Sunday Forward Note - 2024/06/02

An odd one.

This week was an odd one.

After a fairly uneventful Monday, the market went on a downward spiral, accelerating on Friday, just a few hours before the close. At that moment, many market observers thought this was finally it—four big red days in US equities and maybe even the first move down of 2% or more in the Nasdaq for the first time in almost three years.

How did we get here? As we said, it was an odd week. Macroeconomic data were mostly in line—GDP came in weak but still in positive territory, matching the expected 1.3%. Core inflation data were slightly better than anticipated, although still in line at 2.7%. High, but not too high. And certainly not enough to justify any meaningful change in monetary policy.

So, how do you justify that somber mood? Earnings, maybe? Indeed, Salesforce and Dell weighed heavily on tech stock sentiment on Thursday and Friday after posting disappointing results, leading to a 15% drop for both blue-chip tech stocks. Adding to this, as we wrap up the earnings season, some argue that while AI is capturing all the hype, the software industry is not exactly in the greatest shape. Analysts will keep a keen eye on whether their prediction, “the worst is behind us, and we should now accelerate again,” will materialize in Q3 and Q4.

But again, this is an odd one: since when would industry-specific sentiment be enough to weigh on the entire market? “It doesn’t exactly feel like 2001, when the bubble was beginning to burst,” as some veterans in our network pointed out, and we were skeptical at that point.

