Blending IV Rank and VRP: A Path to Sharpe 2+ in Options Trading

'POP goes the straddle'

If you've been with Sharpe Two from the start, you may have noticed that we've never featured a technical analysis chart. Spoiler alert: that will never change. While we aim to add color to our analyses, artistic chart interpretations aren’t our style.

We don't believe in gaining an edge that way. While some may sell argue for their usefulness, we remain committed to our principles. Our approach is a blend of understanding current market dynamics and conducting detailed options price analytics — that will also never change.

Once we’ve grasped the current market narrative – whether it's Federal Reserve decisions, earnings reports, or fears of a recession – our inclination is usually towards short volatility strategies. It's a well-documented fact that options tend to be overpriced in financial markets. However, this doesn’t mean we never adopt a long volatility stance, as exemplified by our most recent Signal Du Jour. Generally, our preference lies where the edge is, and statistics show that selling straddles is profitable about 58% of the time.

And who doesn’t like to be right more often than not?

Definitely not us.

But do you know what we prefer a hundred times over being right?

A positive expectancy.

A high win rate doesn't necessarily translate to positive expectancy, a metric far more crucial than simply the probability of ending up in the money.

A high probability of profit is different from a positive expectancy.

The market is like the ultimate boss in an incredibly sophisticated and complex video game crafted by the peaks of human imagination. It serves as a melting pot of collective views, mirrored in its price action, rendering it (almost) perfectly efficient and notoriously challenging to outperform.

