Forward Note - 2025/04/06

Now what? Get used to it.

The 20th century is remembered for its rough autumns—1929, 1987. So far, the 21st century has served up its own share of market mayhem in spring. Setting aside the GFC, we’ve had Covid in March, the regional bank “crisis”, and now the escalation of the Trump Trade War.

And when we wrote about being long volatility two weeks ago, we certainly didn’t have in mind what just unfold.

Markets, in full denial, started the week calmly—waiting on the long-teased tariff announcement, a cornerstone promise of the presidential race. Trump had dangled it throughout Q1, likely to test the waters, but he finally delivered the full package. Remember the ice bucket challenge? That’s what it felt like for most investors—total shock and disarray, and a 2% reversal in a matter of half an hour as the details landed from the “Beautiful” Rose Garden to unveil this “Beautiful” Bill: 34% on China, 90% (!!!) on Vietnam, 20% on the EU, and a unilateral 10% on any imports transiting through the US.

The post-WW2 world was (re)built on the foundations of free trade, free movement of people, and the flow of ideas—especially with the rise of the internet. While ideas and movement are still humming along, the trade pillar got peppered up nicely this week. And after the initial shock, the market response was pretty unequivocal: -4% on Thursday, and a VIX that spiked hard in the final 15 minutes of the session (not 3:45 to 4pm—the 4 to 4:15pm window, you know, the one where it’s always worth watching what the big hands are up to). It added another point and a half to close just north of 30.

Early birds got the worms, but late insurance buyers are still insurance buyers. And when—oh, surprise—China retaliated with its own 34% tariff on all American goods, it made perfect sense in hindsight. That announcement pushed the market from shock to full-blown panic. The VIX traded (for real this time—not like that fake-ish 60 print back in August) at 45 pre-market, and despite a strong employment report and a tight-lipped Powell, it closed the day at 45. The indices shed over 10% on the week—the worst drop since... well, you guessed it: a certain spring of 2020.

Okay—but now what? On the policy and macro front, we don’t know. Truth be told, nobody does, despite the litany of opinions and market commentary flooding in. On the market front, it’s not that we’re totally clueless... but yeah, we kind of are. Truth bold: everybody is.

Last week, we hoped for calmer waters and to avoid a replay of 2022. Ironically, things turned on a dime, and now we’re staring into uncharted territory. Priority number one: survival. And let’s be clear—it’s totally fine to stay on the sidelines in a moment like this, especially if this is your first major shock. Human nature being what it is, you'll get another shot—give it five to ten years.

But if you can’t wait, can’t resist, or are already knee-deep in the swamp, let’s look at some data.

