Signal Du Jour - Short Vol in URA

Where is the vol?

After seven weeks of rocky markets, volatility has been obliterated through Thanksgiving week, and the turkey snooze has lingered into this one. With VIX comfortably resting at 16 while every trader on the planet analyzes whether this is a permanent state or if we are due for late-year fireworks in a market that certainly did not miss any, the complacency is palpable.

We are now one week away from the most important FOMC of the year, and while we still have reasonable reasons to believe the Fed will cut rates (they are not exactly willing to deal with a VIX at 26 for a prolonged period of time, are they… are they…?), the odds remain perfectly balanced. At this stage, anything can happen.

While we were happily (and successfully) dabbling in US equities two weeks ago, we will distance ourselves from the US market this week and head back to commodities. We are exploring an opportunity in URA, the ETF giving investors exposure to uranium-mining companies.

Let us have a look.

The context

While all the talk was around AI this year, some adjacent sectors did quietly well, and URA is one of them. As electricity consumption is due to skyrocket over the next few years, many are looking at cleaner and more scalable energy sources to fuel that growth. And with that, the nuclear sector is going through a renaissance phase in the eyes of investors.

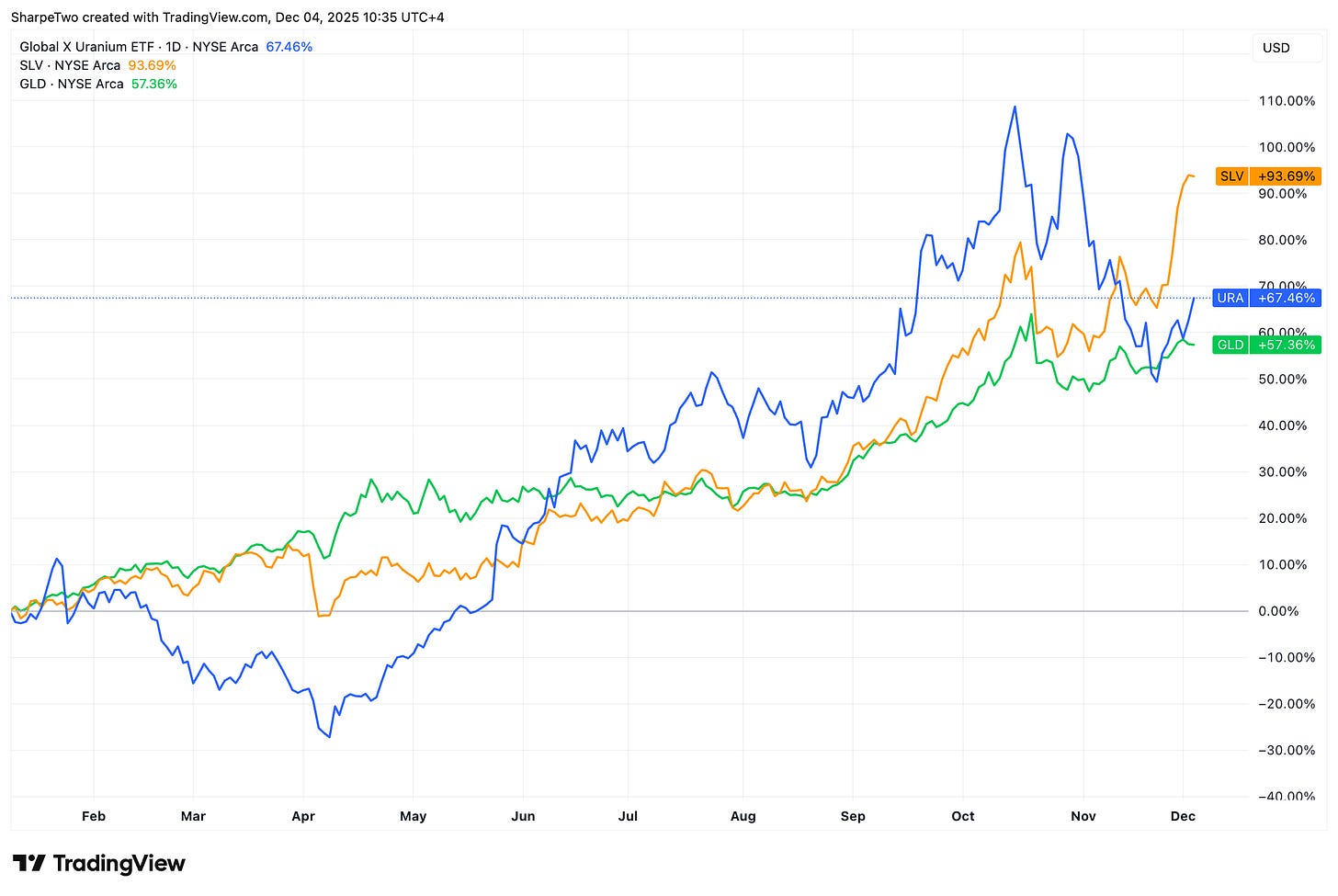

URA is up +67% so far in 2025, and if it were not for the last few weeks of rocky trading, the ETF would still be boasting a rather astonishing +100%, dwarfing the returns of most of the Mag7, but also one of the stars of 2025, GLD. Only SLV has done better with a stunning +93%. And looking at these charts, anyone with a taste for pairs (or trio) trading might already be eyeing some interesting plays between that triptych.

Back to our favorite topic.

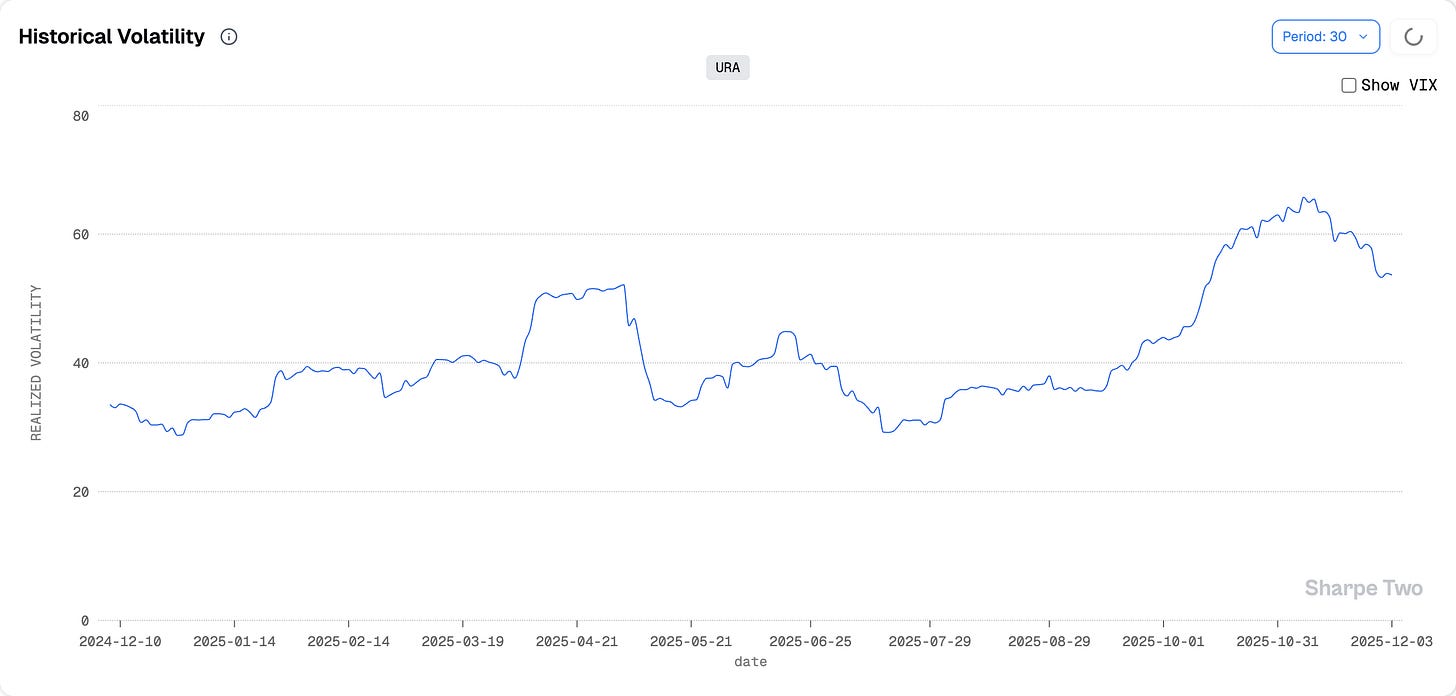

One can easily eyeball that realized volatility for URA went through the roof over the last few weeks: from below 40% as we wrapped up the lazy summer to above 65% at the peak in November. A move not for the faint of heart, and a reminder that things can change just as quickly in the volatility world as they do in the directional one.

