Trade Anatomy - Short Vol in TLT

Post Mortem Signal du Jour 2026/01/22

Two weeks ago, we presented an opportunity to short volatility in the bond market. We won’t lie: we were a tad concerned about the opportunity. We knew a new Fed chair was scheduled to be announced, and we wondered if the first FOMC meeting of the year would impact bond positioning. To make matters worse, the geopolitical landscape was already so packed that we feared a heavy movement in one direction might disrupt the thesis of our trade.

In fact, none of that happened. It was one of those uneventful trades where everything unfolded largely as expected. There is an important lesson here, particularly at a time when commodities are moving like tech stocks: realized volatility is often a great proxy for market consensus on an asset. Obviously, one must take historical prices as a reference point. However, the fact that realized volatility in bonds was fairly stable over the last few months (much more so than in commodities) was an important signal.

If you believe that volatility clusters, why get all riled up about a potential adverse scenario? The inverse is also true: precisely because volatility clusters, hoping for a swift mean reversion to “normal” levels can often have disastrous consequences. All of that is to say, if you are still in the precious metals sector, you need to ask yourself why, especially if it is for revenge trading, a disease no retail trader is immune to.

That said, we will happily take our first win of the year, hoping to start another streak like the one we enjoyed between Q3 and Q4 of last year.

The trade

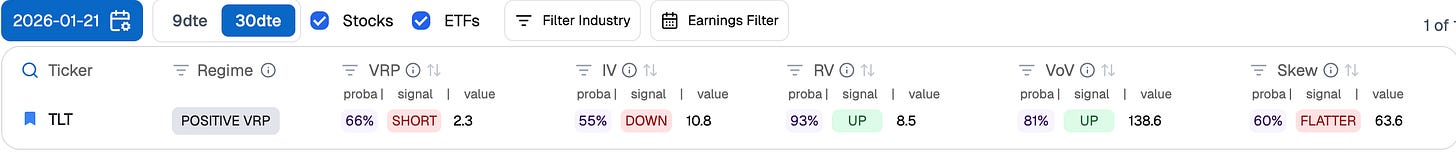

In our Signal du Jour from two weeks ago, we highlighted an opportunity to short the 85/90 TLT strangle in the Feb 27 expiry. At the time, the market had experienced a bit of an awakening right before the World Economic Forum in Davos. The realization that geopolitics would remain a central theme in 2026 caused implied volatility in bonds to rise sharply over the weekend, driven by aggressive rhetoric regarding Greenland.

Our models pointed towards a decent probability that the implied volatility sold that day would exceed the realized volatility for options at 30 DTE. While we didn’t really have a strong opinion on where implied volatility would go during the trade (55% is essentially coin-flip territory), we knew realized volatility was likely to increase.

