

The first is our new series Beneath the Surface. Here we take tools usually reserved for quant desks — volatility surface analytics, fair-value models — and show how they can help you spot where the market is overpaying for options, and structure trades accordingly.

The second is Trade Anatomy, our P&L analysis of the recommendations made through Signal du Jour. We have spent the last 36 months building assets for better data, sharper insights, and ultimately stronger signals. And we have recently release a platform where you can access all of them. This series is a way to measure them.

That is it for us this week. We wish you a happy (FOMC and quarterly expiry) week — and, as always, happy trading.

Ksander

Charts, and analysis are powered by Sharpe Two Insights.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.