Performance review 2024/12/01

+46% in six months and -46% on the subscription

A year ago, I launched Sharpe Two as a newsletter. It took off unexpectedly, and due to popular demand among the early readers, I created a small Discord group a few months later.

I kept the Discord group relatively quiet. Here's why: I'm a trader at heart, and when I don’t, I spend a fair amount of time in data analytics. Running a newsletter demands significant time and managing a Discord channel even more. Since trading remains my primary focus, expanding the Discord community as a one-person operation didn't make much sense.

The members often asked to see my actual trades. At first, I hesitated. Trading isn't financial advice, and what works for me—with constant monitoring, adjusting, and adapting—might not translate well to someone else's approach. There's no guarantee they'd have the same discipline or understand why certain decisions make sense in the moment.

But I soon realized this was precisely what retail traders needed. When I was on the trading floor as a 22-year-old, I learned a ton watching what the more experienced guys were doing, sometimes executing orders without truly understanding why. They were the knowledge gap between the smooth theory and the messy reality of the job.

The internet is flooded with education courses, proven methods, and magical indicators. I didn’t want Sharpe Two and this group to become another artifact of what sometimes makes the retail trading industry unreliable.

So, I decided to share. I was already logging my trades for business purposes. Why not document them as if I were managing a realistic $25k retail account?

Sharing trades proved incredibly valuable for the group. Watching some members steadily improve their P&L curves throughout the year has been incredibly rewarding. It also hurts deeply to see others lose money, but seeing them identify process failures and learn from mistakes helps everyone grow.

A final note before we start - paid subscribers can access the full dataset of trades. Please reach out, and I will pass it along. If you are not subscribed yet, here is a 46% discount (more on this later) for the end of the year.

The global performance

+46% in 6 months. There's some positive unrealized P&L from a few open positions, but let's ignore that now. This includes commissions, as I have implemented every single one of these trades (yes, with real money).

Before you either cry foul or start cheering, let's get real about percentages with small accounts. They can be misleading. You're forced to take risks that you would never take with a six-figure account, let alone a seven-figure one. You need to stay almost fully invested at all times... and without proper knowledge, one bad market swing can devastate your portfolio.

So take that 46% with a grain of salt: in real money terms, we went from $25k to $36.5k. And although I have taken every one of these trades, I didn’t have an actual $25k account to have a perfect replica of the experience. If (when) I reiterate the experience, I will start a controlled portfolio that can be followed over time, regardless of my own trading.

These returns didn't come from long-volatility trades. I'm actually mad about that one - we discussed it in the group back in May 2024. I got rid of some hedges in early July, thinking I could grab them cheaper during what was supposed to be a chill summer. Good job K. But I'll do better next time.

I took some hits over that summer, too, and later during the Middle East crisis or when China's economic "bazooka" turned out to be a dud (more on that later). Still, I stuck to the process and delivered solid profits without too much variance.

The rules

Before diving into the details, let's outline the key management rules that govern this challenge:

I use a maximum of 5 lots with MES for position sizing (more on that later)

For the other tickers, I trade just one straddle at a time.

I mostly traded straddles priced between 1 and 6 USD. There is no vega optimization here (I mean, chill out, guys... it's a 25k account). Instead, I try to capture similar premiums on average across trades. This approach has its limitations but also its advantages, especially when things blow up.

