Forward Note - 2025/08/24

You were right: the game is rigged.

The (trading) game is rigged — few takes are more popular on social media. And after Powell stuck to his music sheet at Jackson Hole, paving the way for a September rate cut and likely another in December, the “rigged game” accusations were everywhere.

We are always a bit taken aback by the anger in those comments. Did he not largely outline the course back in May? And for those who love pattern-spotting, is this not just a repeat of 2023’s “no more cuts, I promise,” followed by 2024’s “big fat -0.5%, thank you for waiting”?

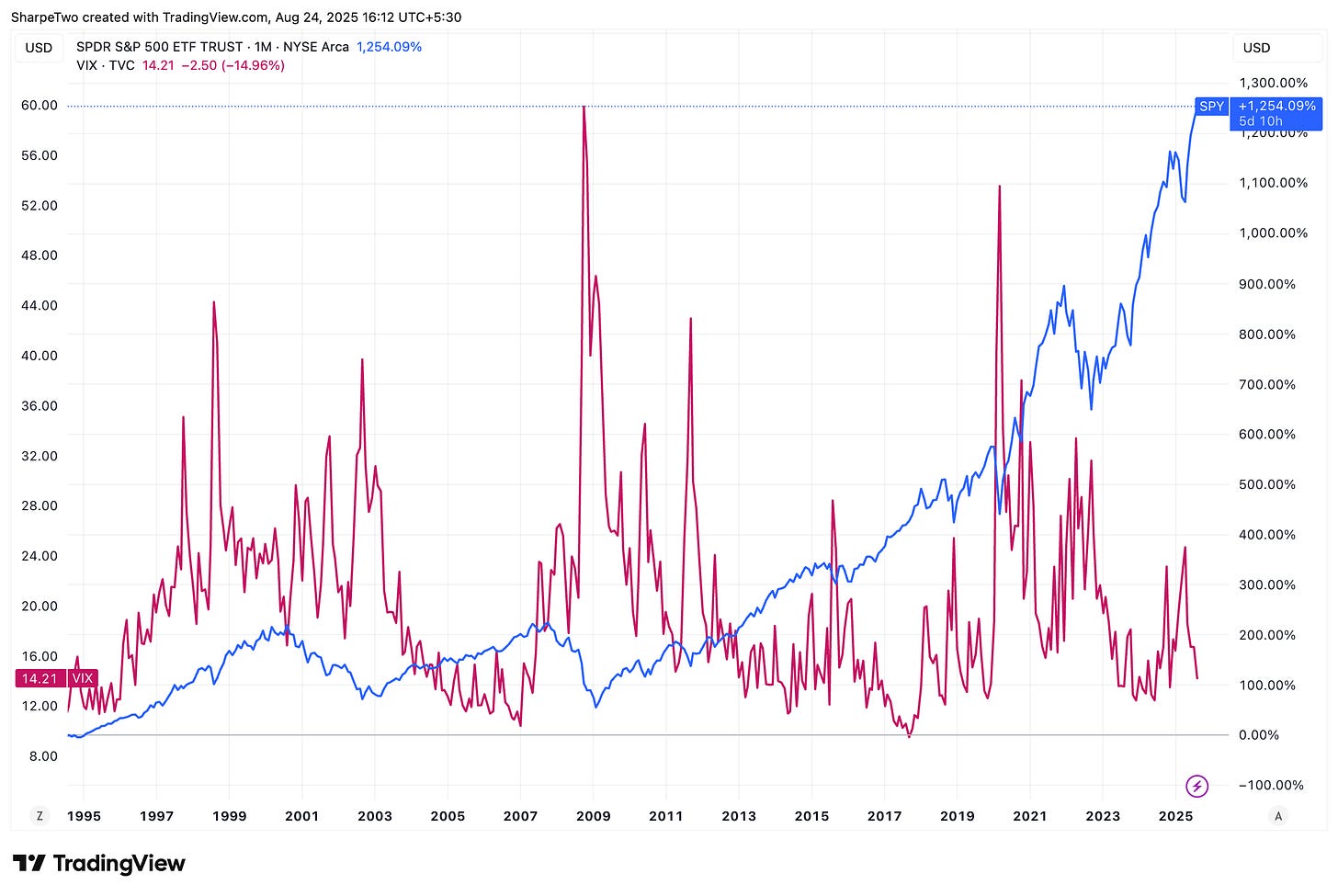

Despite Powell being as predictable as a Swiss clock, some still insist September’s cut is not guaranteed — or worse, not happening. To a point, they are right: until it happens, it is just opinion and probability. But when the entire market is saying something else, sometimes the smart move is not to cling to contrarian views. VIX at 14.45 tells you the market is not pricing even a whiff of trouble in the next 30 days. Maybe a 1% drawdown on a bad NFP or a real NVDA miss, but with all known information discounted into the risk-free rate, the market clearly finds those scenarios unlikely.

