Forward Note - 2025/01/19

Pit stop and trading plan.

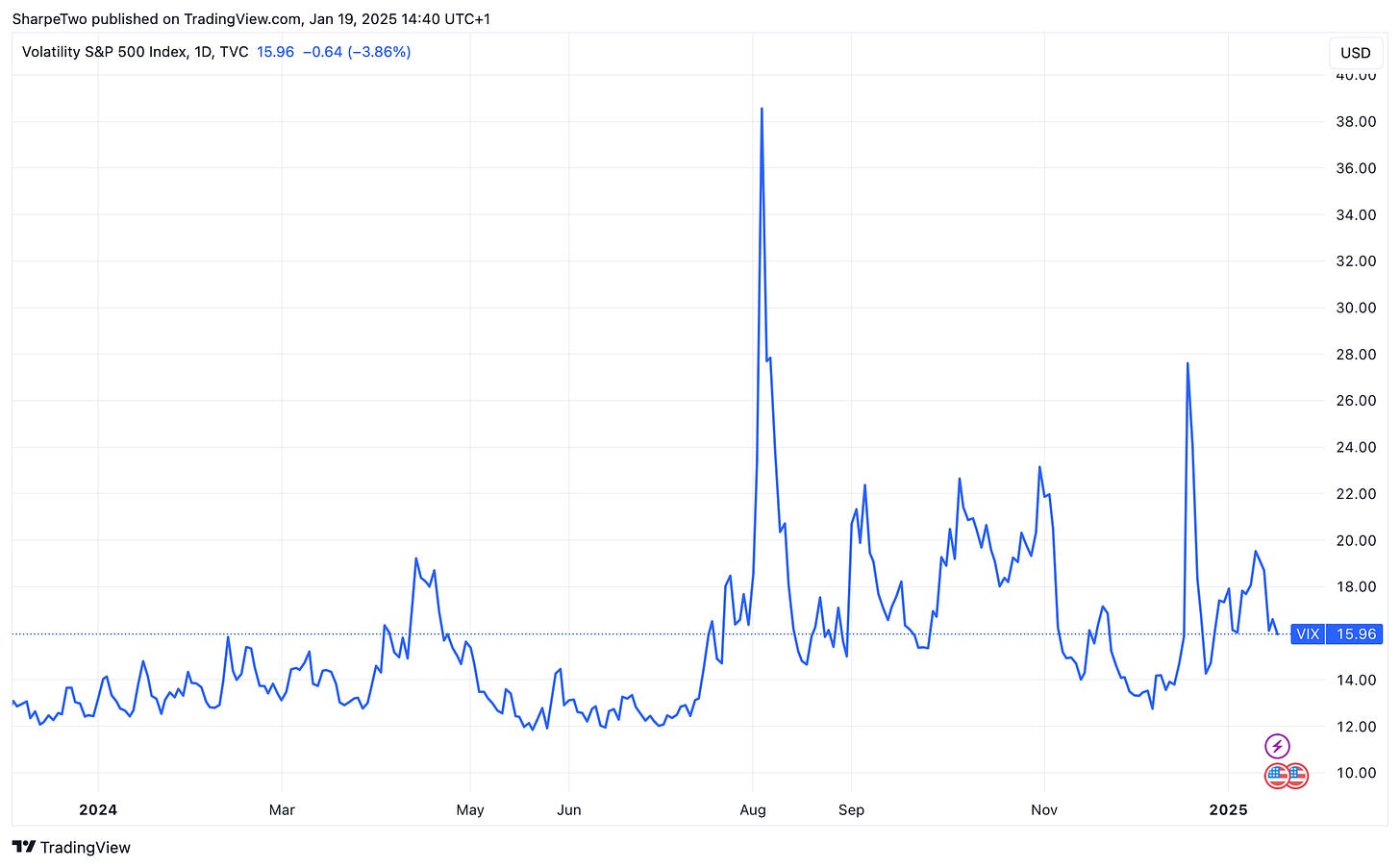

All the pent-up tension from the past six weeks unraveled in… one morning. On Wednesday, we learned that inflation came in slightly lower than expected, triggering a powerful rally that unfolded mostly in pre-market trading. The VIX, in turn, was ruthlessly crushed back down to the 16 threshold.

The following day, stocks stalled, fueling speculation among many that this was “a trap” for opex day and the market’s decline was just around the corner. Instead, another strong overnight move pushed the SP500 to close just shy of the 6000 mark.

We can’t help but feel a bitter taste lingering—after all that tension and turbulence, this is where we land? The past four weeks have been, to put it mildly, challenging. Between sharp end of year rotations and jolts in volatility, it hasn’t been the most forgiving environment.