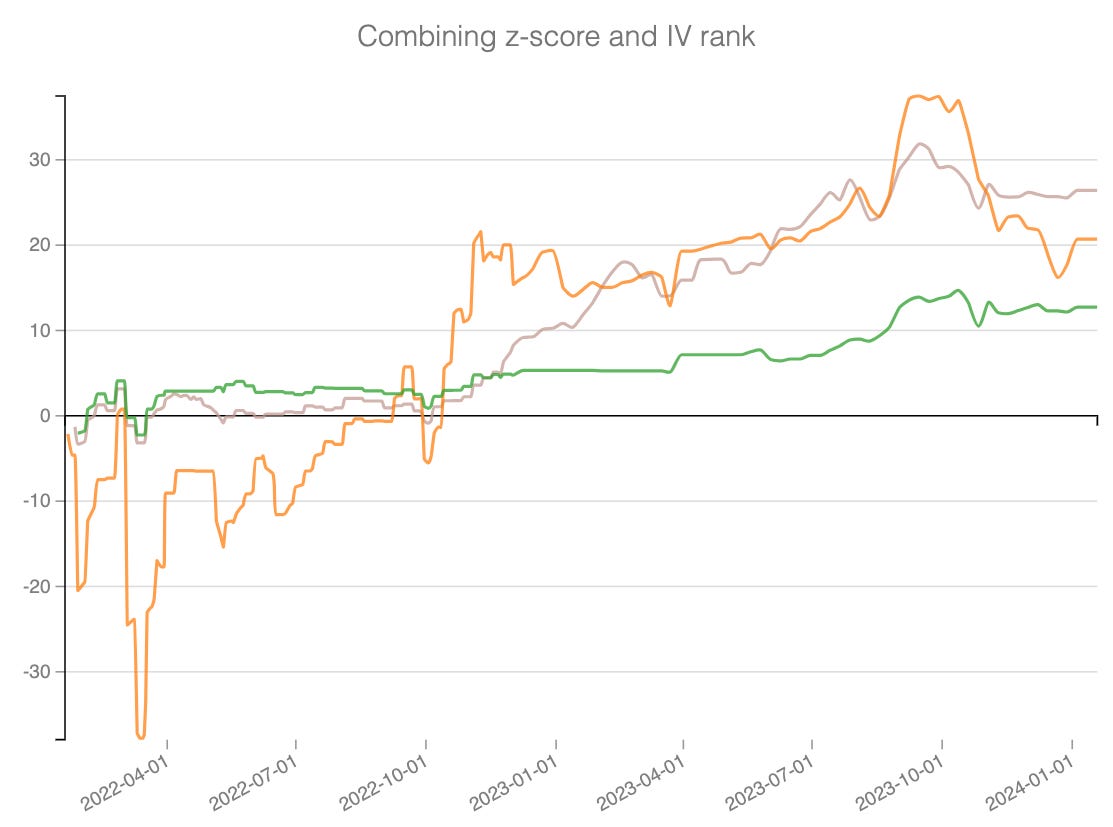

To illustrate this point, let's begin our exploration with a straightforward chart. It shows the performance of selling 28 Days to Expiration straddles across a diverse basket of ETFs. Our selection includes 60 ETFs covering a wide range – from U.S. and international equities to bonds, currencies, and commodities. There’s no secret sauce in this list; we simply focus on the largest ETFs to encompass as broad a scope as possible in terms of geography and asset class.

For our analysis to be meaningful, we've standardized our approach by assuming a $1 credit on each straddle sold, irrespective of the underlying asset. Additionally, we implement a rebalancing strategy every two weeks. This means we enter the trade at 28 DTE and exit at 14 DTE, subsequently initiating another straddle at 28 DTE.

Here are the results:

Since 2022, this strategy has shown a trend of breaking even – not making significant gains but not incurring substantial losses either.

This sideways pattern is a testament to the market's quasi-efficiency we mentioned earlier, reflected in an expectancy hovering around zero. While the win rate is about 58%, the average loss tends to be larger than the average win, making consistent profitability highly unlikely unless one is extremely lucky.

However, a closer examination of the chart reveals an intriguing pattern: the strategy seems to accumulate profits consistently for a period before suddenly surrendering all gains in a sharp downturn. This observation leads us to ponder: if we could sidestep these dramatic drawdowns, could the strategy actually perform relatively well? The crucial question now is, how can we effectively avoid these drawdowns?

The answer lies in a correct assessment of risk.

A gentle introduction to the variance risk premium

If you're a regular follower of our publications, you're aware that our data analysis typically begins by comparing the price of At-The-Money (ATM) straddles with the subsequent movement in the underlying asset.

This approach is a commonly employed technique among professionals to gauge volatility. It's often referred to as the Variance Risk Premium (VRP) in the literature. For those seeking an in-depth understanding of VRP, we highly recommend the works of Euan Sinclair. His studies, which we discovered a decade ago, have been a significant source of inspiration for our work here at Sharpe Two.

In practical terms, we take the current price of a straddle for a given maturity and compare it to the average subsequent movement in the underlying asset. We then construct a rolling z-score, typically over a three-month period, to ensure it reflects recent market data and to simplify interpretation over time. For the purposes of this study, we'll refer to this metric as zscore_vrp_avg.

However, the method we've described isn't the only way to measure the Variance Risk Premium (VRP), and this is often where some traders find their 'secret sauce.' For instance, we've observed some practitioners take an average of the VRP over time and compare it to its current value.

While these varying approaches yield slightly different insights, they all converge on one crucial point: assessing the premium that market participants demand for holding insurance contracts in the underlying asset. Understanding this premium is vital for informed trading decisions.

Let's step back from the market momentarily and consider the perspective of an insurance provider.

Imagine you’re about to write an insurance contract for Dylan, who's planning a road trip from New York to Miami for spring break. Before issuing a quote for this contract, wouldn’t you want to know the frequency of car accidents among young male drivers?

This same principle applies to options trading; informed decisions are only possible with a comprehensive understanding of the risks in the underlying asset.

To illustrate this concept, let's add to our previous chart the average of 'zscore_vrp_avg' across our entire ETF universe.

Without delving into any mathematics, two clear patterns emerge from our chart:

The average zscore_vrp_avg tends to dip into the negative just before we witness significant drawdowns in our basic strategy.

There appears to be a correlation between the consistency of our results and the stability of the z-score. Notably, up until the end of 2022, both the P&L and zscore_vrp_avg exhibit numerous fluctuations, while post-2023, these 'wavelets' seem to smooth out.

