Signal Du Jour - Short Vol in TLT

Greenland's tension melted overnight, now cap on the next FOMC

The market returned from Martin Luther King Day noticeably riled up, with palpable tension between the two sides of the Atlantic regarding Greenland. President Trump initially appeared to draw a hard line in the sand: Greenland must become American by will or by force, and in the meantime, tariff threats loomed over countries refusing to align with this idea.

As we expected, however, a few hours after his arrival at the World Economic Forum in Davos, the mood shifted toward de-escalation. Military threats vanished and tariffs were paused following “very productive and constructive” conversations with the head of NATO. Does this remind you of something? It follows the exact game plan seen at the Asia-Pacific summit last October: create tension before a ninety-minute conversation with Xi Jinping to force a dialogue that drives US interests back to the center of the negotiation.

Ultimately, the VIX at 20 didn’t last long, and we hope everyone feasted on the ten points of variance risk premium available Tuesday and Wednesday morning. If not, keep it in mind for next time; this is our favorite filling these days in our tacos trade.

That said, today we consider a trade in TLT. Truth be told, the signals were extremely strong yesterday morning, and we managed to enter at a great price with our group. If you don’t want to miss out, consider joining us here: you can now try the platform, our signals, and the discord for $14.

Let’s dive in.

The context

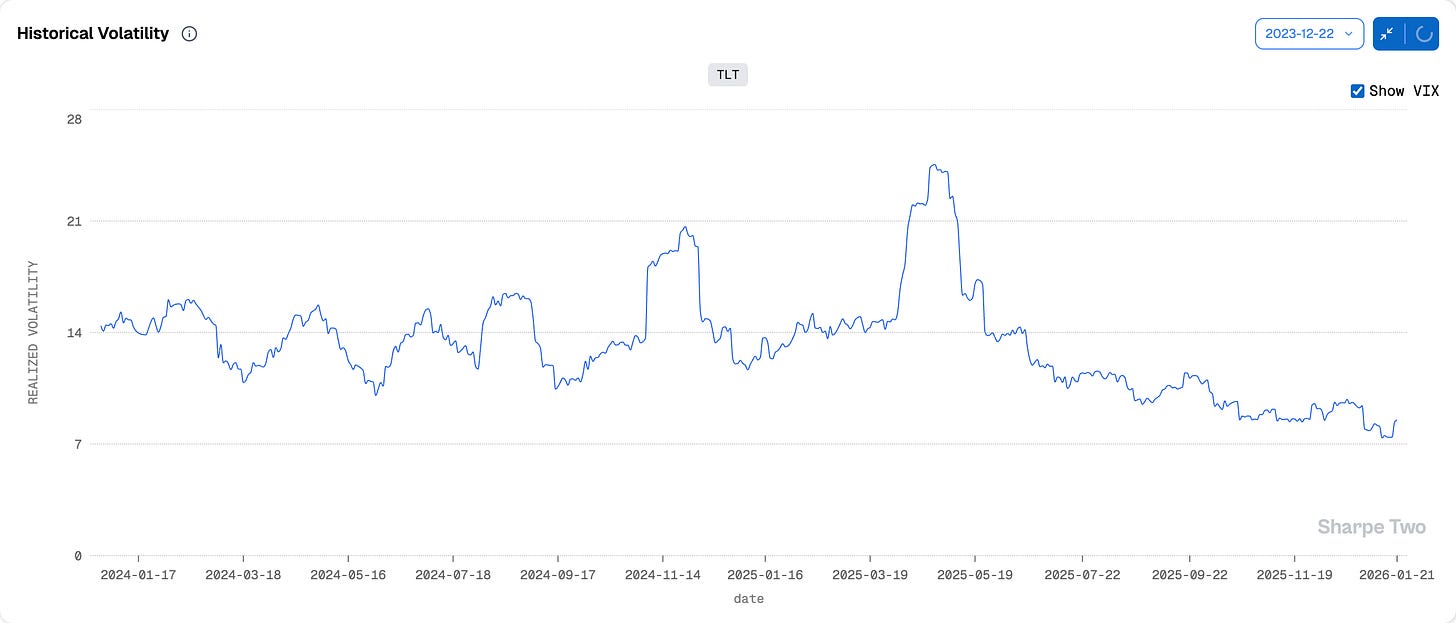

Let’s dive in. While the main focus remained on Greenland, global bond markets suffered a scare on Monday. Following the Japanese premier's announcement calling for a snap election, Japanese Government Bonds (JGBs) repriced violently, and ripple effects were felt across other major economies. Consequently, volatility was on the rise in TLT early this year.

