Volatility Isn’t a Vibe: It’s a Process

Removing guess work from your decision matrix.

Most traders do not lose money because they lack “a strategy.” In fact, everyone has a strategy these days; the wheel, CSPs, covered calls, or the good old “little strategy that works for me”. The real issue is that most of these “frameworks” are descriptive, not predictive. They tell you what the market looks like, not what the market is likely to do next.

And trading is, whether people like it or not, a prediction game. Descriptive analytics can help you understand the environment, but they rarely tell you whether a trade has edge. Staring at twenty indicators hoping one of them is whispering the truth is not a strategy. And when a trade goes wrong, blaming timing, sentiment, gamma, or the Fed is not a path to consistency; it is a way to avoid learning from what actually happened.

Meanwhile, professional volatility desks use the same routine every day:

measure the regime → identify mispricing → structure the trade.

Nothing mystical. Nothing complicated. Just discipline and data.

We did not build Sharpe Two “for the people.”

We built it for ourselves first. We are building a trading house, and to be successful in our own trading we needed systems that made sense: managing the data, the models, the pipelines, the full analytics stack is impossible to do manually while trading full-time. The platform is just the visible part; the frontend that makes our own idea generation faster, cleaner, and less error-prone.

Once we realised how hard it is for anyone to even reach a baseline of clarity, we opened it up. Most traders never get access to the real trade-discovery workflow. They get tools that dump information on them, not tools that guide them. They get charts, not probabilities. They get “education,” not a decision process.

The principles behind Sharpe Two are straightforward:

Answer in 30 seconds: what is the trade right now and how do we make money today?

Every trade must be probability-based so you can compare setups consistently.

Every model must be explainable so your understanding compounds over time.

Once you have that, trading becomes an execution problem.

Cyber Monday is usually about discounts but to make it worthwile, we will give a view on our daily routine at the office to find trades in the platform.

The Sharpe Two Framework

Retail traders rarely see how vol traders find edge. It is not about vibes, gamma walls, or whether someone on Twitter screams “crash.” It is a routine. A fixed order of operations. Once you follow it, trading becomes boring — in a good way.

Sharpe Two uses the same three-step logic institutions use daily.

Step 1 — Classify the Volatility Regime

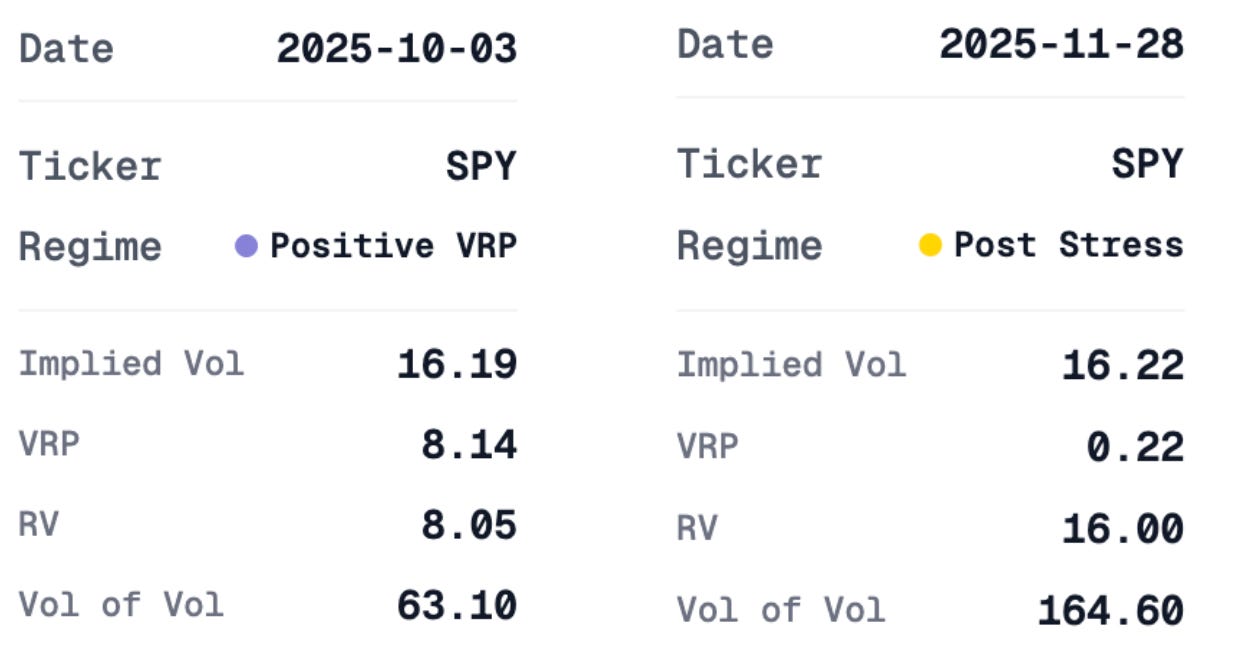

This is the starting point. A VIX at 16 today is not the same as a VIX at 16 two months ago. A VIX at 16 with RV at 12 and vol-of-vol at 60 is a completely different animal from a VIX at 18 with RV at 14 and vol-of-vol at 160.

