Forward Note - 2025/09/07

Swapping old friends for better payoffs.

In case you missed it — we just launched the Sharpe Two platform, where you can access all of our insights. It is built for traders with a data-driven mindset who know that building and maintaining all these models themselves is tedious and costly. You can get a sneak peak of the platform at the end of the market commentary. One last thing: joining in September locks in your subscription price forever.

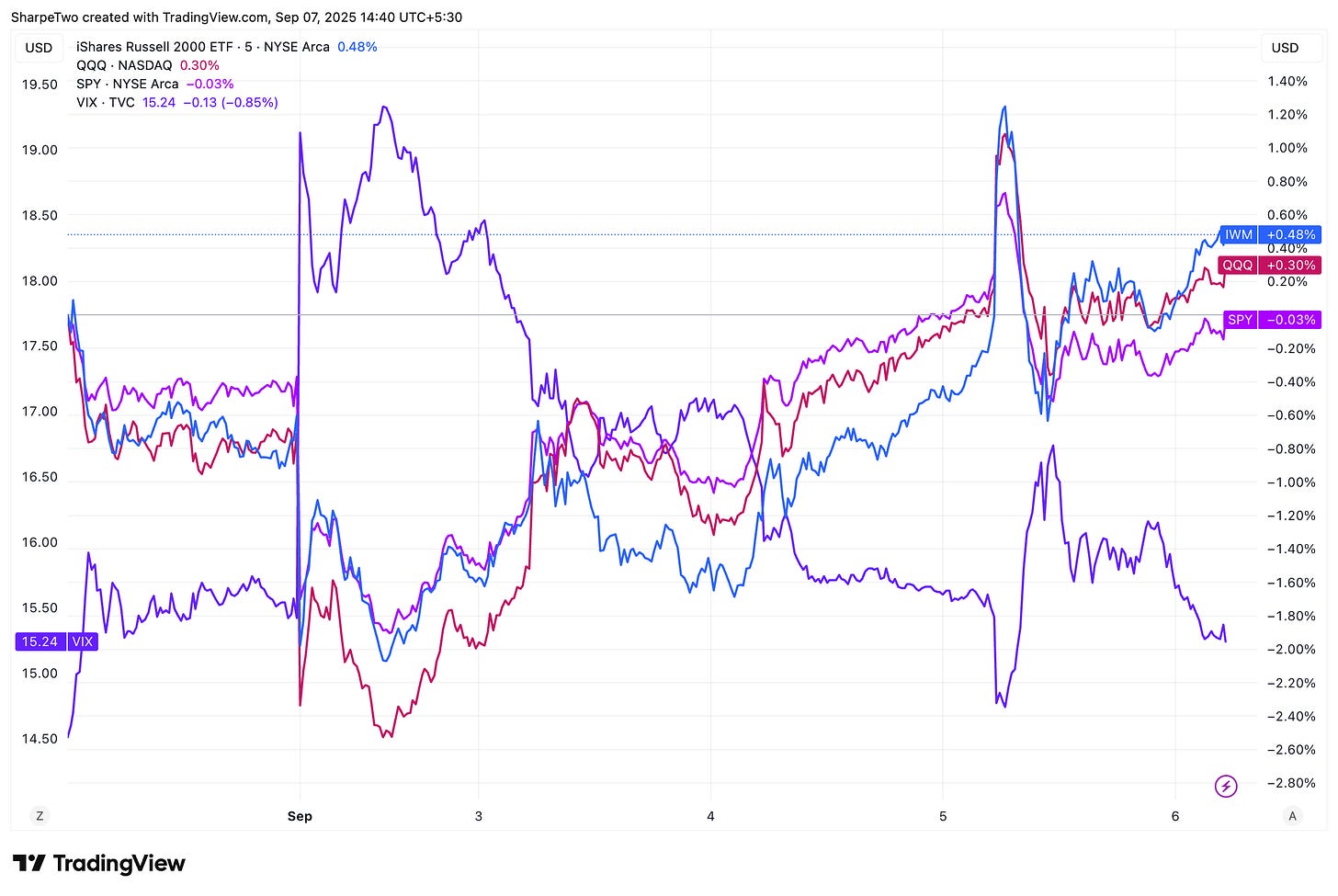

The summer is officially over for markets. After the long Labor Day weekend, traders went straight to work, scooping up what they saw as cheap SPX options and mechanically catapulting the VIX 3 points higher, above 19 — the biggest intraday jump since… the first day of August. And though we closed much lower that Tuesday night, do you start to see a pattern? It may be worth watching what happens in the months ahead. Apart from that, it was yet another quiet week.

