Beneath the surface - TSLA round down

Quiet tape, Loud Skew

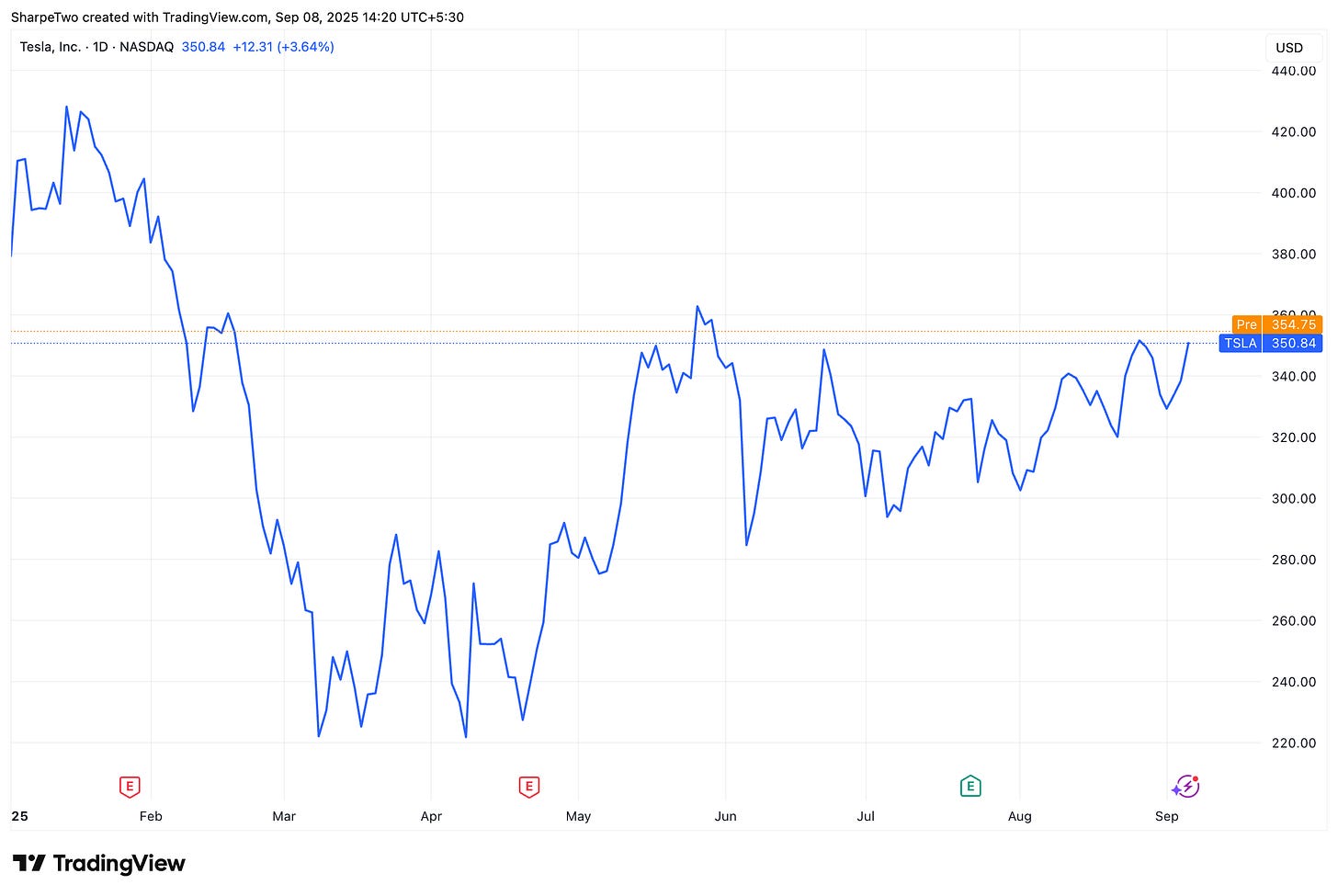

Tesla’s volatility profile has quietly shifted over the past few months. Not with the fireworks of an earnings miss or a tweetstorm selloff, but in a subtler, structural way. The stock has had a rough year, and sentiment around Tesla remains officially bearish. You hear it in headlines and analyst notes: the narrative is still heavy.

And yet, beneath the surface, the options market is telling a different story. Puts are systematically cheap, calls are bid, and the volatility risk premium in the mid-tenors is stretched. The paradox is that traders are talking bearish, but they are paying up for upside convexity instead — leaving the real opportunity not in chasing direction, but in exploiting the mispricing across the surface.

That disconnect is the opportunity. The edge is not in following the bearish narrative — the options market isn’t pricing it. It’s in leaning into the structural mispricings: selling vol where it’s historically expensive, keeping cheap convexity in our pocket, and letting time do the work. In Tesla today, the trade is not about calling the next headline or guessing direction. It’s about exploiting skew and VRP dislocations that stand out precisely because the surface has drifted away from the broader story.

