Forward Note - 2024/11/10

An efficient week.

6012.45.

Much faster than we had anticipated. We thought we’d see this around Thanksgiving, when volatility would finally ease after weeks of being elevated in anticipation of the election.

However, less than 72 hours after Trump’s victory, that critical threshold was breached as the SP500 rounded off its best weekly performance in 2024, adding 4.7%, while the Nasdaq closed up 5.3%.

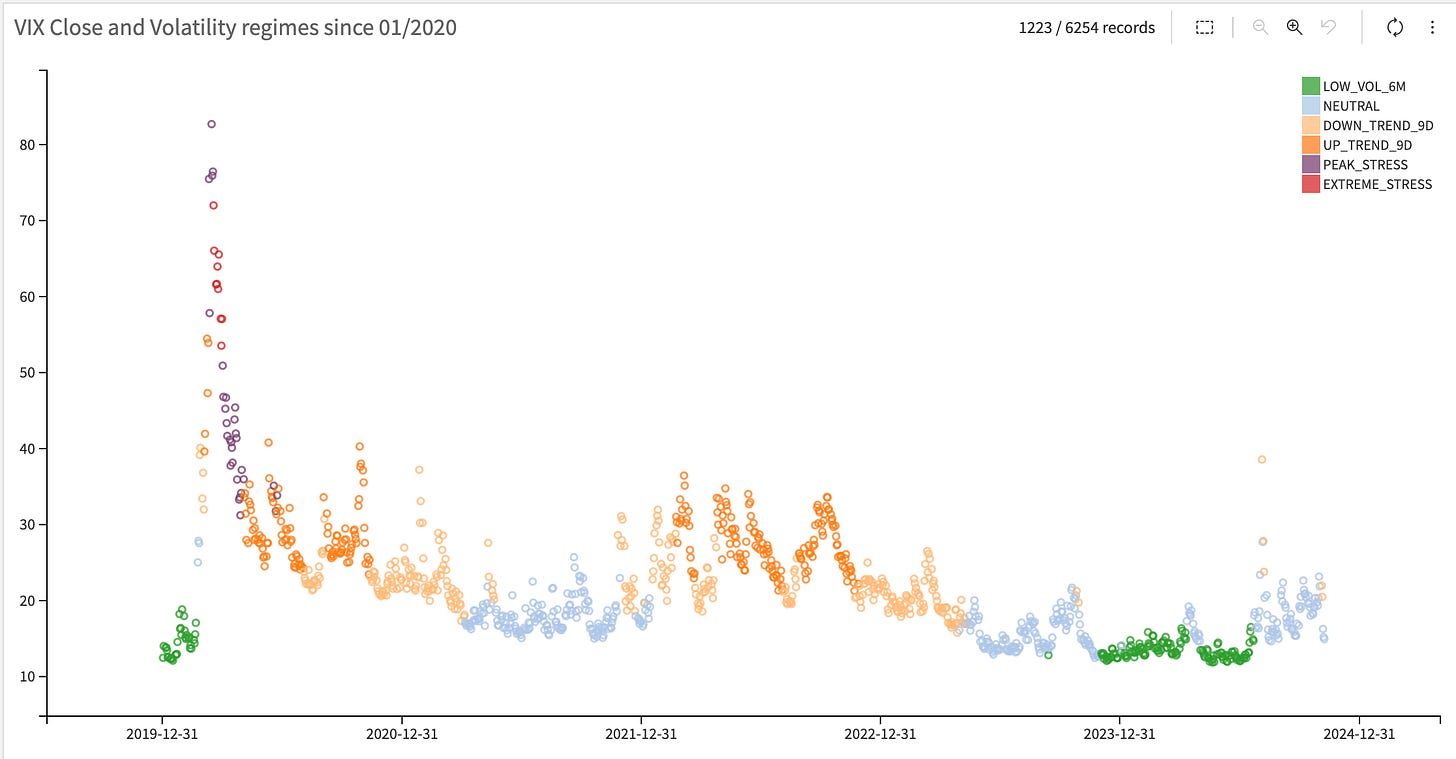

But, as always, our attention goes straight to the VIX. It was completely decimated, closing at 14.81—the lowest level seen in the second half of the year. The VIX futures term structure normalized almost overnight, with election uncertainty lifted from the market: the VIX closed Tuesday at 20.5 and opened Wednesday at 16.

If you’re new to trading volatility, that VIX movement might seem trivial. But as we watched the election night unfold, we couldn’t shake a feeling: in 15 years of observing the market, we’d never seen such an extreme volatility crush happen so quickly.

