Signal du Jour - short vol in EWW

Quick before the election windows closes out!

This is an election week, and the results in India sent shockwaves through the Nifty 50 as Modi won his third term without any triumph.

The results in Mexico were more in line with expectations, yet some initial weakness sent the peso and the stock market down. Although things stabilized yesterday at the close, investors' reactions in the next few weeks will be interesting.

From a pure volatility perspective, this situation presents some interesting opportunities. As we know, volatility tends to get crushed after major market events have passed. While we may have entered the INDA trade too early, the timing for EWW, the ETF tracking Mexican equities, is more appropriate.

Let’s take a look.

The context

Mexican equities have had a mixed performance over the past 12 months. They benefited from the global stock market rally at the end of 2023 when the Fed announced they were done hiking rates and would start cutting them in 2024. However, the few months leading up to the election have been chaotic. They significantly underperformed compared to the US equities (SPY). While they still did better than Brazilian equities (EWZ), they lag far behind the big winner in the LATAM region, Argentina (ARGT).

With the stock down more than 10% over May, we would have expected realized volatility to spike significantly, but that was not necessarily the case.

Even though there is a premium over US equities, the action has been fairly contained. It has realized less than 20% over the past 30 days and is still underperforming EWZ, which is not in an election year!

At this stage, we could spend time predicting where the realized volatility will likely be over the next few weeks. However, if this market event wasn’t enough to derail the stock market seriously, there is limited value in the exercise. Unless something major happens globally, we will probably keep ranging between 15 and 20.

Let’s now analyze the signals in the options data to see how we could structure a trade.

The data and the trade methodology

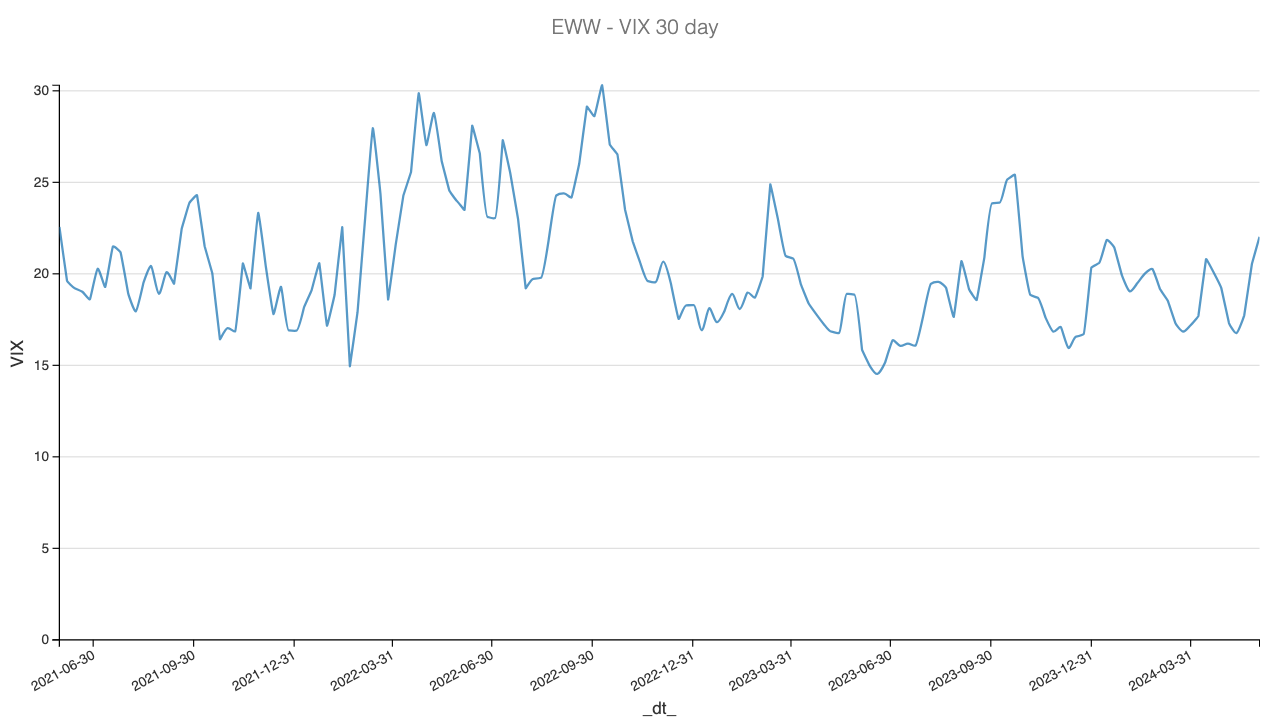

Let’s start with a reconstruction of the VIX index for EWW.

As expected, the options prices follow a similar trajectory to the realized volatility and trade at an overall slight premium over what is often realized but nothing astonishingly high.