Forward Note - 2025/01/05

Veuve Clicquot and Holy Grail.

A business week straddling two calendar years, with market action mirroring the symmetry. Monday started quietly, only to give way to a distressed Tuesday. At that point, many chalked it up to the end of 2024—a classic case of profit-taking as traders closed the books on the year.

By Wednesday, champagne bottles were popped to welcome 2025, and markets seemed poised to kick off the year with a bang. On Thursday morning, the SP500 was up 1% before the market opened. By noon, it was down 1.5%. The anticipated fanfare quickly gave way to silence and focus for those still holding the book while others enjoyed their extended holiday.

However, everything wrapped up in smooth order with one of those classic CVIF™ (Crush Vol, It’s Friday) and BAAM7™ (Buy As Much Mag 7) moments. NVDA is already up 8% YTD, and Tesla, despite a rocky Thursday after missing some delivery targets (more on this later), has clawed its way back to flat.

With the VIX hovering just above 16 and stocks only down half a percentage point, the question arises: Is the champagne glass half full or half empty?

Compared to the exuberance at the end of 2023, it feels decidedly half-empty. Sure, volumes during the last week of the year are thin, and it’s best not to read too much into the action. Yet, realized volatility has been quite elevated—last week was, in fact, one of the most volatile since August. Considering the shockwaves post-FOMC meeting, that’s no small feat.

Volatility is often discussed for its well-documented mean-reverting properties. Yet, its stickiness is just as crucial to remember: it tends to cluster and can remain elevated far longer than the patience (or accounts) of some short sellers can withstand. Like in any business, success hinges on ensuring you sell something that’s genuinely overpriced.

By Friday’s measure, a VIX at 16 poses a problem. While it’s reasonable to expect volatility to linger in the 14 to 16 range over the coming weeks, it's not unreasonable to forecast it above 16.

In fact, our trusty old compass points to realized volatility hovering around 18 over the next 30 days, making the classic variance risk premium trade look a bit shaky until the VIX offers more attractive levels.

We still lean toward the short side as long as we remain in this neutral regime, but patience is key. We’ll wait for better pricing to ensure we’re properly compensated for our risks. Uncomfortable? Sure. But discomfort is directly proportional to your position size. Would we wager our (newly acquired) house on a quick volatility reversion? Definitely not. Would we risk the cost of a couple of dozen Veuve Clicquots? Let’s call it 25—what better way to toast the new year.

Even though the data suggests there’s nothing to lose sleep over, we can’t entirely shake that small, nagging feeling that something has shifted—and that we need to adjust accordingly. For a more data-driven perspective, revisit our final Forward Note of 2024. There, we demonstrated that the past two years were exceptionally calm, but we might now return to what can only be described as “normal” markets.

With that in mind, we’re adopting a markedly different approach this year. Over the last two years, selling naked straddles was our bread and butter. The markets were obliging, with both realized and implied volatility remaining relatively subdued. But as we potentially navigate into more turbulent waters, sticking to the same playbook feels… overly presumptuous.