Despite failing to close at new all-time highs on Friday and with realized volatility ticking higher, the S&P 500 erased most of the week’s losses to finish flat, while the Nasdaq and the Russell each added about half a percent. The VIX slipped a point to close at 15.

That is mostly due to the US economy adding just enough jobs not to rattle markets excessively. With only 22k jobs in July, there are legitimate concerns the labor market may be hitting some rough patches, and this now almost fully cements the rate cut expected in September. The more interesting questions remain: could we see another jumbo cut in September, similar to last year? And how many cuts will we get between now and year-end? In any case, the market feels certain enough about the near-term path to stick with the “wait and see” narrative: monetary policy works with a lag, so the real test comes later. By year-end we will know whether things have truly deteriorated to worrying levels.

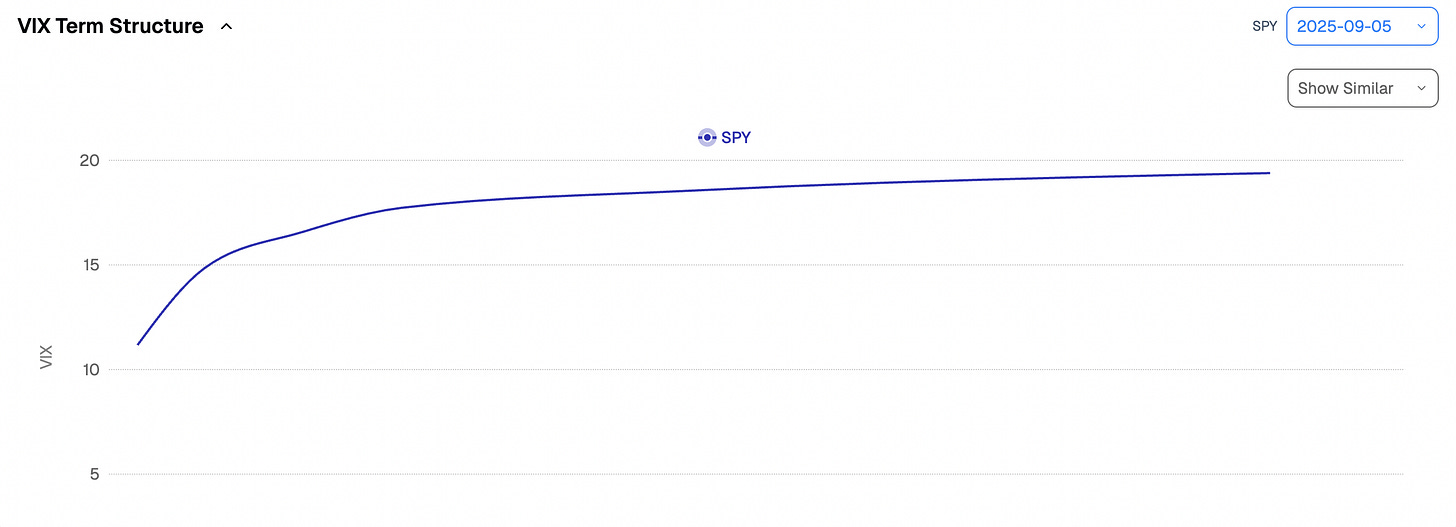

Next week’s inflation numbers (PPI on Wednesday, CPI on Thursday) could corner markets into a very uncomfortable setup: rising inflation alongside a weakening job market. That combination could easily spark enough volatility to crack the near-certainty of a year-end rally implied by today’s VIX term structure.