One is stable premium; the other is a landmine.

Humans cannot integrate 50+ volatility features in their heads. Models can. That is why we feed the entire surface (RV, smoothed IV, vol-of-vol, forward structure, skew curvature, cross-asset risk) into a classifier that identifies the actual regime and what it implies for strike, DTE, and sizing.

Every single decision comes from the regime first.

Step 2 — Probability-First Variance Risk Premium Harvesting

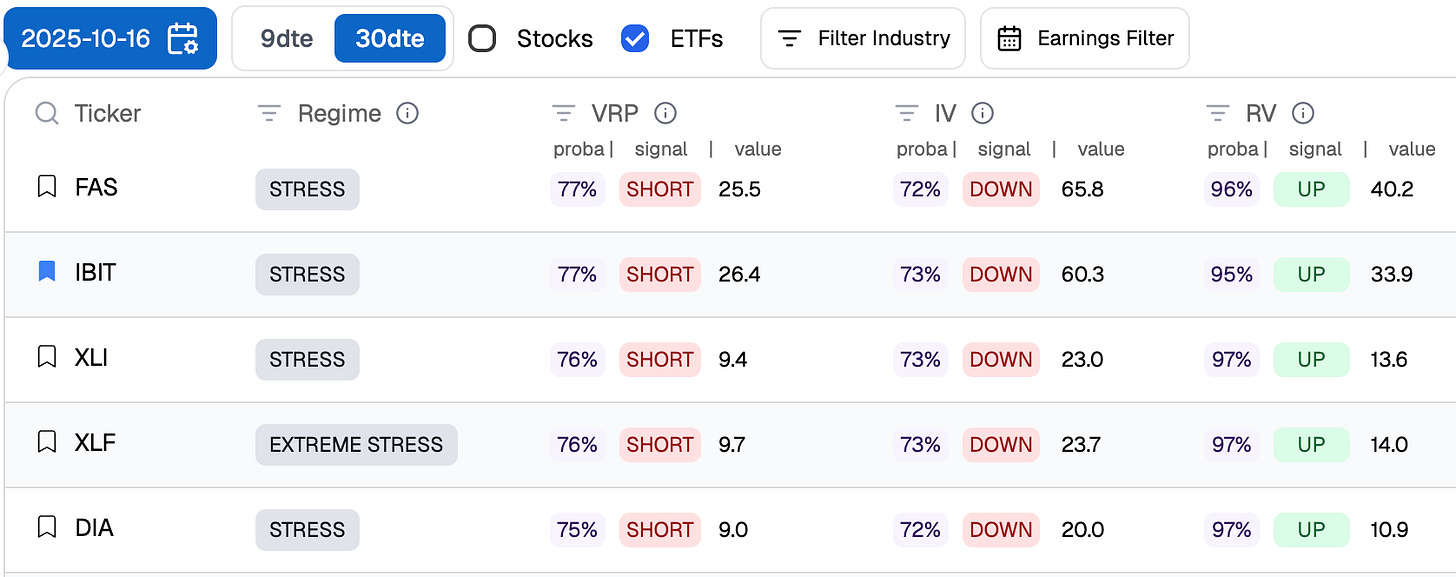

After the regime, you measure whether the market is overpricing or underpricing risk. Most platforms stop at the overly simplistic version:

Implied Volatility > Realized Volatility → sell

Implied Volatility < Realized Volatility → buy

Sometimes they slap a z-score on top and call it analysis. But variance risk premium without context is meaningless.