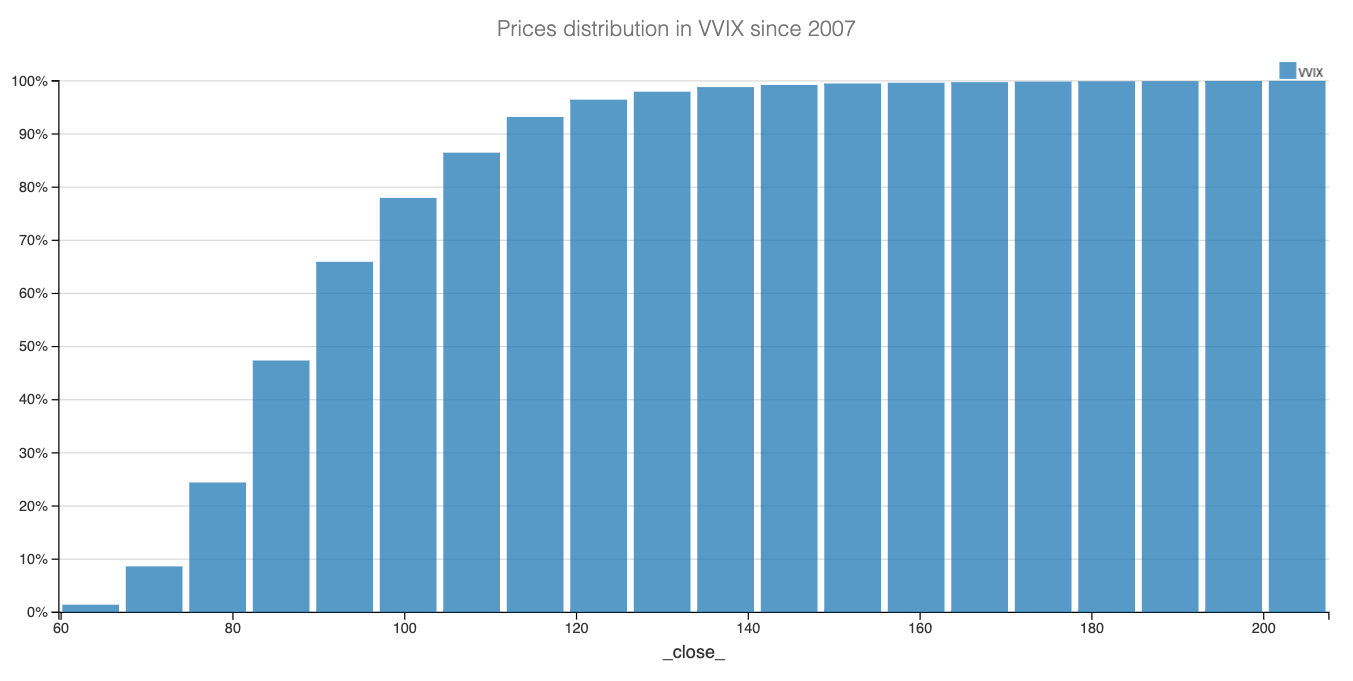

Why the cautious stance? First and foremost, if you’re in the insurance business, it’s vital to think about reinsurance. Now, if you’re looking for a solid business rationale, here’s the key takeaway: the realized volatility of volatility is steadily creeping into levels that compel the largest players on the planet to stick to their mandates and… buy hedges. This dynamic is reflected in the VVIX readings, which have been hovering around 100 for some time now, or it’s 30% top percentile. It will mean revert for sure, but right now, it seems to be clustering in these levels and we need to pay attention.

That said, we thrive on selling these hedges because they’re often overpriced (a hypothesis we always verify by analyzing the variance risk premium). However, it’s critical to remember that the market doesn’t pay for hedges without reason. It’s safer, and often wiser, to assume that the collective market intelligence might have a better grasp of the risks than our own, no matter how clever we think our analysis might be.

So for 2025, our default position is the reliable diagonal calendar spread, humorously outlined in Rozan’s Le Fric, where the author reminisces about trading alongside Nassim Taleb in the '80s: sell ATM options in the front month and buy some inexpensive tails in the back.

You don’t need to be overly meticulous about it, and neither are we. Just ensure that for every option you sell, you’ve purchased some form of protection—never sell your hedges. Why? Most of the time, the front pays for these underpriced lottery tickets, so there’s no reason to part with them. Of course, this assumes you didn’t overpay for them in the first place or that we were 100% sure we sold something really expensive in the front. Anyhow, aim for anything with a delta below 10 in the back, and you’ll be just fine.

Not selling hedges helps cultivate the so-called grail of option trading: convexity. Over time, your portfolio will accumulate options that stand to benefit from a sharp move and subsequent volatility spike, theoretically allowing you to weather storms more effectively. Theoretically, that is. The worst-case scenario with such a structure is a significant move but not strong enough for your hedges to fully activate.

In other news

Tesla's stock took investors on a rollercoaster ride, the company reported its first annual sales decline in a decade, delivering 1.79 million vehicles in 2024—a 1.1% drop from 2023. This shortfall, missing Wall Street's lofty expectations, led to a 6% dip in Tesla's share price, wiping out over $80 billion in market value. Despite the downturn, Elon Musk remains unfazed, steering the conversation toward Tesla's advancements in autonomous driving and the upcoming "Cybercab." And why would he? By Friday, all losses were forgiven. And in two weeks, he will officially be a member of the ruling government.

Thank you for staying with us until the end. As usual, here are a couple of great reads from last week:

A bit of self-promotion to kick things off: our first article of the year covered a trade on UNG. The edge is now gone—not because UNG dropped 8% on Friday, but because implied volatility has declined, and the demand for calls relative to puts has waned. If you haven’t already, it’s time to exit.

Mark Phillips delivers an excellent dose of reality check to start the year. Forget resolutions—a more balanced expectation of your yearly performance is all you really need.

In this clever piece from Adam Mastroianni, we learned about Paul Feyerabend and his critique of the scientific method. As a pseudo-scientific publication ourselves, we could see both side of the argument and this one is well worth the read.

That is it for us. We wish you a great first? week of 2025. And of course, a very happy and profitable year.

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.

"Most of the time, the front pays for these underpriced lottery tickets, so there’s no reason to part with them. Of course, this assumes you didn’t overpay for them in the first place or that we were 100% sure we sold something really expensive in the front. Anyhow, aim for anything with a delta below 10 in the back, and you’ll be just fine."

>> A sub-10 delta would be far, far OTM for the long leg, correct? If the short leg is closer to the money, would this not result in a return profile that can have extreme losses for large swings?