Signal Du Jour - short vol in BOIL

The market is now positioning ahead of winter.

The government is about to reopen in the US, the VIX remains contained below 18, the SP500 is up 17% year-to-date, and the Nasdaq100 a bit more than 22%. Had you asked us (or anyone else on the marketplace) six months ago, at the peak of the tariff wars, we wouldn’t have bet on that outcome. But markets have their own way of reminding us that opinions do not matter in the face of collective intelligence.

It is terrifying but also freeing: your beautifully reasoned thesis can be right or wrong, it does not matter. What matters is making money. As far as we are concerned, we prefer doing it delta neutral, with a data-driven approach, staying away from methods where we cannot statistically put a number on the risk. It’s been two years we’ve written diligently this newsletter and you never saw mention of the GEX or technical analysis for instance. That won’t change.

In today’s edition of the Signal Du Jour, we will step aside from the US equity market and consider an opportunity in BOIL, the leveraged ETF providing exposure to natural gas.

Let’s have a look.

The context

Winter is now just around the corner, and with it, volatility in natural gas has been quietly building.

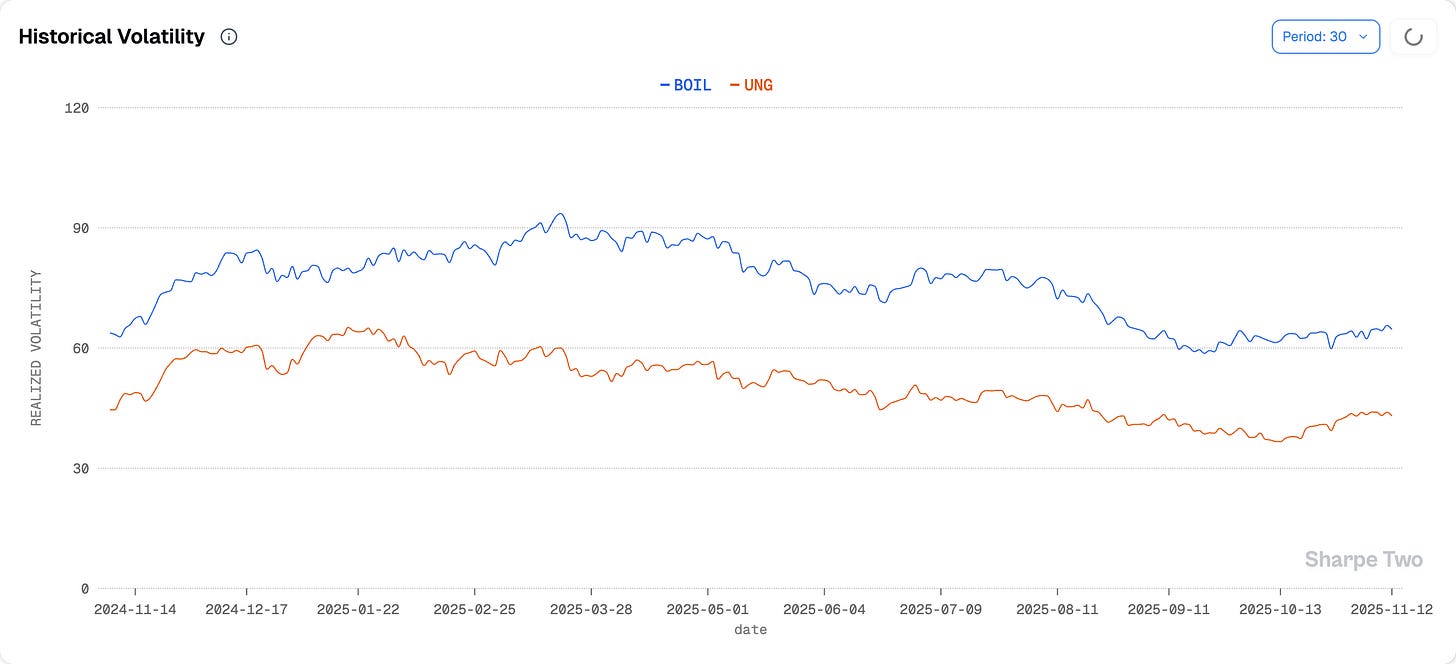

From about 58 two months ago to 66% as we write this note, the change may not look dramatic considering how inherently volatile this product, but it is another sign that something is brewing. We are now watching every small cue about how cold the winter might be, as that will drive whether storage builds further or, on the contrary, gets drawn down.