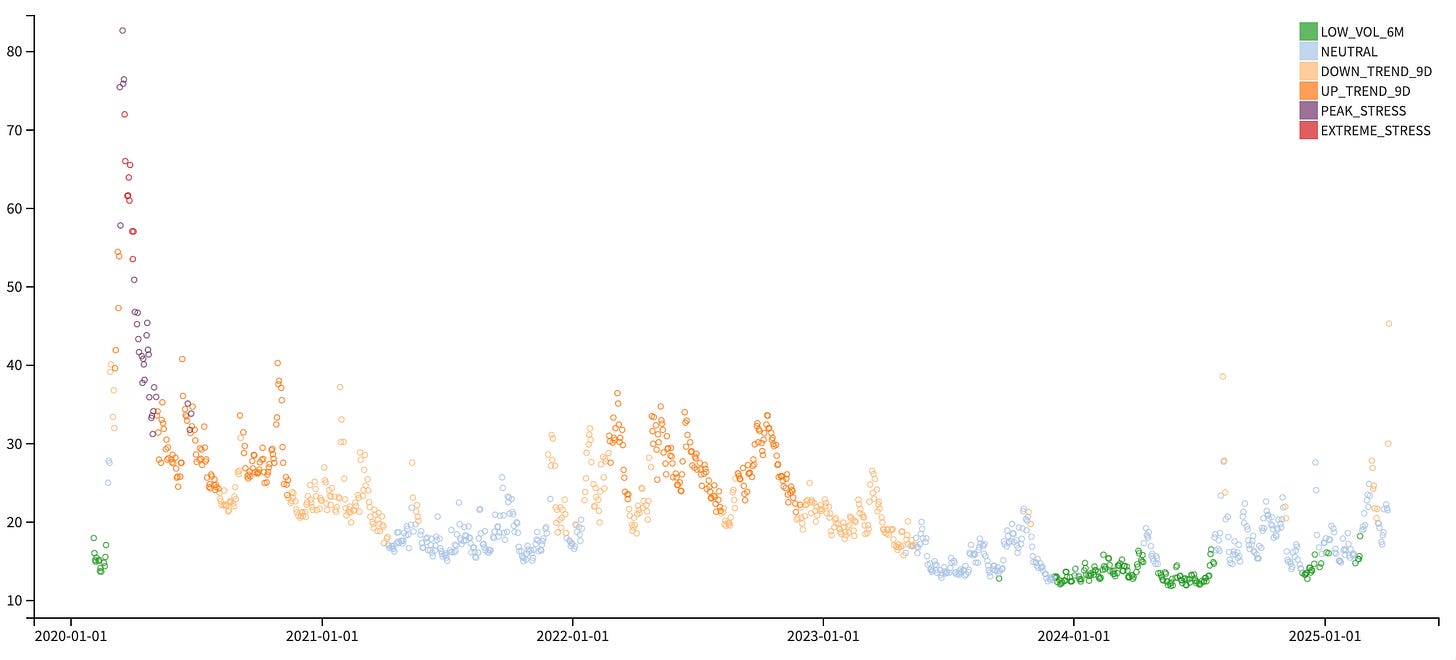

First off: forget everything you’re used to. Daily realized vol is now astronomical. If you’re trading RV 75% the same way you were trading RV 25%, you’re going to get punished—fast.

Here’s another way to frame it: 7-day daily realized volatility. While we are not at 2020 level just yet, we have already passed 2022 busiest weeks, and we’re now barreling toward a whole new set of problems—most likely slower global growth, sharper rhetoric between major blocs, and... stagflation.

Also: it can still get worse before it gets better. Betting on a quick vol collapse—or trying to nail the perfect top-tick on VIX at 50 or 60—is classic rookie behavior. That’s not going to happen, and more importantly, you shouldn’t be trying to make it happen.

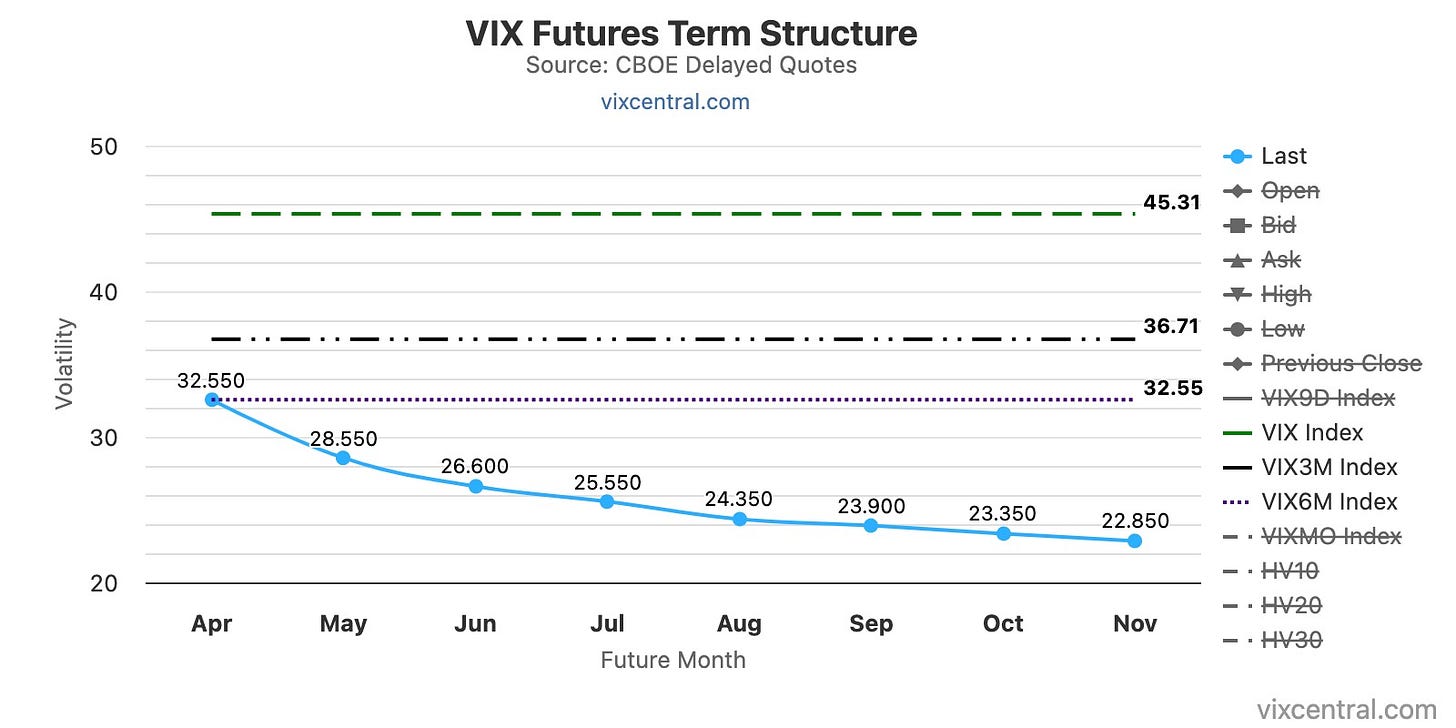

Yes, we all know the VIX spikes and then mean-reverts. But once you've crossed the Rubicon (usually around the 40 mark), the market won’t calm down until it sees real clarity on the policy front. Until then, chaos is the base case.

