Signal du Jour - Skew trade in NVDA

Selling puts or selling calls?

What a week! It’s only Thursday morning, and it feels like the entire price action of Q1 has been condensed into the last 72 hours.

Part of us was thrilled to see luck deliver the much-needed grey swan that catapulted our long volatility signal deep into the green. But just as we started getting excited about the VRP in US equities finally staging a comeback the VIX got obliterated—down to the 15 handle in pre-market, as if the largest company by market cap hadn’t just shed $580 billion on Monday.

The frustration is real, but what can you do? Better to miss a trade that evaporates too quickly than force a reckless position.

There’s never a shortage of opportunities in the market. After two weeks of VRP signals, we’re pivoting back to skew signals today—this time in… NVDA.

Let’s break it down.

The context

Over the weekend, we took note of Deep Seek, the latest AI contender, and immediately questioned what its emergence meant for the valuations of private AI startups like OpenAI and Anthropic. Turns out, Wall Street had the same concerns—but instead of dwelling on the software side, it turned its attention to the hardware providers.

After two years of unchecked investment into AI infrastructure, fueled by the notion that there were no viable alternatives, the market suddenly started asking tougher questions. NVDA took the biggest hit, but the broader sector felt the impact as well.

Before going further, let’s make one thing clear:

DeepSeek’s breakthrough only reinforces our belief that AI will significantly transform the world in the long run—cheaper models are great news for consumers. However, we belong to the camp that believes semiconductor companies will struggle to justify their current valuations in the medium term. After all, it took Oracle 13 years to reclaim its dotcom bubble highs.

That said, this won’t stop us from assessing the short-term landscape rationally and seizing a trading opportunity when it presents itself.

