Forward Note - 2025/08/03

Better prices we got, with a but.

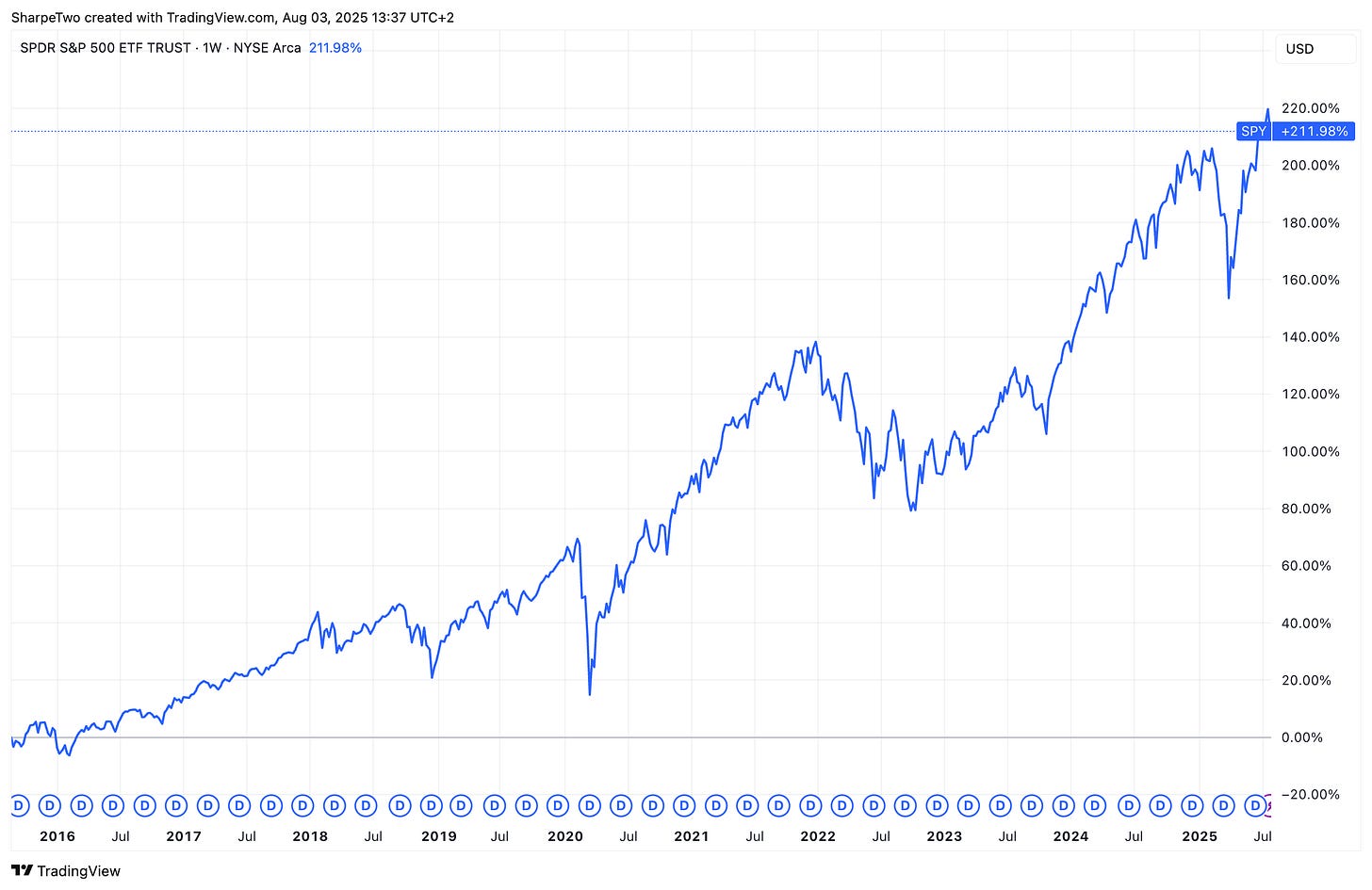

Finally, some action. After weeks of lazy summer, the S&P 500 and Nasdaq dropped 2.5%—the first serious drawdown since May. VIX snapped back to life, jumping from below 15 to just above 20 by Friday’s close.

So what happened?