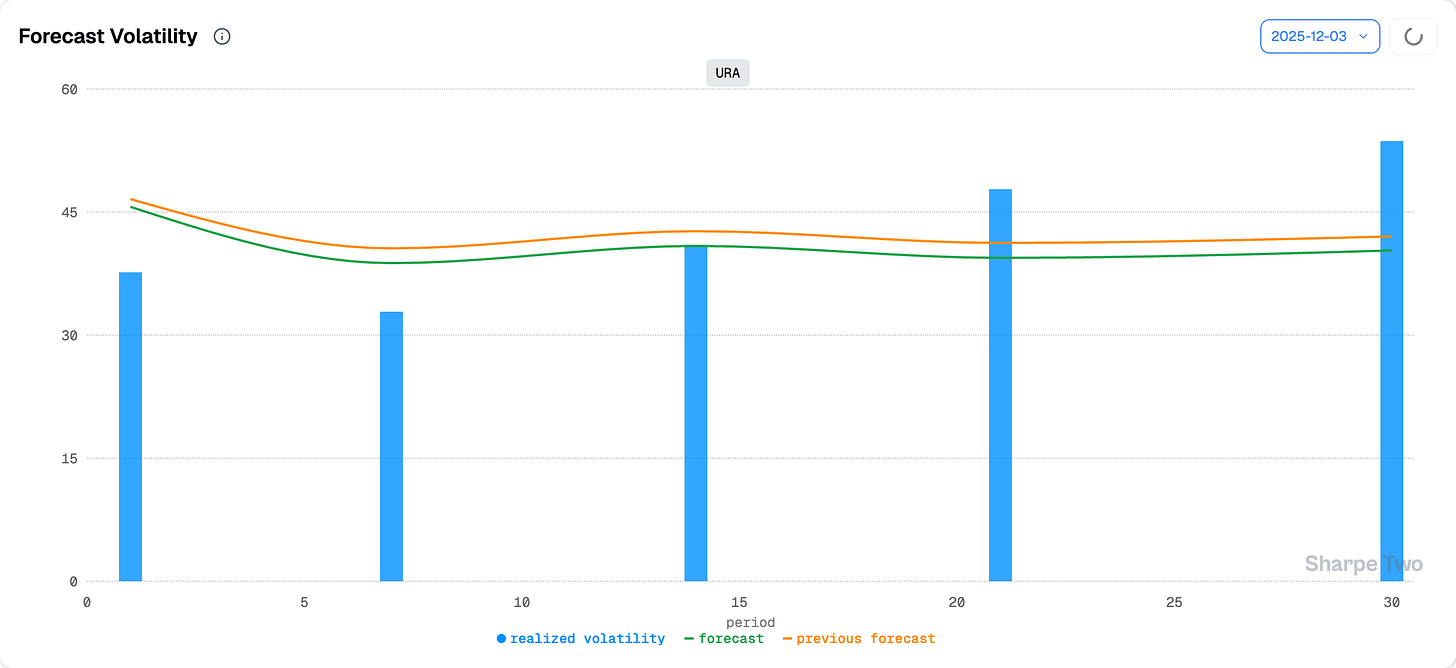

Since then, things have cooled off. At 53% we are still near the highest levels observed over the past two years, but our forecast anticipates that volatility will continue to settle.

If conditions remain this quiet, our models expect realized volatility to drift toward 40% over the next 30 days, which does not seem too far-fetched given the traditionally slower end-of-year period. But in the short term, the 30% observed the last week could get much closer to 40%. Important information for the rest of the article.

Let us now look at the options market to see how we can structure a trade in URA.