We may be part of the problem too, by not digging into every scrap of information to shake up a marketplace seemingly blind to risk — and in doing so, perhaps adding to the complacency. Maybe that is also why this newsletter remains “niche,” with only 2,000+ subscribers (thank you, by the way). But do not expect us to change our tune: we are not pretending to outsmart the collective intelligence. Our edge is in reading what that intelligence has already baked into options data, and telling you what it implies about the future.

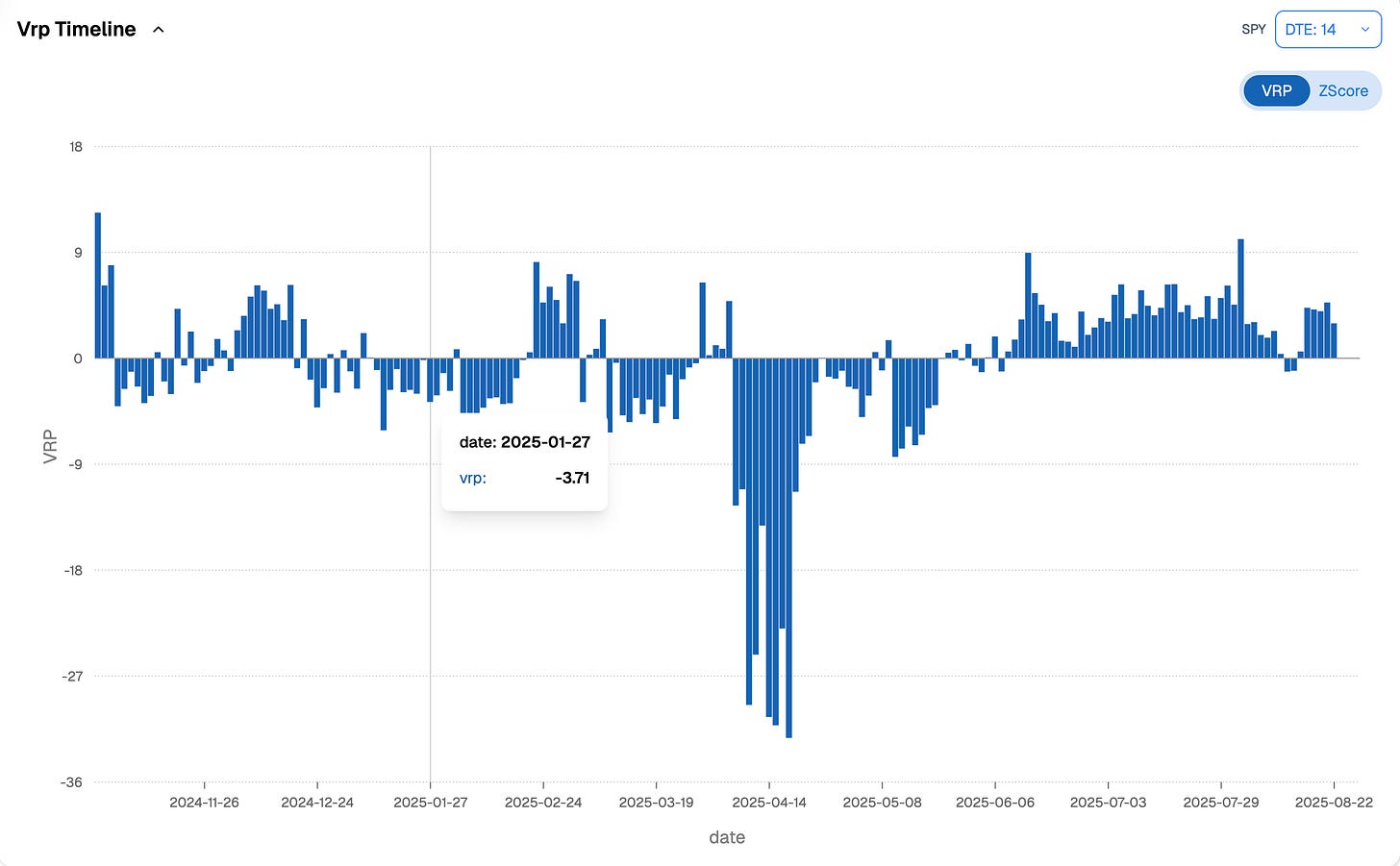

That alone is a full-time job — checking if the data match the mood. Sometimes they do not. Remember February, when everyone was selling puts despite negative VRP, and buying tails actually outperformed the traditional short-option play?

Lucky for us, today is easier. VIX at 14.45 and equities up nearly 10% YTD tells you the views are aligned. The market is far more prepared for another +10% than it is pricing a -10% crash over the next quarter. That does not mean the crash cannot happen — only that the odds, for now, are not there.

We insist on this because, after two months of what we called a lazy summer, and just as we were bracing for more activity into September, these numbers are pushing us to tilt the scenario further to the optimistic side. We are not asking you to be euphoric, champagne in hand at your last beach club of the season. Just a little more relaxed heading into the final four months of the year than the summer headlines had promised.