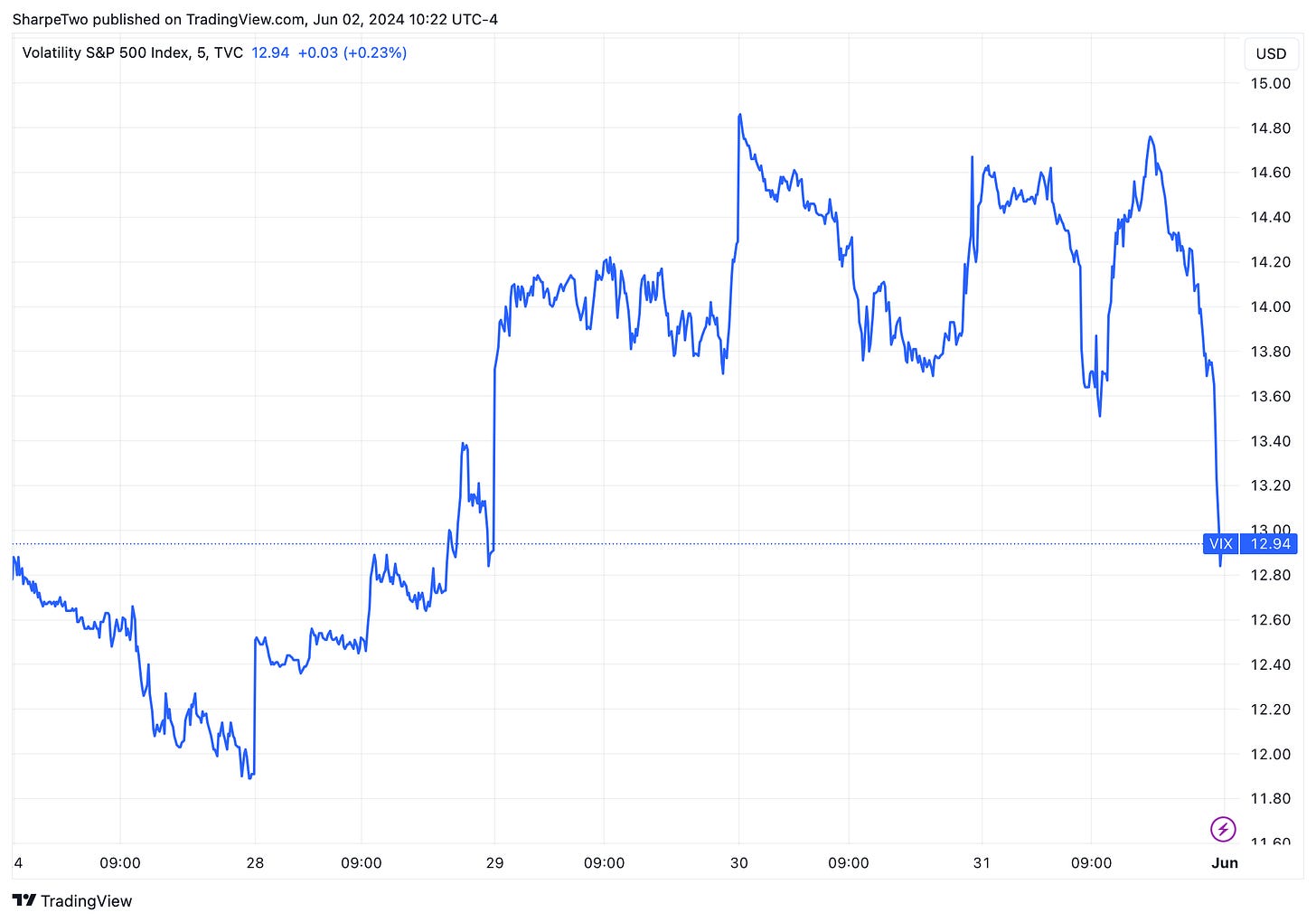

While feelings and market intuition are great, we often prefer more rational and data-driven justification. Once again, the best answer was hidden in plain sight: if you kept a close eye on the insurance premium and out-of-the-money options, you would have noted that the VIX was unphased. While US equities were losing some altitude from their all-time high, the “fear index” went from 12 to 14.87 at the worst of the week. You call that a panic?

We briefly touched upon it two weeks ago, and our mantra at Sharpe Two hasn’t changed: call us when we are meaningfully back above 16, and until then, keep selling vol (or risk reversals).