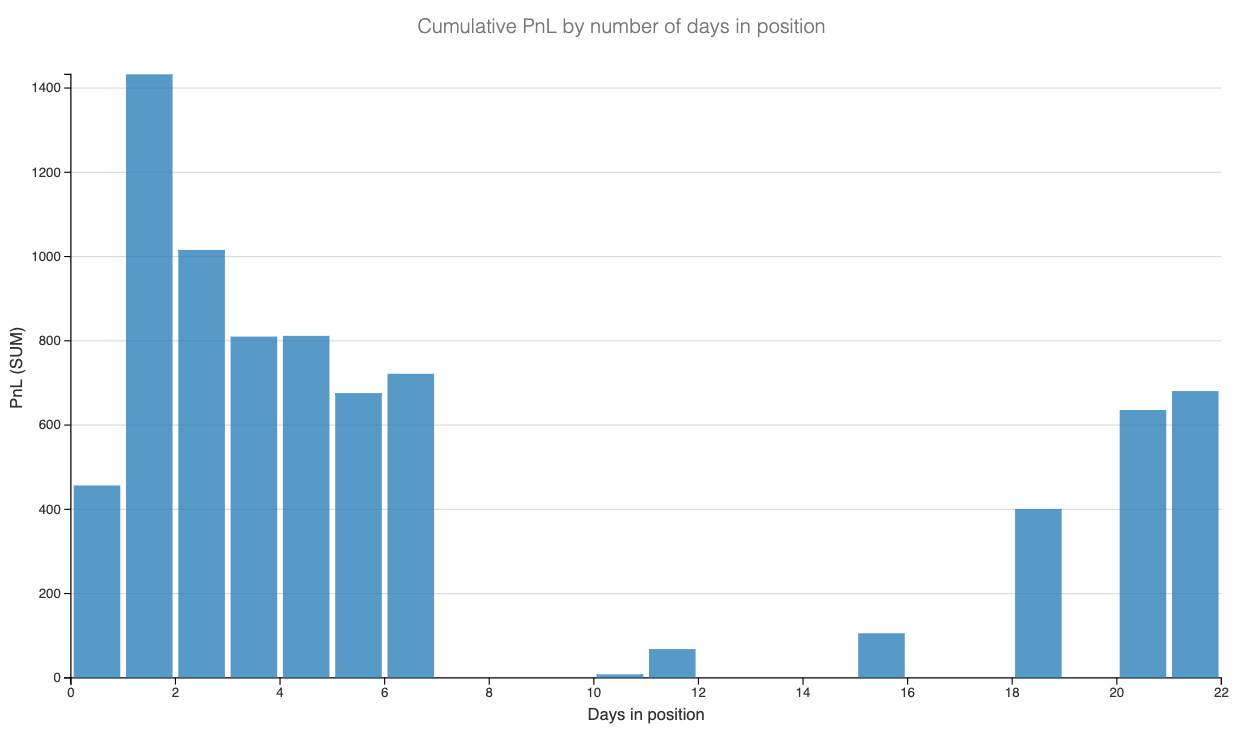

The positions have a two-week maximum hold time unless there's still a premium in the trade, and the data suggests taking another position. In that case, I keep it.

I might have breached these rules once or twice, but nothing that would get you fired by risk management on a trading desk.

Total number of trades

305 trades.

Some might say that's excessive. They may be right but here's my perspective: over the years, I've developed expertise in capturing a straightforward effect - implied volatility tends to be overpriced.

The business case becomes a careful balance between signal quality and position frequency to harvest this effect. It's like flipping a biased coin. If you know you'll win 55% of the time, why wouldn't you flip it as often as possible, regardless of who sits at your table?

Volatility trading demands frequency. It's a variance game. You need to trade small and often, like the house at a casino. And probably way smaller and more frequent than you think.

Let's break down the strategies:

Nearly half of these trades are VRP, with a third focused on VIX-related products.

The skew trades represent a strategy I've developed over time but haven't discussed much in the newsletter yet. That's changing in the coming weeks. Despite a rough start (what better baptism by fire than launching trades during a massive VIX spike?), the results look promising. The last time I was as excited about a strategy was when I found the overnight trade (more on this later).

Hedge MES positions are short futures I maintain. This is just my view, but I believe the best hedge against a market tank is… being short futures. Sure, you can get fancy with cheap puts, but you're still paying a premium. Why not sell that premium against short futures instead? That is exactly what I do with the covered puts in MES. As such, I always maintained the two to have minimal delta exposure, especially after the beginning of the neutral market volatility regime observed early in the summer.

That is a swift shift from the Equity Risk Premium (EQR) type of trades I used to put (mostly in June in that exercise but all of H1 2024) when volatility was nowhere to be found and expressed through Risk Reversals (RR).

