Trade Anatomy - Short Vol in BOIL

Our series continues with 11 correct trades out of 11.

Two weeks ago, we highlighted an opportunity in BOIL, the ETF that gives investors exposure to the ebbs and flows of natural gas. Volatility in the US equities market was also starting to brew, which gave us a clean window to engage in a trade while keeping a healthy distance from the background noise about AI, Burry, and the perpetual tech-bubble debate.

We did not write about it on the Substack, but we were actually long volatility in BOIL in the weeks leading up to this article. Our probability regime was flashing green which, subconsciously at least, added a layer of discomfort when putting on the reverse trade. One always wonders: is this the moment where the real convex move happens, and here I am dancing on the wrong tempo?

In the end, it turned into a comfortable trade, and we ended up making money on both the long and the short side of volatility. We continue our perfect series since the product launch at the end of August. By just taking It is definitely worth your attention; whether you are a retail trader or an institution, we are more than happy to talk.

And yes, we have a Black Friday discount: up to -40% on all our annual plans. You can check it out here.

The trade

In our Signal du Jour from two weeks ago, we highlighted an opportunity to short volatility in BOIL. The only real concern heading into this trade was the potential for disruptive headlines, especially as we enter the winter season in the northern hemisphere where temperatures are scrutinised and traders tend to become overly sensitive and reactive. Yet our systems were pointing towards strong odds of collecting the risk premium between variance expectations and what the market would actually deliver.

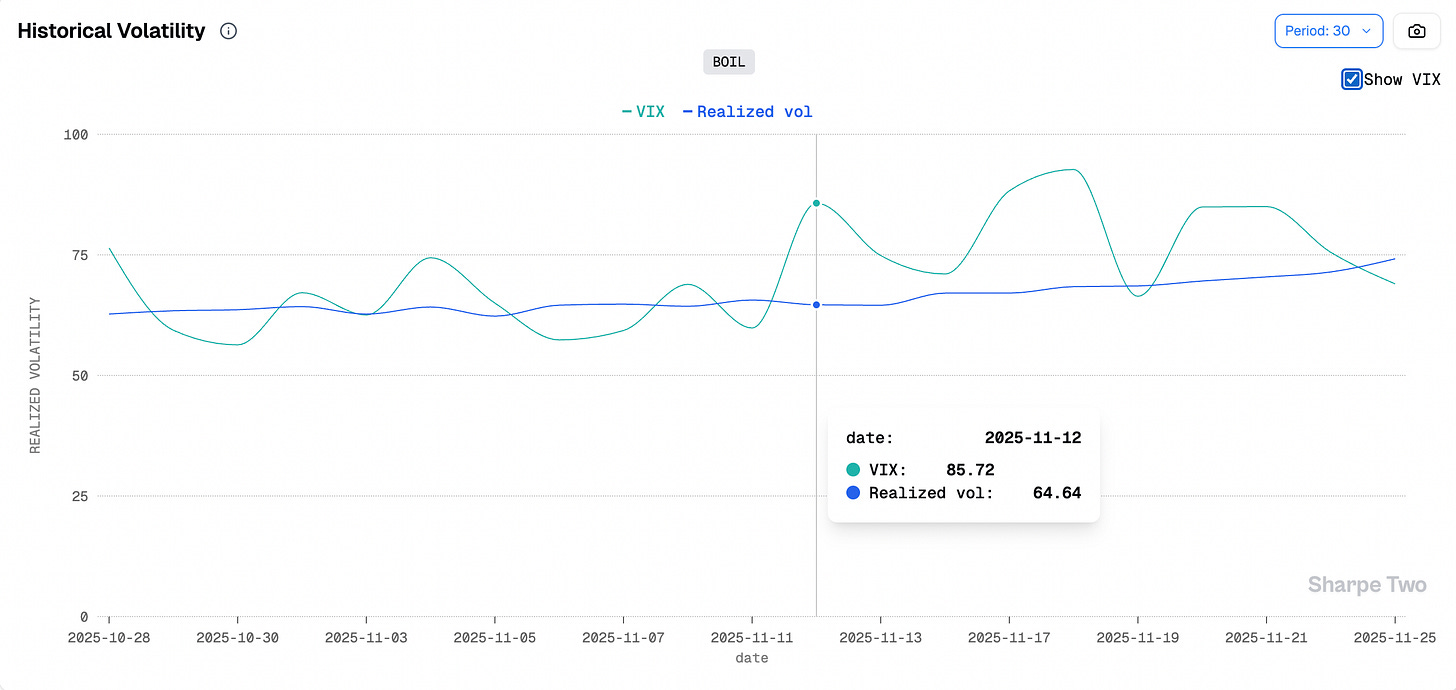

As you can see, we had a 67 percent chance to see the IV sold at 30 DTE exceed the subsequent realised volatility, which becomes significant. We also knew there was roughly a 70 percent chance to see implied volatility cool off from its level of 85.7, while realised volatility had a 79 percent chance of ticking up from 64.6. And while that gave us a respectable margin of error, it was still the biggest risk when putting this trade on: in late autumn and winter, the demand for natural gas can shift abruptly and put pressure on prices. In such moments, the variance risk premium can feel like a meagre blanket to hedge your exposure.

