Trade Anatomy - Short Vol in DIA

Post Mortem Signal du Jour - 2025/11/20

Two weeks ago, we took a short volatility trade in the US equity complex, more specifically in DIA. At the time, the volatility index was climbing dangerously high and the tension was palpable all over social media as everyone was rivaling creativity to find an explanation.

To this day, we do not have a good one: why was the market rocky that specific week, then stopped for Thanksgiving and after? It is hard to tell, and to be honest we do not always need one. We know that volatility spikes and eventually it comes down. The hard part is, as always, the spike: had you entered on Thursday morning, post NFP and NVDA results, when a breath of optimism was blowing over the marketplace, you would have had a few uncomfortable hours as vol of vol was doing its thing and brought the VIX much higher in session.

We insisted on that all throughout the month of November: with such a high level of vol of vol, waiting for good prices was the better strategy instead of taking whatever was on the screen and convincing yourself the problems were suddenly gone. This trade ends up being yet another profitable one if you entered at the prices we suggested or higher, although reaching the profit target may have been a challenge, once again, based on your entry.

This brings the Signal du Jour series to 12 out of 12, another proof that using predictive analytics instead of descriptive ones is a major step forward towards profitability in trading.

Let us have a look.

The trade

In our Signal du Jour from two weeks ago, we highlighted a short vol opportunity in DIA through the 440/480 strangle expiring on Dec 26. There were plenty of reasons to be angsty about putting this position on, starting with the very high level of noise in the marketplace, best illustrated by the elevated volatility of volatility. Yet our systems were pointing to strong chances of harvesting some of the variance premium, as we anticipated the implied volatility sold that day to exceed realized volatility over the next 30 days.

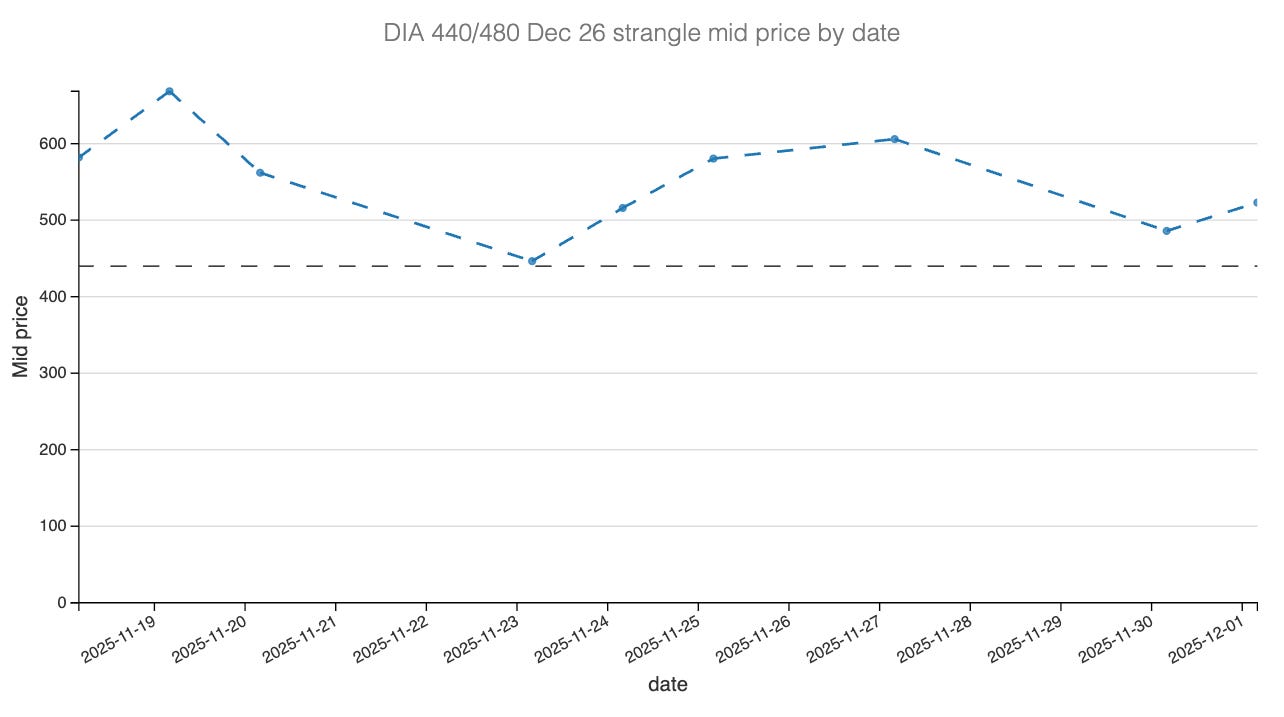

You could sell at 18.8 and had a 68% probability to see it exceed the subsequent realized volatility. That said, we also knew realized volatility had a strong chance to go up from there, while implied should have come down. In the end, things played out pretty much as we had anticipated.