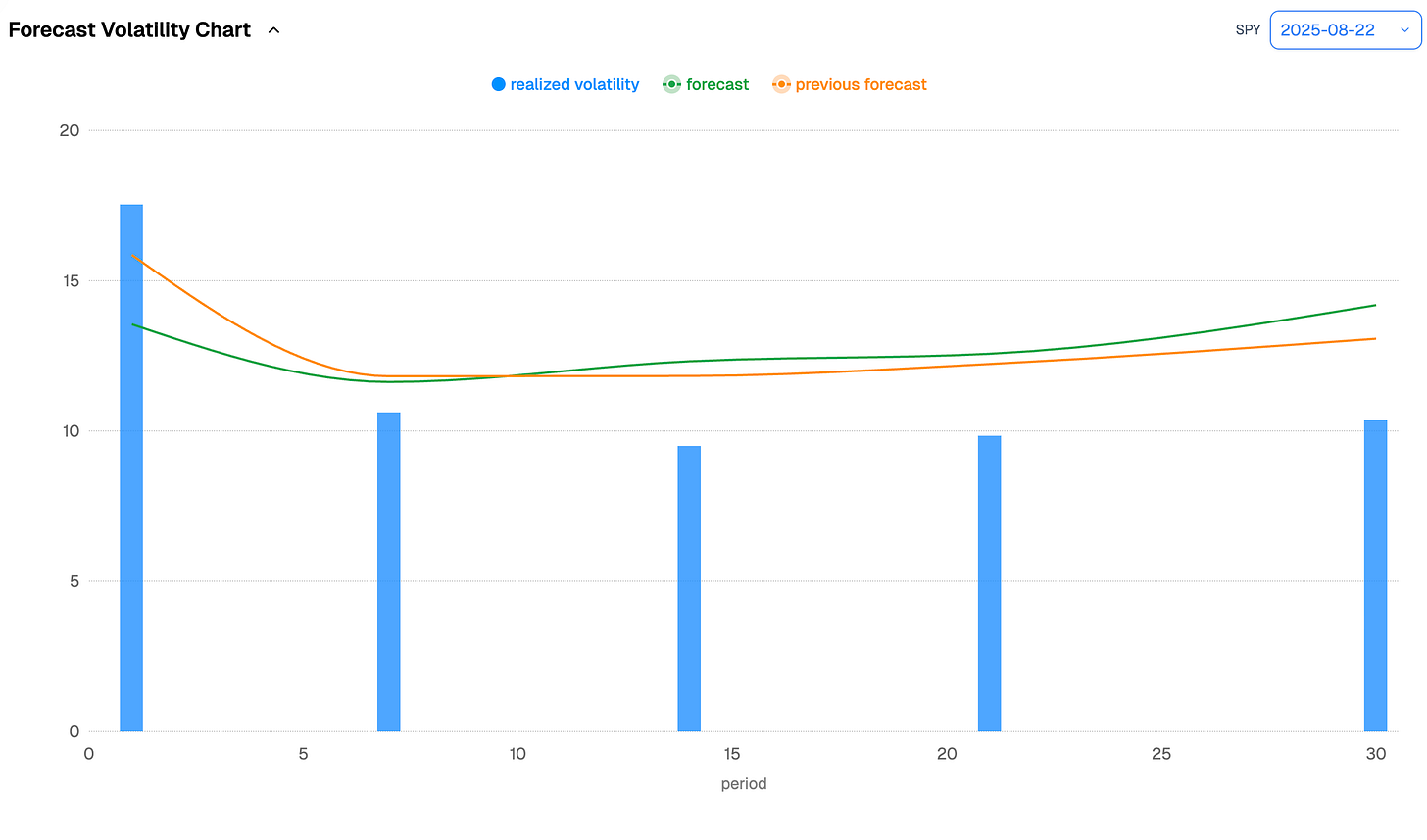

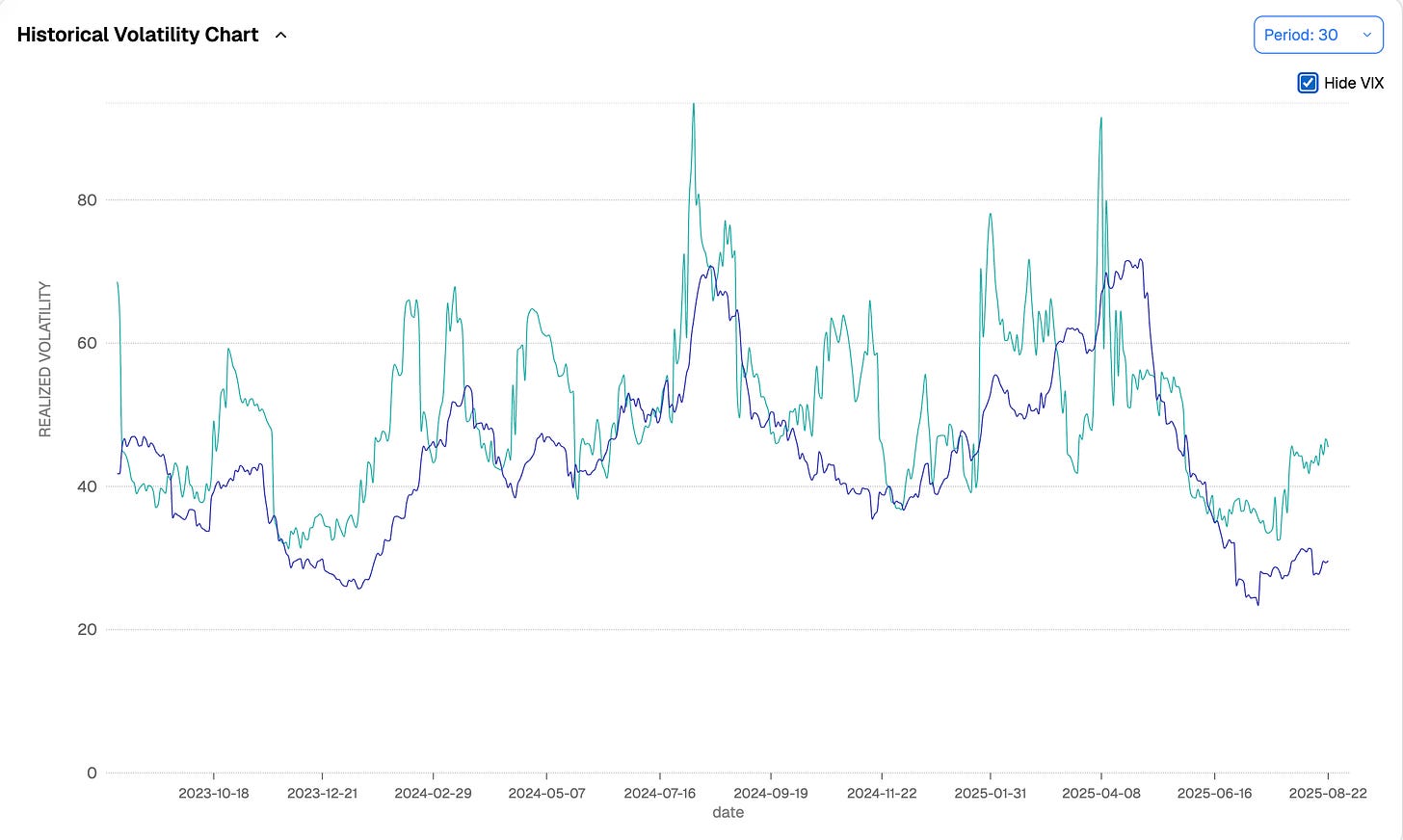

Realized volatility over the past 30 days in SPY has been 10.37%. The long-term average sits closer to 14%, and the market knows it: whatever system you run, you will find forecasts circling that 14% mark for the next month. In practice, it may turn out a little lower, given how much risk has come off the table with monetary policy now largely set for the coming months. It could also edge a bit higher. But one thing seems clear: it is not going to be 20%.