A cocktail of escalating trade war rhetoric as the 90-day deadline quietly expired—President Trump didn’t just let it lapse, he swung hard, targeting a long list of countries. The line between “deal-making” and unilateral decisions has blurred to the point where you need to squint your eyes really hard to make the difference.

Meanwhile, the U.S. keeps raking it in. Behind the noise, the administration has quietly collected $100 billion in tariffs since the start of the year. And with this week’s fresh batch of levies, the “hundreds of billions of dollars” promised during the campagin are suddenly not so far-fetched.

But at what cost? We also learned this week that U.S. growth just posted its slowest pace in three years. To make matters worse, only 73,000 jobs were added in July—less than 100,000 over the entire quarter. It is too early to pin this squarely on tariffs, but growing global defiance toward the U.S. as a trading partner clearly does not help.Layer on the Fed’s predictably rigid stance… and you have all the ingredients for this week’s selloff.

Realized volatility finally returned—after weeks of sleepwalking, we’re on the way up again, with 7-day realized volatility moving up to 12.74.

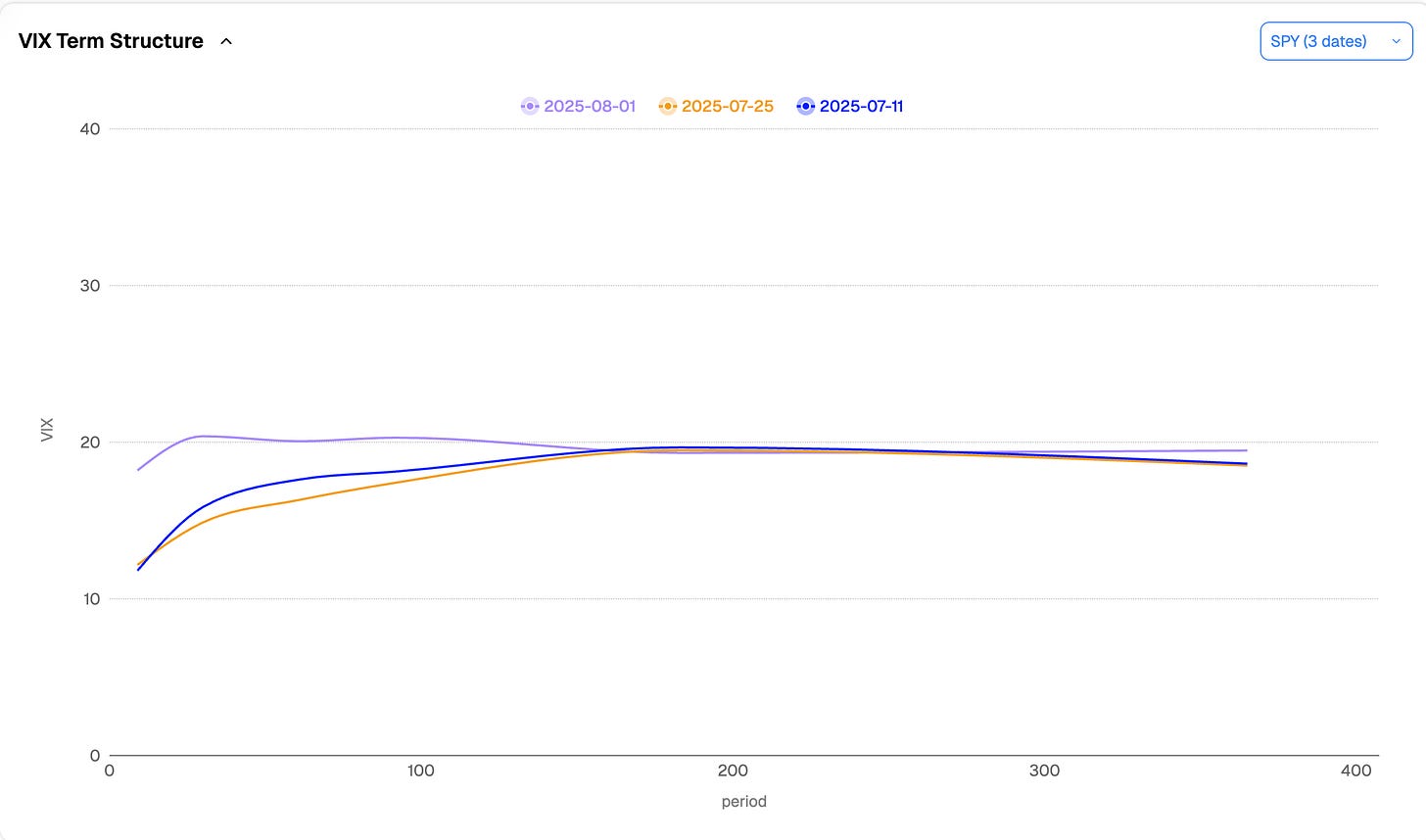

And as you all know by now: volatility clusters. Do not expect the market to revert to lazy summer vibe overnight. Sure, we could/should still see a few quiet days, apart from a few earnings, there are no meaningful economic data to be presented to the street next week. But more likely, we are entering a slightly more anxious regime as we inch toward September—with Jackson Hole and the next Fed meeting both looming.

If you ask us, based on the latest data, a rate cut in September looks like a done deal. But that alone may not be enough to steady the market—especially with fresh inflation prints in two weeks.

That said, while we do expect volatility to stick around and probably a little bit more, we do not expect a repeat of April. Currently we forecast 13% over the next 30 days: if it ends up being 15 or 16, we wouldn’t be entirely surprised. Let’s allow ourselves a little subjective comparison: this feels more like summer 2023—a market that demanded clarity (and an end to rate hikes), and once it got it, things calmed down.

