Signal Du Jour - Short Vol in US equities

Two hurdles down, one last with the NFP.

NVDA managed to surprise again to the upside, and we learnt that the Fed was split. That was enough to ease some of the pressure from the past few weeks, with markets finally finding their footing yesterday and setting up, so far at least, for a very green day. One hurdle remains before we roll into Thanksgiving week: NFP right before the open.

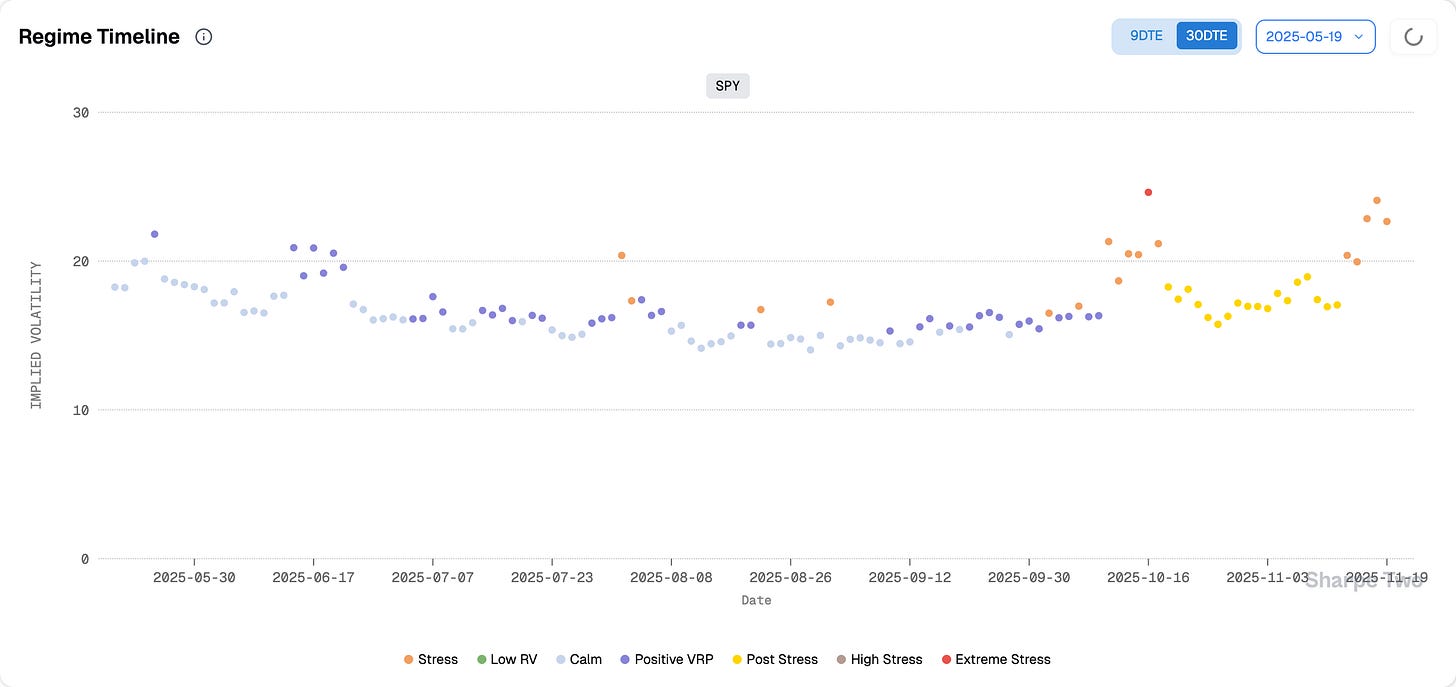

We have read everything over the last few days, from the wildest AI takes to the familiar “the economy is cooked” chorus. As we wrote on Sunday, the noise is reaching its yearly peak; that is perfect for anyone avoiding direction. When bulls and bears disagree this violently, options get bid to levels that look almost absurd relative to the actual movement we are seeing.

