Trade Anatomy - Short Vol in SMH

Post mortem signal du Jour - 2025/11/30

Two weeks ago, we brought an opportunity in SMH, the ETF tracking the semiconductor industry. That came right in the middle of tech earnings, as the most recent bout of volatility had cooled off despite a fairly hawkish FOMC meeting the day before.

Because the market had calmed down, it was a little harder to find opportunities in our usual preferred 30-DTE range. This time, we had to move much closer to the expiration cycle, at the expense of gamma risk, obviously but ideally with a much shorter time in trade.

In the end, this turned out to be our shortest trade ever, and we will see why in a moment. We are now at ten out of ten for our signals and having a stellar quarter since introducing machine-learning-based signals that incorporate everything from the VRP to vol-of-vol levels and even metrics derived from the volatility surface.

As usual, everything is available on our platform; do not hesitate to sign up to trade delta-neutral and find opportunities where options are clearly overpriced.

The trade

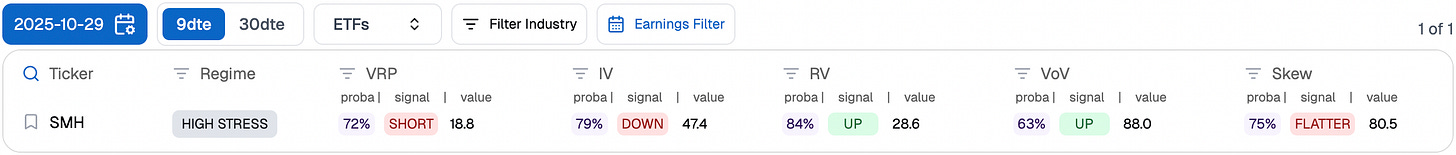

In our Signal du Jour from two weeks ago, we reported an opportunity to short volatility in SMH. This came right before the tech giants were set to report earnings and offer their latest take on the AI narrative. While, as usual, we will refrain from commenting on the earnings themselves or the bubble thesis, one thing was clear: SMH implied volatility was visibly inflated at the close on Wednesday, and our models were pointing to the following.

You had a 72% chance to see implied volatility, measured at 9 DTE, exceed the subsequent realized volatility, putting you in a strong position to harvest that variance risk premium.