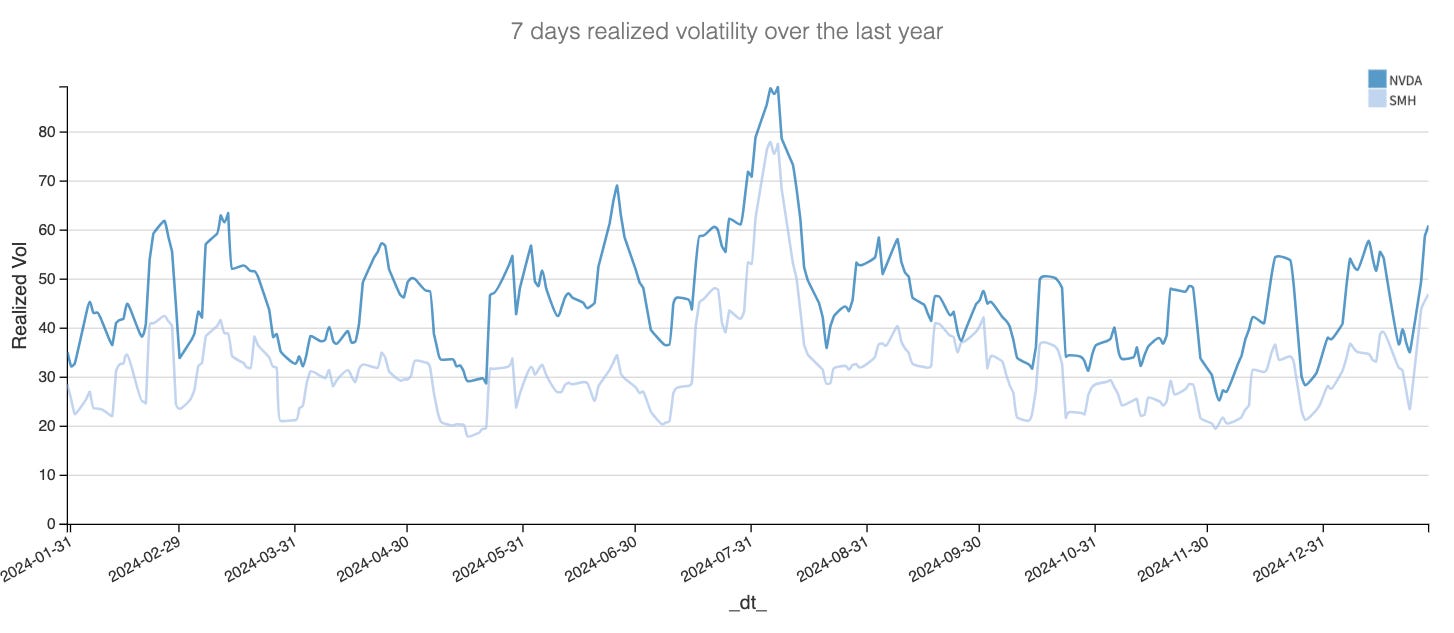

While semiconductor stocks have recovered some of Monday’s steep losses, we expect volatility to remain elevated in the coming days and potentially weeks. With four weeks until NVDA’s next earnings report, a lot can happen between now and then.

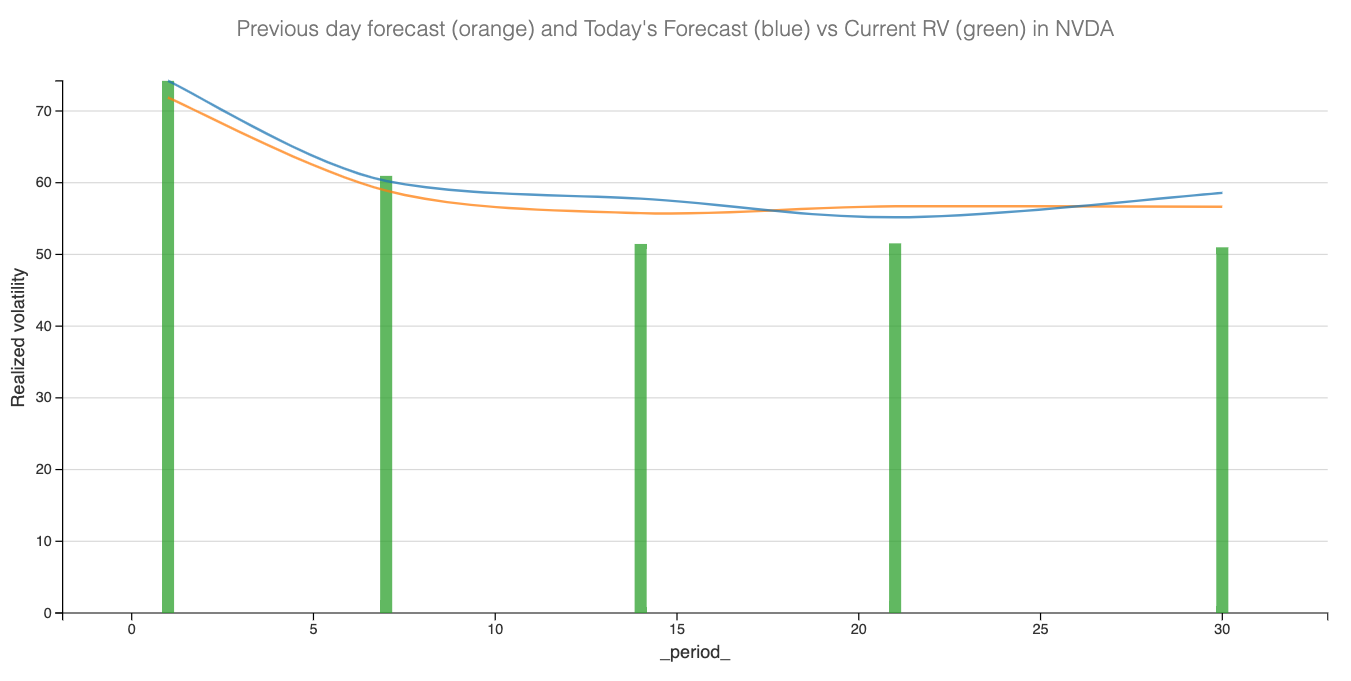

News with such a significant impact takes time to be fully digested by the market. Even though our forecast aligns closely with what has been realized over the past few months, it should be seen as an indication that volatility is more likely to lean toward the upper end of the range rather than revert to lower levels.

Whatever your take on the situation, if you believe trading in these names will settle back to normal after Monday’s shock, you’re fooling yourself—or as we say in French, you’re putting your fingers in your eye up until the elbow.

Now, let’s see what the options data tell us after a few days of relief following the initial shock.