Signal du Jour - Sharpe Ratio 1.81 Win Rate 81%

Quiet winter, wheat a winner?

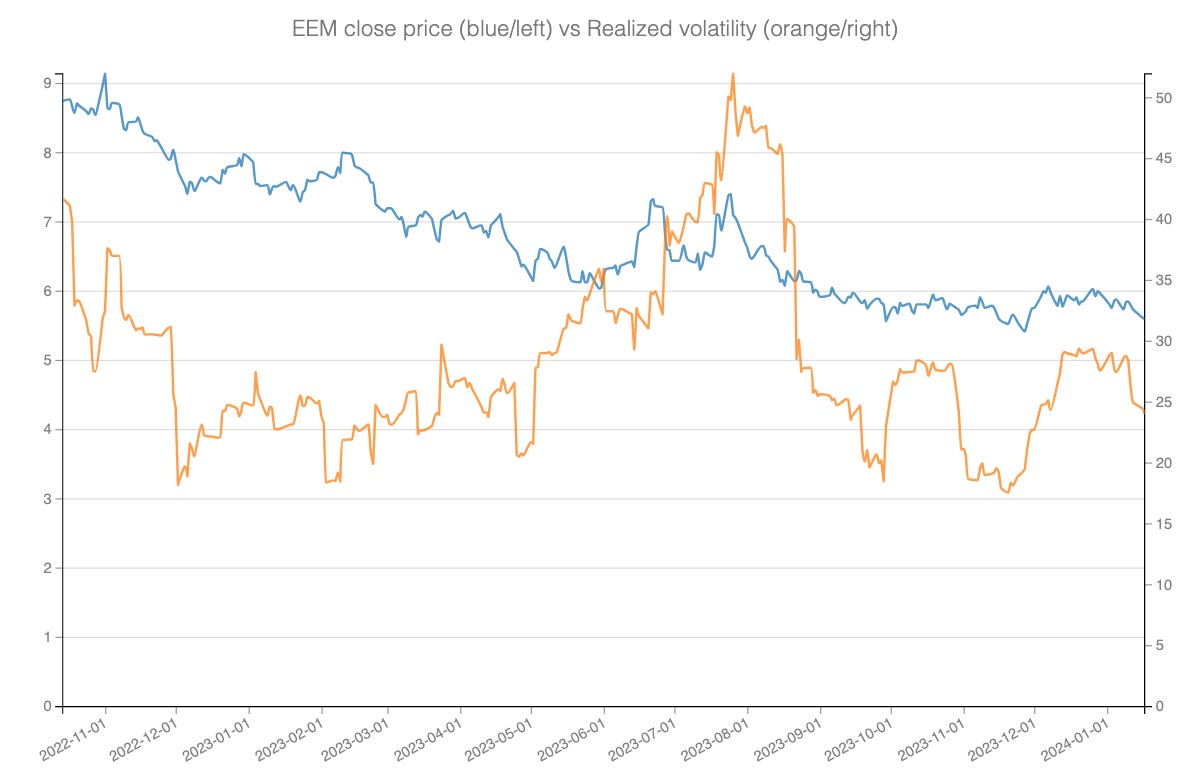

Some speculate that expiration week is currently anchoring the equity markets, suggesting limited volatility movement in the short term. It could be true, but who knows, really?

At Sharpe Two, our approach is all about clarity and repeatability, steering clear of speculative guesswork.

Presently, we're not inclined to engage in short volatility trades within the equity space, but the advantage of trading a diversified pool of ETFs is that opportunities can arise from anywhere.

Today, we're turning our attention to a promising setup in the commodity space, a configuration that currently appears more enticing than anything we're observing in equities.

WEAT is an ETP that offers investors exposure to wheat prices through futures contracts. WEAT has been one of our favorite trades over the past year, and we have good reason to believe its appealing performance will continue until we approach the harvesting season.

Let’s dive in.

This "Signal Du Jour" section is available exclusively to our paid subscribers. Consider joining now to access the full article and gain insights into this intriguing opportunity.

The context

Wheat, a vital commodity for every human being, is influenced by several key factors:

Its seasonal nature and the quality of each year's harvest.

Geopolitical events that can dramatically affect its price.

One recent example is the invasion of Ukraine, a major grain producer in Europe. This conflict caused wheat prices to soar to record highs. However, subsequent agreements allowing wheat exports from Ukraine have helped stabilize prices and avert a global food crisis.

Currently, wheat prices have settled into a predictable pattern, typically rising in spring and summer before stabilizing. With the harvesting season still some distance away, wheat prices have been relatively steady. This equilibrium is mirrored in the WEAT ETP, which has remained within the 5.5 to 6 range for the past six months.

That doesn’t seem like a lot, but it is still about a 10% range.

WEAT's price activity within its 10% range has been notably dynamic, as traders are usually hyper-sensitive to any new piece of information hitting the newswire. Recent factors such as heightened temperatures and supply chain issues in the Persian Gulf region have kept the market particularly alert.

While we haven't reached the extreme volatility levels seen during the harvest season, which can soar above 40, there was a significant uptick at the end of 2023. We witnessed volatility jump from 18 to 30 in just a few weeks.

The uncertainty and potential for rapid changes in the wheat market mean that prices could escalate unexpectedly at any time; under these conditions, it's reasonable to expect that option sellers will demand a substantial premium.

With this background, it's time to dive into the data and explore what opportunities might be present.

The signal and the trade methodology

In this section, we typically focus on the relationship between implied and realized volatility. Instead of relying on annualized figures typically derived from option prices, our preference is to examine the option prices directly.