Forward Note - 2025/03/23

A bruised market.

After a month of uninterrupted beating, the main US indices managed to close the week—just barely—in the green. The S&P 500 added a little over 0.5%, while the Nasdaq eked out a meager 0.25%. At one point, not only were all of the Mag 7 down for the year, but if not for Meta, they’d all have been down a solid 10%.

How’s that for a start to the year? And while Friday’s close looked a little less gloomy, we were left with this bizarre note about a stand-up meeting where Musk reportedly urged employees to hodl because diamond hands for everyone and his enemies are after him. 2021 was the rise of meme stocks, but in 2025, we’re fully living in the memes…

Anyway, back to our topic of heart—after flirting with 30 just ten days ago, the VIX closed the week below 20, bringing us back into a neutral volatility regime.

While the market was genuinely on edge over Jay Powell’s press conference and the first quarterly OPEX of the year, the week turned out to be fairly quiet. Once again, not quite the chaotic vibes of 2024, but much more in line with 2022–2023, when a 17% weekly realized volatility was just business as usual. So, VIX 19 and realized volatility cooling off, so all is well on the western front?

At this stage, any astute observer should be jumping out of their chair: how is the VIX already back below 20% when we just realized another solid 17% this week? And while forecasts aren’t screaming high realized volatility over the next 30 days, they still suggest something around 20% for the next month.

We just realized a little over 20% annualized volatility over the past month—the highest level since 2022. And if there’s one thing about volatility, it’s that it tends to cluster. That’s what tipped us off at the end of 2024 that this wasn’t just a one-off—we had to gear up for something different in 2025. Truth be told, we had no idea it would be this wild.

And in the same vein, just because models say something doesn’t mean we should take them at face value. Fair argument—volatility predictions aren’t highly accurate. But they do tend to be precise enough—not entirely wrong, not entirely right, but usually in the ballpark.

So assuming our gut feel about recent market action is backed by rigorous statistical analysis, how do we explain this “paradox”? Why is the VIX already back below 20 when a realized vol of 15 over the next 30 days seems highly unlikely—both statistically and from a calendar standpoint?

Remember the backdrop: tariffs, the Ukraine war, relative weakness in the US economy, the US-China trade war, no rate cuts until further data—etc., etc. It’s not exactly smooth sailing.

We don’t have a great answer to that question—just the unsatisfying “the vol trade hasn’t been washed out yet, and it’s still overcrowded.” Yet, just as we were scratching our heads over this, JPM went ahead and launched yet another ETF… to short volatility even more easily.

If you were short vol over the past month, there were definitely some uncomfy moments. But overall, most players likely survived the spike, and the moment realized volatility started dropping late last week and into Monday… well, the usual suspects wasted no time. They jumped in and crushed implied volatility—with total disregard for where realized vol is or where implied vol sits in adjacent products.

We’re really not fans of the whole “this trade is crowded” argument. It’s often just a lazy excuse to justify a view that’s miles away from the bearish sentiment you’re trying to sell—whether to investors or, well… an audience.

Yet, we can’t help but ask: who in their right mind—fully aware of how volatility works and the risks involved—would willingly sell VIX 19 on Thursday, with negative premium, given the backdrop?

Here are some potential answers:

People who believe (and have super-advanced models to prove) that realized vol will be 15 over the next 30 days.

People convinced that all the macro/geopolitical shenanigans of Q1 are about to disappear—and have sophisticated analysis to back it up.

People who had zero hesitation selling VIX 16/17 in January because “it was a great price” and implied vol is mean-reverting. Look, Mommy, I’m a vol trader too!

People who panic-dumped expensive protection bought at VIX 27—desperate to unload before getting punished twice. (First, for not hedging in the first place and second for holding too long these expensive puts.)

The correct answer is all of the above and the ones we didn’t even think of.

But whoever the culprits are is not that important. What matters is the variance risk premium is negative again, and that sucks. And it will suck even more if vol doesn’t pick up and the VIX keeps drifting toward 15.

But you know what would actually be really worse than worse? Selling implied vol now—when the edge is negative—getting caught in the next spike (brutal or not), and then having to admit the timing was, at best, questionable.

We spent most of January managing our frustration over not being able to sell puts. And just when we thought selling season (which kicked off somewhere in February) would stick around for a while… that window just slammed shut.

