Forward Note - 2025/03/16

Yes, vol trading is hard: a breakdown.

Another week of heightened volatility, with the SP500 and Nasdaq closing down roughly 2.5%. It could have been much worse, as we flirted with bear market territory on Thursday following yet another Trump tariff threat—this time, a staggering 200% on alcohol from the EU—and the rather tough conditions laid out by Putin for a peace deal in Ukraine. The market took another dive before staging a recovery on Friday as volatility broadly eased.

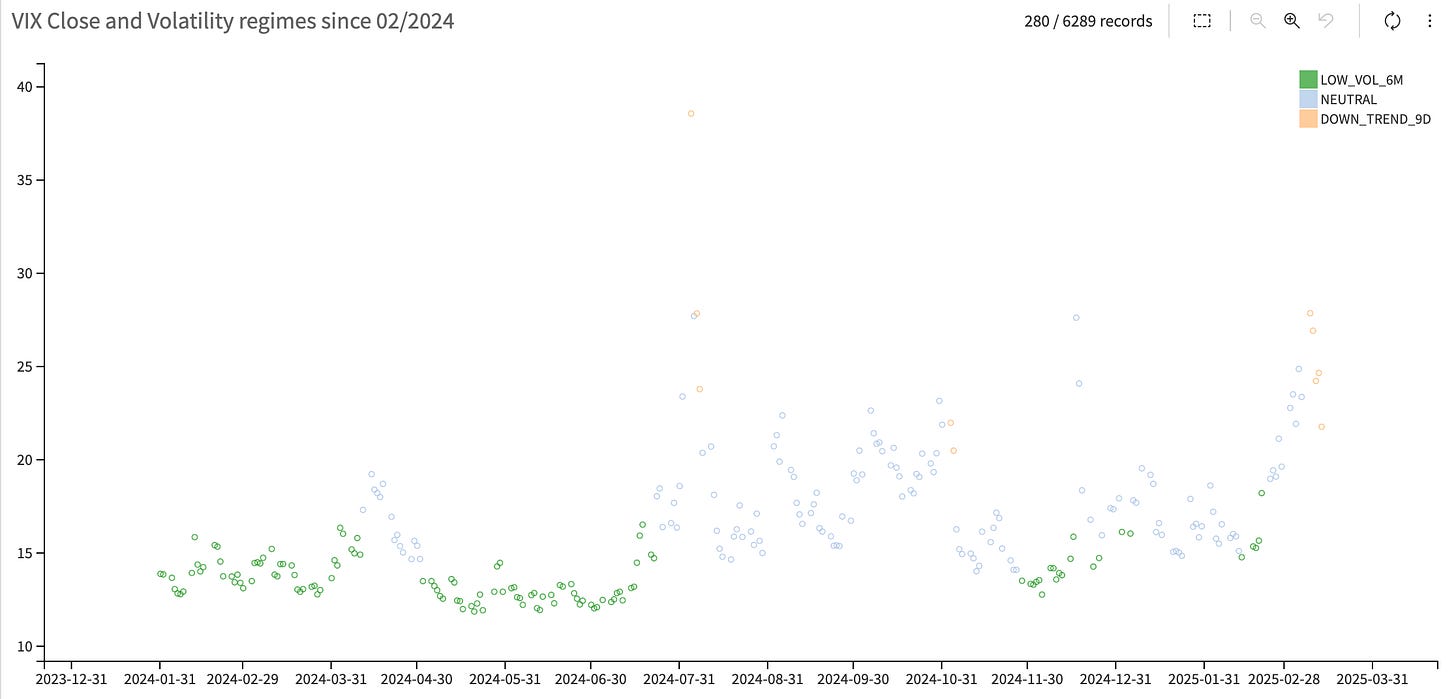

As a result, the VIX closed at 21.37, a far cry from the highs of the week when the 30 handle was getting uncomfortably close. This week was a prime example of why trading volatility is hard. In theory, everyone understands the different regimes volatility can fall into:

Most of the time, volatility sits in a relatively uneventful state, hovering around its long-term mean. This is when you’ll find plenty of posts proudly proclaiming, "Look, Mommy! I, too, am a vol trader."