Let’s dive in.

The Volatility Backdrop

Tesla’s realized volatility has been steadily grinding lower through the summer. Both upside and downside semi-variance have compressed, leaving the stock trading in a far calmer rhythm than the bearish narrative around it might suggest. The turning point was April, when the tariff war briefly jolted realized volatility higher. That burst of downside never followed through. Once the feud between Trump and Musk stabilized, the tape rolled back into drift, and downside realized collapsed back to pre-crisis levels.

This collapse was not because puts “stopped working” as hedges but because no fresh catalyst emerged to unlock the tail. With nothing left to pay them off, downside convexity simply decayed, and the market adjusted. That dynamic is now etched into the skew surface: puts are cheap across tenors, with negative skew z-scores a reminder that demand for downside convexity has thinned (more on that in a second.)

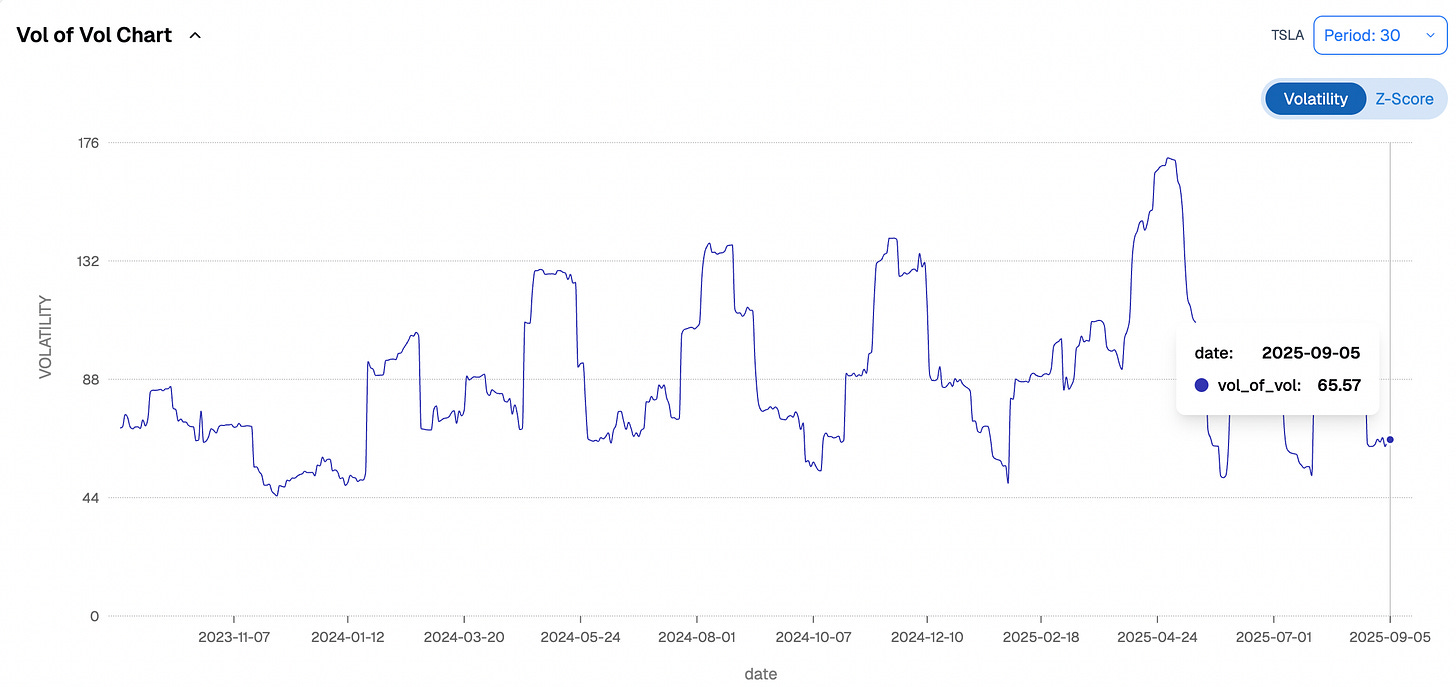

The vol-of-vol chart reinforces the point. After spiking during the spring turbulence, it has deflated to low levels. Traders are not paying for vega convexity or for insurance against a new volatility regime shift. The result is a deceptively calm picture: realized quiet, vol-of-vol subdued, and skew tilted in a way that runs counter to the official bearish tone surrounding Tesla.

The Spot/Vol Correlation Shift

Another subtle but important shift has taken place in Tesla: the spot/vol correlation, which for much of the past year sat deep in negative territory, has been creeping higher toward zero. In plain terms, that means volatility is no longer moving just as a hedge against selloffs. Instead, it is starting to respond on both sides — spiking not only when the stock trades lower, but also when it rallies.

This structural change matters. In a world of persistently negative spot/vol correlation, puts automatically carry a premium because they are the clean hedge. But as correlation rises, the “hedge effect” weakens, and upside convexity begins to command more attention.