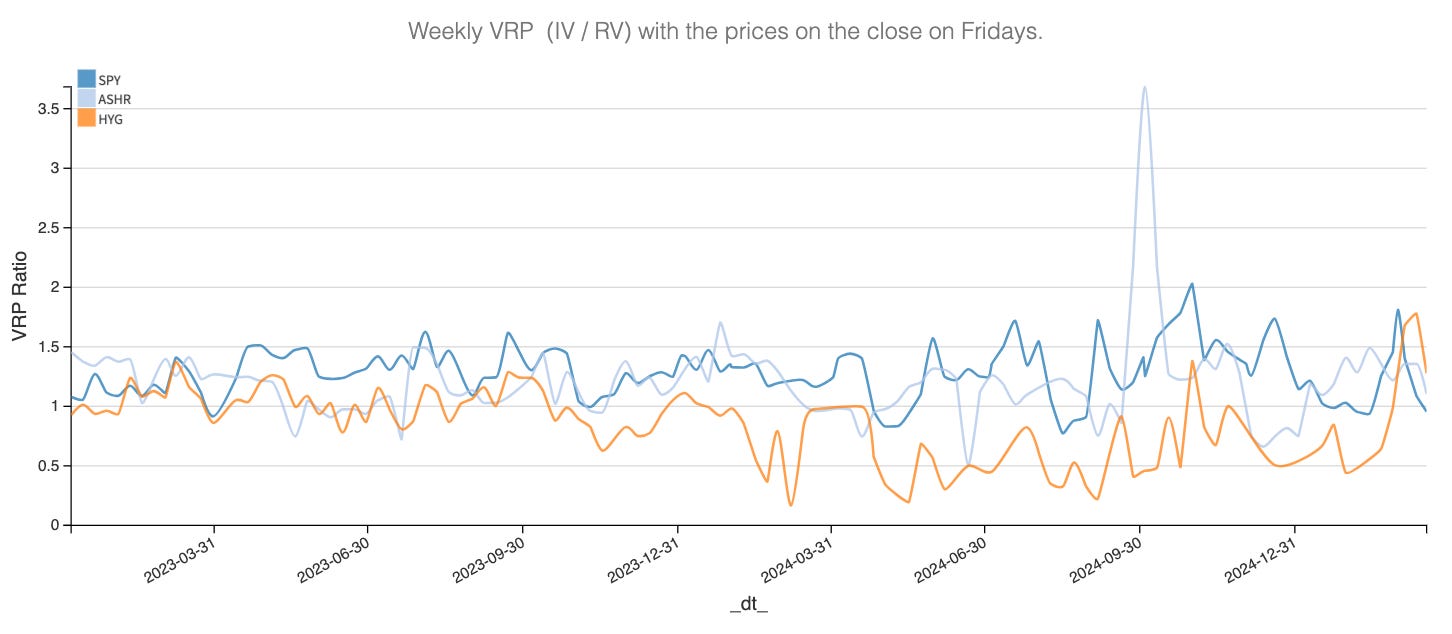

Looks like we’ll have to find something else to do. Like staying active in the Chinese Variance Risk Premium which has been performing pretty well over the last quarter or considering corporate bonds that have been pretty quiet despite raising implied volatility.

In other news

BYD just announced they can charge an electric vehicle in five minutes. Another major milestone of Chinese innovation, right on the heels of DeepSeek. (Yes, yes, we know, Sam—the Chinese are liars and copycats.) The world is shifting at a breakneck pace, and headlines like these still feel a little surreal.

Case in point: this same BYD reportedly hesitated to invest in a Mexican factory over fears of “technical leakage” to the United States. Who’s the copycat now, Sam?

And while no one will admit it—because, obviously, it’s a taboo subject—how many AI startups, growing ARR at record speeds, are quietly running on Chinese tech because… well, it’s cheaper?

Anyway, the beauty of investing is its cold, rational nature. The great rotation from America to China, which kicked off two months ago, has only accelerated in recent weeks—and it’s unlikely to stop here. Compare QQQ vs. KWEB, and decide for yourself where you’d rather put your money. It’s okay, you’re safe—no one’s watching.

Thanks for sticking with us until the end. As usual, here are a couple of interesting reads from last week:

Now that markets are volatile again, plenty of (underperforming) money managers are rushing to declare the death of passive investing. But… really? Here’s an interesting take from the FT.

Stock picking isn’t our forte—we’re much better at analyzing vast amounts of data and betting on the insights. That said, when a great stock picker puts out a compelling thesis, we pay attention. Here’s an excellent one from Durolle Capital .

That’s it from us this week—wishing you a great week ahead and, as always, happy trading.

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.