Signal du Jour - short vol in MSTR

Schyzophrenia.

We were hoping for a little firework from yesterday’s CPI. Instead, the numbers landed right on consensus and the main US indices punched to fresh all-time highs, with a September rate cut now looking almost certain. It also reinforces a whisper-level narrative some economists are cautiously entertaining — maybe, just maybe, the tariff impact will not be as bad as feared.

What is there to hate? Do not ask a bear — the only answer you will get is “how long do you have?” But the VIX, sliding toward 14 — the lowest in over a year — is sending a clear message: the market does not want to hedge a risk it cannot see. That does not mean the market is right, but it does mean the odds are not in favour of long vol or outright short sellers.

Thankfully, we steer clear of directional bets. Still, with VIX at 14 and a low-volatility regime taking hold, finding trades with real edge is going to get harder.

It does not mean one should not try. And with no major risks on the board, today we will structure a trade in MSTR. Let’s have a look.

A side note: this is a textbook example of how schizophrenic a trader must sometimes be. We happen to think MSTR is headed to zero in the long run (more of a short Taylor financial engineering than bitcoin). That will not stop us from selling expensive IV in it.

The context

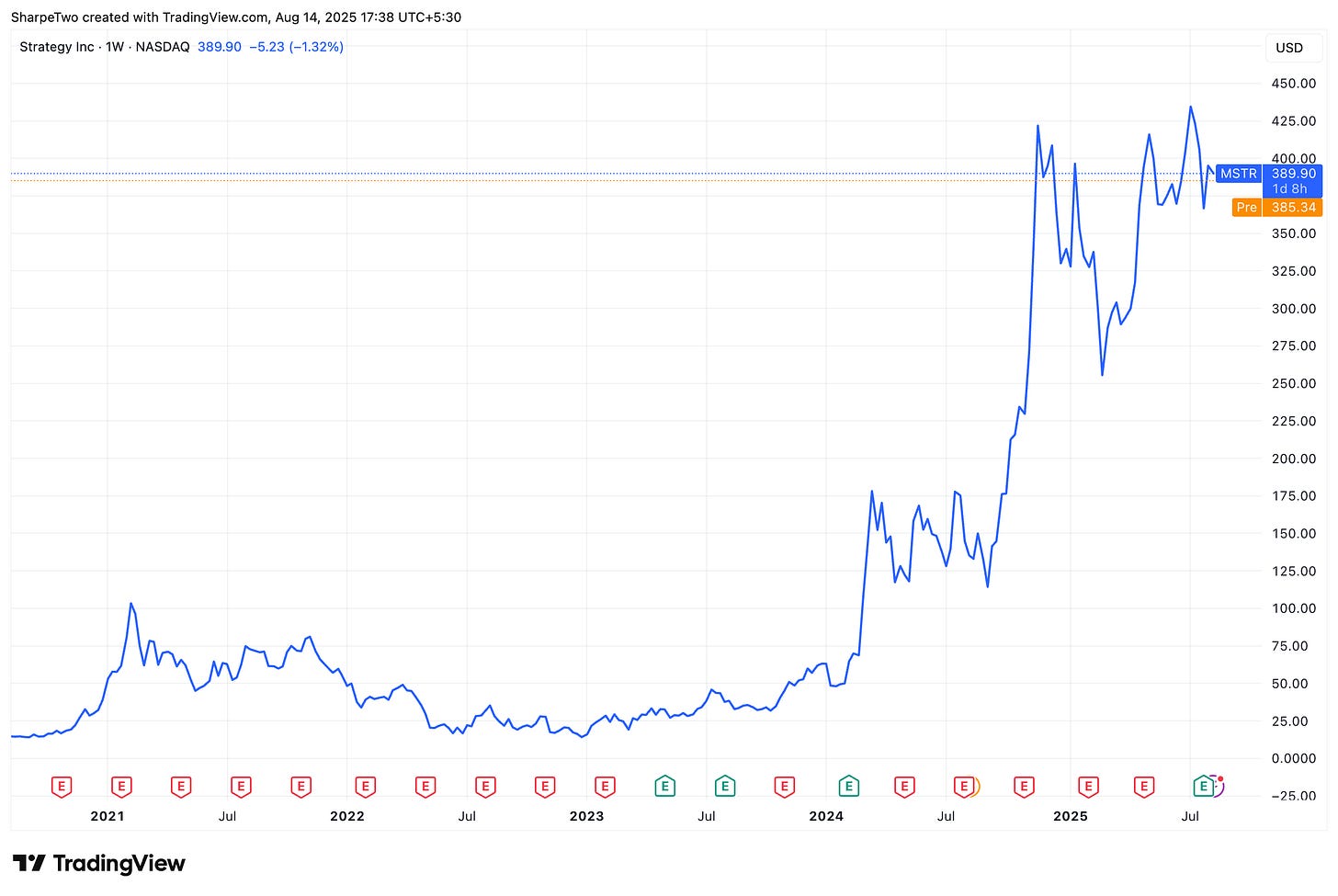

The current administration has been notably pro-Bitcoin. Between the $TRUMP coin and repeated commitments to deregulation and deeper economic integration, the digital currency has been propelled to all-time highs. MSTR, which decided in the middle of Covid to become more of a Bitcoin holder than a software vendor, has benefited massively.

