Signal Du Jour - short vol in US equities

Why changing a winning team?

You can access all our insights and volatility forecasts for about 400 tickers in our platform right here.

Right as we wrapped up our post-mortem on NUGT (takeaway: keep those GTC orders parked where you want to exit), the ticker gave us a nice pullback yesterday. Worth a glance especially if you were wondering if it makes sense to stay in or stretch the trade for a few more days.

Meanwhile, U.S. indices have been drifting lower as December expiry gets underway. What is driving it? A little trimming? A bit of growth and jobs repricing? Very likely. But let’s take a step back VIX is still parked around 16/17 and hardly in panic territory.

Which brings us to today’s focus: an opportunity in U.S. equities that has quietly paid out for four straight months. And there is no reason to think the setup will flip overnight.

Let’s dive in.

The context

Open social media these days and suddenly every options trader is a genius again: selling premium is back to being the magic machine. Income at the very least, generational wealth at best. Funny how there is a near-perfect anti-correlation between that kind of chest-thumping and the level of realized volatility.

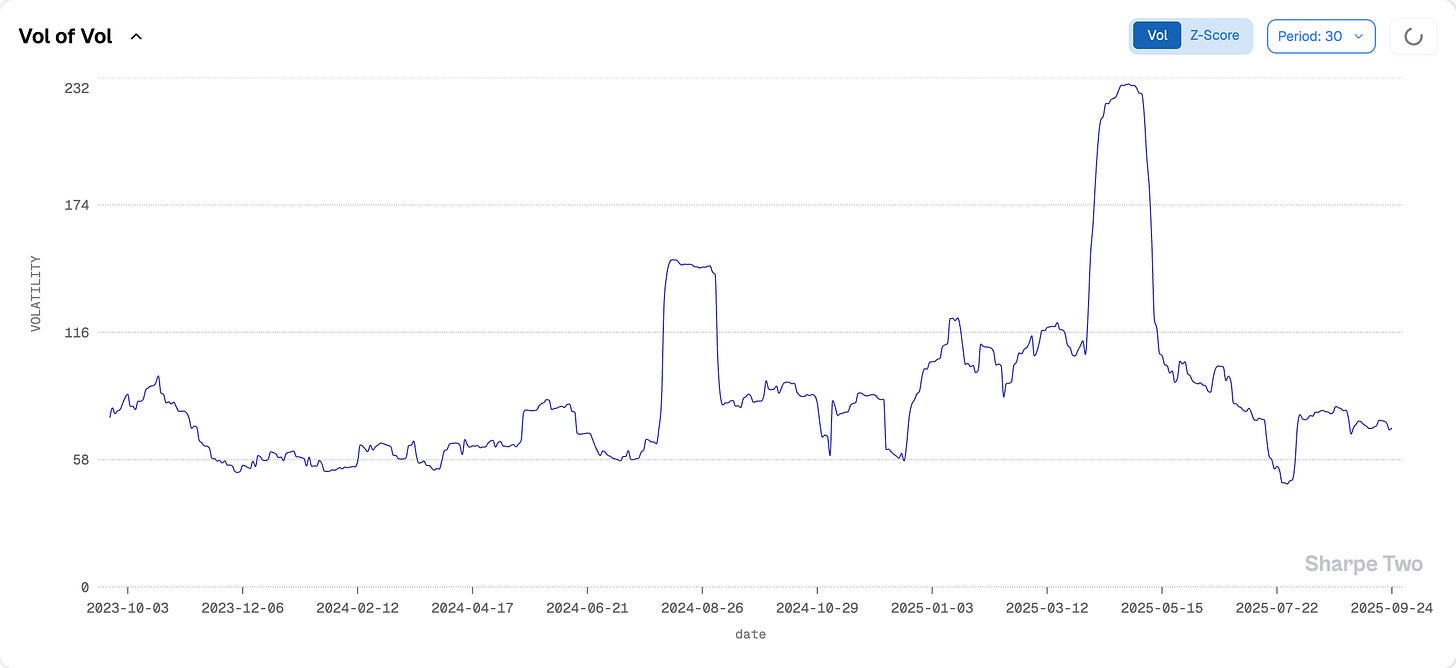

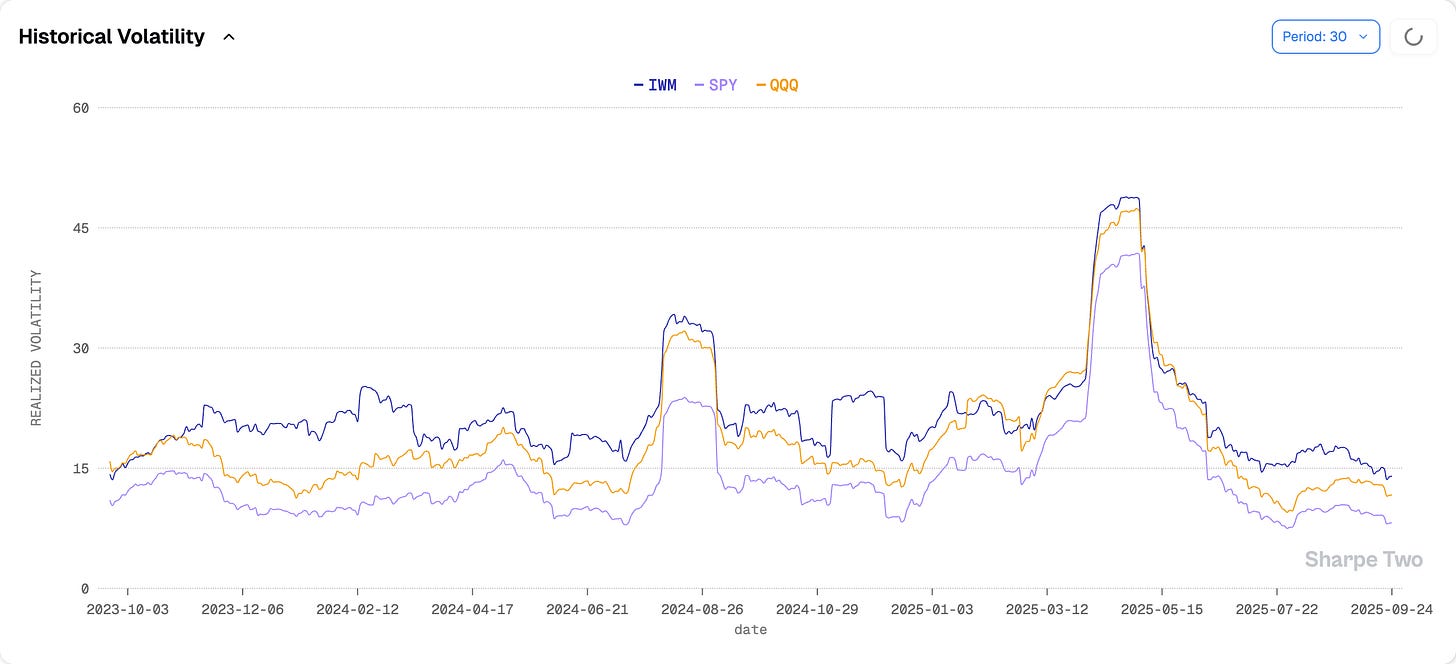

Post-tariffs, realized vol has basically evaporated from the main U.S. indices. Sitting this low in mid-September is a pretty strong tell for how the rest of the year shapes up. We stay clear of direction calls, and we will again: all we are saying is this does not look like a market about to cough up 10% out of nowhere. And for those squinting hard to find trouble on the horizon (yes, “VIX up, stocks up” crowd—we see you), realized vol of implied vol is about as boring and well-behaved as it gets.