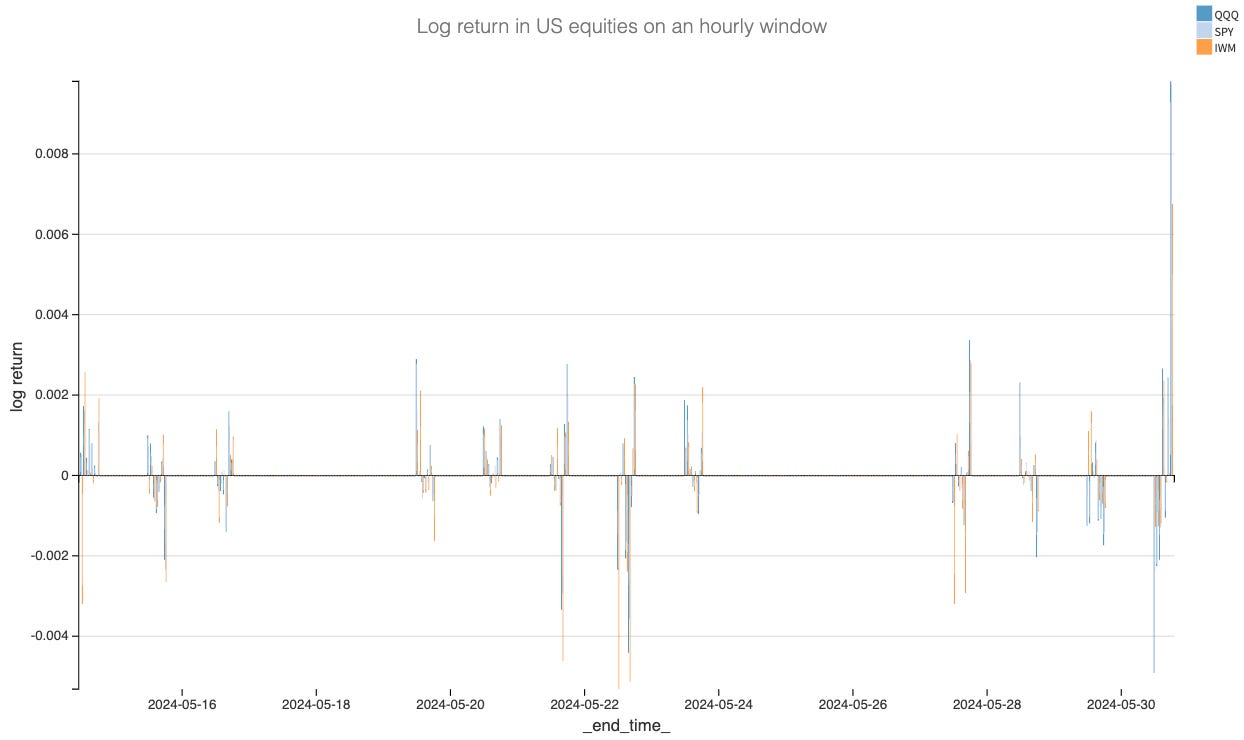

It’s always easier to pat yourself on the back in retrospect or find justification for what happened. And although we tend to have a healthy dose of skepticism toward the supposed end-of-month flow, it is hard to look in any other direction to explain this odd week. Indeed, after some heavy selling until exactly 18250 on the Nasdaq June Futures (who had a touch option at 18250 expiring at the end of May?), liquidity came back in full force.

Oh, you thought the markets were depressed and were already dancing with the Macro Boys, celebrating the SP500 at 4960 by the end of June and the beginning of the big reversal? Not on this market watch. While we ended the week down for the Nasdaq and the SP500, we gained a whopping 1.5% in the last hours of the month. Once again, it's hard not to see fund managers buying back stocks after others have finished trimming their positions.

At least something happened, and we won’t complain about it. However, we want to emphasize that you should control your emotions if the VIX doesn’t panic. Of course, it is a correlation, not causation. Yet, when the VIX does spike, it does “feel” like it, and a 2-point move up from the ultra lows after all that selling doesn't qualify for the spooky award of the year.

It ended up closing below 13, and with that info, what will you expect for next week and even the next 30 days? Our money is on more of the same. With the NFP at the end of the week and the June FOMC the week after, expect some movements for sure, but as long as nothing meaningful hits the newswire or we don’t cross 16 in the VIX and return to a more neutral vol regime, try to stay away from the crowd’s noise and doomsday central. When those days come, it will “feel” like it. And trust us, we won’t tell you to sell volatility that day.

In other news

The software industry hasn’t been doing great since the 2022 bear market (we still need a good name for it). IPOs have dried up; it’s harder to justify extravagant valuations and raise venture capital money on just a PowerPoint idea (well unless you write GenAI these days). And with the great hack of Santander, supposedly due to a door left open by Snowflake, the scrutiny on the sector will stay for a while longer. Expect more data regulations worldwide, fines, and tech groups competing hard to get their hands on your data or even recreate it—yes, Scarlett, your voice does sound great, and we wish you’d say yes to Sam.

Anyway, while the market is maturing, incidents like this always raise questions about some of the philosophical choices made by organizations over the last twenty years—let’s ditch our servers and move to the cloud. Yes, but if it comes at the cost of our reputation, shouldn’t we try to find a good balance between the two?

Thank you for staying with us until the end. As usual, here are a few interesting reads from last week:

The economy is depressed, it feels like we are in a recession, and things are worse than they were 25 years ago. We’ve heard that before. While we empathize with the hard lives of millions, we also like to stay rational about these matters. Nothing better than yet another great article from Claudia Sahm to put things in perspective.

Still, dazzled by that crazy end-of-month reversal in US equities? Check out Michael Hunt analysis from almost a month ago about what to do with volatility at the end of the month. It’s a paid article, but it's worth it. Spoiler alert: Maybe you shouldn’t sell 0DTE in the last few hours of the month.

We are very happy to announce that our data pipeline is now shiny and new after a full revamp throughout May. Expect free analysis to return soon on Sharpe Two. If not next week, maybe the one after. Thank you for your patience.

That is all for us this week. As usual, happy trading, and remember: trade the regime you are in, not the one we may be in.

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.