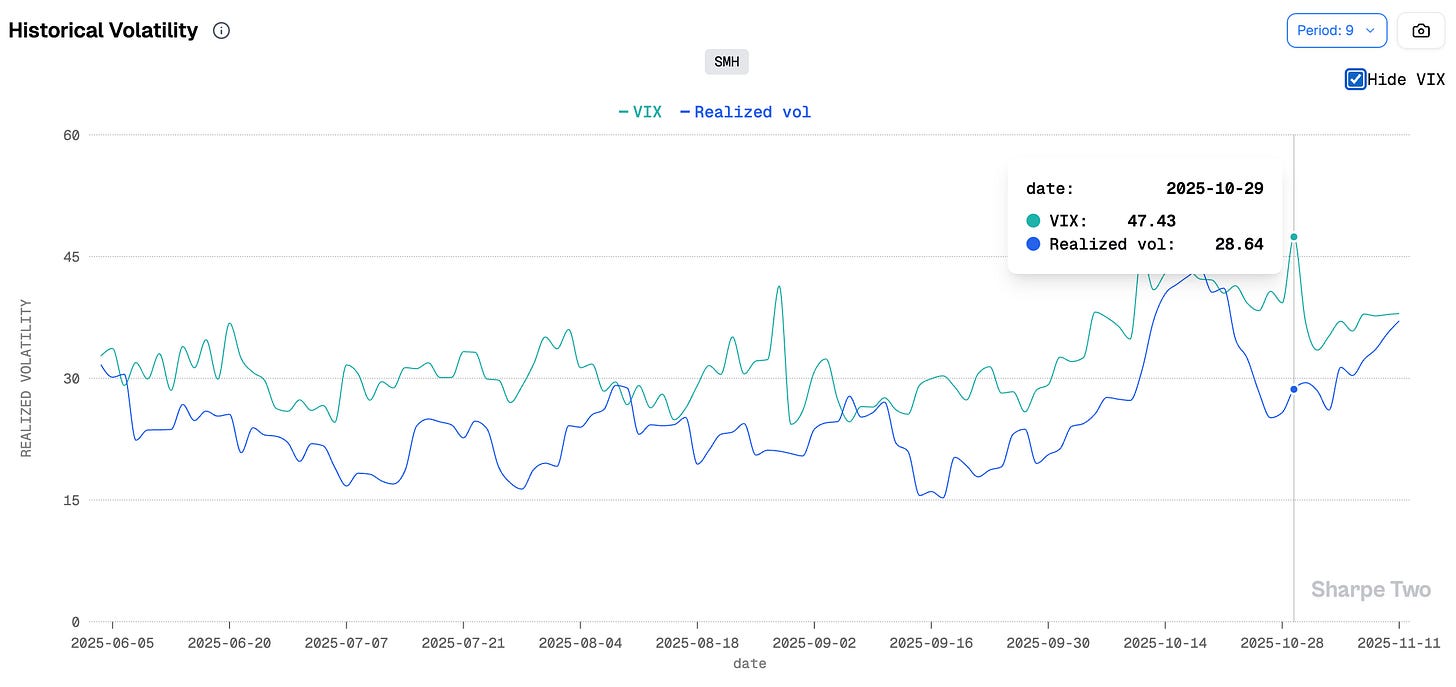

We were also pointing to a 79% chance of implied volatility declining from its then-level of 47.4%, which we expected to be a key driver for P&L. At the same time, we knew realized volatility was likely to rise in the following days. Overstaying the position, therefore, meant taking on unnecessary gamma risk.

Essentially, this was an earnings play in disguise: sell implied volatility in the morning right after the event and capture some of that variance risk premium, but do not bet that things will not move, or worse… trend.

And our models were pretty accurate: implied volatility got crushed from 47.4% at the close on Wednesday to 36% on Thursday and 33% on Friday, before bouncing back the following week.

Realized volatility, however, kept grinding higher (from 28% to 35%) as investors digested the latest news. Being so close to expiry, this meant extreme caution was required: trying to “collect theta” for too long could easily have backfired, as any trend in the underlying would have threatened the edges of the 350/390 strangle.

We insist on this: when you put on a very short-dated trade and keep it until expiration, you are implicitly betting not only that volatility will stay below what you sold, but also that the underlying will not move. Options trading is, by definition, path-dependent and you are most exposed to that path dependency in short-dated structures.