Losing money when you’re wrong on a volatility forecast is part of the game—expected, even. But the harder pill to swallow is when you get the volatility call right and still end up in the red. In the end, the relentless chop on the way down and some strong moves on the way up, left minimal room for error for options sellers. Let’s recap.

Following the FOMC, the VIX surged from 17 to 27, only to plummet from 18.5 (or nearly 20, depending on how you read the action before Wednesday) to below 16 within a few hours. Options theory conveniently assumes constant rebalancing to isolate and trade the volatility component.

But in practice, the real threat has always been the jumps—those sudden, sharp moves that render delta hedging impossible in the moment. And when these jumps are strong enough, they don’t just hurt; they can wipe you out entirely.

Recently, these jumps have been relentless. They occur not just overnight—like the 2% election rally or the -4% plunge in August—but at such an intensity and speed that even seasoned traders are feeling the strain, let alone retail participants.

But venting won’t prepare us for the next occurrence. It’s time to set emotions aside and refocus: where did we fall short, and how can we improve?

Routinely buying tails - anything below delta 10, call side and put side - would have made this period far easier. We can’t stress that enough: make it a habit, especially when the implied trade below realized volatility, and forget about them once they’re in place. They are the cost of doing business and the insurance against bad moods when arrives the weekend. If you don’t do it for your portfolio, do it for your wife and kids; they will be grateful.

That said, buying options alone won't make your year unless you’re ready to embrace an entirely different philosophy and operate as a long volatility shop. So, what else could we have done to navigate the past month more effectively?

Too many retail traders are obsessed with a list of stocks they like to trade. Often, SPY and QQQ and their cousins on steroids, TQQQ and UPRO, are thrown into the mix. This isn’t the most effective approach to running your portfolio like a business. As an insurance provider, if the risks are too high or the premium doesn’t sufficiently cover the risks—you’re under no obligation to trade.

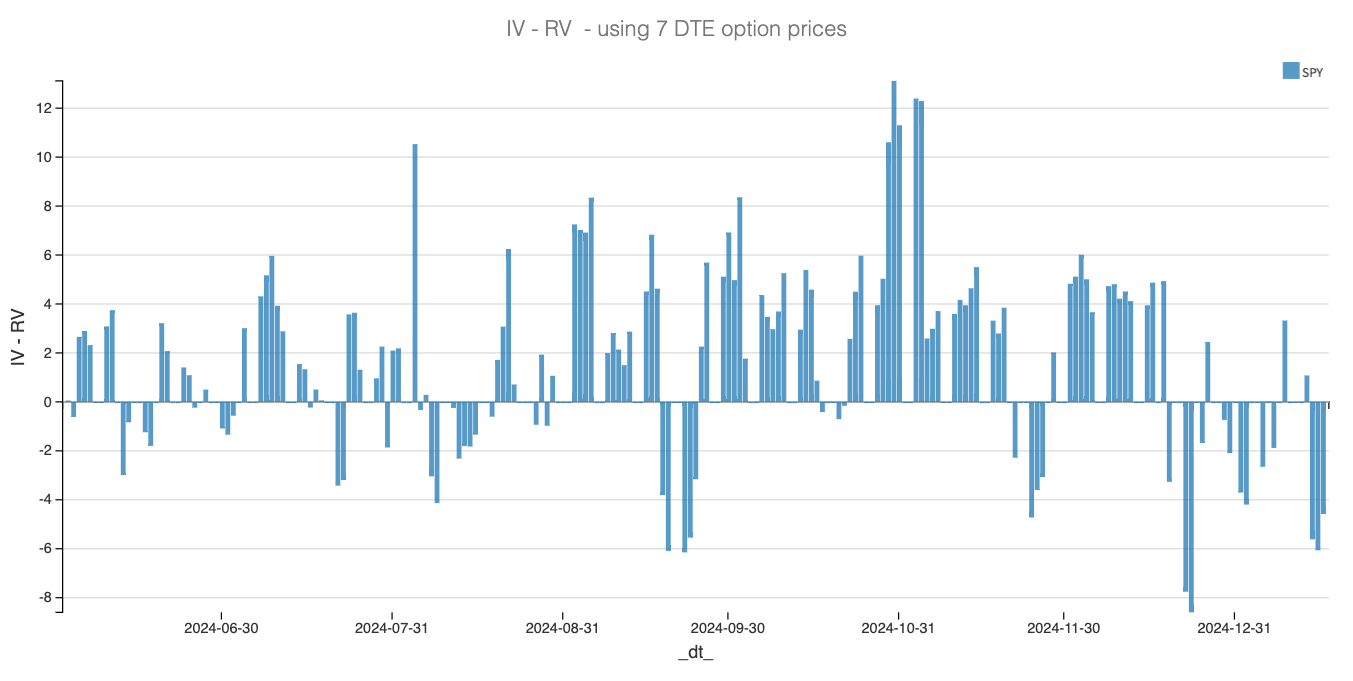

Your primary goal should be identifying where the edge is most pronounced, simplifying your decision-making process. These setups reduce your dependence on precise delta hedging because the option prices already imply such significant moves that your volatility bet incorporates a wager on the terminal distribution. Recently, this hasn’t been the case for SPY and QQQ. In fact, one of our best decisions after the FOMC spike was to reduce trading activity in these tickers and shift our focus to less crowded corners of the market.