Once the dust settled, we checked just how rare this was. How often does the VIX drop by 4 points overnight? As it turns out—not very often.

Since 2000, this type of move has happened only 14% of the time. However, a keen observer might rightly think that a 4-point drop is far more significant when the VIX sits at 20 than at 80.

Calculating percentage changes in VIX is seen as a cardinal sin among volatility traders (after all, VIX is already a percentage). But there’s some truth to this instinct. That’s why, at Sharpe Two, we prefer to analyze movements within specific volatility regimes. So, let’s run the same analysis, focusing only on cases where volatility was low, neutral, or descending—the regime we were in as we headed into the election.

Tuesday night’s events now look particularly intriguing. Once you account for non-expanding volatility regimes, losing more than 4 points in the VIX overnight is incredibly rare—it almost never happens.

In fact, it has occurred only six times in our dataset going back to 2000. And even more compelling, two of those occurrences happened this year, in 2024.

So, what’s the takeaway? Markets are constantly evolving; they adapt to every situation. But they’re also becoming more self-aware, recognizing their own inefficiencies and edges.

The fact that volatility vanished overnight twice in a single year suggests that the market is acutely aware of the volatility trade and the inefficiencies it creates.

Let’s clarify one thing: we’re not saying these inefficiencies will disappear anytime soon. Far from it.

The volatility trade persists because of the constraints placed on major market players, whose strategies differ widely from those of retail traders or proprietary trading firms. These actors operate under layers of risk management, compliance, and oversight by investor committees, all of which enforce strict capital protection rules. These rules might mandate no delta exposure overnight or even require delta neutrality in the lead-up to events like elections.

This dynamic isn’t just about the stock market. Last year, we heard that VCs were wary of taking companies public in an election year, fearing heightened volatility could dampen new stock performance.

But let’s remember: this is 2024, not 1994. The world has changed. Research papers, books, YouTube tutorials, and even emoji-filled tweets dissecting the vol trade are everywhere. Today, every corner of the market is attuned to these trades and ready to capitalize on them.

Are we converging towards an efficient market?

What just happened overnight certainly gives weight to that idea.

But are we ever going to achieve true efficiency?

The way we understand Fama’s famous model, it described an ideal, theoretical market—not the volatile, opinionated, and often mispriced markets we deal with daily. In that sense, the Efficient Market Hypothesis (EMH) is like a mathematical asymptote—something we may approach over time but will likely never fully reach.

Setting the philosophy aside, what does this mean for us—retail traders and small-capacity investors? First, if billions are now dedicated to capitalizing on volatility inefficiencies or shedding costly hedges at lightning speed, we need to get our operations in order, too.

Professionals are working around the clock to leave as little on the table as possible. If we don’t follow suit, knowing about volatility crushes in special situations and the resulting Vanna effect might sound impressive on social media or at cocktail parties. But it won’t be enough to make a living out of it.

In other news

The Trump trade: stocks surged—especially Tesla—while bonds dropped as the specter of tariffs renewed inflation fears. Emerging markets fell (tariffs again), green energy stocks and the cannabis ETF took hits, and oil and other traditional energy stocks rose.

This was the dominant narrative on Wednesday, with Bloomberg, CNBC, FT, WSJ—all attributing the market’s moves to Trump's election. There’s truth in that; it’s hard not to notice Tesla’s 12% spike or the peso’s weakening in anticipation of future policy shifts.

Yet, no one mentioned how the bond trade reversed much of the “Trump trade” by Thursday, with energy fading and cannabis stocks recovering from their lows. So, was it truly the “Trump trade”? Or was it just the usual messy, volatile market—finally unleashed and free to move after months of restriction due to, well… the election?

This gets under our skin a bit—the market doesn’t care about Republicans or Democrats; they come and go like clouds in the sky. But that doesn’t sell papers, and it doesn’t stick as well in the minds of readers scrolling through headlines … and ads.

Thank you for sticking with us until the end. As always, here are a few interesting reads from last week:

There’s a new book about retail trading on the shelves, and it’s a must-read. Andrew Mack and Euan Sinclair collaborated on this trove of information and who better than Kris Abdelmessih to write the foreword?

This isn’t technically from last week, and you might remember seeing it here a few months ago when it first came out, but given this week’s theme, we had to revisit it: the Financial Times’ interview with Eugene Fama.

That is it for us this week; we wish you a fantastic week ahead and happy trading.