Signal du Jour - Skew trade in KWEB

Chinese equity trading - part II

We’re now in mid-February, and the VIX remains stubbornly glued to the 16 handle. Is the writing on the wall? Hard to say—the market has developed a habit of ending up where we least expect it. Yesterday was no exception: despite a concerning inflation headline pre-market that sent futures down 1%, the market shrugged it off, clawed its way back, and closed flat.

That reaction will leave more than a few macro traders scratching their heads, especially after Powell once again reiterated that the Fed is in no rush to cut rates. Have we overplayed the inflation narrative and the idea of rates pushing toward 6%? Still too early to tell. But in any case, trade the regime you’re in, not the catastrophe that may (or may not) unfold down the line.

With this in mind, we’re sticking with Chinese equities. After last week’s recommendation to short volatility in this space, we’re shifting gears to explore a skew trade—specifically in KWEB, the ETF that provides exposure to Chinese internet companies.

Let’s dig in.

The context

Chinese equities have had a turbulent start to the Year of the Dragon. What was supposed to be a strong recovery for the stock market never quite materialized, as the government’s much-anticipated economic stimulus failed to meet expectations. While realized volatility spiked in September 2024, it quickly faded as investor interest dried up.

Then came DeepSeek. While it shook up the US market, it also sparked a significant rotation into Chinese tech stocks.

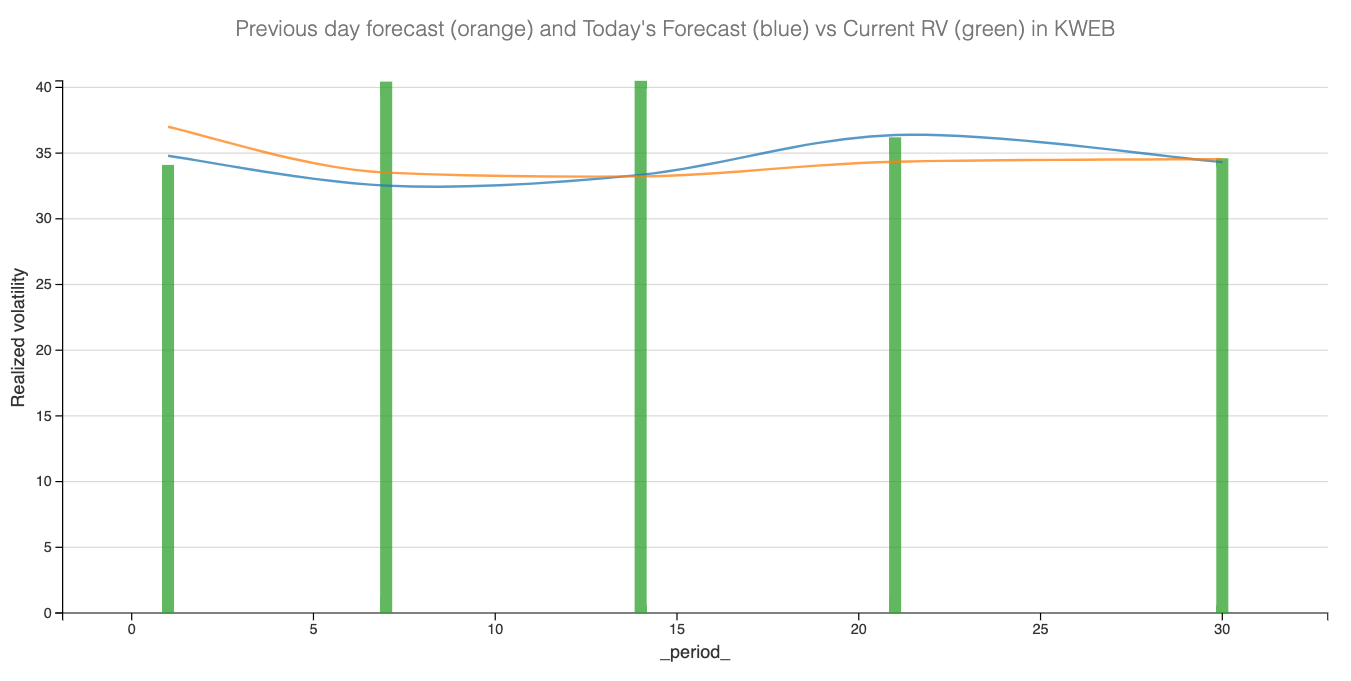

While it’s still too early to gauge the full impact of how fund managers are rethinking the AI thesis, KWEB’s 20% gain over the past month makes it clear—it’s significantly outperforming its US counterparts. Big moves like this tend to leave a distinct mark on realized volatility. Let’s take a look at the short-term volatility in KWEB:

The rise in January has been gradual, seemingly peaking now. By comparison, it pales next to the sharp volatility spikes observed in Q3 and Q4 last year, when the market was eagerly waiting for any sign of new stimulus from the Chinese government.

So, while the latest developments have undoubtedly moved the market, they haven't been drastic enough to fundamentally alter the outlook for realized volatility over the next 30 days. With the initial shock now absorbed, it’s likely that things will start to settle down.

The move to the upside could very well continue, but likely not with the same intensity. We expect the swings in the ETF to soon revert to the levels observed before January 25.

With that in mind, let’s take a look at the options market to see how we can use the skew to structure a trade to our advantage.

But first, a quick reminder—we’re not expressing a directional or contrarian view in KWEB. If you haven’t read our explanation on how we use the skew/VIX matrix, we strongly recommend doing so first.