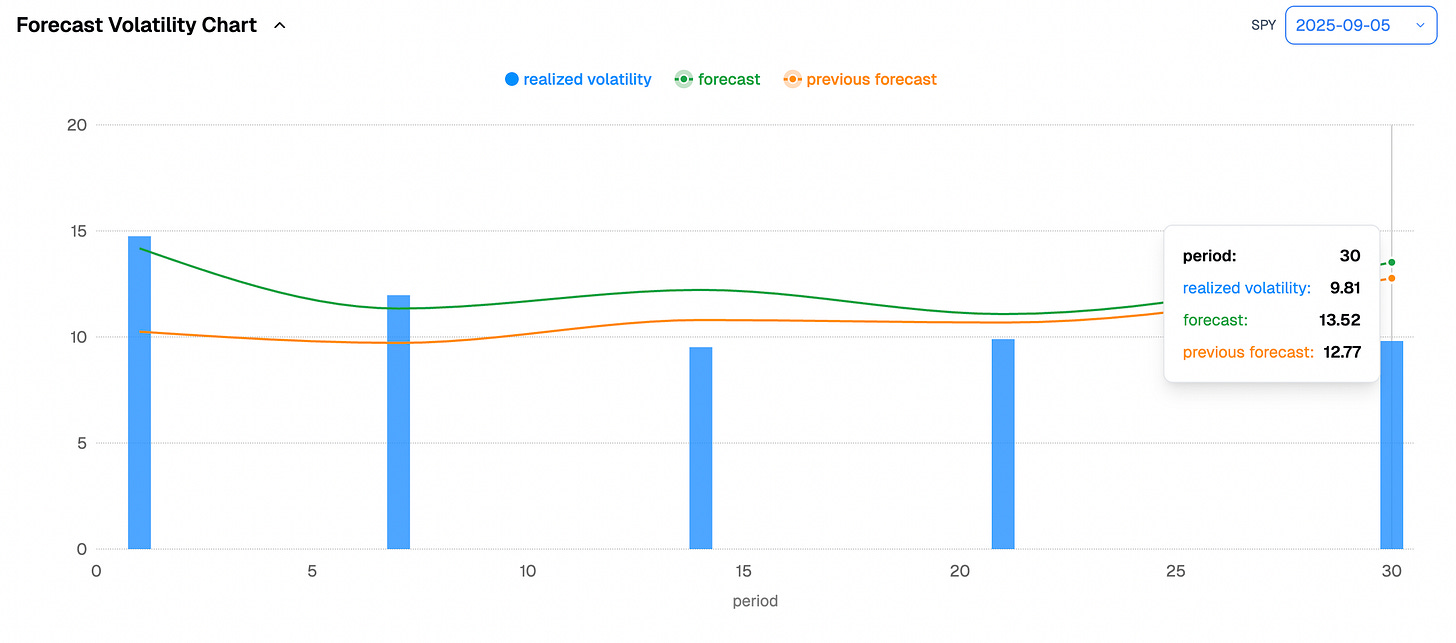

Whichever way you look at it, this is not a market that feels overly stressed about the months ahead. That does not mean it is right. And it certainly does not mean we should take every bid and offer it throws our way. Through most of August, the game was simple: wait for better prices, and once they show up, step in — as long as the broader market dynamics had not shifted. At 4 points of VRP in SPY, though, we may need to change our tune: is SPY still the primary breadwinner, or should we start looking elsewhere?

Once again, selling options is first and foremost a risk analysis game, and only second a margin game. You get paid if you can answer one question correctly: is the market overpaying for the risk it wants to insure against? Early in the year, we would have killed for 4 points of VRP in SPY — back then it was mostly negative, and selling vol was painfully complicated. But back then, realized vol was not sitting below 10. Right now, the greater risk is that realized volatility rises for any number of reasons, rather than grinding even lower from here.

Our models currently show a 76% chance that realized volatility over the next 30 days will be higher than it is today. And in terms of magnitude, we expect it closer to 13–14 than the current 9.81. Remember: it is a margin game. If you are selling 14-15 now and we end up realizing 13–14 over the next month, that does not leave much room for error. Worse, if we take the paranoid view — that models are too generous, smoothing toward the average and, by definition, missing the unexpected — then a 17–18 realized print would be a pretty painful place to sit.

So is it time to bid farewell to the friend who carried us through three lazy summer months? Maybe. Or at least keep some distance. And if nothing changes and the market once again pays 18–19 in implied, like it did last Tuesday, that would be justification enough to jump back in.

So what to do if we leave our old friend by the side of the road? We pick up a few hitchhikers — a little stinky, breath reeking of beer, skin overcooked from too much sun this summer. Higher risk profiles, for sure. But almost guaranteed fun at the next rest stop along the highway.

