Forward Note: 2024/05/19

Selective memory.

About six months since my first post, you are now more than a thousand reading the market notes I publish most days of the week. This is quite an achievement, and I want to thank each of you sincerely.

I want to give special attention to the paying subscribers and those who’ve helped significantly make Sharpe Two what it is today—Max, Hugo, Kris Abdelmessih, and Leila, who deals with the inconvenience of me waking up at 5 a.m. to write before the markets open.

Although it is a significant milestone, I got used to bringing practical and data-driven trade to the public, and this is just the beginning - I can’t wait to bring you even more exciting stuff over the next six months.

Thank you again.

11.99.

Did you forget?

That was the price (in Euros) of a cinema ticket in Paris in the early 2010s, and it was also the cost of a Netflix subscription in 2017.

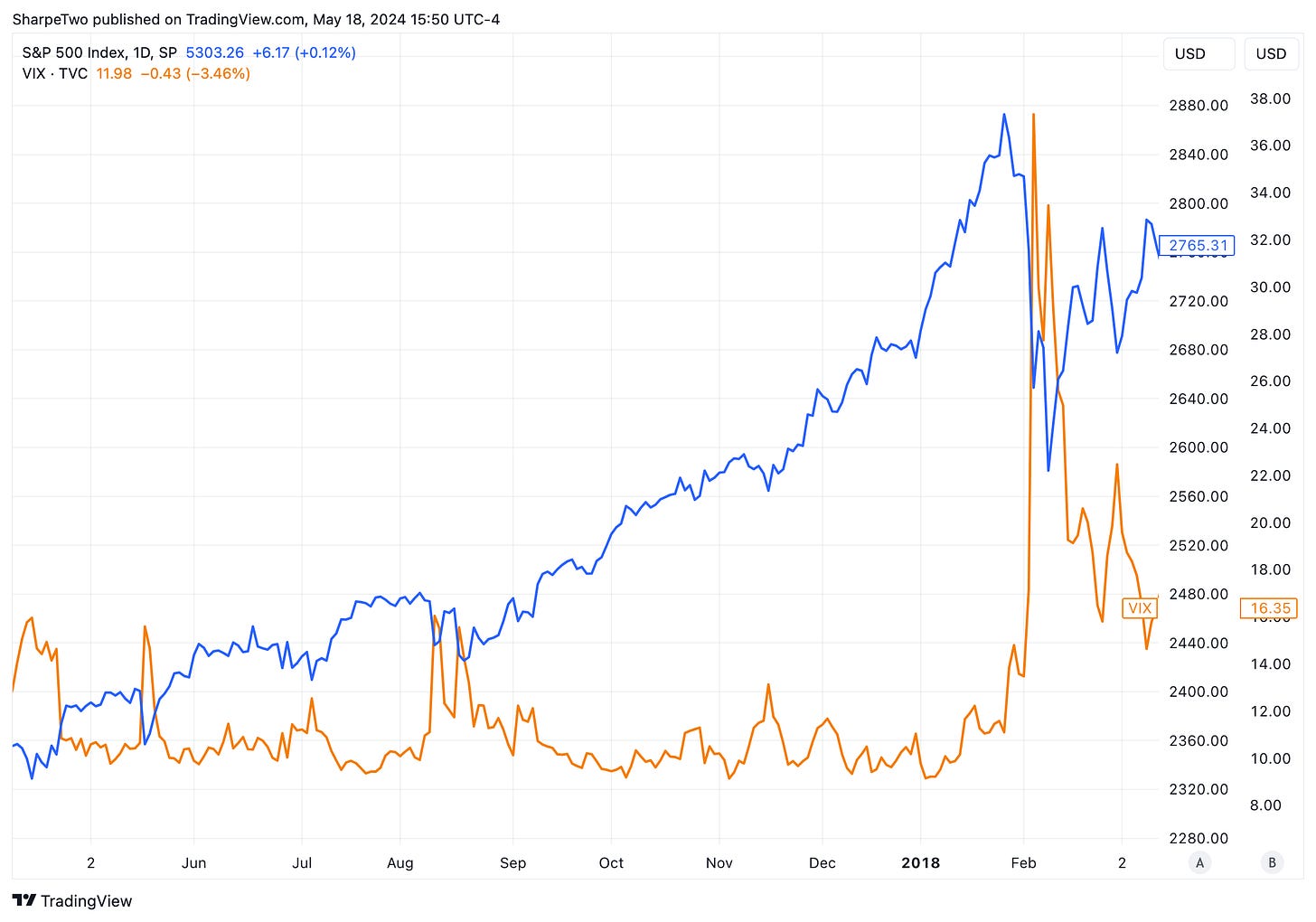

Last Friday, that is where the VIX closed. Yes, it was below the levels seen over Christmas 2023. In fact, it was also below the levels observed during Christmas 2019: the last time we saw such low levels was in November 2019, which feels like an eternity ago—do you really remember the world before GME and COVID-19?