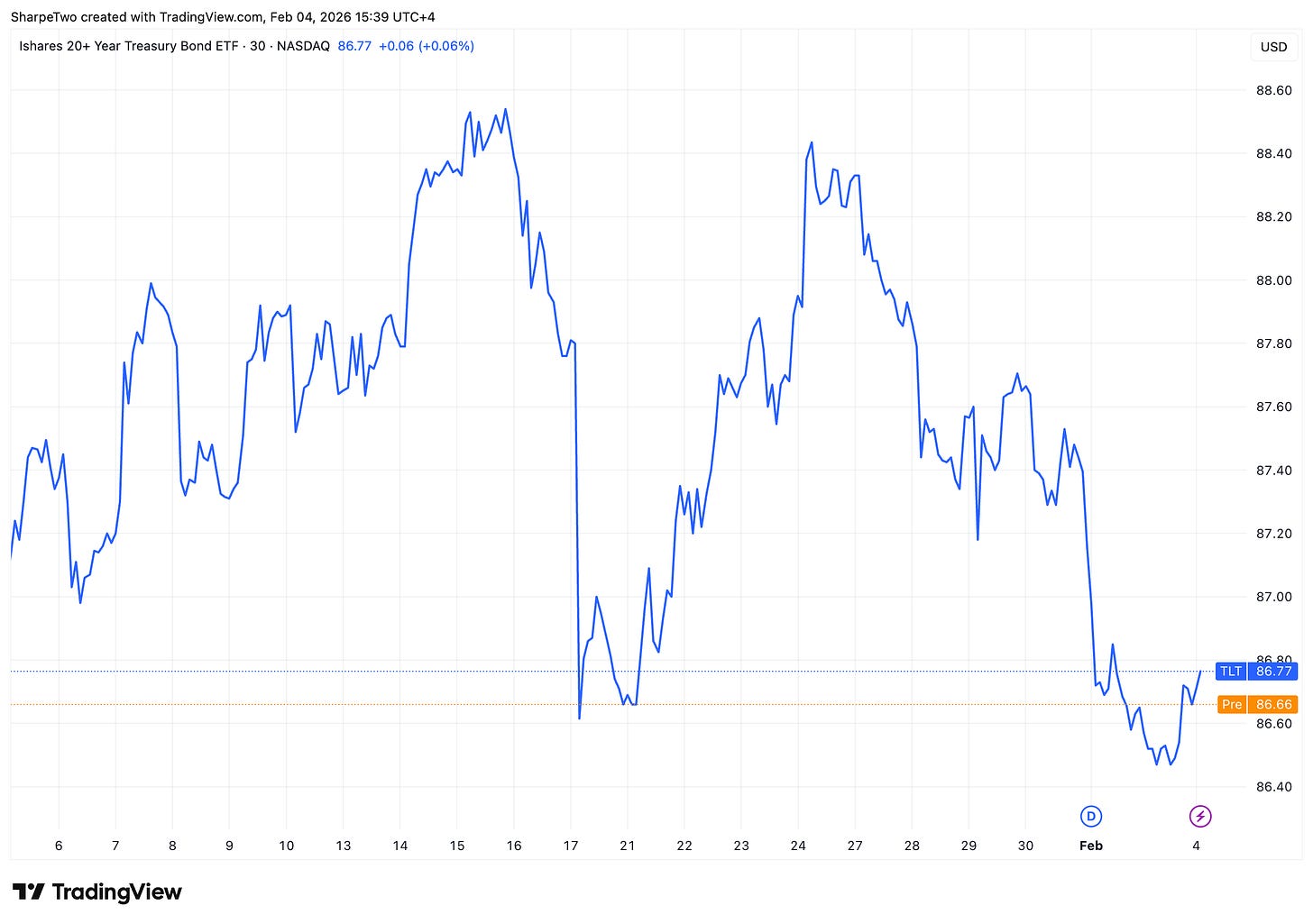

In the end, events transpired exactly as we anticipated: we saw a slight rise in realized volatility while implied volatility stayed fairly neutral. The rise in realized vol from 8.5 to 8.9 was clearly not enough to challenge the 10.8 level we sold when striking the trade. Obviously, these strategies are remarkably path-dependent. While we do not delta hedge, we must always ensure that movement in the underlying asset doesn’t get too close to one of our strikes, which could damage our thesis.