Before we move any further, let us be clear about one thing: we are not saying things cannot break over the next 24 or 48 hours, or even in the coming weeks. But if you buy options here, you do not just need a move, you need a fracture for the trade to pay. Otherwise, time is not on your side.

Let us have a look.

The context

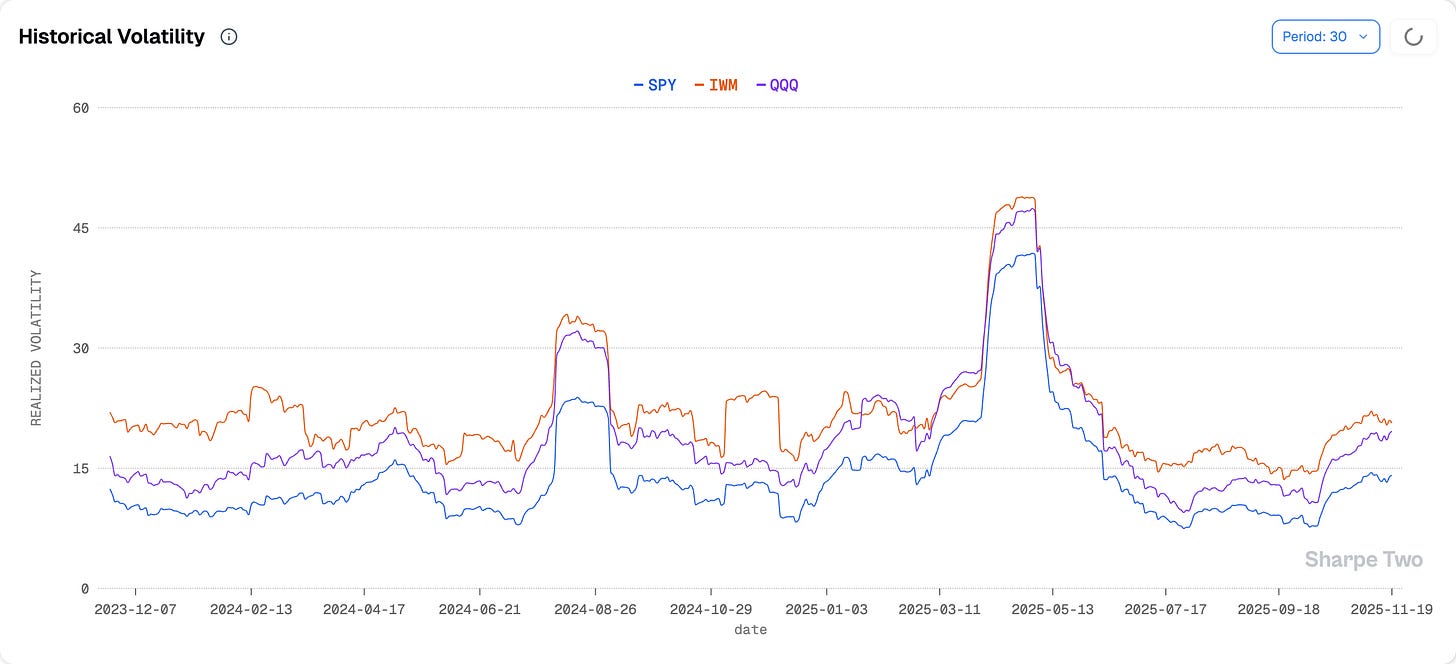

It took a while for the market to shake off its summer torpor. After an intense end of Q1 and Q2, with tariff wars and nuclear facilities being bombed, the market took a much-needed breather and extended it well into early October, long past the usual back-to-business mood of September.

However, since then, realized volatility has been trending higher, almost doubling from the extremely low and unusual 7.5% we saw at the end of September, right after an FOMC where two rate cuts by year-end were basically a given.

Fast forward six weeks, and that certitude evaporated. A surprisingly hawkish Powell threw cold water on the entire marketplace. Add the usual froth around AI valuations, a few wild theories about “legendary” investors, and the current backdrop has been stressed to say the least.

