Special announcement

Your Assistant on the Trading Floor.

When I began publishing research two years ago, I did not expect it to take off the way it did. What started as a small API for the most technically inclined readers soon grew into a private Discord, an improvised bridge between raw analytics and the chaos of the market.

But neither of those setups was built to scale.

APIs are powerful but hardly inviting. Discord has warmth, but it is not a quant desk. And the last thing traders need is another “education program” that teaches theory but leaves you stranded when the market opens. What actually helps is access to the kind of tools and workflows a quant team would quietly build behind the scenes. What was missing was a way to surface those assets cleanly—without spending months building and maintaining them yourself— and put the signal in your hands, every day.

With that in mind, I am very pleased to reintroduce Sharpe Two — this time, as a platform.

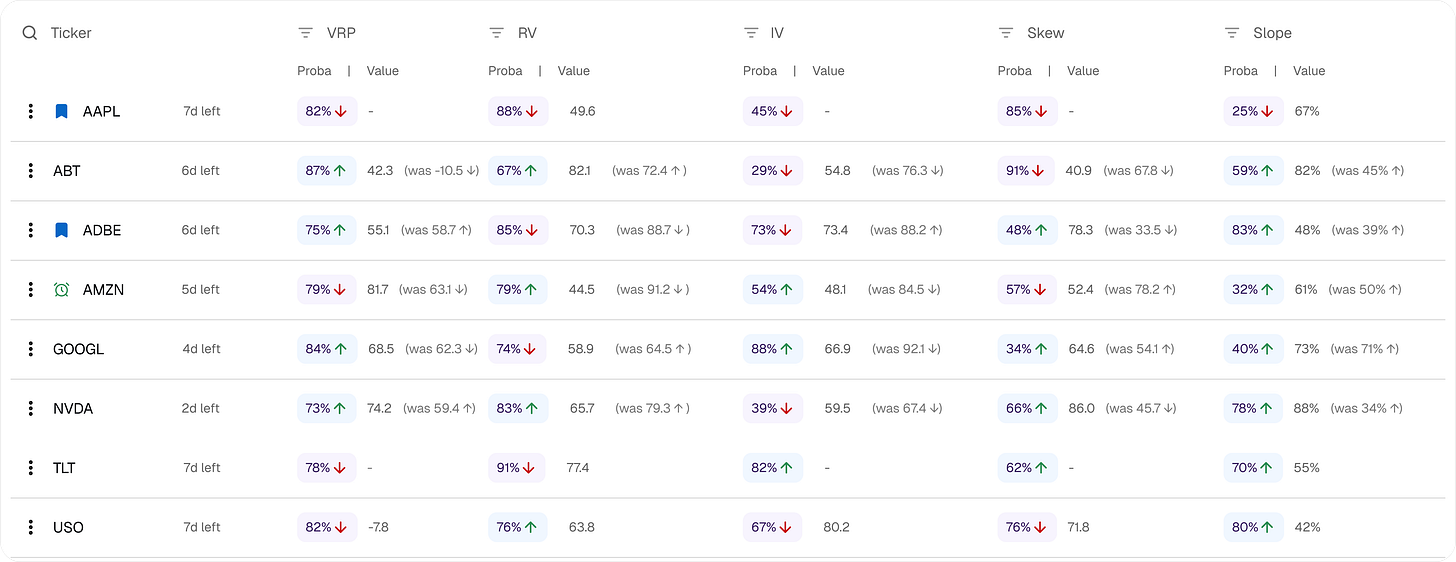

Over the past few months, some of you have noticed an evolution in the charts and metrics I publish. They come straight from this app, built selfishly for my own trading and designed to quickly answer questions like:

Which tickers are most likely to experience a volatility crush in the coming days?

Is realized volatility more likely to rise or fall from here?

If I sell this level of IV and delta-hedge until expiration, what is the likelihood that I collect the variance risk premium?

What does the complete vol surface look like for this product and where should I structure a trade to exploit the skew?

The platform is rooted in predictive analytics, because trading is a prediction game: you can trade without an opinion, but you will perform better with one.

Equally important: explainability. Black-box models are useless if you cannot see why they predict what they predict. The goal is not blind trust—it is to validate a hunch, challenge an intuition, or reset an opinion with the right arguments.

Overall, think of the platform as an assistant.

A good assistant irons out your workflow and hands you the tools you need to perform at your best. It saves you from paralysis by analysis and, more importantly, gives you back the hours you would have spent wrangling data just to get to a decision.

Olga, the AI assistant built into the app, has not earned her trading license yet. But she already gives you a better map than most traders ever see—and the ability to interact with it. Ask questions, test assumptions, explore angles. It is not about handing you trades, it is about helping you frame them smarter.

Automation is a central part of the vision. You can already receive reports and alerts. There is much more to come, and while it remains a work in progress, feedback in recent weeks suggests it is already good enough to release to the world.

And because it is still evolving, joining before September 30th gives you two advantages: automatic access to the Discord for feedback and tips on using the platform, and a locked-in price ahead of any future increases as the assistant grows more powerful.

Dedicated tutorials will also roll out in the coming weeks to make the learning curve even smoother.

Thank you for making this an unexpected, immensely gratifying journey so far. Time to see what the assistant can do.

Ksander

Charts, and analysis are powered by Sharpe Two Insights.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.

Good luck! 🍀

That's great man. Nice app