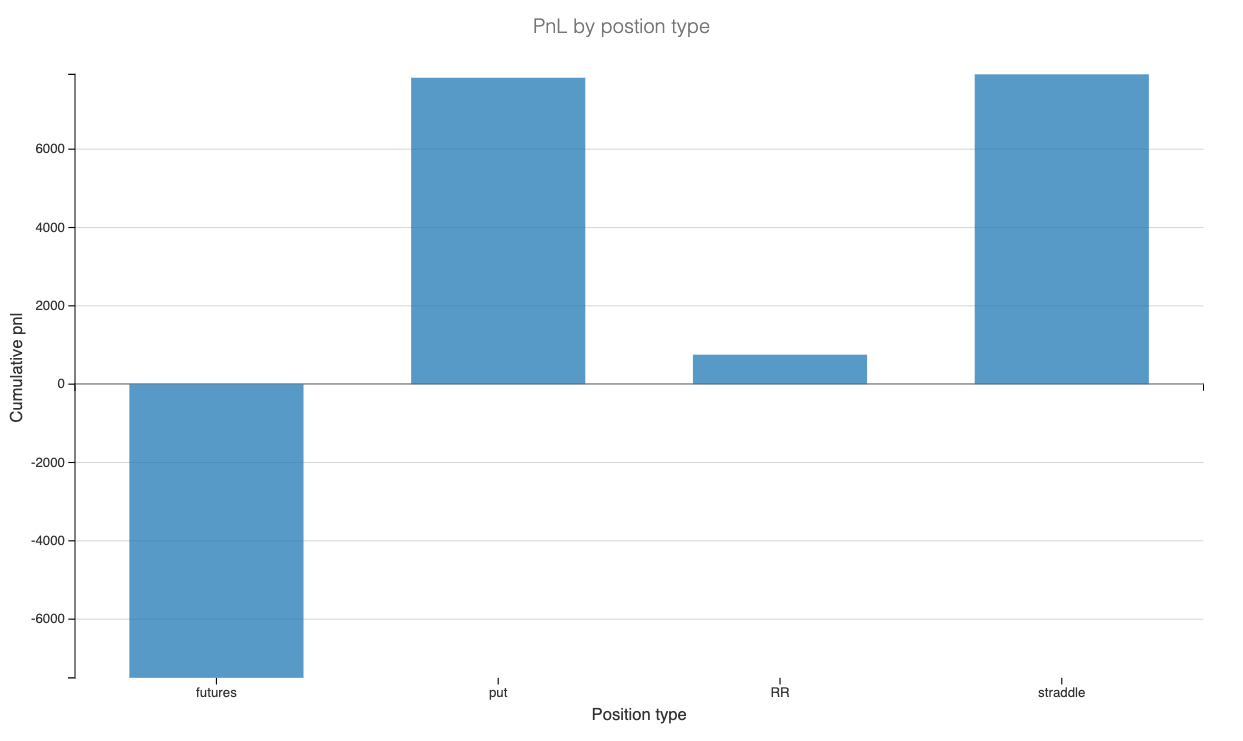

Let’s look at the breakdown of PnL per structure.

As expected, most of the pnl comes from the covered puts and the straddles, the primary (and almost exclusive) tool I used to capture the VRP.

The prevalence of good data and research

The quality of setups matters significantly in trading, and this is where being a data-focused trader pays off - 73% of trades were profitable during this period. But let's be clear: this success rate partly reflects the favorable regime since the end of summer. When VIX hovers above 18 while realized volatility sits in the 12-14 range and gradually decreases, it naturally boosts win rates and profitability.

In my broader trading experience with straddles, which I trade most frequently, the win rate typically runs just above 63%.

Strong data analysis and robust modeling techniques remain crucial for accurately gauging realized volatility against market implications.

Early Sharpe Two readers know I primarily used straddle prices to study VRP in the first half of the year. I'd compare these against actual underlying movement—a decent proxy for realized volatility, especially on 14-21-day timeframes. Traditional techniques (close-to-close, Parkinson, Garman-Klass, etc.) fall short here, as you often lack enough data for realized volatility to reach its true value.

Since May, I've switched to high-frequency data; the results are night and day.

Can you make money with the simpler method? Absolutely—I did for years. But as sophisticated methods proliferate and option edges get captured faster, it's becoming exponentially harder.

This is why it's worth investing in your data architecture to measure realized volatility more precisely. It's also worth studying classics like Corsi to move beyond GARCH methods for predicting future realized volatility. The pros have used these techniques for twenty years, and now retail traders have better access to them than ever.

Abnormal returns from special situations

Theory is important - it helps you understand what you're trading and where your profits come from. But theory alone rarely generates "abnormal" returns. This year's performance benefited from several special situations.