So don’t jump the gun: survive the spike and wait for the confirmation that selling volatility has better odds. With backwardation this steep, you’re better off hedging by buying options in the back months than trying to sell front-end puts and hoping for the best. And while delta hedging is mandatory, it may not completely help you - people are buying options and imply volatility is on the rise, hurting pnls and margins. This is something we usually ignore in more normal regime, knowing well that things will calm down soon. We can’t make this assumption in this market.

Yes, trading vol is frustrating. It’s a lot of sitting around waiting for the spike (if you’re long), and just as much painful waiting for things to calm down so you can scoop up the pieces (if you’re short). If you think you’re about to hit a home run on the short side, think again—and maybe sit this one out. If that kind of mindset sounds foreign, you’re probably not mentally ready for this.

Now, let’s talk about a more elegant hedge—precisely because of the backwardation. VIX futures are trading at a steep discount to spot VIX. And yes, we all know you can’t trade the VIX directly, but the VIX itself is just the interpolation of a strip of OTM options around the 30-day mark.

So when you see “VIX 30,” you can, for instance, pull the May 5 expiration and compare it to the corresponding futures contract and start spotting some real discrepancies.

Right now, despite the steep backwardation, VIX futures are trading at a clean 8 to 10 point discount to their respective variance swaps (or “spot VIX”—yes, we know that’s a flawed term, but you get the idea).

Either the options market collapses down toward the futures in record time—which feels like wishful thinking—or the futures drift upward to meet spot. Historically, it’s usually the latter. And even if things do calm down, they’re unlikely to normalize faster than the option market is pricing. That sets up an interesting dislocation: you could sell the options and buy the futures.

And if, like us, you were short options already, those same futures now offer a cleaner, cheaper hedge than reaching for overpriced back-month vol. Instead of paying 30+ on parts of the curve, you can express the same defensive view through futures, which are likely to be dragged higher if realized vol stays elevated.

Futures become a smarter, more cost-effective way to hedge—if used wisely. Truth be told, they haven’t always been front and center in our toolkit and we have to thank a giant in the space, Euan, for surfacing the idea in our Discord.

Now the most pressing question: how long does this backwardation last? And what’s the best way to take advantage of it?

Once you’ve accepted that things may take time to normalize, the temptation is to short everything outright. And while that may feel logical—even compelling—we wouldn’t recommend it. The beauty of volatility is that it lets you express counterintuitive views and still find edge.

Take this example: while most traders look to sell calls on VXX products, hoping to catch the top of the spike, a much better position might actually be... to sell puts.

Because everything you do when you trade options has a volatility component embedded into it— and in that case, a volatility of volatility.

Let’s break down the different scenarios:

If volatility keeps rising (and yes, it still can), selling puts on VXX gives you natural long exposure to the vol complex. It’s a subtle way to lean long while alleviating broader portfolio imbalances.

If volatility stalls, but VXX continues drifting higher due to the steep backwardation in the VX term structure, those puts will still benefit. You're essentially playing the curve rather than the spot.

And if volatility drops, here’s the interesting part—you might still make money. The decline in implied vol, especially from elevated levels, means you’re short something expensive. As long as you’ve kept some distance from the strike (i.e., not too close to the money), a normalization in vol pricing can still work in your favor.

This isn’t a new idea—truthfully, this position burned us more than once in 2024. The VIX would spike one day, only to get crushed the next, wiping out the hedge or the money-making opportunity almost instantly.

So why would this time be any different?

Well, if you believe we’re heading toward a prompt resolution, this trade probably isn’t for you. And to be fair, we wish you Godspeed. Because, like Spring 2020, who knows how long this will last?

In other news

Banks sent a record number of margin calls on Friday, and hedge funds had to comply. That likely accelerated some of the downside pressure into the close. But that’s part of the game—the first rule of finance is to survive.

Something that won’t make it into mainstream financial news also happened: brokers—particularly IBKR—sent out some odd margin call messages to very healthy accounts. Obviously, it’s not ideal if it spooked you into closing a position, but let’s be honest: you can’t really blame the brokers. Having a glitch at the worst possible time sucks, but you’re still responsible for your own book. You should know whether you’re in real danger or not.

We bring this up because when stress hits the financial system at this level, the skeletons in the closet tend to surface. What’s hidden in the dark often gets dragged into the light. We’re not pointing fingers—IBKR is likely fine. But it’s a good moment to check the viability of your smaller brokerage firms. Things break, and they break faster than you think. Remember MF Global?

Thank you for staying with us and as usual, here are a couple of interesting reads from last week

We have presented a long/short signal in the banking space this week. With chaos as the new base case, this methodology can apply to many other sectors. Happy hunting.

And while tech IPOs have been postponed this week, this market route is bringing some perfectly healthy business at attractive valuations. Here is a good round up from Clouded Judgement .

That is it for us this week, we wish you a happy (spike) week, and happy trading.

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.