Signal du Jour - short vol in XLF

Harvesting the earnings premium.

The government shutdown drags on, and stocks still flirt with all-time highs while the VIX stays “low,” hovering around that 16–17 handle. How long will it last? Hard to say but our money is on something much longer than the previous record of 35 days. The government can wait, especially if equities do not correct. And stocks, it seems, have all the time in the world as they calmly drift toward the close of a peculiar year.

But the real story is gold. It traded above $4,000 an ounce for the first time ever and it does not look ready to stop. Up 53% this year, it’s the undisputed winner, raising the question: who exactly is buying, and why? Kenny G offered a few clues in a recent Bloomberg interview, and it’s worth paying attention.

In the meantime, let’s see what cards the market is dealing us. Today, we turn to the financial sector again; we have had good success since early September with KRE, but today we will focus on XLF. With earnings season just around the corner, some prices may already look a bit inflated.

Let’s dig in.

The context

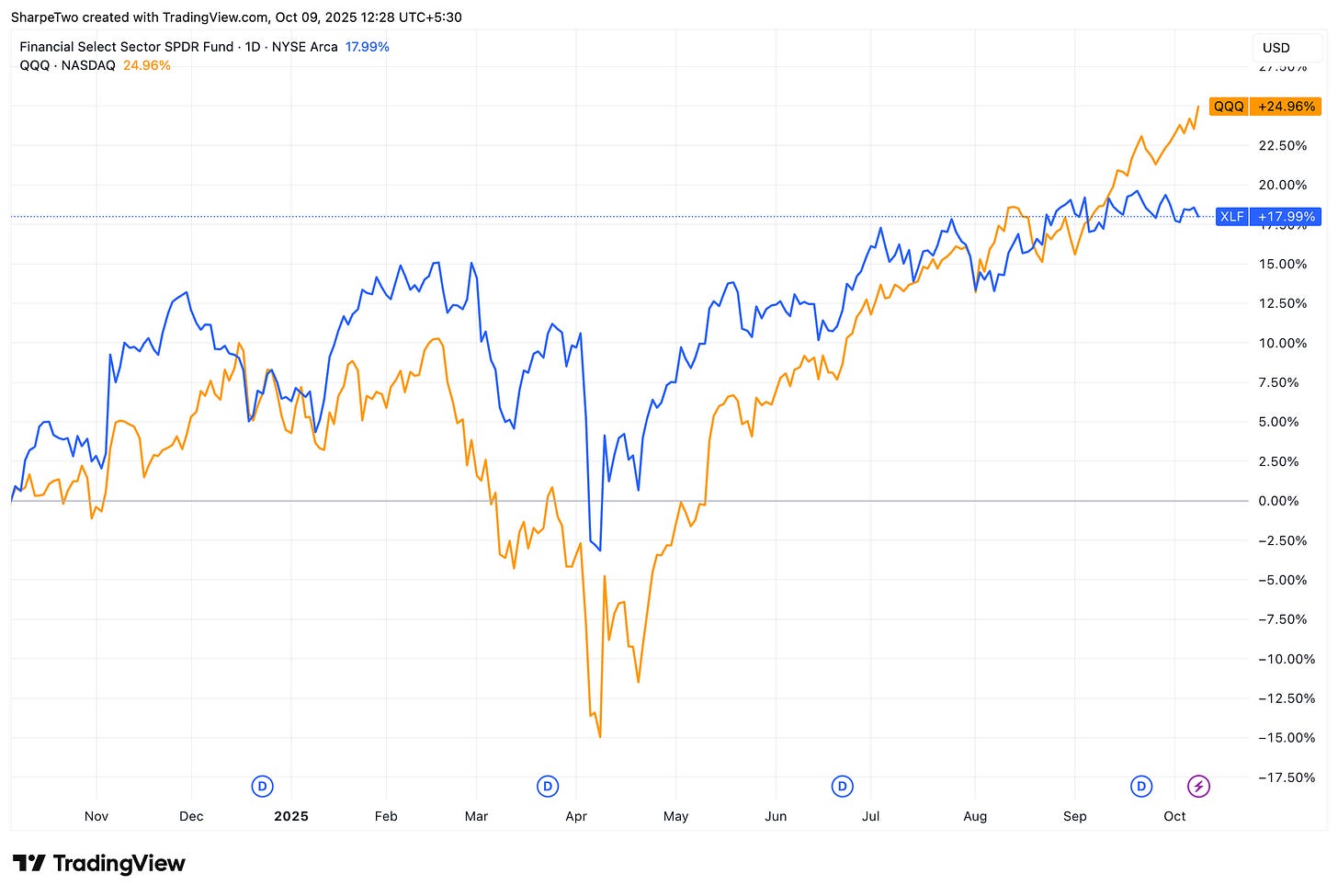

The financial sector ETF has been quietly but steadily climbing — up nearly 10% in 2025. That’s a remarkable performance by any standard, especially when you set aside the fireworks happening in more volatile, hype-driven corners of the market like tech.

With an annualized realized volatility of just 12% over the past 30 days, XLF effectively delivered a Sharpe ratio of 1 over the last year. Sometimes, owning the “boring stuff” really is easier than trying to impress the crowd with fancy tricks. The contrast becomes obvious when you line up the realized volatility of both tickers.

Lately, we’ve found ourselves in an unusual situation where realized volatility in XLF actually sits above QQQ — not something you see often. Over the long run, though, anyone trying to reduce variance while maximizing return knows which one offers the better risk profile. But enough digression.

Our models suggest realized volatility could tick slightly higher in XLF over the next few weeks, especially with earnings season coming up.

That said, like the rest of the market, we do not anticipate any major regime shift that would justify staying away from the financial sector altogether. As long as the economy remains steady and the market believes the Fed has the tools to stabilize any slowdown — which it does at a 4% rate — there’s no need to overthink it. Things could stay this way for a while.

Let’s now turn to the options market and see how we might structure a trade in XLF.