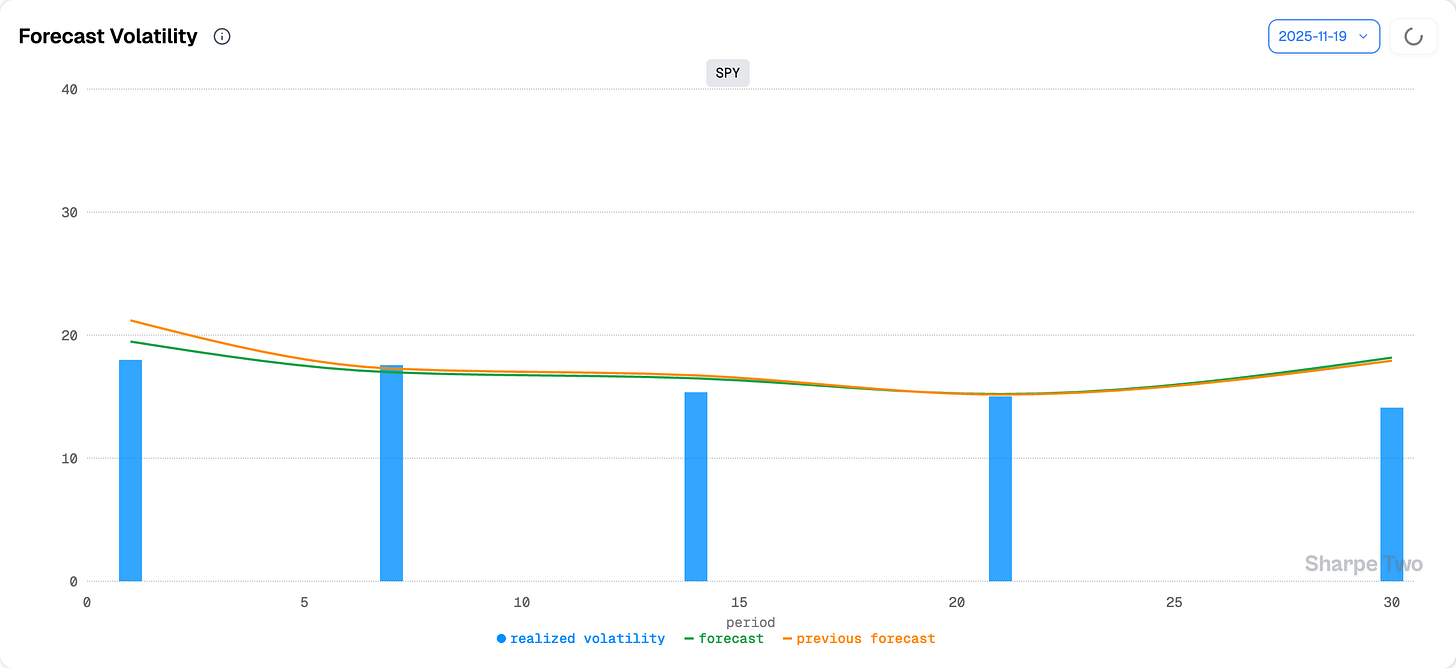

Selling volatility does not mean being oblivious to risk or pretending nothing can happen. When the market is stressed, it is usually because perceptions of risk far outweigh the number of people betting on stability and you always pay attention to that. But staying agnostic to direction keeps us focused on one thing only: realized volatility, and where we think it will go over the next few weeks.

Currently sitting just under 15, realized volatility could easily push toward 18 if a bit of calm does not return to the marketplace. The next few sessions will therefore matter for our perception of risk, but also for gauging our margin of error. If you sell VIX at 20 and expect realized volatility to reach 18, that cushion gets thinner by the day, and sizing becomes more important than ever. Sometimes the right decision is to stay out, even when prices look tempting.

Let us now look at the options market to see how we want to structure a trade in the current environment.