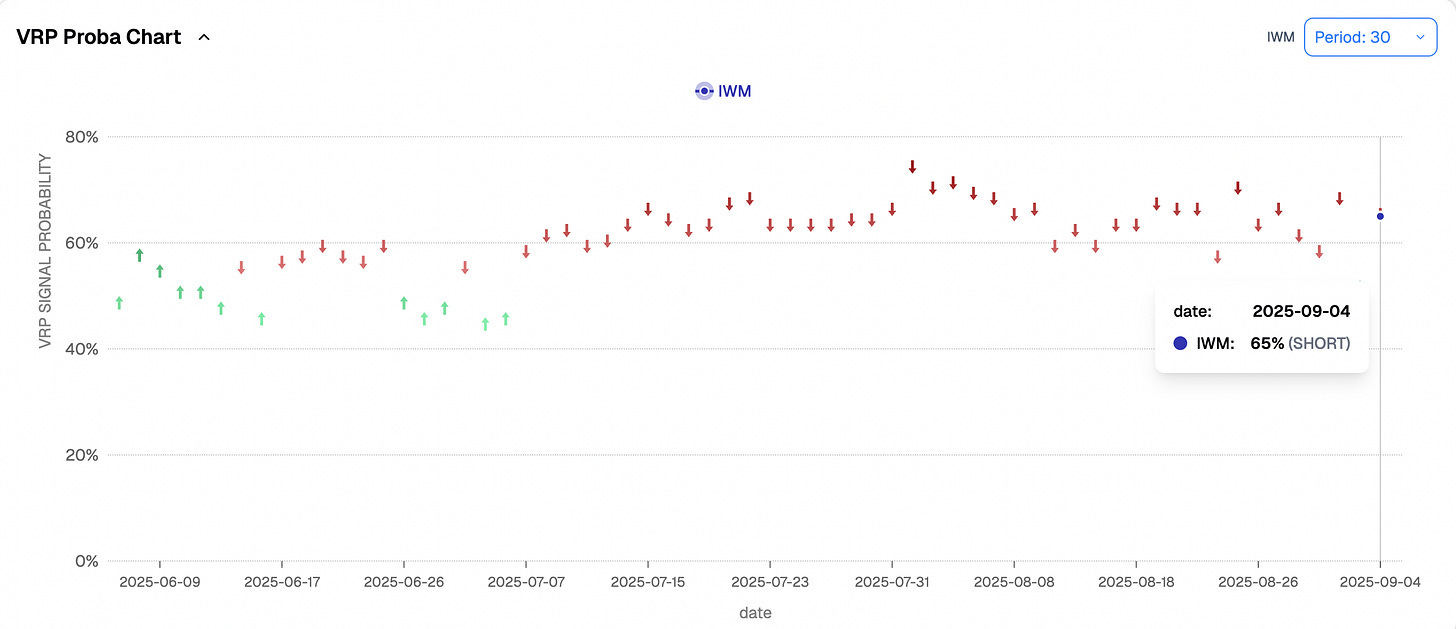

A few weeks back we talked about selling vol in IWM, and it worked out nicely. The fundamentals have not changed: with a few rate cuts expected between now and year-end, as long as the US avoids recession, the index should be fine. In fact, our models currently predict a 65% chance that realized volatility over the next 30 days will not exceed what the market priced at Friday’s close. Good enough reason to rinse and repeat the trade from two weeks ago? Absolutely. You can try to time it, or put it on now — and if the market later hands you better prices, just add more.

And what about our good old friend KRE — the drunken sailor who got hammered in the head back in March 2023? The market still demands crazy insurance premiums, always fearing he will stumble into another pickle and reveal he is broke and overleveraged.