After a peak at the close on Thursday, it went pretty much straight down from there, while realized volatility pushed higher before cooling off during Thanksgiving week. The critical piece of the trade here is what you did on Thursday. If you sold right at the open, the implied volatility you got was likely below the 18.8 we were targeting, and the intraday action that followed would have been fairly uncomfortable. In a situation like this, it is perfectly fine to add to the trade: the probabilities are still on your side, and as long as you are not exceeding any risk limits, you are betting on mean reversion. If better prices become available, you should take them.

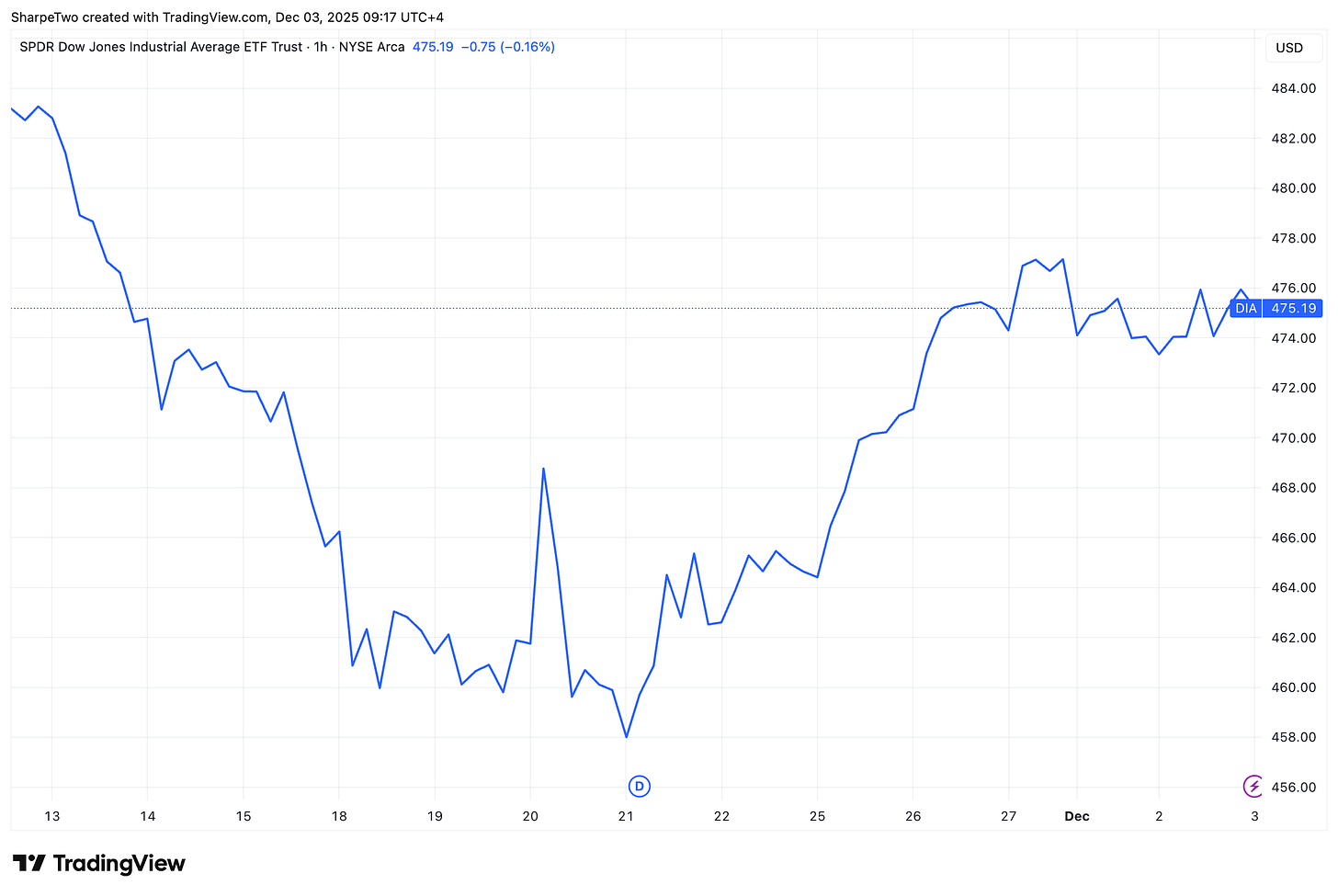

The real problem on this trade came from the well-documented effect of spot going up when vol goes down, bringing additional delta to our position. And because we do not delta hedge, this was a force working against us for the vast majority of Thanksgiving week.