Looking at that, one might wonder: how on earth could you have missed such an obvious trade? A reminder: it is always easier in hindsight. And if the idea was to ride Bitcoin’s move, why not just buy BTC directly? The results would have been even more spectacular. We remain puzzled by the thesis for holding MSTR instead of the coin itself.

Back to our volatility trade — what is obvious from this chart is that realized volatility in MSTR is not for the faint of heart.

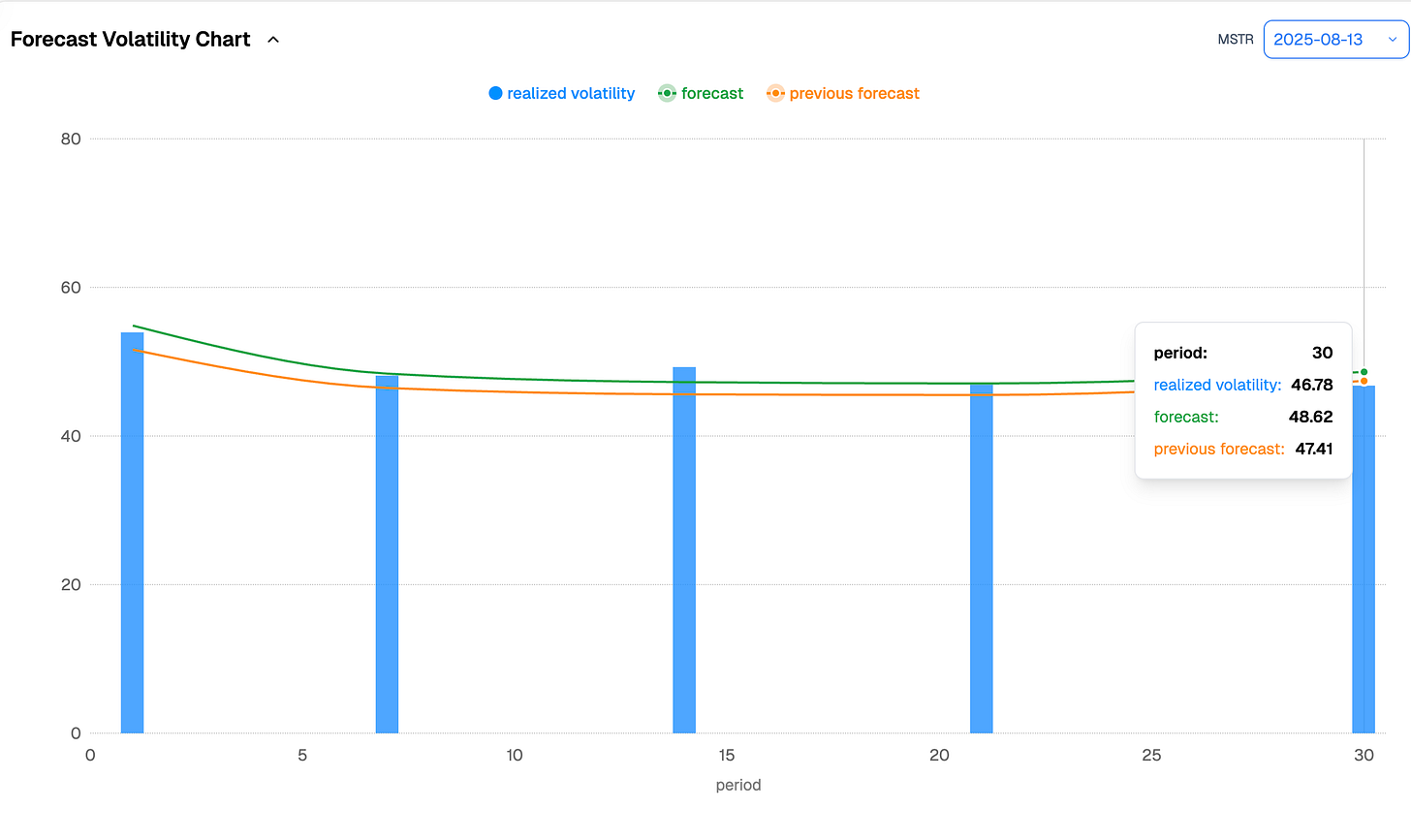

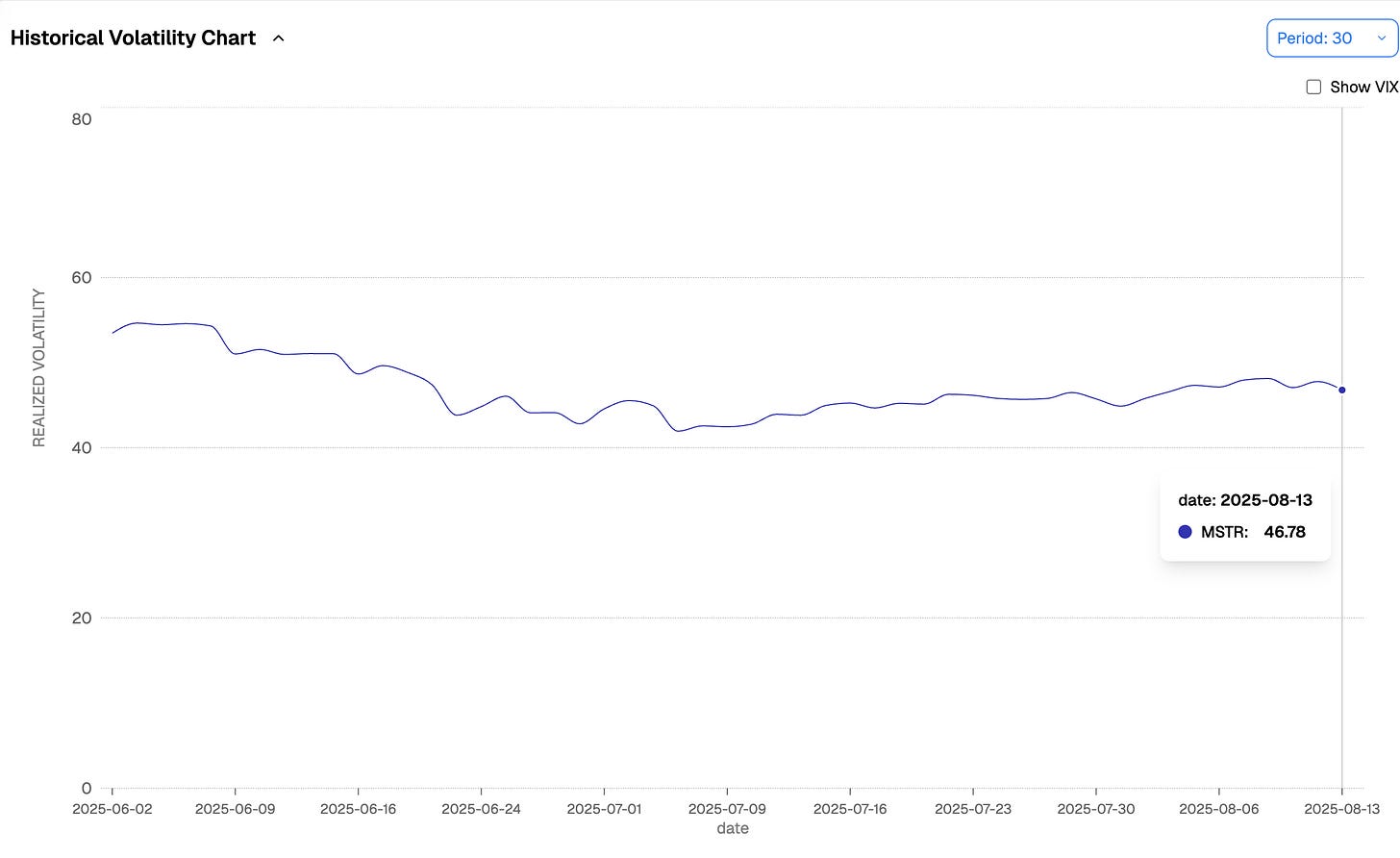

Did you enjoy the April swings in the SP500? Realized volatility there was still lower than what we see right now in MSTR — and this is during a relatively “quiet” period for the stock. With all the speculation around it and the embedded jump risk, forecasting is not trivial. Still, in this lower-volatility regime, we see no obvious catalyst in the next two weeks that would lead us to doubt our forecast.

Given the mean-reverting nature of volatility, we often say today’s vol is a pretty good proxy for tomorrow’s. MSTR is a prime example: if nothing changes, you should expect somewhere in the 45–50 range over the next month.

Of course, given how fast this stock can move, we would not be surprised if the variance risk premium turns out to be quite significant. Let’s take a look.