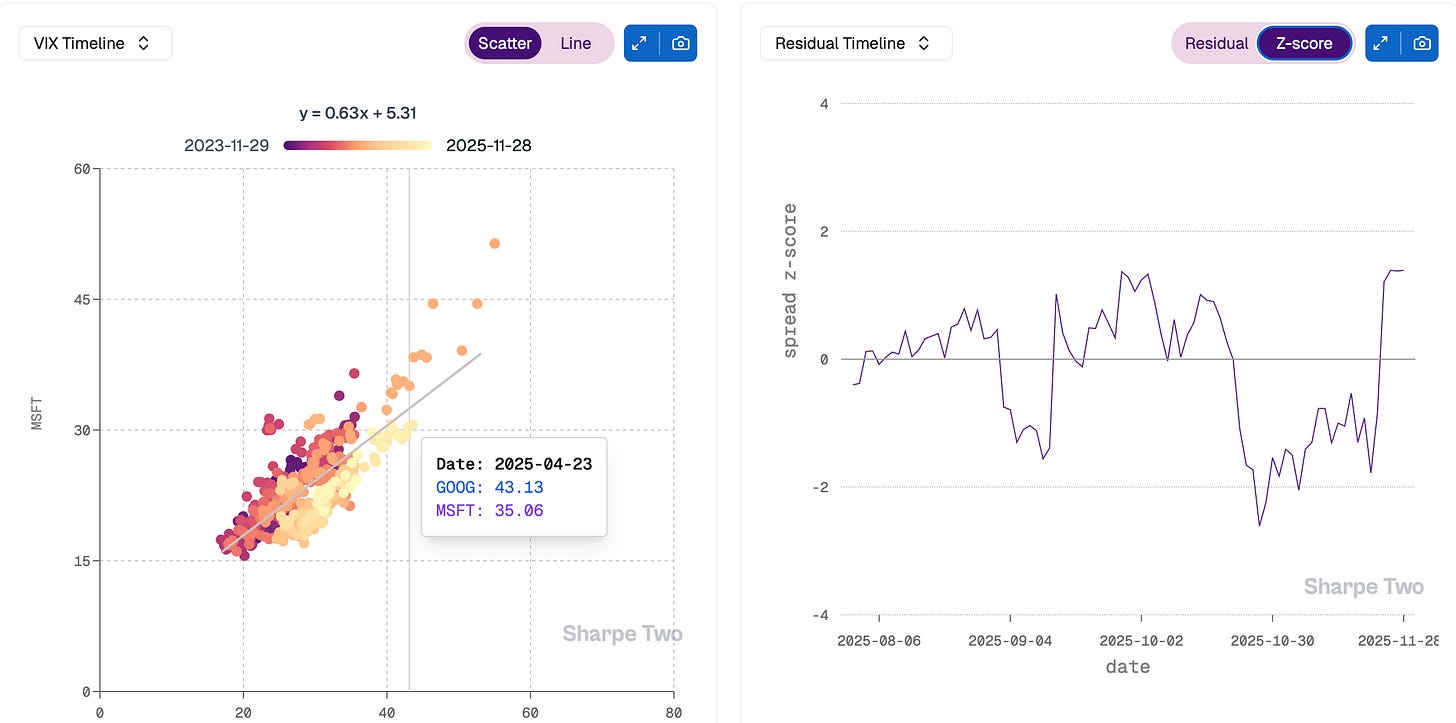

This is why we built a probability model that reads the full space: IV-RV spread, term-structure shape, forward vol ratios, vol-of-vol, inter-index correlations, skew tension, tail expectation.

All of this collapses into one clean output:

“What is the probability that implied volatility will exceed realized volatility over your trading horizon?”

This is the question you should ask every day.

This is the question our models answer.

This is the question that drives all profitable variance premium harvesting.

People talk about conviction in their analysis.

Probability is conviction.

For instance, our morning routine is about focusing on the ETF where the odds to see implied volatility exceed the subsequent realized volatility above 66%. We then arbitrage between the different ideas based on what we already have in portfolio, the current narrative in the market place, and liquidity between tickers.

Step 3 — Forward Vol, Skew, and Dislocations

This is where active traders find risk-defined, institutional-style structures. Forward vol dislocations help you build: diagonals where skew is stretched or calendars where carry pays for theta risk or cross-ticker relative value spreads.

This is not cute complexity. This is how you can structure risk defined trade whatever the regime you are in.

And Sharpe Two highlights these dislocations automatically. You decide whether today is a simple VRP trade or a day for something more structured — and how to size it.

The Results

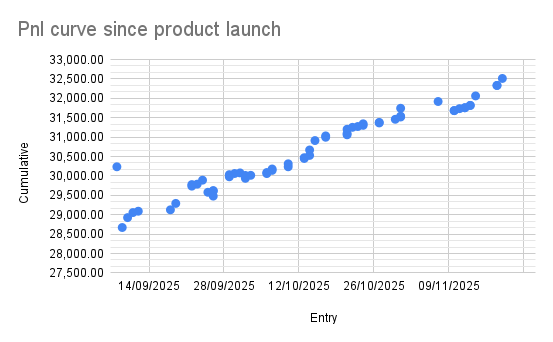

Since the product launch, we’ve been logging trades with our Discord group and here are the results

roughly 50 short-premium trades

~90% win rate

Sharpe above 3

These results align with our backtest and the in depth analysis some members have done of our database of past signals. That is the beauty of being 100% data driven in the idea generation: we can always revisit and assess how we would have performed in a specific environment.

Trading can still be stressful; especially when VIX is at 25 and you know it could hit 40 in a blink; but when done right it becomes predictable and repetitive.

Just like all the Signal du Jour entries and PnL attributions we publish.

Regime → probability → structure → exit.

If You Want One Framework You Can Actually Commit To

Sharpe Two gives you the same process used on prop desks. Most importantly, you get access to the Discord, where you can see which setups we focus on, ask questions, and slowly make your own decision process automatic.

Cyber Monday is the lowest price we offer.

If you want professional volatility tooling, without the five-year build process, now is the time and we can’t wait to see you inside.