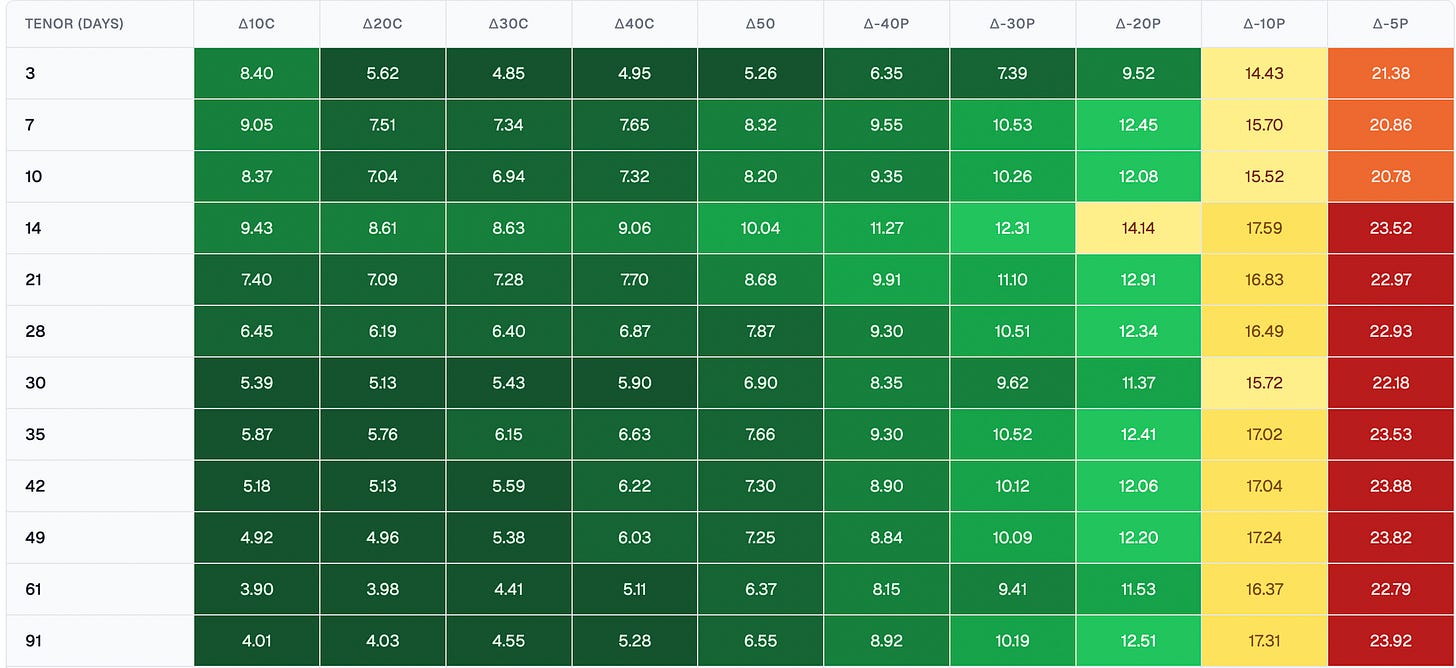

We do not claim to know anything for certain, but looking at the overall volatility surface — with a solid 7 points of VRP across nearly every node — there is decent margin for error if something unexpected hits. In fact, we recorded a short video about it on Friday right after the job report, giving you a sneak peek of the platform.

In other news

HOOD is now part of the S&P 500 — news that will surely delight many degen traders. On one hand, it is a continued success story of how innovation and pushing against the status quo can fuel a meteoric rise. And while no one is naive anymore about the business model behind it, the fact that HOOD made market access so much simpler for so many people is a testament to the quality of their product.

Now for the darker side. We remember when we fought tooth and nail to argue that calling the stock market “gambling” was unfair. With tools like HOOD, that line is harder to defend. Yes, many people use it to invest, buy-and-hold, or DCA. But plenty are pulled in by the gamification — the flash and sparkles, the free share on signup, the 0 dte, WallStreet BETS or the fascination with watching money come and go.

The Aaaannnnd it’s gone South Park skit has never been more alive. Latest example? Just this past Friday, when many retail traders painfully discovered a fine-print detail in the OCC rulebook: options can be exercised after 4 p.m. and until 5:30 p.m., at the 4 p.m. settlement price. Imagine thinking your 105/110 bear call spread expired safely OTM — only to see your 105 call exercised at 4:15 while you were having a few beers, and of course failing to exercise your own 110 call hedge in time.

We have no problem with people using the stock market as a casino. But the lines are blurry, and the protections you would find in an actual casino or online do not translate here, because the market was never built for gamblers. Long story short: be careful out there, and read the small print.

Thank you for staying with us until the end. As usual, here are a couple of great reads from last week:

The official announcement of the Sharpe Two platform launch — a solid recap of the work we have accomplished over the past two years.

A rare U.S. article offering a balanced view on China. It is a sharp reminder that disinformation is not always one-sided. Having lived in Asia for five years, traveled to China last year, and with many friends still there, we could not agree more with its perspective.

That is it for us. Wishing you a wonderful (inflation) week ahead — and, as always, happy trading!

Best,

Ksander

Charts, and analysis are powered by Sharpe Two Insights.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.