Forward Note - 2024/01/21

The cricket having sung all summer along ...

This week has been a milestone for Sharpe Two. Not only did we break the 100-follower barrier, but we have soared past 150, now proudly standing at 182 subscribers as I publish this Forward Note. A sincere thank you goes out to each and every one of you for your incredible support. A special shoutout to those who have been sharing and liking our articles - your efforts have significantly boosted our visibility. And to our valued paying subscribers, your continued engagement and feedback are deeply appreciated.

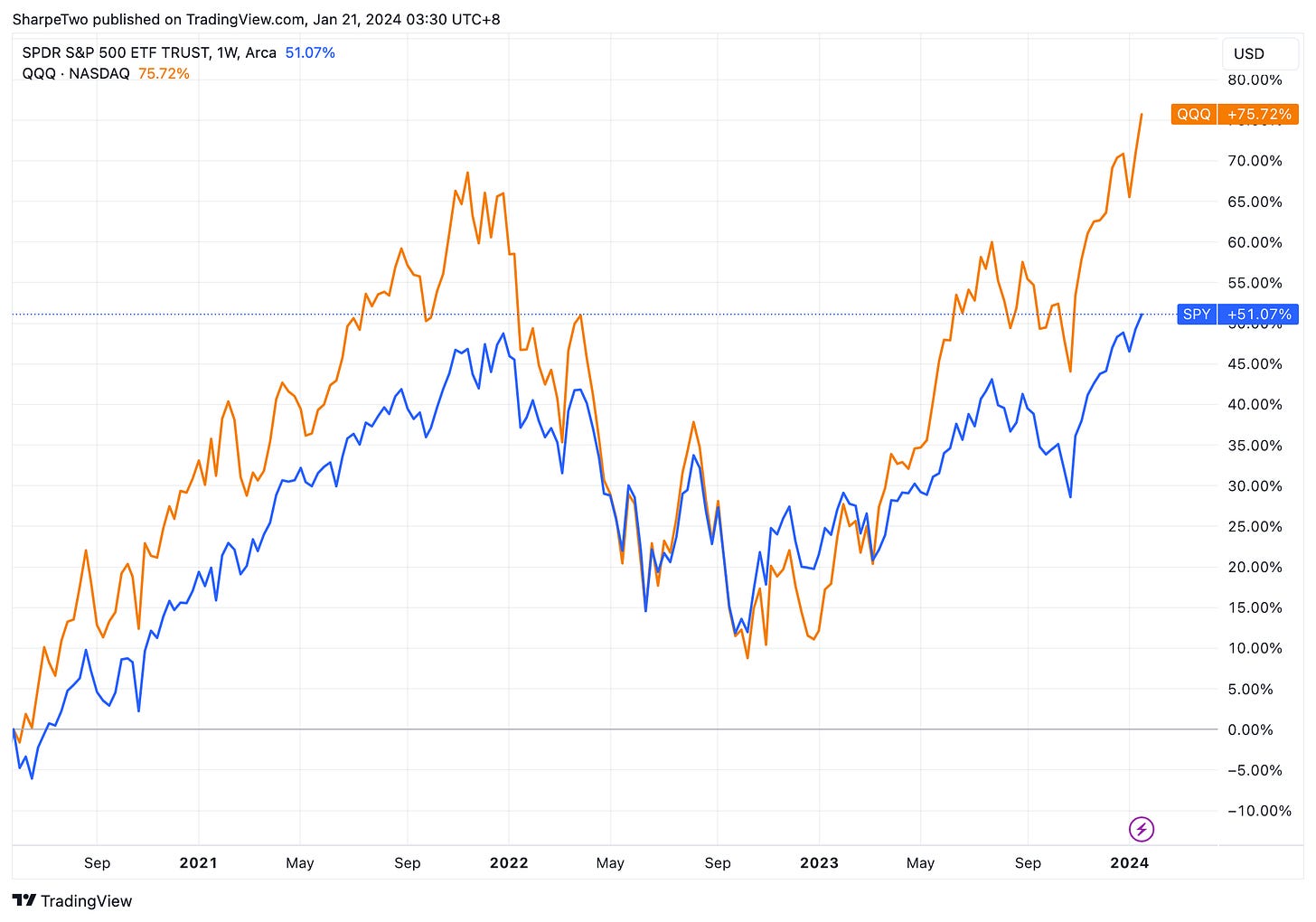

What an exhilarating week it's been in the equity markets! We've witnessed new all-time highs, breaking records that stood unchallenged for two years when the last bear market started, and the raging fight against inflation was only eclipsed by the war between Ukraine and Russia.

Social media have been buzzing with a blend of emotions: from those who boldly invested during the challenging times of October 2022 to others lamenting missed opportunities like snapping up META at $100, it didn’t leave anyone unphased.

Well, except the perma-pessimistic macro analysts continuing to sip on a glass half empty. Sure, every economy faces challenges (yes, we're looking at you, China – more on that shortly), but right now, the US seems fine.

Here is a recap of the key numbers from the past week:

Retail sales surged at 0.6%, surpassing expectations of 0.4%

The Michigan Consumer Sentiment Index hit 78.8, above the expected 70.