While we reached 88.5 in anticipation of a more accommodative Fed in 2026, with a Fed chair more lenient toward White House expectations, the last week has seen a violent repricing of expectations, pushing prices below 87. Bonds have found some footing since then, but realized volatility is reaching highs for 2026.

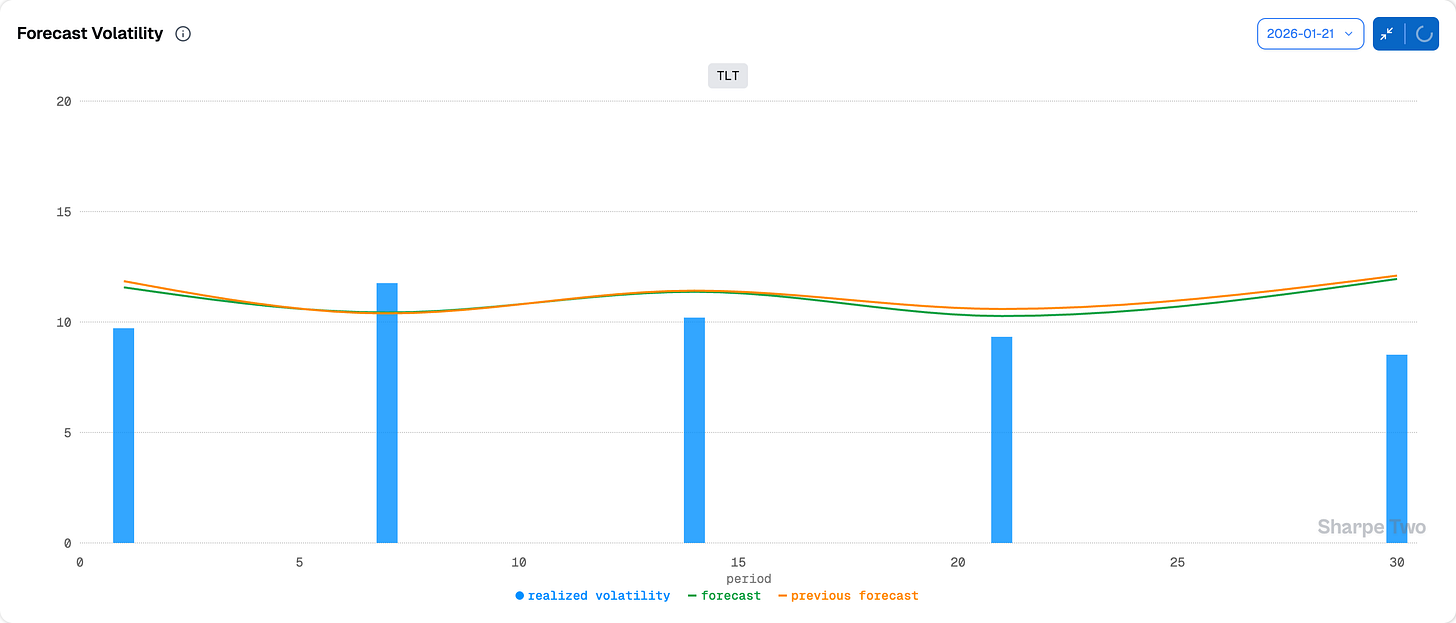

Let’s pause there for a second: at 8.5%, we are at the lowest realized volatility observed over the last two years. As usual, we won’t comment too much on the macroeconomic side. However, one must admit there may be a disconnect between the permanent narrative seen in financial media (reinforced by the “Vigilantes” on social media) and how much the market has actually moved. Since the start of the tariff war a year ago, at no point did long-term bonds look fragile from a realized volatility perspective, and our forecasts for the next month don't suggest otherwise.

While we expect volatility to climb slightly from current levels to potentially 11% over 30 days, it is hard to envision a move much larger than this. The next obvious catalyst is the Fed meeting in a week. Obviously, one must always remain vigilant for unexpected announcements, but in the meantime, let’s look at option prices to see what they anticipate.