A significant portion of the P&L came from the overnight effect we discussed in April. VVIX proved to be an excellent indicator for identifying overpriced overnight implied volatility in ultra-short-dated options (1DTEs becoming 0DTEs overnight). With Euan Sinclair's classic weekend trade, this strategy generated $8k in P&L without excessive risk. The execution was consistent: sell 5 MES straddles just before close, then close positions the following open.

Did we take some scary losses? Sure. But overall, this was an extremely profitable trade. We're looking forward to deploying it again when VVIX gets volatile next year - which seems likely now that the Chief Agitator Officer is back in charge.

The bitter-sweet VRP trade

The VXX or UVXY straddle is another edge I've often discussed in the newsletter. Yes, VXX trends down, yet the short straddle trade has generated steady cash flow for years now. You'll occasionally take hard hits (like August 24), but stick to proper sizing, and you'll make solid returns. Our six-month experiment demonstrates exactly this.

Here's an important note particularly for those who dismiss this as a "dumb trade because VXX goes down": Our profits were abnormally high compared to the usual (already attractive) returns, thanks to market conditions since August. The backwardation - or at least flatness - in VIX futures made VXX and UVXY straddle excellent proxies for straddles in VIX and neutralized the typical downward drift we see in contango. Result? Calls paid out more than usual, much to our satisfaction.

Let's discuss what didn't work so well—a fair review demands it. VRP trades underperformed my usual expectations this year. It started well in June as a continuation of Q1, and the market regime changed.

But let's not blame market conditions - my approach often avoid delta hedging. It's typically costly and error-prone for retail traders, so I prefer setups where the edge is large enough to accept directional risk while remaining profitable.

This strategy hit its limits this year, and delta hedging would likely have improved performance. At the very least, recentering the trade at least once over the two-week holding period.

The worst trade of the year - ASHR

This year, our worst trade came from ASHR.

I’ve made money for years trading Chinese equities because they typically carry an inherent Chinese risk premium. The market often prices in uncertainty: we don’t fully understand what’s happening there, things are supposedly crumbling, and the ongoing trade war with the US doesn’t help build confidence.

So when a special situation presented itself at the end of September—a significant spike in volatility driven by macroeconomic announcements—I was optimistic. I sold straddles, confident in the pricing, and adjusted our deltas as the market climbed (recentering positions to avoid carrying overnight risk). But the trade turned south when the government failed to impress, and the market swung back.

Ironically, I’ve been skeptical about extreme bullishness in Chinese stocks for some time, a sentiment solidified after my trip to China in September. But as a volatility trader, you must set aside your macro convictions and avoid mixing trading styles. My aim here was to harvest a volatility premium, and I failed. I could have “saved the trade” by leaving the straddles in place, hoping the market would revert, leaning on my bearish macro view. If it worked, I might have claimed to be a genius—or, if it didn’t, turned a bad loss into a catastrophic one.

I always remind myself that when you think your worst-case scenario is unfolding, it likely hasn’t even started yet. You have two choices in these moments: stick to your approach or exit the trade entirely. Ultimately, what “saved” the day and mitigated the losses in this case was that Chinese equities stabilized, and the VRP ended up paying off, allowing me to recover some of the losses.

These situations are part of the business. Could I have handled it differently? Absolutely—perhaps avoiding the trade during China’s long holiday would have been wiser. But hindsight is always clearer. The key takeaway is that scenarios like this will inevitably happen. Your success depends on being mentally prepared, managing yourself as much as managing the position when things turn against you.

What’s next?

I’ll keep doing this little exercise because it’s genuinely enjoyable. More importantly, I’ve realized how useful it has been for the group, which makes me think it could also be valuable for a broader audience. I’m currently working on an extension of the newsletter to show retail traders how someone with a data-driven approach and trading floor experience manages options strategies—something a bit more sophisticated than “the wheel” or selling at 45 days and managing at 21.

I’m targeting a launch in the near future—perhaps January 2025—and I hope it will be both practical and useful for retail traders. From there, the sky’s the limit. While I’ll always be a trader first and foremost, Sharpe Two has shown me that I’ve grown into something more over the years. Helping others go the DIY route in trading is a meaningful goal for me, and achieving that requires embracing a strong entrepreneurial spirit.

Stay tuned and happy trading!

Don’t forget paid subscribers can access the full dataset of trades. Please reach out, and I will pass it along. If you are not subscribed yet, here is a 46% discount for the end of the year.

Ksander

is there a discord?