Forward Note - 2024/12/15

How did 0dte do in 2024?

If you are not subscribed yet, here is a 46% discount until the end of the year and the story to justify it.

We were on course for three weeks of daily realized volatility below 10 when Thursday (again, and more on this later) derailed everything. Higher jobless claims ended a streak of complete nothingness and took us far, far away from all-time highs. We really wonder how we will recover from this: The SP500 closed the week down more than half a percent, and the Russell lost 2.5 percent. The Nasdaq is up slightly less than 1 percent, finishing the year on a strong foot.

The VIX gained one full point but remained below the 14 level. We are now more than ever anchored in that low volatility regime we have discussed many times. Do not get caught in the daily ebbs and flows; until you see VIX 16, there is probably nothing the market is apprehensive about.

Yet, in calm markets like this, the temptation to dab in super short-dated options is even greater than usual. And what is not to like about them? The chart above shows the performance of selling a 1dte at 3.45 pm and taking it off right before expiration at 3.45pm the next day in SPY, QQQ, IWM, TLT, GLD, and USO since 2020.

This doesn’t consider transaction costs and assumes execution at mid-price, so take it with a grain of salt. Finally, each position is standard to $1, meaning you would need to adjust the number of straddles sold to balance all products equally (If QQQ straddle is a $2 and SPY at $1, this chart assumes you sold 0.5 straddles in QQQ).

Let’s see how each ticker would have performed individually.

The first important conclusion is that the asset class matters—equities are clear winners of that little backtest, and the riskier the basket, the more juiced up the 1dte is. This makes sense, as the market will ultimately demand a higher premium for small and medium-sized companies more likely to go bankrupt and suffer in an economic downturn than blue chips in the SP500.

Now that we’ve said that, we haven’t really said anything yet. How did that trade go in 2024, when we alternated from a very low volatility regime to a more neutral stance and a few periods of high stress? For the rest of the article, we switch to the 0dte universe, entering at 9:35 a.m. but still closing it at 3:45 p.m.

The least we can say is that it wasn’t a fantastic year for 0dte gamblers traders. The first part of the year was a slow grind-up without any clear direction or edge. Yes, there is some strong seasonality—Mondays or Fridays seem to be okay days to venture into that space, while Thursdays and Tuesdays are questionable.

A more clean-cut phase appeared after the big spike in August and the weeks before the US election.