Another key consideration: we spent much of 2023 and 2024 trading straddles. The relative calm in volatility-of-volatility made straddles ideal for extracting as much premium as possible in a low-volatility regime, bringing little to no surprises.

However, with jumpiness now back in full force and volatility-of-volatility on the rise, targeting out-of-the-money options may be a smarter approach. By selling OTM options, particularly on the put side where the skew is steeper, you capitalize on higher implied volatility and position your bet on a wider terminal distribution.

Of course, there’s no free lunch. This approach inherently means accepting less potential profit. The knee-jerk response from many retail traders is often: “Well, let’s sell more, right? Strangles have a higher win rate anyway, and I feel in control trading them, so what could go wrong?” Everything.

When you sell a single at-the-money straddle, you’re exposed to 100 shares of the underlying stock if things go sideways. Now imagine selling five straddles because you haven’t experienced a loss in weeks and want to squeeze every dollar of premium from the market. One nasty jump and the consequences to your account can be catastrophic, far outweighing the supposed comfort of trading strangles.

Is this the trading methodology for 2025? Absolutely.

Focus on ensuring the variance risk premium (VRP) is present—and aim for as much of it as possible. Take this week’s short-vol trade in BOIL as a great example of finding opportunities where the VRP is stretched.

Shorten your exposure to the front week and regularly hedge by buying wings in the back weeks or months. Ideally, for every option you sell, you should have a corresponding reinsurance contract—whether in the same underlying or in another part of the market where options are cheaper. Once again, the VRP is an invaluable guide for identifying these opportunities.

Exit positions when they show a profit—and do it faster than you would in a low-volatility regime. This is your best defense against gamma exposure. Remember, gamma is the silent hitman waiting to pounce on your account. One sharp move, and if you’ve neglected to hedge with wings, the pain could be severe.

Rinse and repeat.

In all honesty, this should be the trading plan for any volatility trader, regardless of the circumstances. We grew complacent last year after months of a low-volatility regime. But the memo has been received, a few screws tightened, and now, we are ready for 2025.

In other news

Hindenburg has been dismantled. No, it’s not a famous rock band, though for the financial community, it might as well have been. Every tweet and report they released sent shockwaves through the marketplace, and their "greatest hits"—Nikola, Adani and Block—will be etched into the memories of traders forever.

Their influence ran so deep that it spawned true (and somewhat absurd) stories: rival firms reportedly called their competitors late on a Friday evening, pretending to be Hindenburg, just to casually “warn” them of a damning report coming on Monday morning. A mix of mischief and terror, perfectly encapsulating the aura they carried.

Short sellers are often surrounded by controversy, with many questioning their motives or even their relevance in the marketplace. But we would argue they fulfill a role that some regulators simply cannot—whether due to lack of resources or, let’s be honest, lack of will. They conduct deep, thorough investigations to uncover financial irregularities, exposing practices that dupe shareholders. And they do so at their own risk—not just financially, but sometimes with life-threatening consequences.

It’s a tough spot to be in. Even when they’re right, the market can move against them, making their position incredibly precarious. We wouldn’t want to take on such a role full-time, and we have a lot of respect for those who do, often motivated by reasons far removed from the portrayal offered by the (completely unbiased, of course) financial press.

Thank you for staying with us until the end. As always, here are a couple of compelling reads from last week:

Oil continues its grind upward, and AlphaPicks has an insightful review on what to do next. It’s worth your attention.

Do you think the planes you fly on represent cutting-edge technology? Think again. Innovation often stays under wraps until the timing is right for commercialization. Alberto Romero makes a strong case that this might be exactly what’s happening with Anthropic and OpenAI right now. A stunning read.

That’s it for us this week. Wishing you a productive week ahead and, as always, happy trading!

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.

“However, with jumpiness now back in full force and volatility-of-volatility on the rise, targeting out-of-the-money options may be a smarter approach”

I thought the overnight straddle trade (Digging into the overnight trade

VVIX or IV regime? APR 17, 2024) relied on an elevated VVIX for its success? Is this still the case for the overnight sell straddle for the indexes?