Trade Anatomy - Short Vol in XLF

Post mortem Signal Du Jour - 2025/10/09

Two weeks ago, we presented a short volatility trade in XLF, betting on inflated implied volatility ahead of earnings. Instead, we found ourselves short vol in a market where implied kept rising, sometimes to uncomfortable levels. If VIX at 16 tells you everything you need to know, you should also pay attention when it starts settling comfortably around 25.

In the end, volatility did what it usually does: it mean-reverted, and the position ended up making money — bringing our series to 7 out of 7. Now the real question: was it luck? When you survive a spike, the answer is obvious — yes — because, first and foremost, we were wrong.

But you can still be wrong and make money in options trading. When that happens, enjoy it. Because there will also be times when you are right and still lose money — that is the reality of the variance game.

What matters is that the conditions under which you struck the trade were favorable and that you let the law of probabilities play out. Options trading is an insurance business, and therefore a margin business: the more margin you sell upfront, the more room you leave for error — and for situations to potentially correct themselves over time.

Let’s have a look.

The trade

In our Signal du Jour from two weeks ago, we highlighted an opportunity in the 51/57 Nov 21 strangle on XLF. At the time, the market gave little hint of the frenzy that would erupt barely 48 hours later and last a full week. Our objective was straightforward: harvest the variance risk premium, inflated as banks prepared to report earnings.

Back then, our signals indicated a 74% chance that implied volatility sold around 30 DTE would exceed the subsequent realized volatility — in other words, that IV was overpriced over the next month. The VRP stood at roughly 6 points, leaving enough room for realized volatility to rise modestly without threatening the trade. We believed there was a 74% probability of that outcome, and we were reasonably confident that implied volatility would drift lower once the traditional post-earnings vol crush set in after the major banks reported.

Well, we were certainly right about one thing: realized volatility did go up.

From 12 to 14 — a two-point jump in 30-day realized volatility in less than ten days — is no small move. As expected, it translated into a rise in implied volatility. We entered the trade when IV was around 18, and it spiked to 24 during the peak of stress observed last Thursday. This inevitably affected P&L, as we will see in the next section.

Then the dust settled. Realized volatility stopped climbing, leaving plenty of space for the edge to play out — especially since no major downside trend materialized.

We entered the trade with XLF around 53.5. It dropped as much as 4% at one point, but then recovered and mostly traded within the boundaries of our strangle.

That was the real element of luck here. A volatility spike is often tied to a directional move that leaves traders without a proper delta hedge footing the bill. So what could you have done to mitigate this? It may sound counterintuitive, but the only real answer is to ask whether the edge was still there during the vol spike. And if it was… you should have added to the position.

After the first blow on Friday the 10th, our signals still showed a 67% chance that implied volatility sold that day would exceed the subsequent realized volatility. That probability climbed back to around 75% for most of the following week.

An easy way to reduce some of the delta risk would have been to sell options in the direction of the move — 20-delta calls as the market dropped, followed by 20-delta puts as it bounced back up.

This, of course, requires knowing your risk limits ahead of time — and more importantly, knowing whether you still have edge. For that, nothing beats having access to solid analytics.

In the end, we sold the strangle for roughly 0.70, saw it move almost 100% against us, and still hit our profit target right at yesterday’s close.

Let us now look at the different P&L drivers and validate our observations.