In the end, however, things played out almost exactly as expected.

While implied volatility experienced a few twitches (down early in the trade, then higher in the middle) it ultimately finished below the 85 percent threshold we observed at entry. Realised volatility, for its part, climbed gradually and closed just under 75 percent by the end of the period. This reinforces the need for discipline when harvesting the premium: the quantity we do not know is the subsequent realised volatility, and if we become a little too relaxed about jumping on any price just because it “still looks good”, we can end up with a nasty surprise at the end of the trade, especially when one does not delta hedge.

In this instance, BOIL stayed fairly contained around the entry levels we had in mind when we struck the trade, wiggling without any real conviction in either direction.

This definitely helped: delta was not an unbearable force dragging the PnL down, which allowed us to collect the premium as time passed and realised volatility failed to pick up enough to challenge our entry zone.

As usual, we aimed for a 25 percent profit target, and you would have reached that in a little more than a week. Looking at the chart above, one could argue he should have stayed in the trade to collect more premium. This makes sense if the edge is still there. And for that… well, you guessed it, you need to be able to reassess the probabilities for your VRP harvesting every single day as new data and information come in.

Had you exited at the end of last week, the probabilities were no longer as compelling. In other words, you could have stayed in the trade, but you would have been more exposed to variance and to bad luck hitting you than you were at the outset. It is important to keep an objective and rational view here, as it prevents you from being fooled by randomness.

The greeks decomposition

The attribution for this BOIL trade is unusually clean, almost textbook. If you look at the cumulative PnL per-Greek chart , the profile tells the story immediately: delta barely moved, theta and vega-level carried the load, and vega-skew stayed contained. For a leveraged natural-gas ETF in late autumn, that is already a minor miracle.

Start with delta. BOIL spent most of the trade oscillating around our entry zone without ever committing to a trend, which is precisely what the cumulative bars show: no runaway drift, no violent squeeze, no forced hedging. In other words, the underlying behaved, and that alone removes the biggest source of PnL noise in short-vol setups.

Theta did exactly what it should do in a properly structured VRP trade: accumulate steadily, day after day. Natural gas products can sometimes erase theta with one silly headline in the middle of the night; here, the decay profile is almost linear. That is the definition of premium harvesting working as intended.

The vega-level contribution is the second pillar. While implied volatility twitched during the holding period (down at inception, up mid-trade, then settling below our entry level) the overall effect remained positive. The daily attribution chart shows that most of the swings were modest, and crucially, they never aligned with an adverse delta move. That combination is why the trade felt “comfortable” even though IV was high.

Vega-skew and residuals are the only negative components, but they are small. Skew cheapened slightly as upside panic pricing bled out of the surface, but it was never large enough to threaten the overall profile. Residuals remain noise, as they should.

Put simply: this is what a good VRP harvest looks like. Delta quiet, theta steady, vega cooperative, skew irrelevant. You do not get this often in BOIL. Enjoy it when it happens.

Now we’ve seen that keeping the trade longer was risking it as probabilities were not as clear cut as at the time of the trade entry. But what about now? Let’s have a look.

To roll or not to roll?

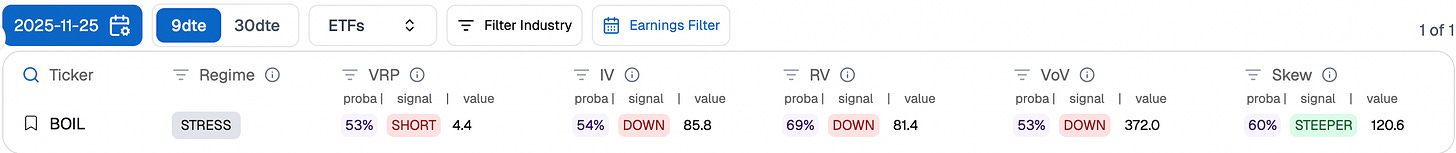

Let us start by reviewing our set of odds for short-dated options.

You are basically in coin-flip territory: if you are in a position, you have a very thin margin working for you. But really, what are four points of VRP when realised volatility is sitting at 81 percent…

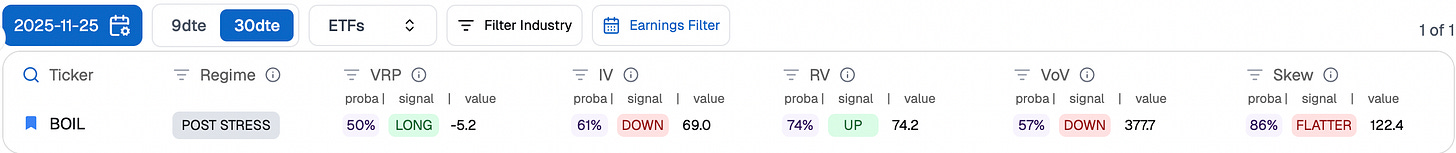

Things are not any better at 30 DTE.

The VRP is actually negative and, while we do not have a strong reason to go long volatility either, one should definitely consider getting out of any remaining position or at least de-risk it. The last thing you want is to be hit by variance during your Thanksgiving weekend.