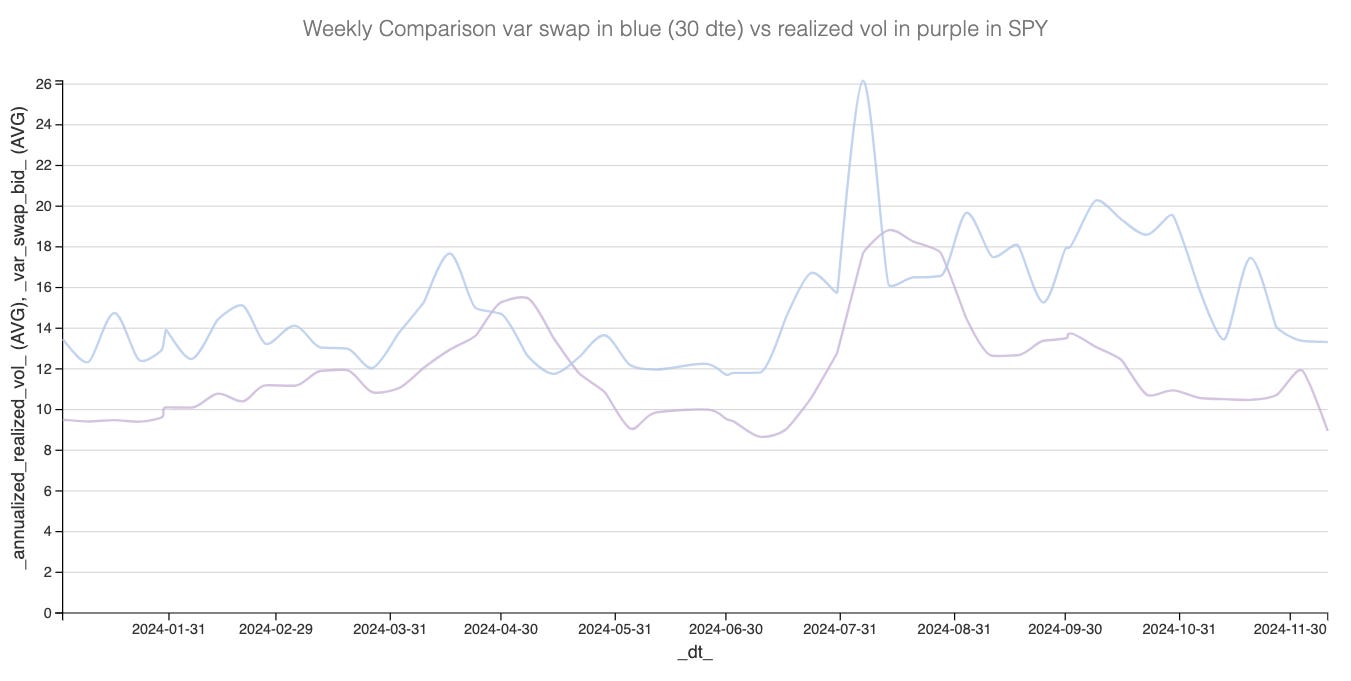

Even if it is always easier in retrospect to highlight the should-haves and the would-haves of the year, this was the moment where the Variance Risk Premium in SPY was by far the most pronounced: VIX regularly hovered above 18, and we barely realized 12 in the index. If trading is about calculated risk, this was the moment to pounce.