Sometimes, though, it spikes as news ripples through the market, pushing participants to rush into options for hedging. If you’re not particularly skilled, experienced, and—let’s be honest—a little lucky (a league mostly reserved for institutional managers), chances are you’ll get smacked in the face.

Once volatility spikes, it tends to revert to its mean. This should be the easiest regime to trade, right?

Then why was it so hard this week for many retail traders to make money, despite the VIX heading back down?

A side note—when we say selling VIX 25, it's just shorthand for entering a short vol trade at that reference point, one way or another. The author of this newsletter is acutely aware that you can’t trade the VIX directly.

Let’s start with the obvious: the spike. It can wipe out an account before the calm-down phase even begins if not managed properly. The market is littered with stories of major funds blowing up, and while selling VIX 25 on paper might sound simple, holding the position at VIX 29—when financial media is running high on adrenaline—is a different beast entirely.

But before blaming the media for doing its job, let’s focus on the data for a second. The market isn’t going to hand you VIX 25 without a reason. More often than not, that reason involves an increase in intraday volatility. Major indices are not meme stocks, so when they start trading at 30% daily realized volatility—miles away from their long-term daily mean of 11—it gets very uncomfortable for anyone betting that things will calm down.

The last three weeks were no exception:

Twelve out of the last fifteen sessions saw single-day realized volatility exceed 20%, with four above 30%—two of them just shy at 29%. Of course, if you spend your days trading NVDA or other highly speculative names, these moves might feel like a casual Sunday league football match. But for the rest of us, the mind starts drawing parallels with other periods of heightened market agitation—and it plays tricks, mostly in an attempt to protect itself.

Taking a step back and looking at seven-day realized volatility, even the turbulence of early August 2024 didn’t match what we’ve just been through. Yet, back then, VIX supposedly touched 65 at some point. In the heat of the moment, anyone holding a short-vol position is bound to second-guess themselves… and maybe even hedge with a few futures or puts, just in case.

Another reason why this is difficult: volatility clusters. We were stunned by how fast vol got crushed in August, post-election in November, and post-FOMC in December. This time, VIX didn’t follow the same pattern. With realized volatility averaging around 25% over the last two weeks, this environment is starting to look more like the post-COVID months—or even 2022, when it took days for the market to reassess risk expectations and for things to cool off a little.

Here’s the problem at VIX 25: a few days can feel like an eternity. And if your risk isn’t properly hedged and your sizing on point, that’s more than enough time to get margin called.

Once again: volatility clusters. Get used to this new regime where things can move—fast. We’ve said it repeatedly since December’s final warning: If you keep trading 2025 like it’s still 2023/2024, you will get hurt. This is especially true when it comes to tail and delta hedging.

Let’s start with tail risk. We were baffled in January when the market flat-out refused to buy SPX puts, opting instead for VIX calls—almost as if volatility itself was the only real threat to performance. At the time, we recommended the opposite: selling VIX calls and buying SPX puts, since a big volatility spike was highly unlikely without a corresponding market drop.

With our Discord group, we structured a strip of 5800/5700/5600 puts against 22/24/27 calls, based on an overstretched VVIX-to-VIX ratio… at the time.

Clearly, that’s no longer the case. The next logical question: Why not flip the trade—sell puts and buy VIX calls now?

Short answer: terrible idea.

SPX can keep dropping without the market feeling the need to bid up an already elevated VIX. Traders understand that it would take something truly extraordinary to push vol significantly higher from here. And while the last three months have been concerning (or entertaining—pick your poison) on the geopolitical and economic front, we still can’t answer yes to any of these three questions:

Is another Covid-level disruption imminent?

Are banks on the verge of blowing themselves up (again) and threatening the economy?

Are people rioting because they can’t find jobs?