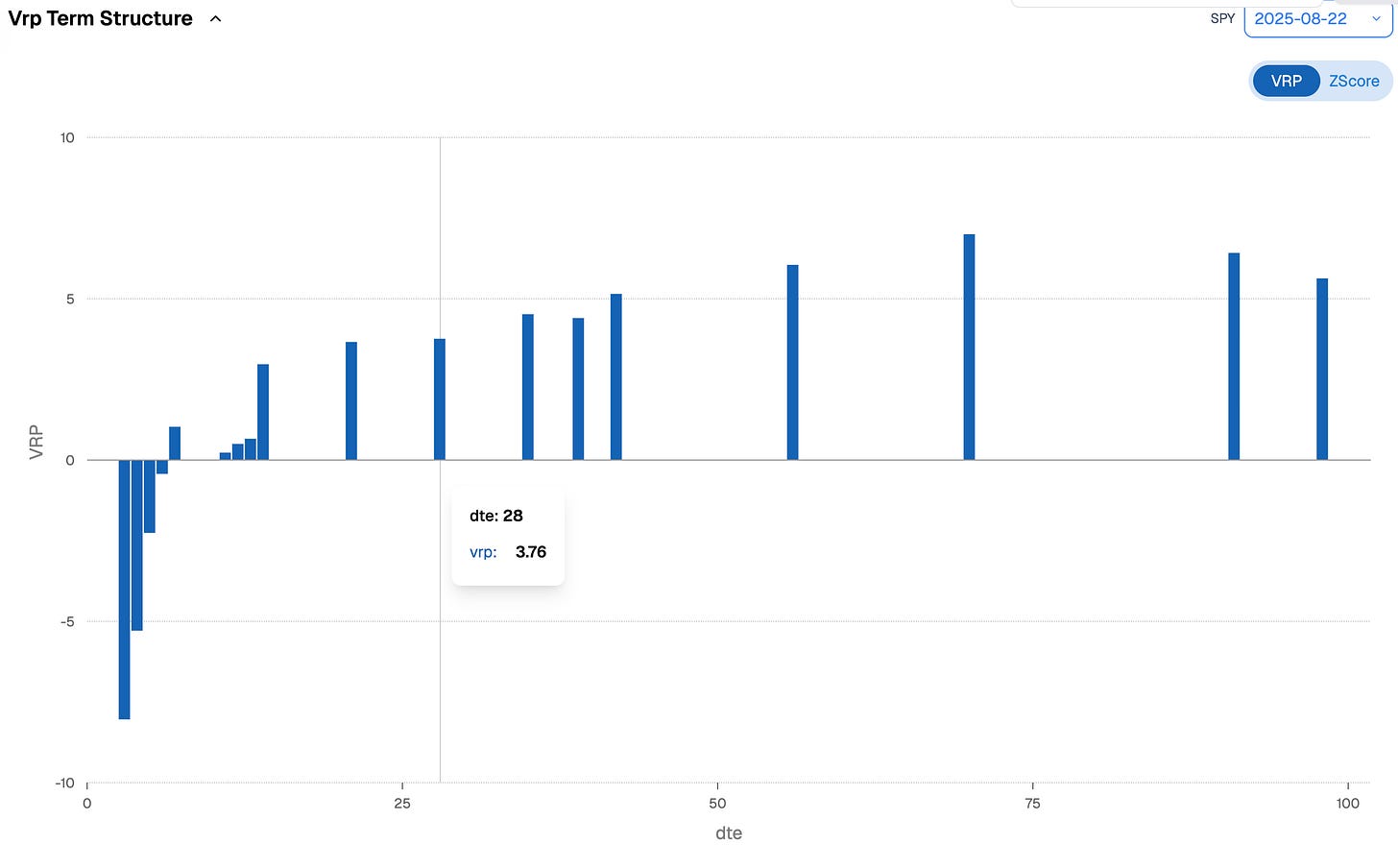

And the market being the market, it always finds a reason to scare itself. This week, the obsession was testing the reality of the AI hype. No doubt a slightly wobbly NVDA print could spark selling and bring back volume and volatility. But enough for a broad sell-off and a -10% correction? Stay grounded. That is not what the market is telling you right now: realized volatility is sitting at its lows, and the variance risk premium remains very healthy. Even if prices wobble mid-week, the odds are high that new buyers step in quickly, treating any dip as a discount over the following days or weeks.

Which brings us to the same warning we gave back in August: you do not need to sell implied volatility at levels you are not comfortable with. If we expect 14% in 30 days and VIX is giving you 14.45, it is perfectly fine to be choosy and wait on the sidelines. But if you see 16 or 17? Do not forget to pull the trigger.

The annoying part of a low-vol regime is that premiums keep getting thinner, and selling vol starts to feel almost too comfortable. Remember a few weeks ago when you did not like 16? Now it is 14. And once September and October are behind us with no fresh catalyst on the tape, nothing says it could not be 12. So how do you make money in that environment?

One option is to spend more time in meme stocks, where both implied and realized volatility usually run hotter than in the index. If the VRP is strong, periods like this can be very forgiving (our short vol in MSTR, for instance).

Otherwise… you are simply long. You should always be long in some shape or form, but now more than ever.

VIX at 14 tells you demand for options is low. Fund managers are not hedging; they are perfectly happy to eat a little realized volatility rather than explain why performance was chewed up by puts that never paid. If those guys are long, why are you not? Oh right… because some smart-ass on Reddit is rumbling about a crash? Got it. Be sure to tip them for their service when the SP500 hits 7,000 (!!!) and you are still sitting on the sidelines with them.

SP500 at 7,000 — insane, right? Even we struggle to picture it. We remember when it traded at 600, and we thought it was such an insignificant number that we paid more attention to the Dow. Needless to say, we did not buy: we were to busy building “super-smart” cointegration systems for pairs trading.