Markets will have their usual ups and downs—that is life—but if a potential 5% dip feels unsafe in these conditions, the real issue is probably sizing. Now, do we expect things to stay this quiet? Sort of.

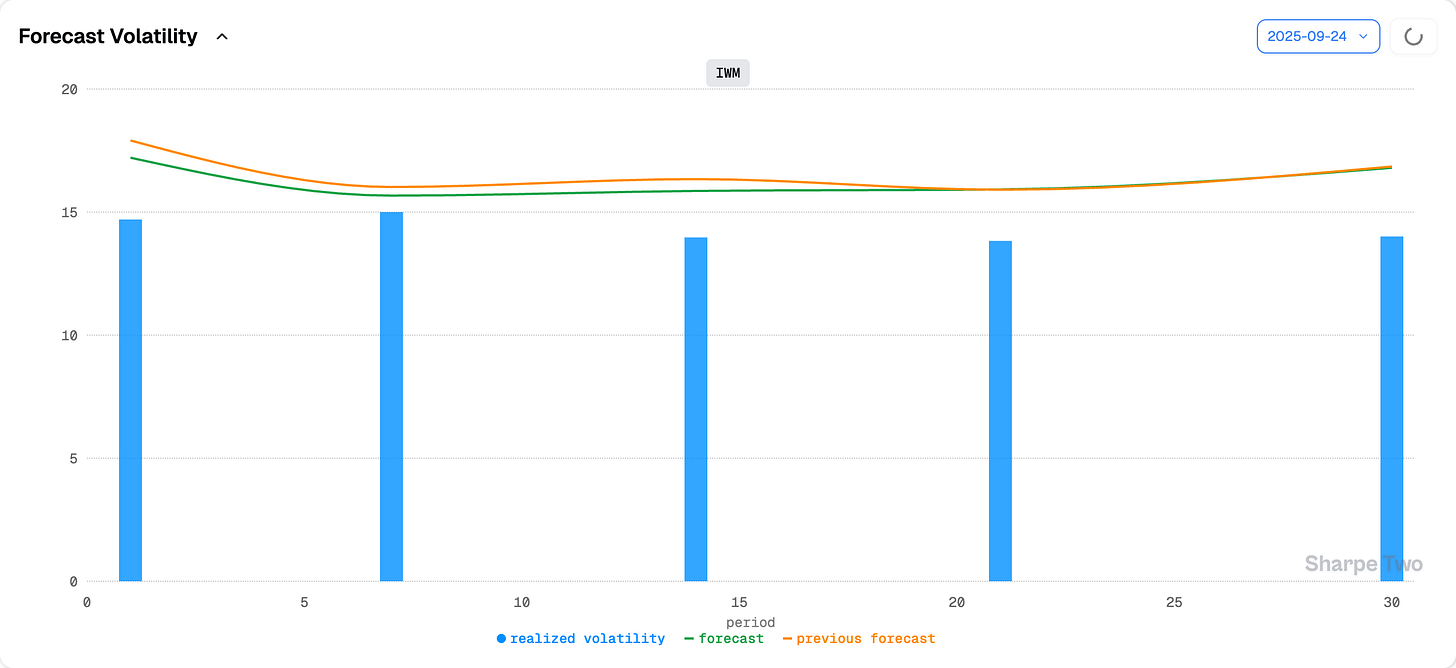

IWM has been running at a staggering 14% annualized over the last month, and we are bracing for something closer to the long-term mean of 17%. But that is exactly what we flagged back at the end of summer—realized vol has a way of coming back. Why should this time be different?

We are not sure. As we wrap this note, GDP just printed much stronger than expected, and while equities are red on the day, it is hard to imagine fund managers shorting an economy that stubbornly refuses to collapse—no matter how many have called for it, and failed, over the last three years.

But enough scorekeeping with macro. Time to have some fun with the options tape. Because yes, the VRP in IWM is so fat that you could fit the… well, we will let you finish that sentence in the quiet of your own mind.