As we mentioned last week, now is not the time to bet on volatility expansion. Let’s put things back into perspective.

We are now far from the natural average for the product, which is around 19. Yet, readings between 11 and 15 represent more than 35% of the observations over the last 20 years.

Most of the time, markets are calm and quiet, and we don’t remember it as our lives go on and (hopefully) our investments grow. What leaves a lasting impression are those moments when things are really up in the air. We are human; we have emotions and are wired to remember painful moments, identify patterns, and hopefully avoid repeating them in the future for our species' survival.

I still remember the day MF Global went bankrupt or the day the US lost its AAA in August 2011, which caused the market to go crazy.

But what happened in Q3 2019? I have no idea, yet I’m sure that if I return to Twitter, I will find some doom-and-gloom posts alerting us about the dire situation ahead. Let’s cut the crap right now—it is always easier in retrospect, but no one could have predicted COVID-19 and the turmoil that followed.

Super low phases tend to remain for a long time. It is a well-known fact that volatility clusters. Yesterday’s reading may very well be the best estimation of today’s, and, all else being equal, the market can stay in equilibrium until some significant new information disrupts that equilibrium.

Almost a third of the readings below 12 happened between Q4 2017 and Q4 2018, and a staggering 45% occurred between Q4 2004 and Q1 2007. What is striking about that chart is that we rarely arrive at these levels by accident. Sure, we’ve had some outliers in 2013 and 2015 when the market was binging on QE infinity. However, there is a strong case to say that once the VIX lands below 12, it tends to stay there for an extended period.

The irony is not lost on us, a volatility publication: we won’t tell you to buy it and bank on the next imminent crash that no one sees yet; that would be criminal.

But finding good spots to sell it is increasingly complex, and at this stage, our best advice is probably to be long like the rest of the market.

There it is: we’ve crossed our cardinal rule about staying market neutral, but it is a special occasion (the 1000th subscribers mark, remember?). Look at the chart above: you can keep selling at 12 and 13; there is nothing wrong with that, but it may be easier to buy and forget about it.

You may not remember what we wrote about VXX and EWZ, or the multiple Signal Du Jour pieces that ended up on the right side. Still, if things blow up tomorrow, you’ll surely remember that Sharpe Two was dumb enough to be long when the VIX was at 11 and every macro signal was screaming sell.

Yet, we stand by it.

Volatility trading is tough, and being dogmatic about it can only result in disaster. When no one is hedging, volatility is low, and it may be wise not to bet against the whales busy putting hundreds of billions of dollars to work while you read the next entertaining macro analysis on Twitter.

And because we are not dogmatic about it, we certainly listen to arguments for protection, not speculation. As we like to say—it’s that home insurance you pay for every year, and you’re happy you did so when your neighbor’s barbecue party turns into a disaster.

Volatility trading is like running an insurance business; a big cost center is the cost of reinsurance. Buying puts in January 2025 contracts after the main event—November 2024 and the US election—is acceptable because something will happen at some point, inevitably.

When? We don’t remember.

In other news

Roaring Kitty is back, and with it, the GME saga. However, nothing indicates that Diamond Hands members will hodl as long as they did in January 2021. On Monday, the stock spiked 80% after a Twitter post from one of the most famous Wall Street Bet Redditors. Yet, it reverted most of its move by Monday.

While we saw interesting posts about options pricing, Greeks, and implied volatility behavior, the market still remembers well what happened last time. We noticed something much more interesting (to us, at least).

Don’t you? Nothing? Maybe you are right, and that blip in volume at the end of April and then early May was probably nothing. Curious about who the buyers were, though. We may never know.

As a side note, we have no substantial evidence that someone may have bought the stock before and sold it last week on the basis of speculating on the impact of a potential tweet.

Thank you for staying with us until the end. As usual, here are a few interesting reads from last week:

Chinese stocks are up almost 33% since the beginning of the new Dragon Year. Looking to jump on the bandwagon? Here is a full analysis of the situation by The Last Bear Standing .

In a strange paradox, Arman Khodadoost makes the case that we have a constant choice to make—half full or half empty. How are you going to think about it next week?

Still no educational content on Sharpe Two, but we are making significant progress on the data infrastructure. Just bear with us; we will be back shortly.

That’s it for us, we wish you all a fantastic week ahead.

Happy trading!

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.