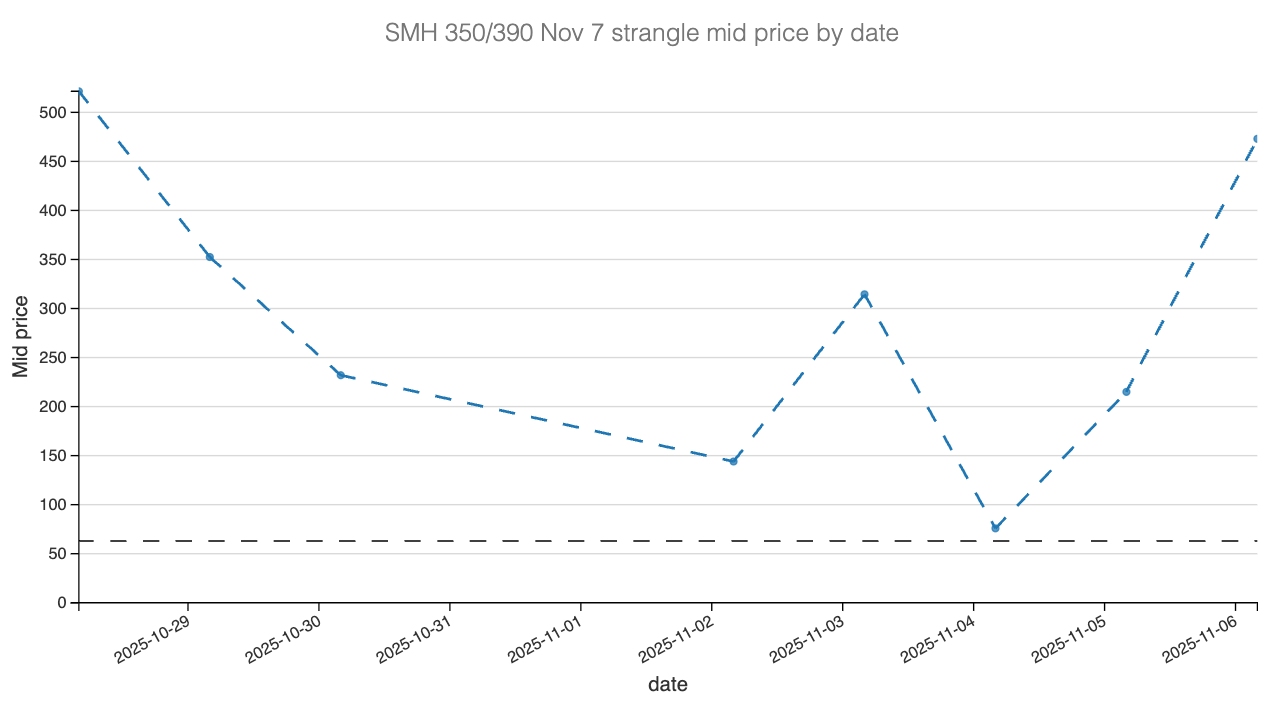

The underlying path after October 29th does not tell a different story: had you held that 350/390 strangle expiring on November 7th until expiration, you would have lost money which is rather unfortunate considering that after just one day, you were already up more than 25%.

A few remarks we received from our readers: on the Thursday before the open, our signal was pointing to a strangle price of around $5.25, based on Wednesday’s close. But by the open, $5.25 was nowhere to be found, as implied volatility had been crushed following big tech earnings. Still, you could sell a respectable 42% IV, which kept the thesis intact.

That is exactly what we did with our Discord group, right at the open on Thursday — selling at $3.25 — and by Friday’s close, we were out at $2.45, having captured 25% of the premium.

As one can see from the chart above, had you succumbed to the temptation to squeeze a little more theta from the trade, you would have had a nasty surprise by Monday’s close and by Friday’s expiration, you would have been outright losing money.

We trade volatility, and while we accept some path dependency and distribution risk (since we do not delta hedge our trades) we must counter those effects by taking profits as quickly as possible. The 25% rule remains a matter of good hygiene and discipline: harvest the carry from expensive options without taking on risk you do not want.