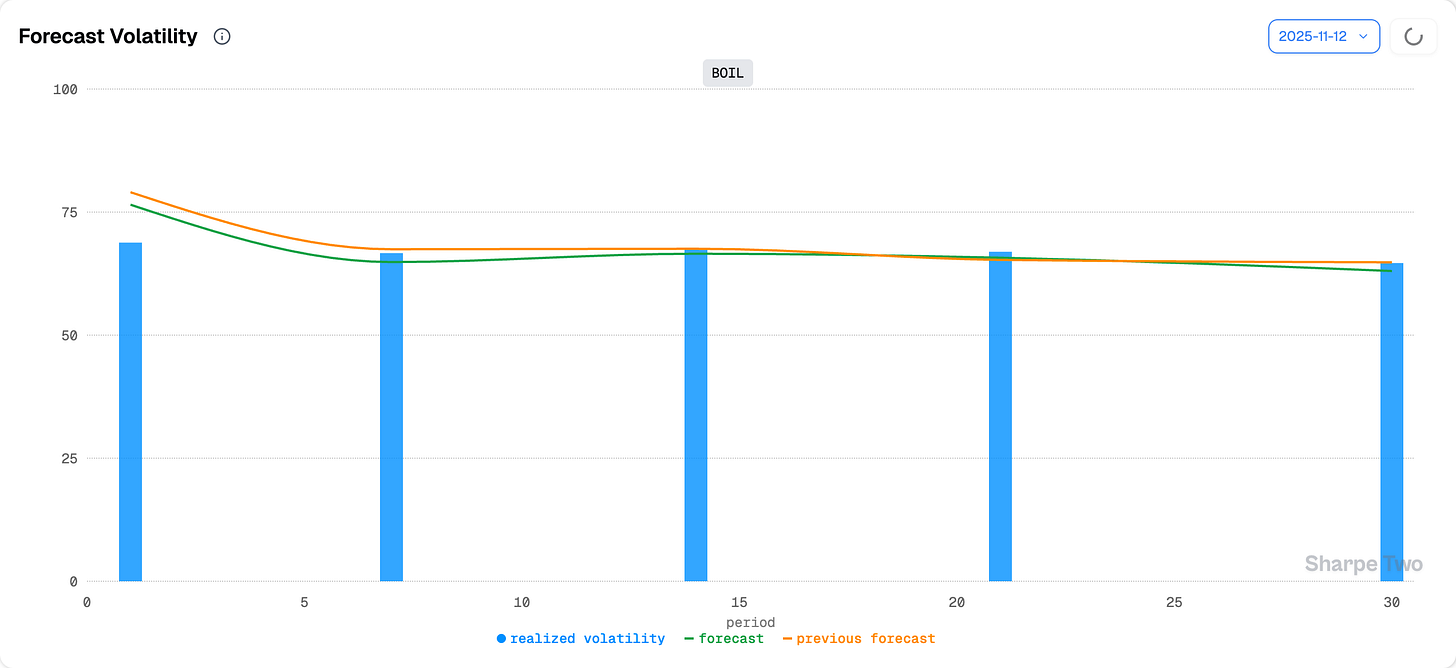

That seasonality is key to keep in mind, especially when we look at our usual forecast for realized volatility:

As it stands, we do not anticipate things to change drastically over the next two to four weeks. But, as always, caution is warranted: all it takes is one announcement to send the market rushing to accumulate exposure and for BOIL to suddenly explode higher. That is why we remain on the cautious side and still see room for a potential 5 to 10 point rise in realized volatility over the next month, running against this model’s view.

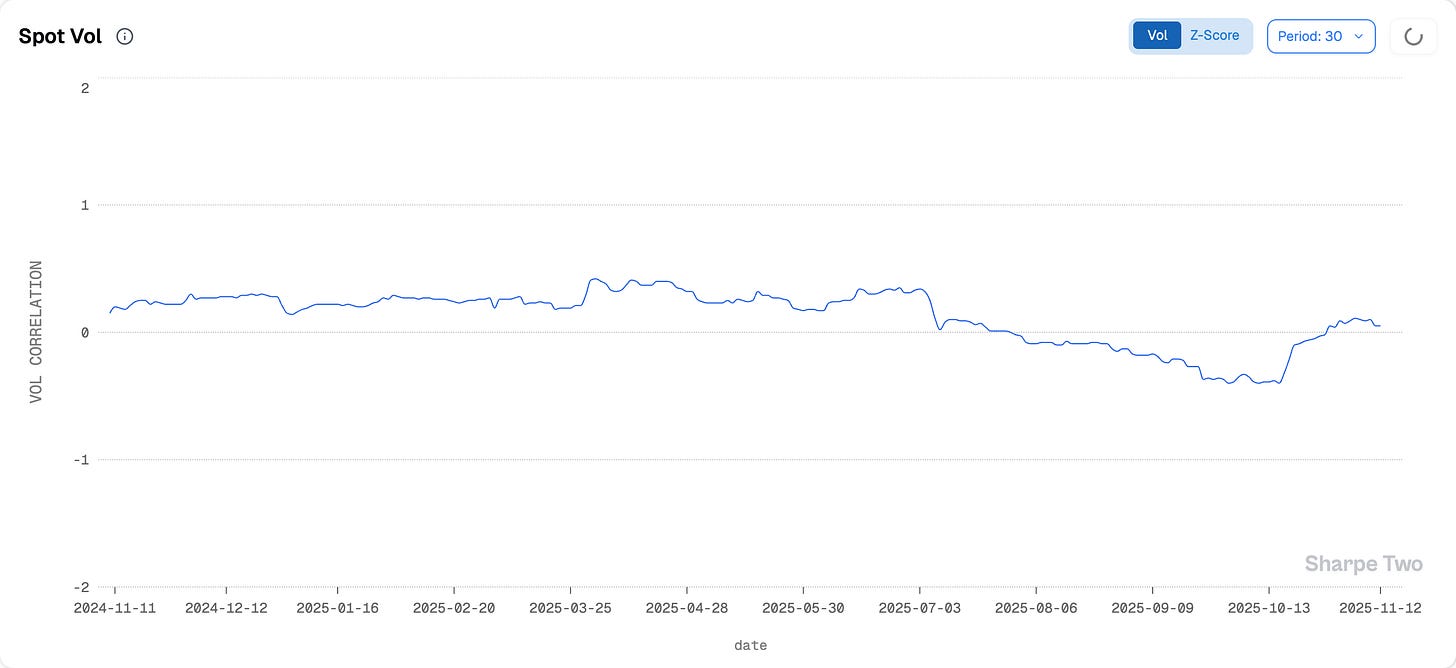

Another interesting observation tied to this seasonality is the spot–vol correlation, which shows a clear shift in the market’s hedging behavior.

We moved from roughly -0.4 to slightly positive a sign that traders are no longer solely focused on hedging downside moves. The prospect of a strong upside rally now seems just as relevant.

With that in mind, let us see what option prices are implying and how we could structure a trade around it.