We struck the trade when the underlying was trading roughly at 460, and it closed around 475 at the end of our holding window. In situations like this one, it is fair to accommodate for a potential relief in equities. We would be careful though: this effect is strong in indices and may not be as strong in other products. You could have sold a skewed strangle instead of a delta-neutral one and sold a closer put or a further call. This would have alleviated some of the pain of watching the index catch up after the unnecessary beating.

In the end, the success of this trade is highly dependent on your entry, and this matters more often than not in a high vol of vol environment: if you entered when the tide was low on Thursday morning, when the relief post-NVDA and NFP was being priced, it would have been a little harder to be profitable. But if you waited to get 18.8% of vol, or higher, it was a fairly easy trade.

As you can see, you would have been down in PnL at the close on Thursday, but if you managed to secure a better entry than the one we highlighted in the original Signal du Jour, you would have been out unscathed on the Monday of Thanksgiving week. Otherwise, you should close the trade now with a meagre profit, but a profit still.

Now let us look at the Greek PnL attribution in detail.

The Greeks decomposition

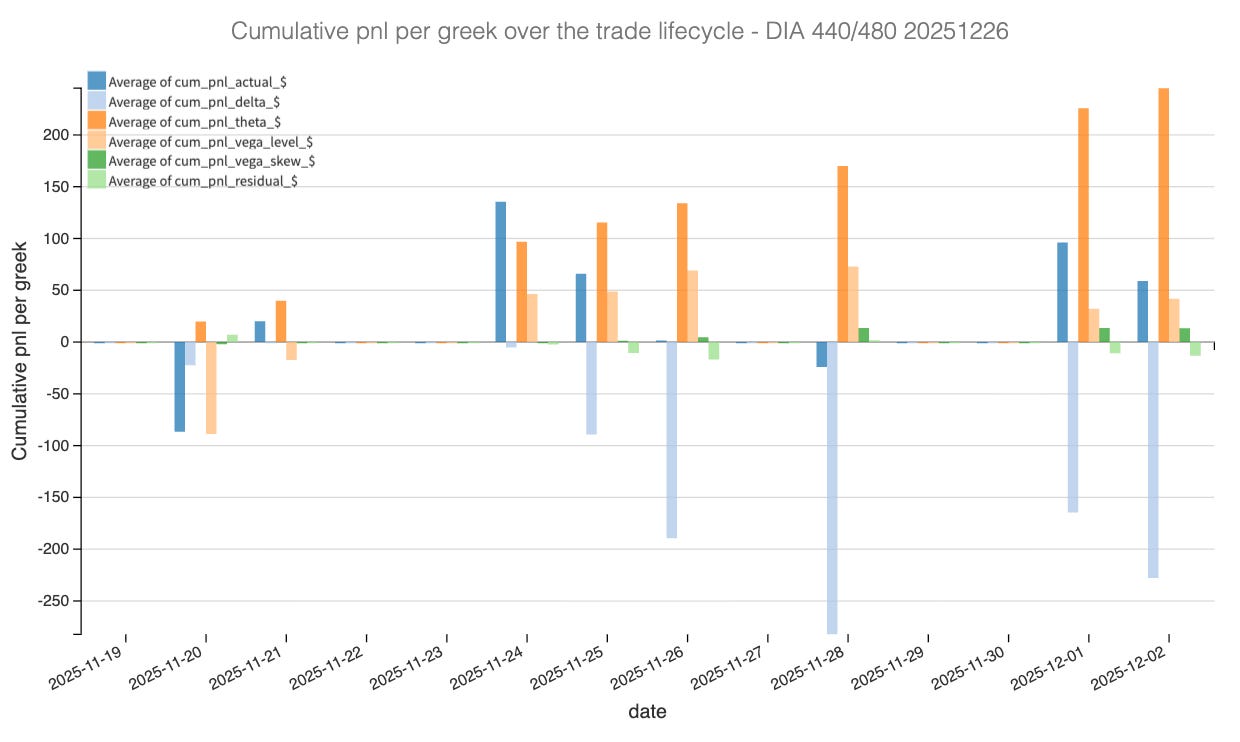

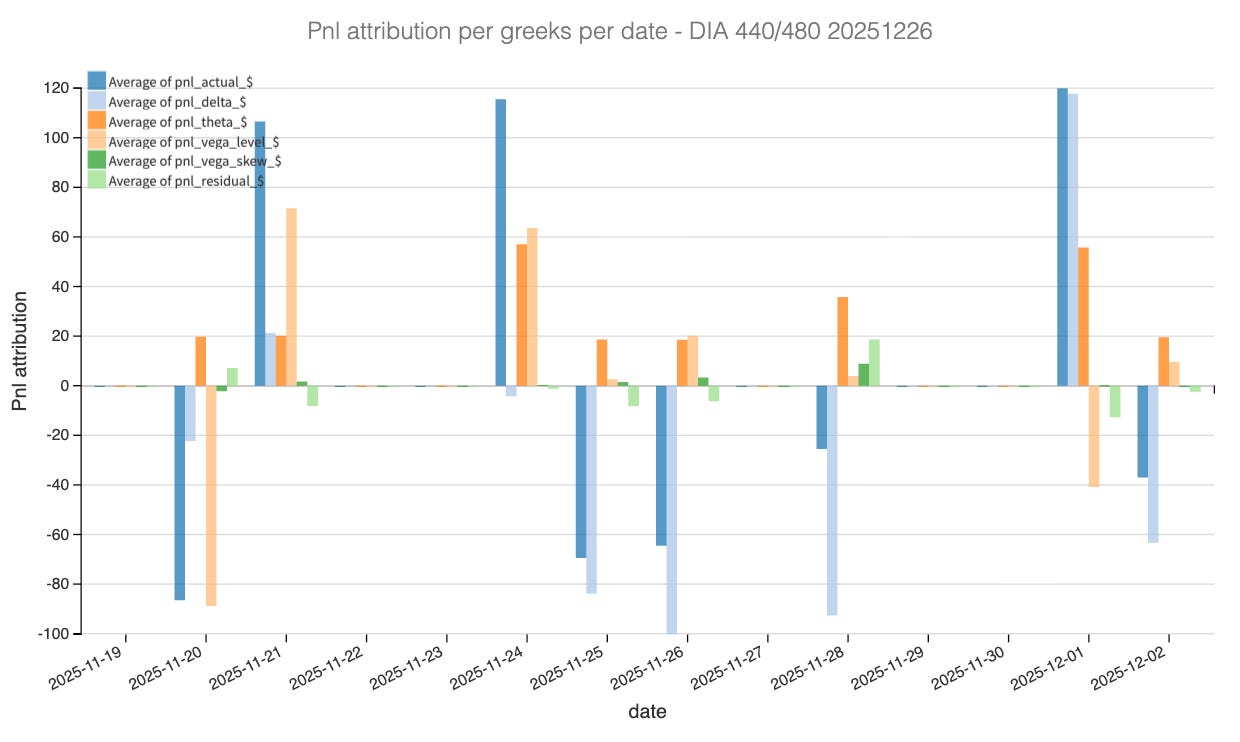