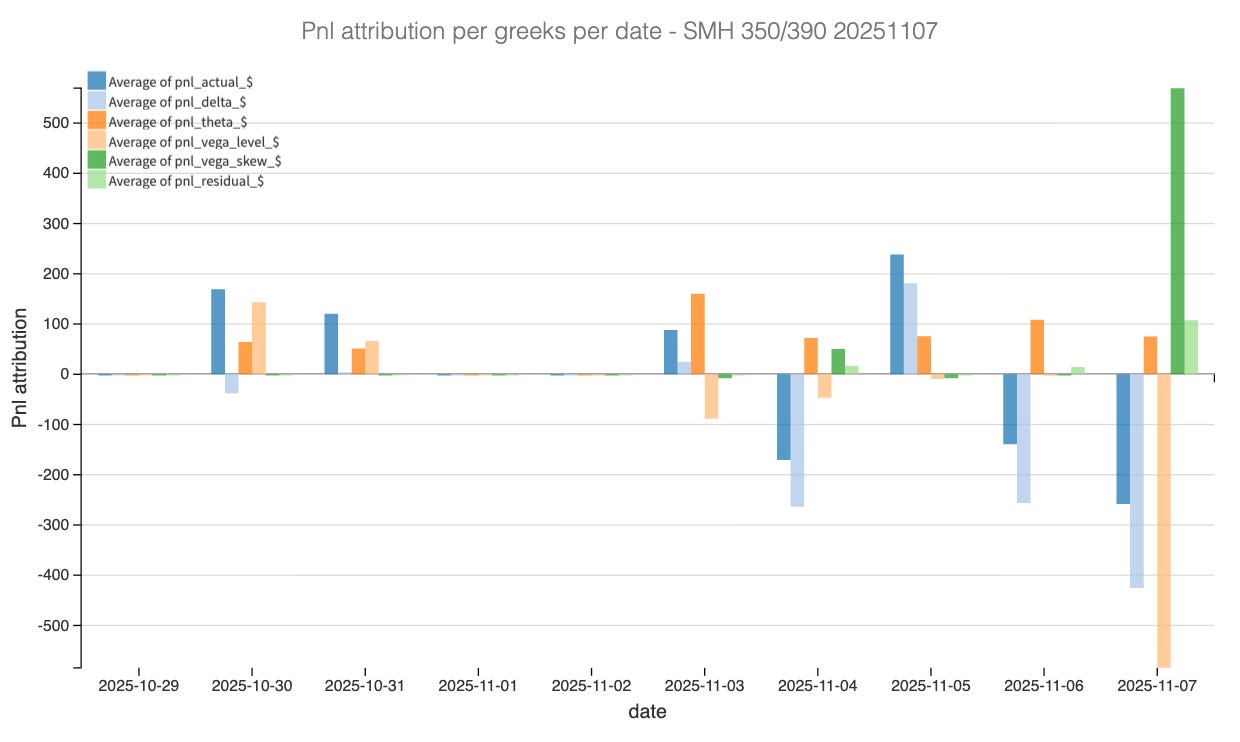

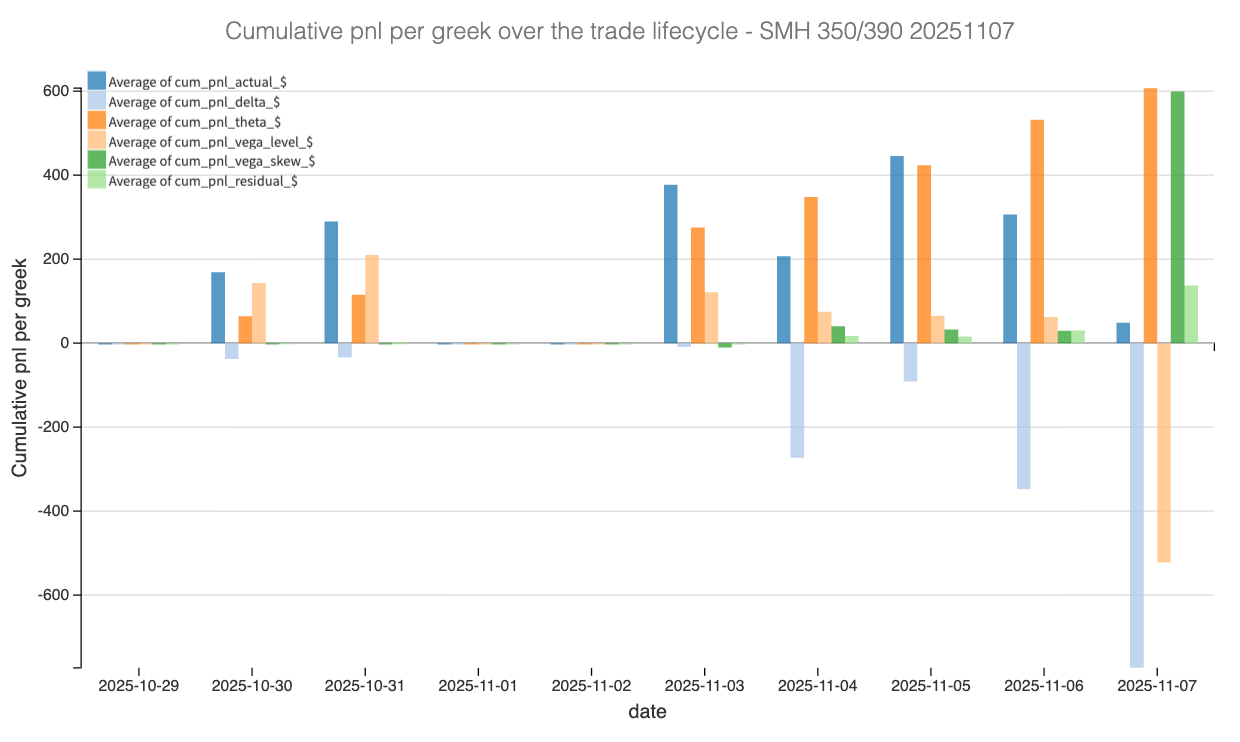

Let us now look at the Greek P&L attribution for that trade.

The Greeks pnl attribution

The Greek PnL attribution tells a clear story about why this trade had to be short-lived. The early profit came almost entirely from the vega-level and theta components, as implied volatility collapsed immediately after earnings. The short-vol position benefited from a rapid normalization of the surface: volatility dropped from 47% to the low 30s within forty-eight hours, delivering a textbook vega crush while theta added its usual carry. That was the clean part of the trade.

From there, things turned messier. As the underlying kept trending, delta quickly flipped from neutral to negative, erasing part of the gains. The mark-to-market impact of gamma exposure became evident: when you sit close to expiration, every directional move hits harder, and with realized volatility rising from 28% to 35%, the daily PnL started to swing violently.

Interestingly, the residual component stayed contained and there was little unexplained noise in pricing, meaning the move was fully consistent with the mechanics of the greeks. The sharp rebound in implied volatility the following week explains the late-trade drawdown visible in the cumulative chart. Had the trade been kept through expiration, the vega reversal combined with adverse delta would have turned an initially strong winner into a loser.

In sum, this was a pure volatility-decay harvest: the profit came from selling overstated vol and exiting before path dependency kicked in. Once the vol crush was done, the risk-reward flipped instantly another proof that in short-dated structures, timing is the edge, not patience.

Now would it be worthwhile to put this trade back in? Let’s have a look.