This is the highest mark since July 2021, a period when inflation was skyrocketing, and morale was in free fall.

So, what would you call an economy where people are employed, spending money, and optimistic about the future?

Regardless of personal perspective, the consensus among most professional investors is clear: it's tough to bet against an economy that's outperforming expectations.

Not even Raphael Bostic's remarks on Thursday could dampen the market's spirit. The Fed official hinted at a possible rate hike only in the third quarter of 2024, causing a brief sell-off. However, the market quickly shrugged it off and continued its upward trajectory.

In what could be seen as a moment of rational restraint amidst the general market euphoria, the likelihood of a rate cut in March was recalibrated to a 50/50 chance, and the total number of cuts for the year went down from six to five.

So, what does this tell us?

The market may have its irrational moments, but it's quick to adapt to new information, making it a tough bookmaker to beat.

Despite periodic bouts of anxiety, such as the one induced by Powell's firm stance in Q3 2023, the market has consistently been a step ahead of the Fed, often with correct anticipations.

These two points underscore once more the power of collective intelligence. The market, as a melting pot of diverse opinions and analyses, has been doing a great job at going beyond the Fed’s narrative and interpreting it in a broader economic context.

“Inflation back on the rise? We don't see it coming, and until proven otherwise, Jay P, we’ll buy.” - April 2023

“A labor market collapse? We doubt it, and until proven otherwise, Jay P, we’ll keep buying.” - July 2023

“Another rate hike? The economy doesn't seem to warrant it, and until proven otherwise, Jay P, we’ll buy some more.” - October 2023

“As for those rate cuts, we're betting they'll come sooner than later. And until proven otherwise, Jay P, we’ll dance on all-time highs.” - January 2024

The Fed communication has been a tricky affair lately. As we enter a new market regime where the plane is actually landing softly (read the excellent Claudia Sahm on the subject), it has a diminishing impact on market movements.

Speaking of market regimes, with recent all-time highs, many might wonder if it's not too late to join the WallStreetPlayboys and their celebratory free-flow Sunday brunch.

The key distinction between professional investors and retail traders often lies in their approach to risk management. This past week, while the crowd was fixated on NVDA's 20% jump year to date (!!!) and TSLA's 15% decline (!!!), astute observers noted intriguing activity in VIX contracts.

Twitter was buzzing with excitement: 'Big players are buying VIX calls; the market crash must be imminent, right?'

The typical retail trader's mistake is to see signs of a crash everywhere. What's more likely? Savvy fund managers spotted discounted insurance in the marketplace and seized the opportunity. 'Better safe than sorry' is a prudent mantra.

And why not secure a cheap hedge? Our current implied volatility regime indicates risk anticipations are at their lowest levels, precisely as we enter the meatier part of the year, with key events like next week's GDP number and the year's first FOMC meeting at the end of the month.

The market assigns a low probability of violent and unexpected crashes, and it's probably correct. However, it might be off in overestimating the likelihood for the current mood to prevail.

When investors and speculators buy protection here, they are simply saying the odds are a little too skewed toward the dominant view, and it’s a good bet to expect some mean-reversion.

We tend to agree, and a glance at the Fear and Greed index supports this narrative. With high levels of greed in the market, a shift in sentiment is likely once new information emerges.

The adage from the Oracle of Omaha, 'Be greedy when others are fearful, and cautious when others are greedy,' is once again timely. Or reusing a wildly famous French poem - in summer, be the ant, not the cricket.

In other news

First off, a heartfelt apology for the mix-up last week – yes, we mistakenly swapped the American and Chinese flags when looking at in coming GDP data. It's a blunder we're not proud of, but thanks to eagle-eyed Jack for pointing it out.

Turning our gaze to Beijing, the economic horizon looks increasingly murky. China's GDP growth slowed to 5.2%, and more alarmingly, exports declined last year for the first time since 2016. So much for what should have been a big bang year, as Covid measures were thrown away. Add the looming real estate crisis to the mix, and it's a concoction of challenges that's understandably spooking investors; Chinese stocks are already down 7% year-to-date.

Wondering where these money flows pushing the Nasdaq higher and higher were coming from? There may be some element of the answer.

Further amplifying concerns, China’s biggest broker has clamped down on short selling – rarely a sign of confidence for investors. It's a tough end of the year for the Rabbit, and we can only hope the Dragon will bring better prospects in 2024.

Thank you for staying with us until the end. Before you go, here are some interesting reads from last week:

With everyone poking fun at ChatGPT’s math skills, DeepMind throws its hat into the ring, claiming its model could rival the world’s best at the Math Olympiad. We’ve participated (not very successfully) in 2005 and can only vet for how impressive that performance is. Tough time to bet against the semiconductor sector.

A Financial Times piece skillfully captures Dubai's emerging role in the eastward shift of the world's economic center.

Finally, if you’ve missed it, we talked at length about the VIX nature this week, and we don’t believe it’s broken.

That's it - wishing everyone a fantastic week ahead, and as always, happy trading!

Ksander