The attribution tells a very clean story. The bulk of the noise came from exactly where we expected it: the delta. As DIA grinded higher throughout Thanksgiving week, the short strangle naturally picked up directional exposure, and without any hedging this bled steadily into the PnL. You can see the effect clearly in the cumulative chart: delta chipped away at the trade almost every single day once the index moved from 460 to 475.

Theta, on the other hand, behaved exactly as designed. Carry worked throughout the lifecycle; slow, mechanical, and largely immune to the intraday swings that made the setup feel uncomfortable at entry. Even during the sessions where vol-of-vol was ripping, the strangle kept harvesting time decay, cushioning the mark-to-market drawdowns.

Vega exposure split cleanly between the “level” and “skew” components. The level effect contributed positively as implied volatility mean-reverted from the Thursday spike. This is the core engine of the trade: you sold IV at levels the market could not sustain. As IV came down, the vega-level bucket paid right on schedule. The skew bucket stayed small throughout (as it should in DIA) but it helped modestly as the right tail cheapened faster than the left.

Finally, the residuals remain tiny, which is exactly what you want in a 440/480 strangle: very little coming from higher-order Greeks, very little you cannot explain.

In short: the trade made money for the same reason the setup was attractive in the first place as vol came down faster than realized went up. Delta hurt, theta helped, and vega did the rest. A textbook short-vol harvest, provided your entry was disciplined.

Now, the big question: volatility has come down and the market seems to be chilling. Should we go back into the trade? Let’s have a look.