Signal du Jour - Short vol DBA

An oasis in the low-vol regime.

It’s been a tricky month for those selling volatility. Opportunities were there, but in this persistently low-volatility environment, our indicators have been lighting up more frequently for long trades.

Navigating this landscape of subdued implied volatility is akin to resisting thirst-induced mirages in a desert: it's easy to see opportunities where none exist.

So, unless an opportunity is glaringly mispriced, we approach long volatility trades with a healthy dose of skepticism. We're keeping our fingers crossed that our last week’s picks will be as fruitful as our earlier trades in U.S. equities and bonds from early January.

Today, we're shifting gears. Instead of venturing once more on the long side, we turn our attention to DBA, an ETF that offers exposure to the agricultural sector primarily through futures.

Let’s take a closer look.

The context

DBA is a diversified fund when it comes to agriculture. A significant portion of the funds sits in nonrisky assets, but the rest are large futures positions in the main components of the agriculture markets.

The advantage? Each of these markets is niche and requires deep expertise from the participants. You need to understand the macro element that can influence the price of your markets - the weather being an obvious one or some geopolitical tensions - but also some microelements.

For instance, would you know the difference between hard red winter Wheat and a normal wheat future? Certainly, we don’t. But if we were futures arbitrageurs, here is what we would say: it’s still wheat after all, and maybe prices should follow some sort of equilibrium, like Brent and Crude Oil.

Anyway, we are vol traders so let’s go back to the subject du Jour.

While DBA's holdings span various agricultural products, the fund's aggregate effect smooths out these individual volatilities. This setup is ideal for exploring variance risk premiums, particularly given the inherent risks associated with the agriculture sector. It’s like trading volatility on SPY instead of individual name components.

Let’s start with the prices over the past few years and their subsequent realized volatility.

A glance at DBA's recent price trajectory reveals a relatively stable range between $18 and $22. Despite some spikes in 2022, the overall realized volatility has remained subdued, particularly in January, following a high at the end of last year.

This pattern suggests that while the fund's price movements are fairly stable, the volatility inherent in the agricultural sector might lead option sellers to maintain higher quotes. This discrepancy could open up attractive opportunities for us.

Let’s now dive into the data to explore these potential trading opportunities further.

The data and the trade methodology

Let’s start by building some intuition on the options market with moontower.ai, the software from Kris Abdelmessih - we recommend if you need solid visual analytics.

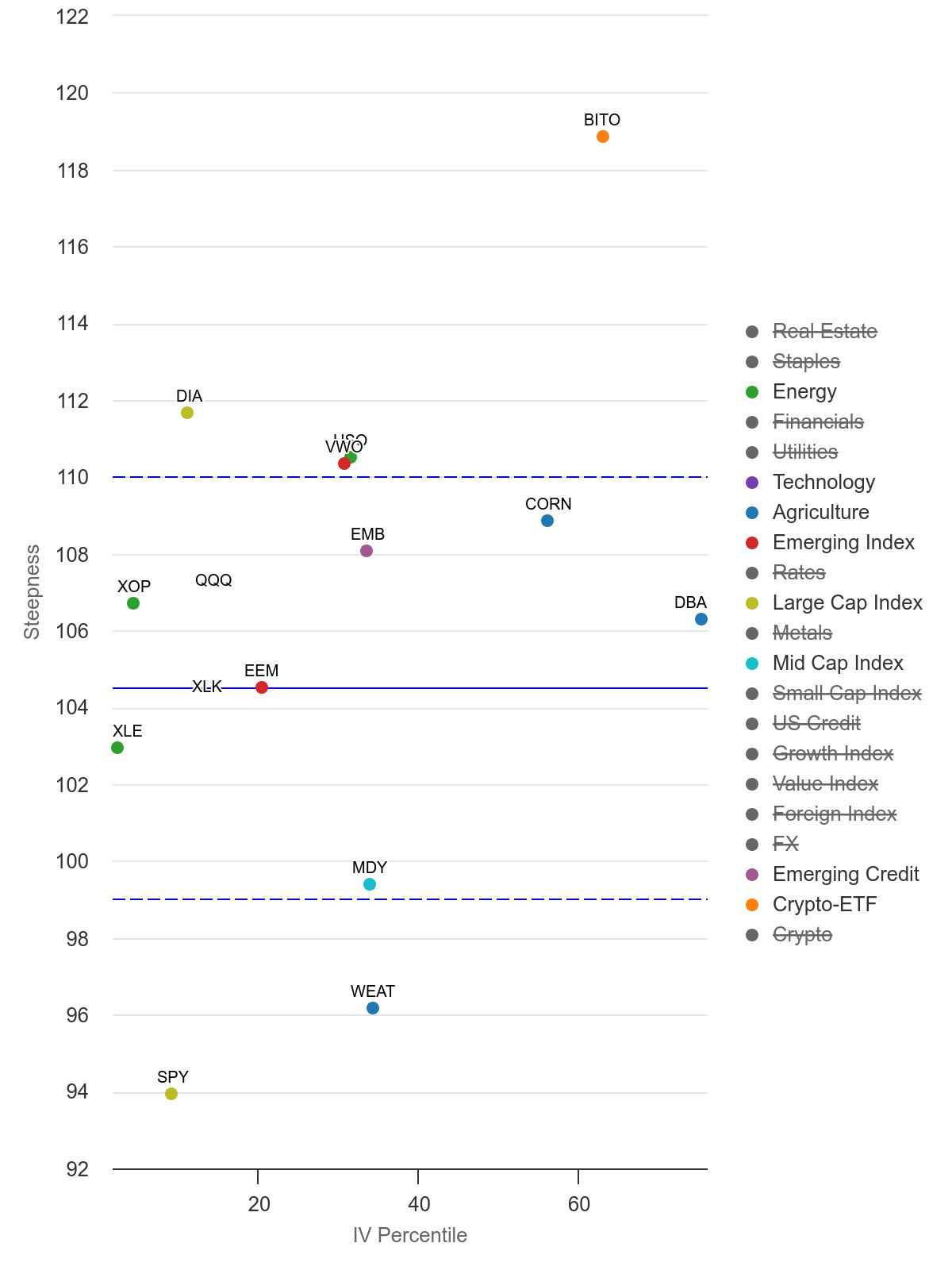

With some decent steepness in the term structure and quite high implied volatility, DBA is definitely a prime candidate for a short volatility position.

As volatility traders, our first step is to compare the current at-the-money (ATM) straddle prices with recent movements in the underlying asset. We then add a z-score on the ratio to ease the interpretation.