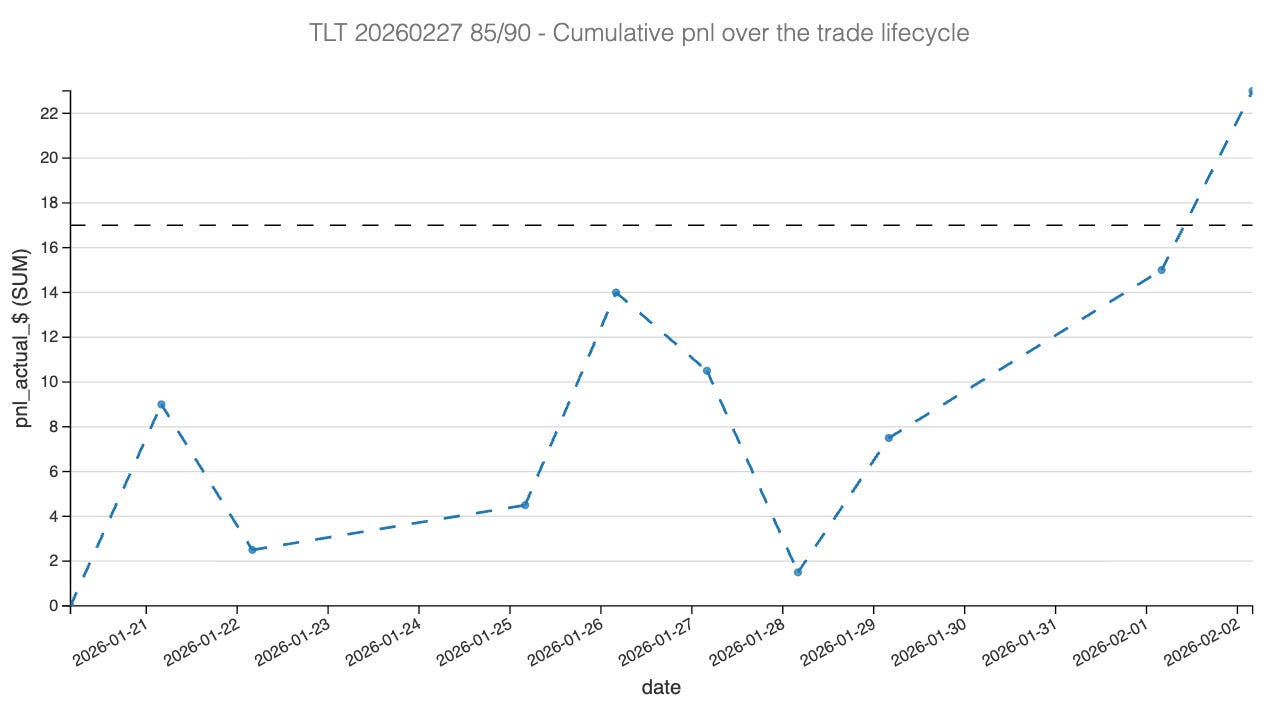

In our case, while the tension during the Davos forum brought the price of TLT higher as investors were looking for safety, things normalized a few days after that and the path dependency was never a factor to challenge our strikes. In the end, the strangle’s price decreased steadily through the trade lifecycle allowing us to exit the trade fairly early. Had you been able to enter earlier in the week (which we had with the Discord group) you would have benefited from the bump in IV on the Tuesday and stay roughly a week in the trade.

Otherwise, the readers with limit orders would have been able to exit right before the weekend, or just recently, as implied volatility post FOMC went down.

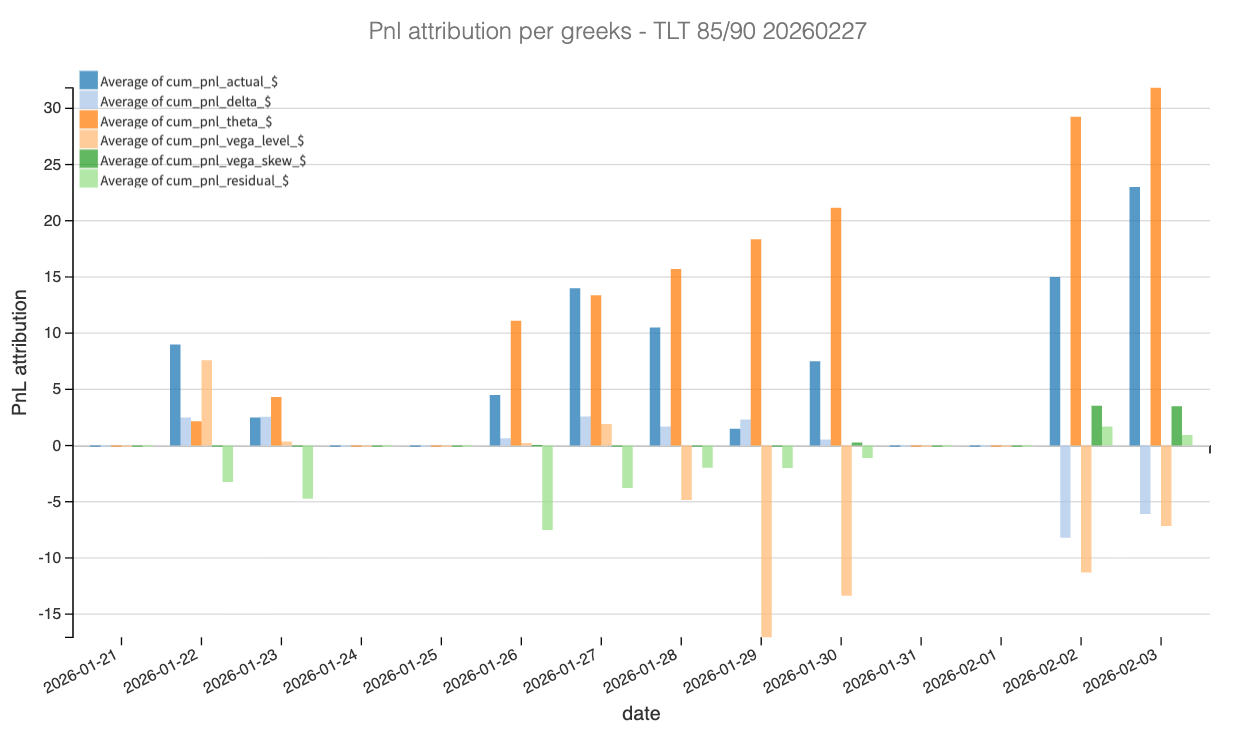

Let’s now have a look at the pnl decomposition through the Greeks to understand where the pnl came from, what played for us and what was a tailwind.