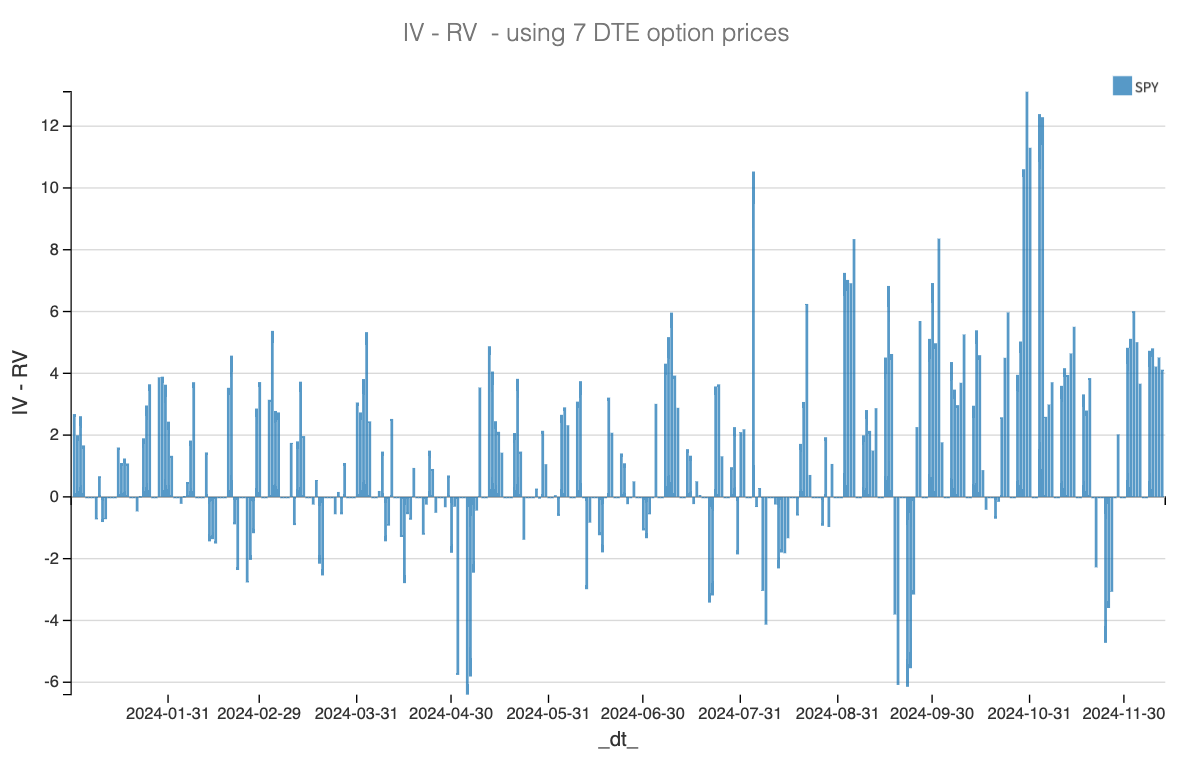

It also translated well into shorter expirations. Here is a view of SPY's 7-day variance risk premium. There are two distinguishable regimes: before August and after. After August, the market was still burnt from the spike to 65 in VIX, so the 7-day premium skyrocketed. While the VRP did turn out meaningfully negative on a few occasions, it’s been above 2 full points for most of the last five months.

Since the election, the VRP measure at 30 days to expiration has scaled back quite a bit, but we can’t say the same for the 7 dte. Considering how strong the VRP was, how did selling a 7 dte with no delta hedging go? Is it outperforming the okay-ish returns observed in the zero world?

Pretty well, when you keep in mind that there is no delta hedging in these backtests: the month of November saw a ferocious rally hurting the call side. But there was enough room to make money if you managed your delta exposure without the stress of 0-day options.

That is our main message for this end-of-year 2024: take a step back. Breathe. Relaxed. There is really no reason to burn capital in fees and high stress in 0 dte. A data-driven approach will improve your performance, but fighting the market when there is little evidence that you have a consistent advantage usually doesn’t end well.

Remember: it’s not because we occasionally hear these extraordinary stories (verified or not) about people making a killing in these products that you ought to do the same.

There are simpler ways to make money.

If you are not subscribed yet, here is a 46% discount until the end of the year and the story to justify it.

In other news

There are a few spots available in the Discord group. It is a paid community ($99 a month), and if you are interested, please let me know, and I will share the details.

Why am I opening a few spots? It’s been an absolute blast doing it this year. Not only do I get to make new, meaningful connections with other people passionate about the markets worldwide, but I also learn a lot from acting as the “senior trader” in the group, showing old tricks and answering questions to less experienced yet highly motivated people.

What to expect? No course. No education. No technical analysis. No stop loss (wouhouu spooky spooky). Obviously, no wheeling and minimal directional exposure. Theta has been mentioned only 25 times since the group's inception in early 2024.

How do we make money, then? The trades are based on volatility analysis and the research I publish. There are also other strategies that a weekly newsletter cannot adequately express. We have a good mix of professionals and retail traders, some of whom have a day-to-day job, making it a fantastic learning experience.

Thank you for staying with us until the end. As always, here are a couple of standout reads from last week:

Now that the Forbes 30 under 30 list has transitioned from a badge of genius to, let’s say, an interesting proxy for “creative accounting,” one can’t help but wonder: where are the Einsteins and Da Vincis of our time? In 2024, when education is cheaper and more accessible than ever, why don’t we see more revolutionary minds? Tomas Pueyo dives into this thought-provoking topic with a piece worth reading—and rereading.

Another publication on our regular reading list this year: AlphaPicks delivered a fantastic Year in Review. If you’ve been curious about the strategies and trades they executed in 2024, don’t miss it.

That’s all from us this week. Wishing you a fantastic (and hopefully uneventful FOMC) week ahead. And, as always, happy trading.

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.

Thanks, Ksander