Yes, the game is rigged — just not the way you think. It is rigged to go up more often than not, with the occasional difficult stretch.

What are you waiting for? VIX 12? Got it.

In other news

K like Ksander… or like Ketamin?

We only ask because MusK is famously fond of Vitamin K. And now, apparently, so are VCs. Why? K like DatabricKs, raising a Series K to be valued at 100 million K dollars. That is a lot of K, and soon we will run out of alphabet letters to describe this new crop of startups — hooked on private capital and refusing to grow up and face the public market. In other words, the Gen Zs of the corporate world?

These valuations beg the obvious question of rationality, but we will not debate that here. If you earned a penny every time the market did something irrational, you would still be poorer than if you simply indulged in its irrationality. We are only trying to look at it from a founder’s point of view. And yes — not having to report to Wall Street every quarter is comfortable. It lets you focus on long-term product development without being punished for a bad print.

The other question is what happens to investors whose money has been tied up in these companies from the early days, with no exit in sight? Increasingly, these late-stage rounds are less about growth and more about offering liquidity to early employees and backers.

But the real question is sharper: given the current pace of innovation (Databricks is only 12 years old), what are the odds that valuation goes from $100 billion to $10 billion — not because of fraud, but simply because somewhere, right now, the next Databricks is being born, and it will not take 12 years to reach the top? If today’s discounted value is $100 billion, what is its innovation-adjusted value?

As always, thank you for staying with us until the end. Here are two reads from last week we found worth your time:

Not convinced by our market take? Think we are too bullish? Too bad. Here is yet another piece to drive the point home. As we say in France, only idiots never change their mind — so consider this your last chance.

The FT is running a superb series on organized crime, and in this installment they dig into a subject the market knows well: gold. Frightening and insightful in equal measure.

That is it from us. We wish you a wonderful (NVDA-earnings) week ahead and, as always, happy trading.

Charts, and analysis are powered by Sharpe Two Insights.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.