While long SPX puts are a great hedge against short VIX calls when the market is complacent, the reverse isn’t true when the market is tense. Yet, what this chart tells us is that puts are no longer cheap. And in the context of the variance risk premium, that becomes even more obvious.

Sure, VIX at 28/29 might look scary, but the VRP as a ratio between IV and RV measured at 28 days has been well above 1.3 for the past two weeks—meaning that shorting SPX puts was the right trade.

Yes, we can hear you already—easier said than done, Ksander. Everything makes sense in hindsight. Fair point. So let’s add another data point that could have helped during the process.

Despite Monday’s sharp selloff, our models had already flagged that VIX 9D (which measures volatility using options expiring within 10 days) had stopped climbing and was actually starting to trend downward.

It then stayed firmly in that regime all week, giving us one of those rare moments where the market goes down, and implied volatility follows suit. With VIX9D coming off, daily realized volatility unable to push past an already elevated 30, and a significantly stretched VRP, you had all the right signals to hold onto your short volatility position and not cave to the panic spreading across social and financial media.

That said, this was still not an easy trade. And without delta hedging, it would have been even tougher to pull off. Managing risk at VIX 25 with daily realized at 30 is a whole different game than doing so at VIX 18 with daily realized at 11 (Look, Mommy! I too am a vol trader, remember?). Things move. And they move a lot more.

While we previously wrote that we were comfortable making a bet on the terminal distribution of an underlying asset by holding a straddle for a couple of weeks, that stance completely changes when things start moving this much. Over the past weeks, we’ve demonstrated in the Discord how to delta hedge a strip of short puts in SPX and weather the storm. That will be the subject of another article with detailed PnL breakdowns and key metrics.

Spoiler alert: by hedging directional risk and scaling in—starting to sell at VIX 23 and adding more at VIX 28—we … made money.

Volatility trading is hard. When nothing happens, you’ll eventually get screwed because overconfidence leads to poor sizing (we do wonder what happened to all the “let’s sell delta 10 six months out” strategists or the TSLA wheelers…). Then, when things do start moving, you’ll get screwed by delta if you don’t manage it with discipline. Yet, with a solid understanding of what you’re trading—volatility has zero opinion on direction—and the right approach to hedging risk, it’s entirely possible to generate strong returns.

And to end on a more positive note: this market-wide reset in risk perception is the best thing that could have happened for vol traders. If the past few weeks didn’t go well for you, don’t be too hard on yourself. Just make sure you learn from any mistakes—because there will be plenty more opportunities like this ahead.

In other news

Klarna is filing for an IPO despite heightened market volatility. If you ask us, this isn’t just a bold move—it’s a clear statement of confidence from management in the company’s fundamentals. It reminds us of Arm in 2023, which went public despite market tensions.

This raises an interesting question: if VCs were holding off on IPOs until 2025 because 2024 was an election year and therefore too risky (sic), and 2023 was too uncertain due to the Fed’s rate trajectory (double sic)… who exactly is advising them on market timing? And how much are they paying for that advice? According to the Wall Street Journal, the much-anticipated fireworks of 2025 may now be delayed to 2026.

And what did they really mean when they said they were waiting for a more favorable market? Should we understand that as betting on investors being more willing to buy stocks with shaky fundamentals—or even… no fundamentals at all?

Finance, by nature, is both adversarial and seasonal. When the IPO window does reopen, just remember: some businesses have been waiting more than three years to go public. And still haven’t.

Thank you for sticking with us until the end. As always, here are a couple of interesting reads from last week:

We came across a fantastic quant trading publication, and this is our top recommendation of the week. Here’s an article from Quant Trading Rules on momentum trading in ES and NQ—worth a read if you want to sharpen your edge.

We don’t trade VIX futures often, but they can be a powerful way to express a view in the volatility space (think… no delta hedging required?). The Till published a solid (paid) piece on how to incorporate them into a portfolio—worth checking out.

That’s it for us this week. Wishing you a great (FOMC) week ahead, and happy trading!

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.