The Greek decomposition

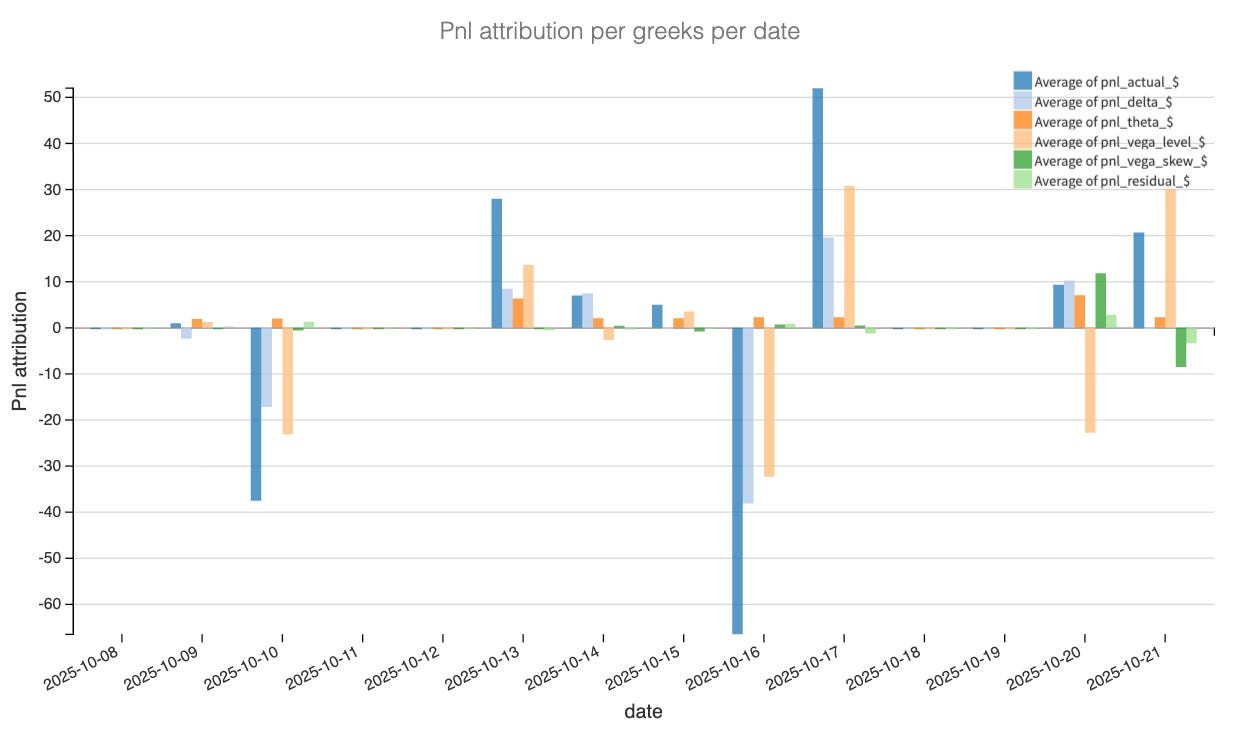

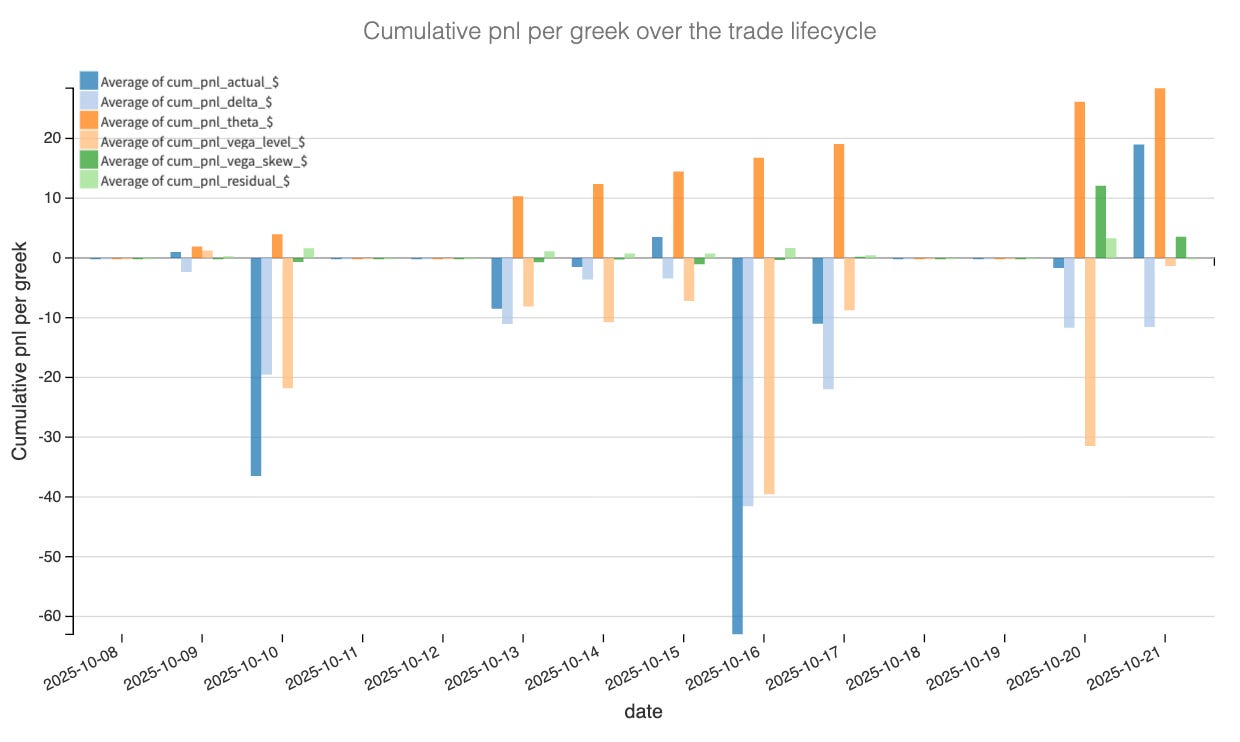

The story is exactly what it felt like in real time.

From entry, implied volatility bled a bit, then ripped into the storm on 10/16. As a result, half of the loss observed on 10/16 came from vega-level and the other part from the delta as the market tanked.

Yet at that stage, the spot didn’t breach the wings, so delta hurt but wasn’t the killer; it was the parallel lift in IV that doubled the strangle’s marked price (your mid jumped to ~1.30).

Theta worked throughout, but the carry can’t keep up when term-level vol jumps that hard in a day and one you have violent up swing or down. This perfectly proves the point that theta in and of itself is nor a strategy nor an edge.

The snapback on 10/17 is the single best day and a classic “vol crush” bar where vega-level flips positive and recovers a big chunk of the drawdown.

Cumulatively, the contributors line up with the thesis:

• Theta did its job as despite a spike in realized volatility, it was never enough to completely annhilate the carry of implied sold at 18 and realized topping at 14.

• Vega-level is the villain-then-savior—responsible for nearly all the trough on 10/16 and most of the recovery afterward as IV mean-reverted. That is why we trade volatility: it tends to mean revert which means that even when wrong, you can get away with a trade more often than not. You cannot say the same with non mean reverting asset, and this explain why we do not put stop loss on, nor do we buy wings.

• Delta nets out modest because price never trended beyond the 51/57 rails.

• Skew is second-order: a mild headwind on the way down (puts getting bid) that fades as the tape calms.

• Residual is tiny—model error/marking noise.

So was it luck? Surviving the spike, yes. But the attribution validates the edge: a fat VRP (carry) plus IV mean-reversion (vega) outweighed path risk (delta).

The key lesson here is on the execution: when the signal still says “short vol has edge” during the spike, adding in the direction of the move (sell calls on the selloff, sell puts on the rebound) is the cleanest way to let theta + vega do their job while managing the directional risk.

Now, the market has calmed down this week, yet implied remains elevated. Should we put this trade back on?

Let’s have a look.