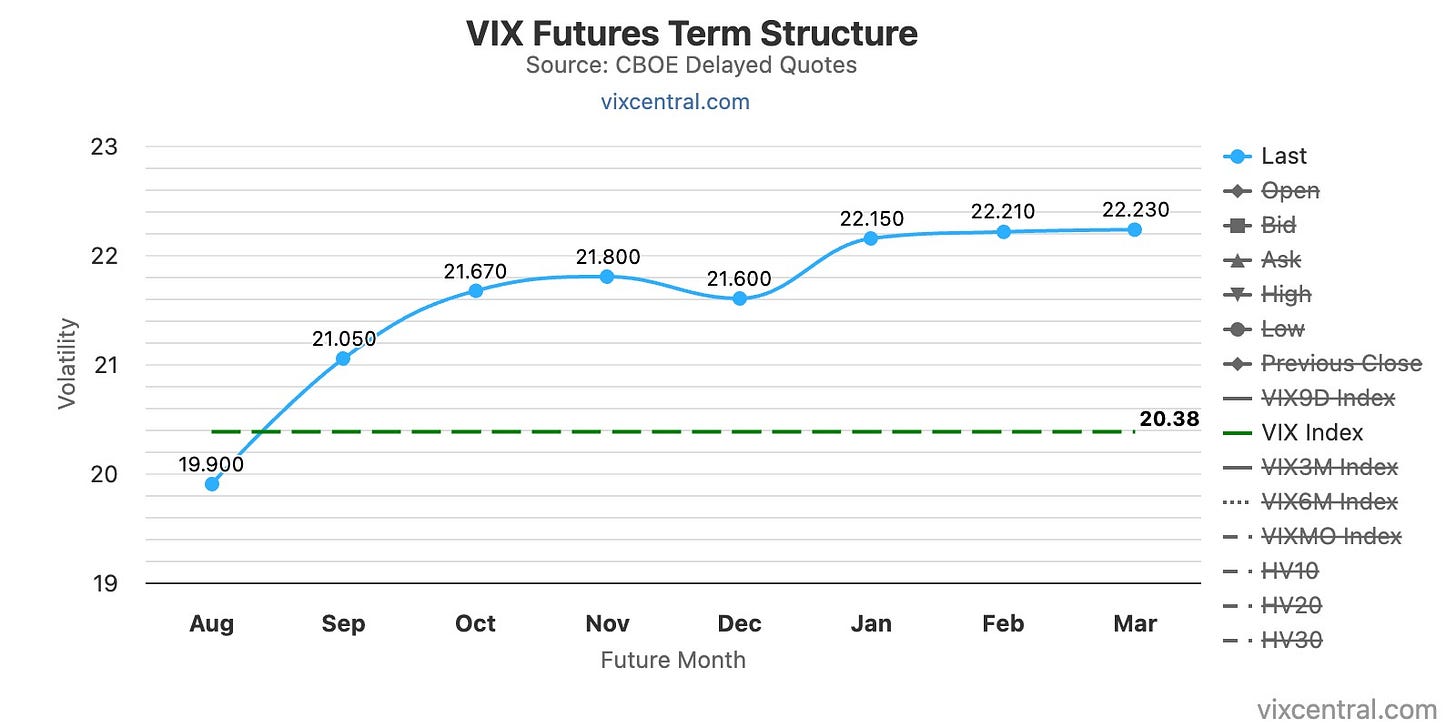

So how do we trade this? First things first: with a flatter VIX term structure, do not expect your short VXX or long SVIX trades to perform like they did over the last three months. There’s still a bit of contango left, but nothing like the juicy carry that delivered -25% from June to late July.

And what about the VRP in SPY? Last week, we said it was better to wait for better entry levels. Needless to say—better prices we got. We layered into some trades midweek, but even we did not expect to be handed a VIX at 20.

Let’s be clear: this does not change our data-driven view. At these VRP levels, this is a classic "sell and walk away" environment. Put the trade on, let time do its thing, and check back in a few weeks.

Here’s the “but.” Realized volatility is likely heading higher—even if not with April-style intensity, which means do not blow all your ammo at once. Be patient. Wait for the market to really start looking unhinged before pressing in size. Practically speaking? If you cannot be in front of a screen all day, selling a little when things (subjectively) look worriesome is more than enough. This does not need to be perfectly timed. It just needs to be sane.

And if you really do not want to manage anything? Well, one trade is looking attractive again: the good old SPY calendar spread we did for a big chunk of Q2.

The term structure in SPX has noticeably flattened—markets want answers from the Fed, and they want them now. A 3M/6M calendar makes sense here. We like the Sep 30 / Dec 30 structure. It is clean. It is patient. And it benefits from time.

Now, maybe you're reading this and thinking—wait, is this just another buy-the-dip newsletter? Not quite. But hell, why not?

When you sell volatility, what do you think you're doing?

Let’s skip the complicated explanations for a moment and have a look at the only chart that should matter for retail traders.

Some people have indeed some very smart theories that help them to catch every little moves on the way down. We are not that smart unfortunately and we simply try to be there when things go south a bit and doing what it takes to not lose our shirt, waiting for when they will come back up again.

And whatever that tremor was last week, it is worth keeping things in perspective—VIX6M is still only at 22. This is not a market bracing for six months of maximum pain. Could that change quickly? Of course. But right now, the odds are not on your side if you are betting on doom.