The Greeks Decomposition

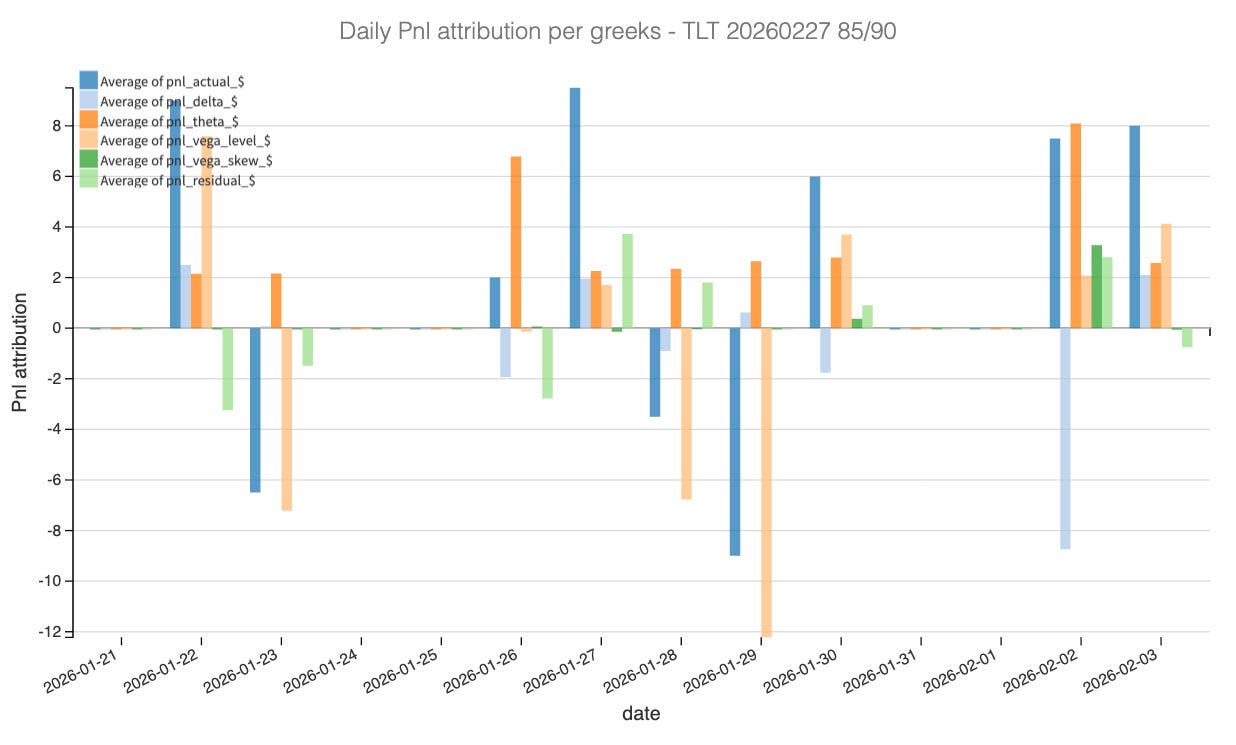

Looking at the attribution, the mechanics of this win are straightforward: this was a textbook victory for Theta, unencumbered by the volatility drag we often fear in these setups.

As illustrated in the cumulative PnL chart, the equity curve is generally smooth and upward-sloping, recovering quickly after the dip around January 22nd. This is the hallmark of Theta (time decay) working efficiently. By selling the 85/90 strangle, we positioned ourselves to harvest the premium daily. Because the underlying price remained within our designated range, that time value eroded consistently into our account, providing the bulk of the profits.

The real difference-maker compared to other recent trades was Vega. In a short volatility strategy, Vega can become the enemy lying in wait. In this instance, Vega remained neutral to slightly supportive. While realized volatility ticked up slightly from 8.5 to 8.9, it never threatened the 10.8 implied volatility level we sold at inception. Crucially, the implied volatility itself stayed flat. We did not see the repricing or “panic” in the options market that often wipes out Theta gains. The variance risk premium we captured at entry was sufficient to absorb the minor increase in realized movement without forcing a mark-to-market loss.

Finally, Delta and Gamma acted as minor noise rather than structural risks. The brief price spike in TLT following the Davos headlines created the temporary PnL dip seen on the chart. This created directional exposure (Delta), but because the move normalized quickly, we weren’t forced to hedge or realize losses on the directional component. The price never challenged our strikes seriously, meaning the negative Gamma acceleration never kicked in.

In summary, the PnL came from exactly where we want it to: the steady passage of time in a calm volatility environment. This trade serves as a reminder that when the variance risk premium is mispriced and the market consensus remains stable, short volatility remains one of the most consistent generators of alpha.

Now the glaring questions: should we go back in positions or not? Let’s have a look at what the data say.