In this article, we'll primarily focus on the first observation, leaving the second for a detailed exploration in a follow-up piece.

The occurrence of drawdowns during periods when zscore_vrp_avg is negative aligns logically with our expectations. It indicates that the pricing of the straddle wasn't sufficiently high to account for the actual movements realized in the underlying asset.

This typically happens during periods of escalating volatility, such as in September 2022 or during the regional banking crisis in March 2023. Interestingly, it can also occur during significant market rallies, as we saw at the end of 2023.

An immediate enhancement to this strategy, therefore, would be to only sell the straddle when the z-score for any of our 60 ETFs is above 1, choosing to stay on the sidelines otherwise.

This approach significantly enhances the strategy, laying the groundwork for a more robust method.

However, we also recognize that accurately measuring price movements in the underlying can be complex and time-consuming, necessitating both dedication and/or some more advanced technological infrastructure, usually the playing fields of professionals.

This complexity has led to the popularity of a simpler, less labor-intensive technique among retail traders — Implied Volatility Ranking, or IV Rank. Now, let's delve into a comparative analysis of their performances to see how they stack up against each other.

Variance Risk Premium or IV Rank?

IV Rank is a methodology that ranks the observed Implied Volatility (IV) for a given underlying asset. It's used to determine when IV was relatively expensive or cheap compared to its own history.

To continue with our insurance analogy, it’s akin to pricing a contract for Dylan, not based on the recent frequency of car accidents among young males, but rather by examining the past six months of pricing data from competitors. This method, while acceptable, overlooks the recent market context, a factor that is often reflected in the performance of such a strategy.

Let's take a step back to explain our ranking methodology in more detail. Instead of focusing directly on IV, we've chosen to work with the prices of 28 DTE straddles, ranking them against their own performance over the past three months. Based on this analysis, we then opt to sell a straddle only if its rank is above 50.

While both strategies yield similar results, they differ significantly in their risk profiles. Relying solely on IV Rank to make trading decisions often leads to greater variation and more pronounced drawdowns. We're not advising against using IV Rank; rather, we aim to highlight a potential blind spot in this approach.

As a matter of fact, we can build some intuition as to why the IV Rank has more volatile returns. It does have a significant flow compared to the VRP - it assumes that the price of straddles always overshoots their subsequent movement, which is a grotesque mistake.

Traders often get caught off guard by unexpected moves in the underlying, regardless how how expensive the straddle was in the first place.

In fact, some survivorship bias should intuitively lead us to be more cautious when IV is expensive — the market isn’t quoting a high price for no reason, and in situations of high stress, that is often because it is quite difficult to have a correct assessment of the magnitude of the movement. Therefore, one shouldn’t be surprised to see it getting worse before it gets better.

That being said, both approaches have their merits and complement one another nicely, so much so that wonders happen when you combine them.

Let's explore this further.

The caveat of this approach is that it results in fewer trades. However, the trade-off is a significant reduction in the volatility of your returns, boosting your Sharpe ratio much closer to 2.

Conclusion

Ultimately, the way you choose to position yourself in the options market should align with your personal risk tolerance and trading objectives. If options trading is more of a recreational pursuit for you, akin to gambling, then indulging in speculative puts and calls can be entertaining. We acknowledge the thrill, but it’s crucial to ensure it doesn’t evolve into a costly habit - yes, 0DTE degens, we are looking at you.

For those aiming to grow their account, utilizing IV Rank across a diverse range of assets is a commendable strategy. It's important to assign equal notional exposure to all positions to balance your wins and losses. Failing to do so can skew your performance, making it susceptible to the whims of 'expensive' underlying and altering your risk profile.

For traders focused on account growth while minimizing return volatility, incorporating the difference between straddle prices and subsequent moves in the underlying is essential. Further enhancing this strategy by combining it with IV Rank can lead to a high Sharpe ratio strategy, optimizing both risk and return.

Be sure to follow us on Twitter @Sharpe__Two for more of our insights. If our work resonates with you, don't hesitate to share it with others who might find it helpful.

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.