One last (subjective) tell? The Figma IPO—massively oversubscribed pre-market, launching the company north of 60x earnings.

If you're looking for signs that risk appetite is dead, you’ll have to look elsewhere. It is very much alive.

In other news

In other news—what’s another thing the U.S. and China now seem to have in common? It is becoming increasingly difficult to trust their official statistics.

A year ago, job numbers were revised down by a manic 820,000. This time the revision was less dramatic—but still raises serious questions about the reliability of the data investors consume monthly.

To make matters worse, the U.S. President just fired the head of the Bureau of Labor Statistics, calling her “a Biden appointee” and claiming the numbers were designed to make him look bad, in one of his special social media salvo.

This is… problematic. And there is no good outcome here for the rational-minded investor who prefers to stay as far away from politics as possible.

The independence of U.S. institutions—from the Fed to the agencies in charge of statistics—is being steadily eroded.

Would we be surprised to see job numbers revised up—right after the first rate cut in September? Not really. Even less so after the second cut in December.

Naturally, this will be attributed to the Fed’s brilliant policy shift. Just as the President has said all along: rate cuts are the sine qua non for economic recovery—for the good of millions of Americans.

Thank you for staying with us until the end, as usual, here are two good reads from last week:

XLE isn’t a sector proxy—it’s a concentrated bet on two giants steering through policy risk, capex cycles, and commodity chaos. With AI demand, CCUS bets, and a fresh M&A wave, energy’s “terminal decline” might be wildly premature. A sharp structural overview worth bookmarking.

Trump’s tariff regime was supposed to bring auto jobs home—what it brought instead is chaos, lawsuits, and a $7B earnings hit for Detroit’s Big Three. Supply chains are tangled, exemptions are incoherent, and the companies meant to benefit are footing the bill. A vivid snapshot of what happens when trade war rhetoric meets industrial reality.

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.